The COVID-19 pandemic has compounded existing uncertainties to create a perfect storm for the shipbuilding markets, as well as having widely differing impacts on different sectors of shipping. MSI’s newly introduced Low Case scenario helps users navigate how the future could look, both under both Base and Low Cases developed by MSI, as well as testing their own scenarios. This article examines the current state of the shipbuilding industry and what scenarios of the New Normal might mean for its future.

Earlier this year, attempts were made to draw parallels with the SARS outbreak in 2002-04 or the Global Financial Crisis five years later. However, it has since become imminently apparent that there is no reference case for the current crisis. Despite the best efforts of governments and international organisations, the world economy now faces a sharp bifurcation in possible pathways. Equity markets have remained extremely strong – implying overall bullishness about growth prospects – even as a second wave of infections have gathered strength in the US and Europe. Given such a sharp dichotomy, uncertainty has never loomed so large.

Living with Uncertainty

How can the shipping industry overcome this chronically pervasive uncertainty that has been dubbed the “New Normal”? Put simply: by building it into our decision-making processes. This can be achieved in large part by quantifying the current market situation and exploring possible ramifications through forecasting. However, the COVID-19 pandemic has rammed home some significant lessons about forecasting. Firstly, that a model is only as good as its assumptions. Secondly, and more importantly, it is necessary to take a scenario-based approach to forecasting that incorporates a comprehensive understanding and structured assessment of potential downside risks.

In one of the few happy coincidences this year, MSI launched a new feature on our MSI Horizon platform in Q2 2020 that focuses on the potential downside. As well as our standard Base Case and the user-generated scenario modelling capacity, we now include a topical MSI Downside Scenario that is put together by our market-leading team of analysts. Our Q3 2020 Low Scenario asks the question: what would happen if there is a significant second wave of COVID-19 outbreaks in key regions over the next six months as well as a more prolonged struggle to eliminate the virus over 2021?

Whilst the Downside Scenario is implemented across all the markets which MSI covers, the shipbuilding market is a good exemplar of how this approach allows us to capture the uncertainty inherent in forecasting. Before delving into MSI’s Q3 2020 Low Scenario for the shipbuilding industry, it is of course important to understand the shipbuilding industry’s current position our Base Case outlook for it.

Already Challenged

The impact of the COVID-19 pandemic compounded existing trends, complicating an already challenging newbuilding environment at the start of the year. Foremost amongst these was the long period of yard rationalisation after the contracting boom in the 2000s, and more recently, the uncertainties surrounding the potential impact of environmental legislation. These existing impediments, combined with the adverse impacts of the COVID-19 pandemic, created a perfect storm of events that has effectively suppressed the appetite for fresh ordering this year.

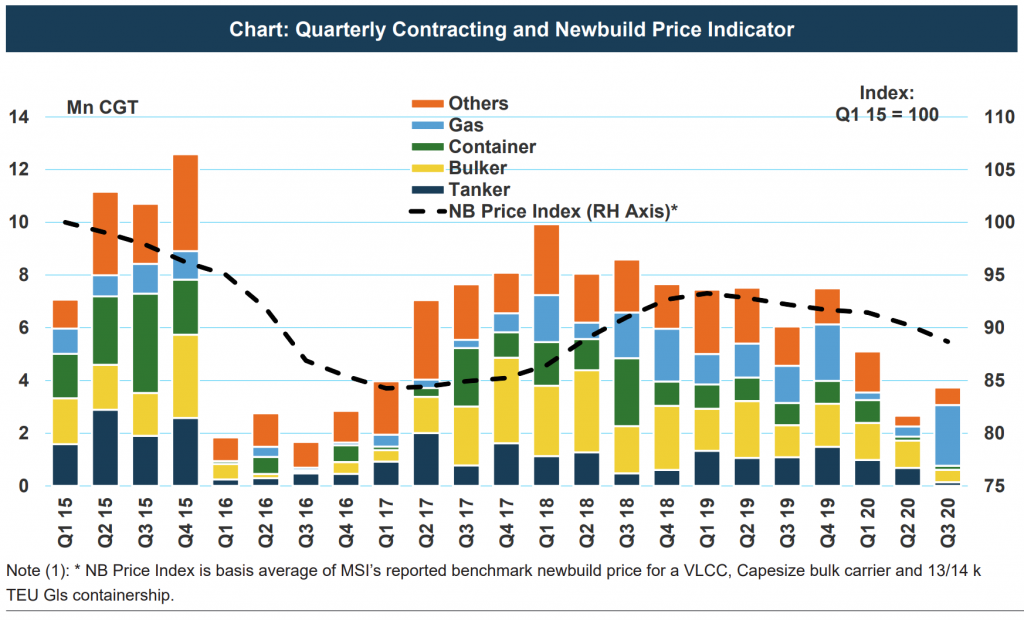

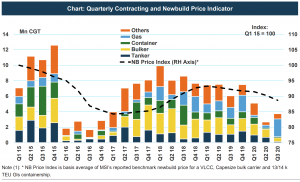

In the first nine months of 2020, 11.5 Mn CGT of fresh ordering has been concluded, down 45% yoy. The pain has pretty evenly been spread across different ship types, with the exception of the passenger sectors which have been particularly vulnerable to the COVID-19 pandemic and has consequently been the most adversely impacted. Whilst the apparent resurgence of containership liner companies in ordering mega-vessels is certainly welcome, the reality is that these orders will only benefit at most a small handful of yards.

