With the Suez Canal open again, a stretched world trade system can’t catch up overnight, increasing the disruption to supply chains.

The blockage is over, but the damage is done

The six-day-long period of traffic being completely stopped in both directions along the Suez Canal has delayed some 16 million tons of cargo freight on hundreds of container ships. Getting back on track will put an already stretched system under more strain. Estimates suggest that the queue of ships which has built up will be able to move through the canal within two weeks.

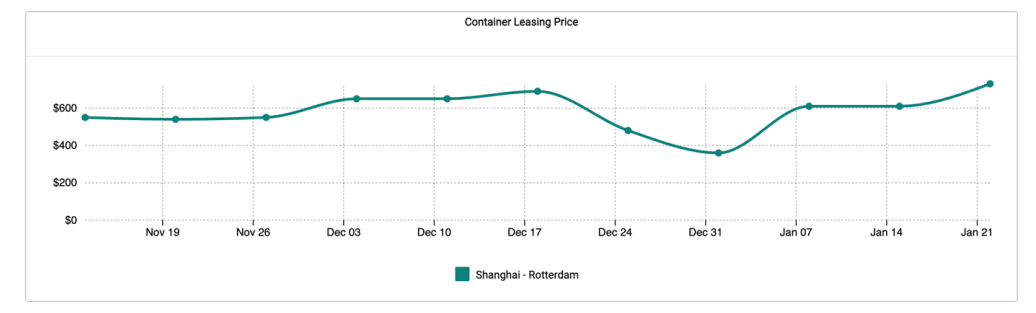

Ships arriving at the Suez Canal will be delayed while the backlog is cleared, but opting for the Cape of Good Hope route to avoid the Suez Canal will add at least a week on to journey times. Taking into account the likely bottlenecks when ships arrive at their destinations via either route, the effects of Ever Given’s time in the Suez Canal will be felt in vessel waiting times and port congestion in European and Asian ports for weeks to come, and in global supply chains for much longer.

