(June 23) Record breaking jump in Capesize spot is a game changer

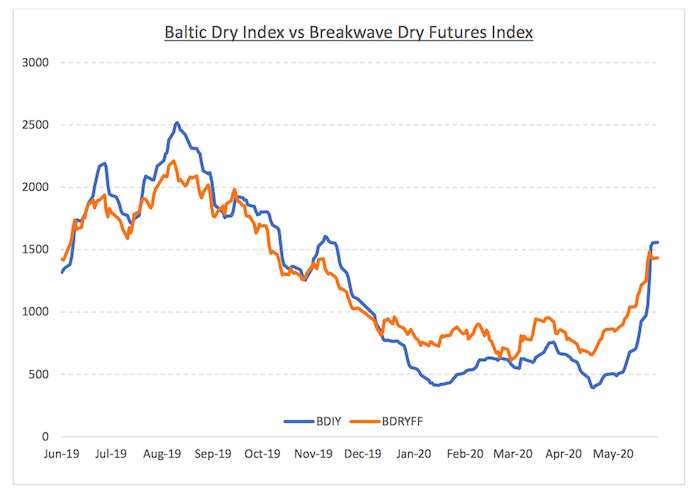

Last week was one of the most exciting weeks in many years for the Capesize market, as spot rates more than doubled in a relentless rally that caught even seasoned freight traders and brokers by surprise and validated once again the incredibly volatile nature of shipping. The reasons behind the jump are real and the increase in rates is supported by fundamental reasons as evident by a tightening supply/demand balance in the Atlantic, something we had spent a lot of time talking about in recent months.

The effect of a tightening balance in pricing is not linear and definitely not a smooth process. In a commoditized market where there is no “inventory” adjustment (i.e. there are no idle ships stored somewhere to make up for a potential shortfall as is the case in other commodities, for example oil storage), prices will react violently. Once owners realized they had the upper hand on freight negotiations, the price impact on concluded deals took a life of its own and prices increased exponentially. With spot rates currently standing in the mid-to-high 20,000 level for Capesizes and with implied volatility increasing rapidly, the next few weeks are going to be extremely interesting from a price action perspective and thus freight futures will see considerable fluctuations in a short period of time. However, with the futures curve now steeply backwardated, the freight market sounds cautious on the sustainability of current freight levels, a pessimistic view we do not share.

Where do we go from here?

We believe the second half of the year will be one of the best periods for dry bulk shipping in quite some time. However, it will also be a very volatile one. Any increase in rates will not be linear while large drawdowns are very likely. We expect spot rates to exceed last year’s levels (circa 40,000 was the high of last year). Our justification for such a bullish outlook relies on all the drivers we have been discussing recently and are slowly coming into play at the same time: A) Global economic stimulus is approaching ~USD18 Trillion or ~20% of global GDP, an amount that would have been unimaginable before. B) China is in the center of such stimulative action with infrastructure spending increasing rapidly. C) Inventories are low, and a re-stocking cycle is bullish for shipping. D) Brazil has the capacity to expand iron ore exports quite a bit in the face of $100/ton iron ore, and with only six month left to hit their target, Vale has every incentive to ramp up production and exports (note: Question- mark remains the development of COVID-19 in Brazil and the potential impact on iron ore operations).

Shipping is cyclical, and cycles are strong

While we remain positive on dry bulk for this year, one should not forget that shipping is a highly cyclical industry and needs a trading mentality when it comes to capital allocation. Historically, shipowners have thrived by trading ships in similar environments and thus one must always keep that in mind when dealing with shipping. However, the current very low dry bulk orderbook makes the longer-term prospects quite interesting, with the 2021 futures trading at less than 14,000/day, a level that we find relatively low. Although this is still quite far out in the future, one should also keep an eye on the broader supply/demand developments as a longer upcycle might be slowly forming.

Source: Breakwave Advisors. Connect with them on Twitter:

[tfws username=”DryBulkETF” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]