Yards Holding the Line on Newbuild Pricing, So Far

In this context, it is surprising that newbuilding prices have not fallen further – for example, VLCC prices are down 6% on their pre-pandemic levels but remain 7.5% higher than their mid-2017 lows. However, this belies the position of the shipyards. The true threat to the shipbuilding industry is not the disruption which the pandemic has wreaked to date, but the longer-term demand weakness which we believe it will induce.

Under MSI’s Base Case Scenario, at some point in 2021 the virus will come under control, most likely through the development and widespread use of an effective vaccine. We expect that after declining by 4.3% this year, global GDP will recover strongly next year, growing 5.5%. This will result in a strong rebound in growth for seaborne trade across the major volume sectors. Thereafter, trade will continue to grow, albeit at much more modest levels than those we have become accustomed to: 1.4% over the next decade, compared to 3.2% in the 2010s.

However, the longer-term impact of the demand destruction will mean that 2020 and 2021 will represent the first time since the 1990s that global vessel newbuild contracts have remained below 20 Mn CGT for two consecutive years. It is this sustained weakness, rather than the short-term ramifications of the pandemic, that are causing problems.

Contracting Pick-Up Forecast, in the Base Case Scenario

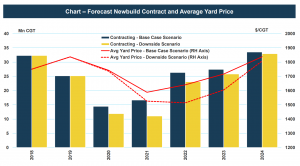

Our projections call for contracting to pick up from 14 Mn CGT and 17 Mn CGT in 2020 and 2021 respectively to reach 26-27 Mn CGT per annum in 2022 and 2023 before surpassing the 30 Mn CGT mark in 2024, as the recovery becomes entrenched. Coupled with yet further consolidation of shipbuilding capacity – decreasing from 36 Mn CGT in 2019 to 27 Mn CGT by 2022 – this recovery means that 2021 will mark the nadir for newbuilding prices.

This Base Case Scenario is, of course, subject to inherent downside risk, as the current resurgence of the virus in Europe and the US attest. As previously mentioned this forms the core of our Q3 2020 Low Case Scenario.

Downside Drivers

Compared to the Base Case, the Low Case Scenario posits a steeper fall in global GDP of -6.9% in 2020, followed by a markedly more modest recovery of just 1.2% in 2021. Once filtered through each of our individual sector models, total seaborne cargo demand under the Low Case Scenario would contract by 4.8% in 2020 and only rebound by 3.8% in 2021. For both years, aggregate cargo demand is around 1.5 percentage points below our Base Case, although of course these manifest differently across each sector; the impact on crude oil cargoes for example is a net reduction of around 1.4% in the period 2020-21, whilst for containerised cargoes the reduction is north of 5%.

This would have a significant impact on achievable earnings for each vessel class, which subscribers to our reports can view. It also, unsurprisingly, has significant implications for the volume of newbuild contracting and the wider shipbuilding markets. Under the Low Case Scenario, annual newbuilding demand remains marooned below 12 Mn CGT in 2021 after a weak 2020, with the 2022 recovery also suppressed. Newbuilding contracting demand is cut by a fifth over this three year period, equating to an average reduction in absolute terms of 3.8 Mn CGT per annum.

The consequence of this newbuilding shortfall is further downward pressure on newbuilding prices. As the chart below shows, the impact is acute, with average bulk newbuilding prices troughing at almost $1,500/CGT in 2022 under our Low Case Scenario. By contrast, newbuilding prices in our Base Case will already be rebounding in 2022, hitting $1,640/CGT.

Building Uncertainty into Future Planning

Of course, if the Low Case Scenario came to pass, its flow through impact on yard profitability would lead to further cuts in yard capacity, which would support a recovery in prices and ultimately, bring shipyards back into the black and the markets back into balance. This retrenchment is projected to be effective: in our Low Case Scenario, prices return to levels comparable with our Base Case by 2024.

The future may well be unknowable. But by embracing uncertainty and factoring it into the decision-making process, you will be better prepared when it arrives. These Base Case and Low Case Scenarios provide both insight into the current status of the markets and also a certain measure of foresight by forecasting supply and demand fundamental, and market balances under two specific sets of circumstances.

Subscribers to MSI’s modelling services have the ability to alter underlying assumptions and run their own forecast simulations via MSI’s proven, cross-sectoral modelling framework, not only for the three main merchant shipping sectors but across all sectors of the shipping and offshore markets.

Source: Adam Kent, Maritime Strategies International

Follow MSI on Twitter:

[tfws username=”InfoMSI” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]