What the Suez blockage really means for trade

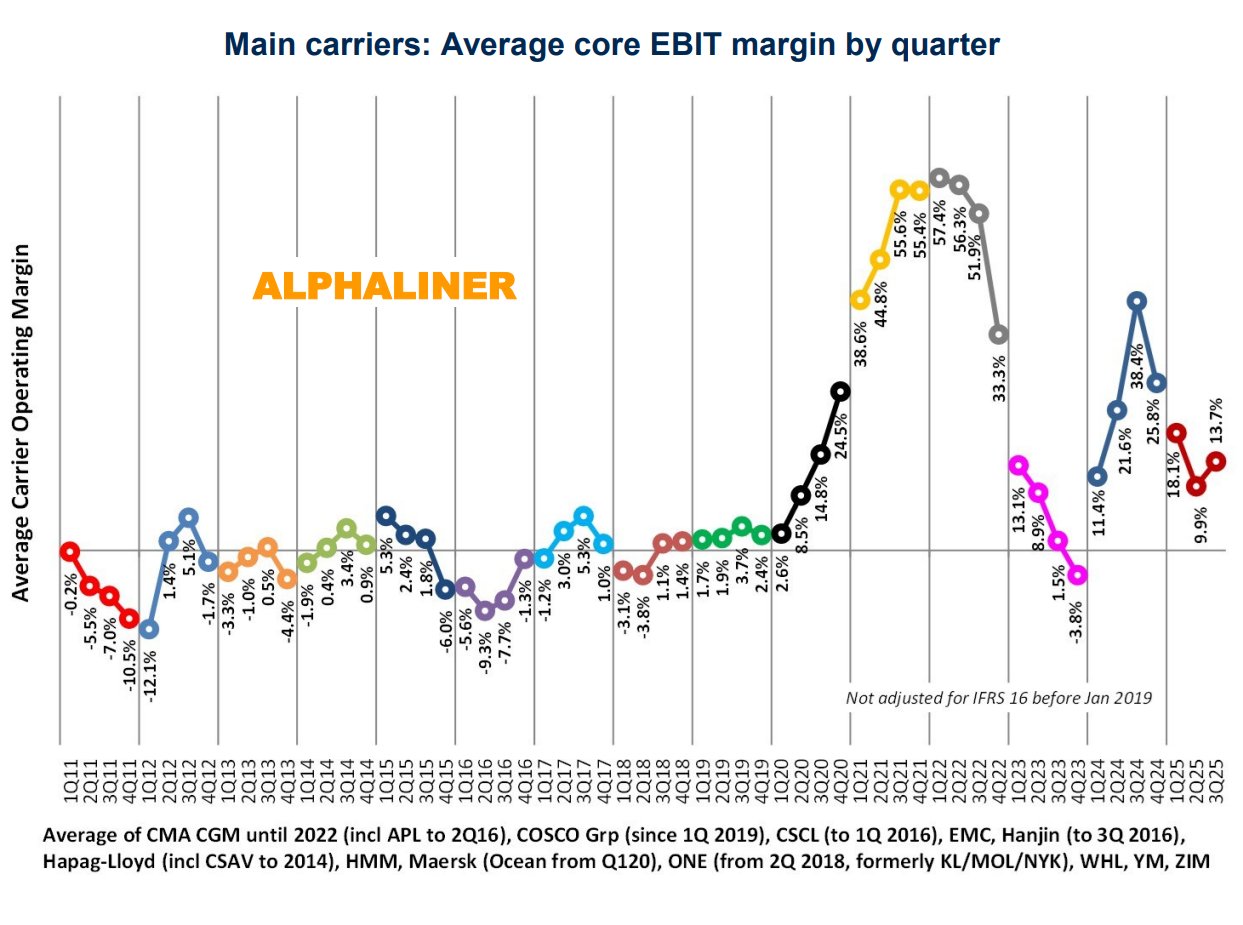

While the impact of the canal disruption may not register on world trade volumes already straining against capacity constraints, it illustrates the risks of the system operating at such tight capacity. This results in any disruption having large ripple effects, with delays quickly causing problems along supply chains that take a long time to resolve.

