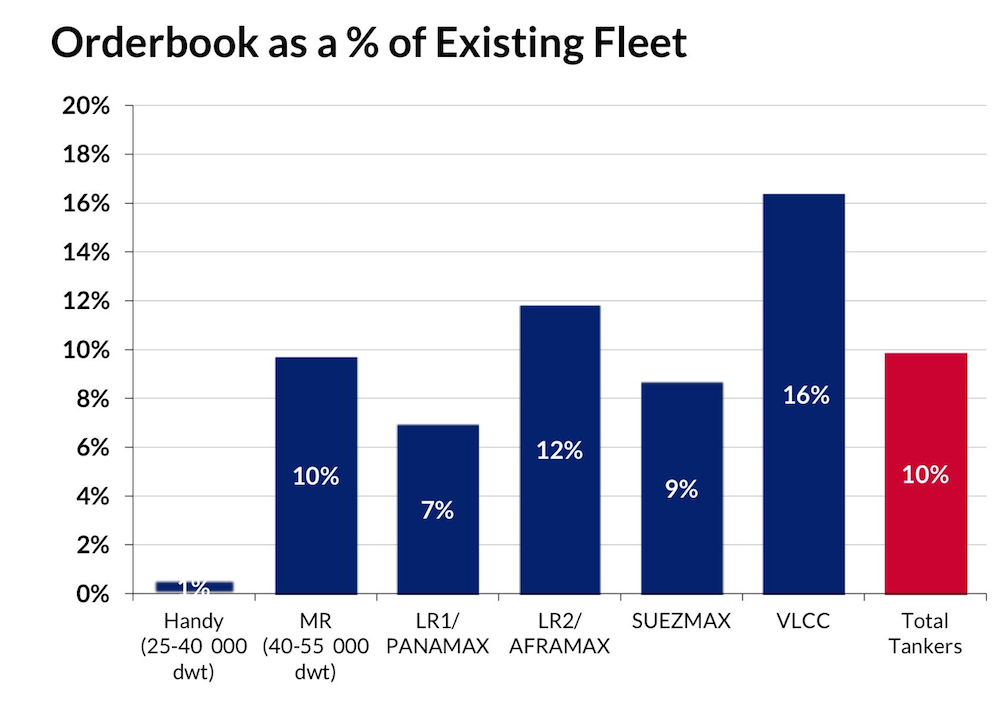

Source: GIBSONS

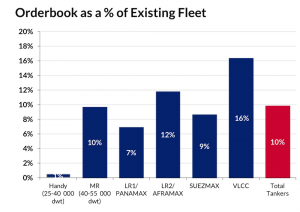

Much attention has been given in recent months to continued activity in newbuild VLCC tonnage. Shipbrokers Gibson’s, are not an exception to that, warning repeatedly about the risk of over-ordering if investment in VLCCs continues at such a relentless pace. However, what has gone largely unreported is the fact that the pattern of ordering activity has been completely different in other tanker segments, starting from Suezmaxes down to MRs. Most notably, investment in new tonnage has been minimal in the LR1/Panamax size group.

Just 4 tankers have been ordered so far in 2018, while ordering was also highly limited over the previous two years. Without doubt, a lack of investment interest has been driven by poor performance. In recent years, LR1s have also faced an additional challenge in terms of the increased competition from both smaller and larger product carriers, frequently reporting lower earnings compared to other sizes.

Not surprisingly, owners have showed preference for smaller MRs or bigger LR2s when ordering a new tanker. With the exception of Handy tankers, as of now LR1/Panamaxes have the smallest orderbook, at 7% relative to its existing fleet. The orderbook for Suezmaxes is also becoming notably smaller. Only 2 firm tanker orders (plus 4 shuttle tankers) have been placed this year to date, while investment in new tonnage was also somewhat restricted in 2016 and 2017. As a result, the Suezmax orderbook has now fallen below 9% relative to its existing size, nearly three times smaller from its position two years ago.

The MR orderbook (40,000 to 55,000 dwt) stands close to 10%. Investment in new tonnage so far this year has been rather modest, with just 26 confirmed orders; yet,

The MR orderbook (40,000 to 55,000 dwt) stands close to 10%. Investment in new tonnage so far this year has been rather modest, with just 26 confirmed orders; yet,

last year over 70 new tanker orders were placed. It is also worth pointing out that the orderbook for Handy tankers (25,000 to 40,000 dwt) is almost non-existent, with just 3

tankers yet to be delivered. However, this is largely a reflection of owners’ preference for the larger MR size when ordering new tonnage.

Finally, LR2/Aframaxes have the second largest orderbook of all size groups, largely as a result of robust investment in 2017. Yet, investment has slowed once again this year, with 12 confirmed orders for the year to date. As such, the orderbook remains notably below that of VLCCs. Just under 12% of the LR2/Aframax fleet is on order versus 16% in the VLCC segment.

The above developments indicate that the growth in fleet size for most size groups could slow down notably next year, particularly if the demolition market remains active. Scheduled deliveries for Suezmaxes, LR2/Aframaxes and LR1/Panamaxes are expected to fall in 2019 to their lowest level since 2015. The number of scheduled deliveries in the MR segment in 2019 is on par with levels this year, yet still notably below the number of new deliveries seen between 2014 and 2016.

This paints a much healthier picture in terms of fleet growth going forward. However, in order to see a much-needed rebound in tanker earnings, the current trend of robust ordering in the VLCC segment should certainly not be repeated in other tanker classes.