The Asia to Europe trade (including the Mediterranean) is expected to experience many blanked sailings in the coming weeks, despite demand holding strong.

Drewry’s World Container Index (WCI) shows that as of Thursday, spot container rates from Shanghai to Rotterdam stood at $8,740 per FEU, up 322% from a year ago, while rates from Shanghai to Genoa totaled $8,736 per FEU, up 227% year-over-year.

Although blanked sailings are typical around Chinese New Year, congestion at European ports is partially spurring these blanks, a trend that is also very prevalent on the transpacific trade.

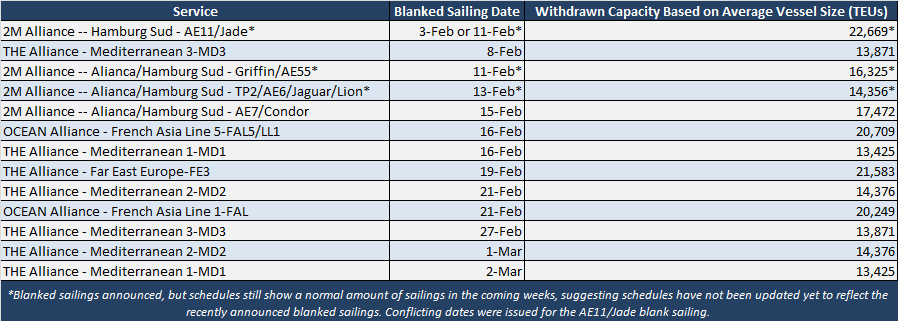

Based on current available data, BlueWater Reporting estimates there will be 13 blanked sailings between February and the start of March on the Asia to Europe trade, which will result in a total of 216,707 TEUs of withdrawn capacity. This figure is highly subject to change as schedules continue to evolve, with more blanked sailings likely to surface. This estimate was configured using notices issued by Maersk and MSC on blanked sailings, carrier schedules as of this Thursday, and data from BlueWater Reporting on average vessel size for each service to estimate the amount of withdrawn capacity for each blanked voyage.

Maersk and MSC both revealed this week four blanked sailings on their Asia-Europe services in February.

The carriers attributed these blanked sailings to not only Chinese New Year, which will fall on Feb. 12, but also to supply chain issues that were spurred by the pandemic.

“In light of ongoing schedule reliability considerations, Maersk is implementing measures to improve schedule reliability in its Far East Asia to Europe network. In combination with the Chinese New Year period, Maersk will have four missed sailings and aims to free up these services for schedule recovery measures to respond to the recent, unprecedented market situation with severe port congestion and equipment limitations across global supply chains,” Maersk said. “This situation has been driven by a combination of rapidly increased demand and measures to fight the pandemic that led to slower supply chain operations across ports, inland depots, warehouses and inland transport modes.”

Hapag-Lloyd revealed this week that congestion and delays in most European ports is leading to “persistent and extreme” delays of ocean vessels at Container Terminal Tollerort (CTT). “This situation has a direct impact on the yard utilization, as the dwell time of export containers is increasing constantly and day by day,” Hapag-Lloyd said.

Consequently, Hapag-Lloyd said that effective this Thursday and until further notice, CTT is forced to implement the ’48-hour rule’ for export containers delivered by truck, meaning that the terminal will not accept any export container (including dangerous cargo units) more than 48 hours before the vessel’s arrival.

Congestion is also bogging down operations on the Asia to U.S. West Coast trade, namely transits from Asia to the southern California ports of Los Angeles and Long Beach, where vessels are continuing to anchor outside these ports waiting to moor.

Hapag-Lloyd announced last week numerous sailings that are expected to be blanked on the Asia to North America trade as a result of this, with most of these blanked sailings involving services from Asia to southern California.

Source: Hailey Desormeaux, Bluewater

Follow on Twitter:

[tfws username=”BWReporting” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]