Running short of equipment is an increasing problem for EU businesses

Source: DG ECFIN, ING calculations

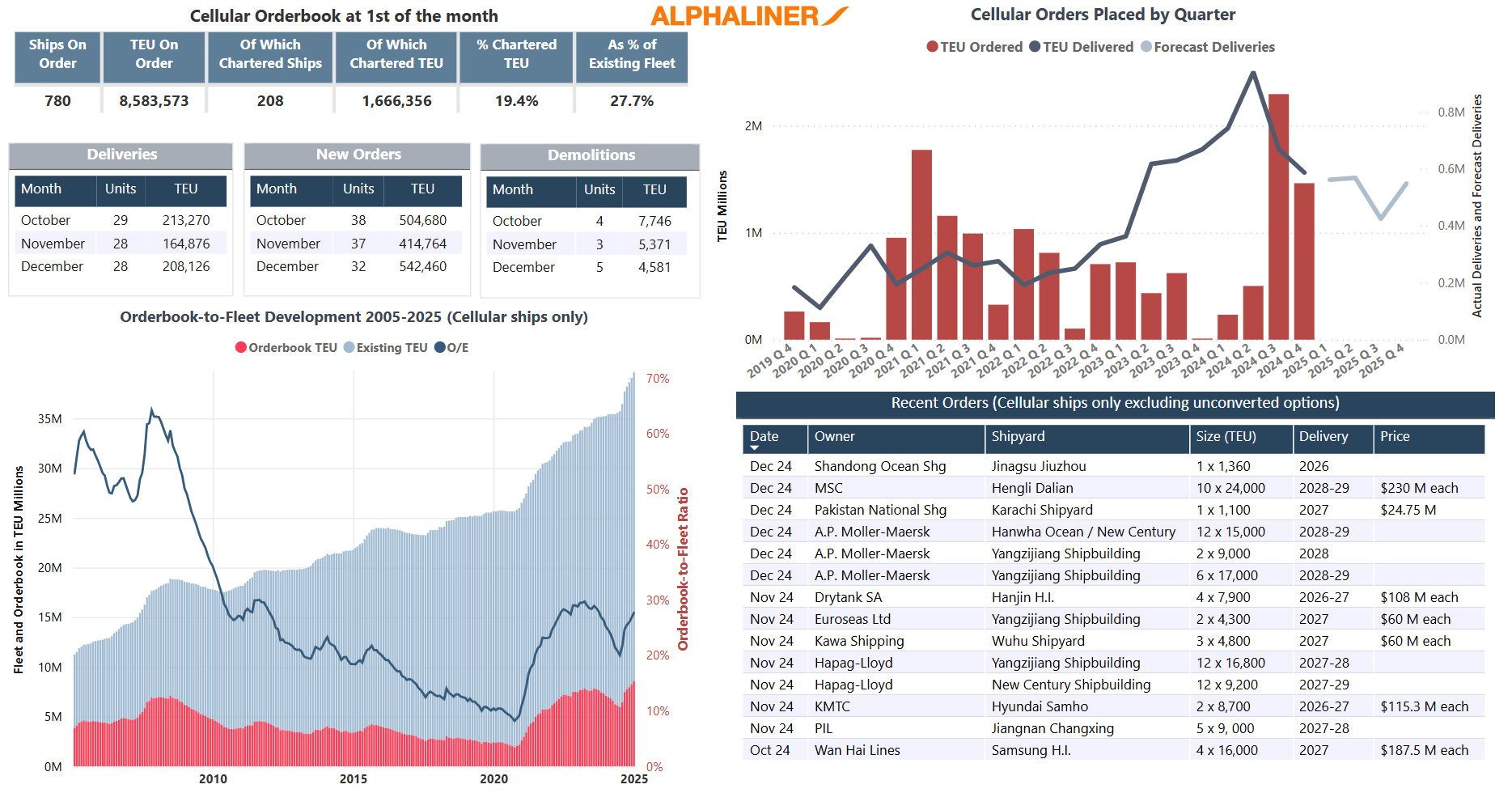

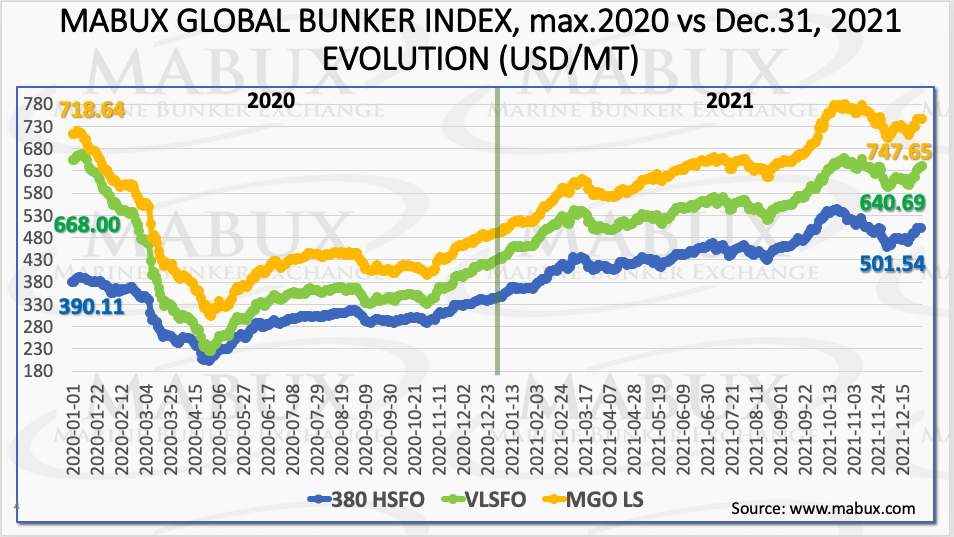

Shipping capacities between Europe and Asia have been under pressure since the beginning of the pandemic, suffering four out of five cancelled sailings of ships while Pacific Routes have seen capacity little changed. Problems have mounted, including continuing shortages of containers and equipment affecting the ability of European countries to export their goods.

Inbound trade has also been a problem, with equipment shortages in the sectors most associated with ocean freight – investment goods (such as machines and computers used by industry), intermediate goods (inputs to manufacturing) and consumer durables (furniture and electronics) increasingly being reported as limiting production within the EU.

Deliveries delayed by the Ever Given will add to these disruptions, in some cases bringing production to a stop. The average delay for late vessel arrivals at ports has risen above six days in 2021, the highest on record, having steadily increased during 2020, as world trade has struggled to keep up with fast-recovering demand around the world.

Another alarm bell ringing, but don’t expect a big rethink of global supply chains yet

The faster than feared re-floating of the Ever Given will help to limit the damage, and allow trade between Europe and Asia to continue to normalise. But this is a setback in what has already been a sustained period of difficult conditions for trade between the two regions.

Nonetheless, a major re-shoring effort is unlikely to follow. Relief is round the corner for some of ocean freight’s worst difficulties, as air freight capacity begins to recover and the most time-sensitive goods can once again be transported by air. Port handling speeds will also increase once safety measures for staff can be relaxed.

Source: ING Economics

Follow on Twitter:

[tfws username=”ING_Economics” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]