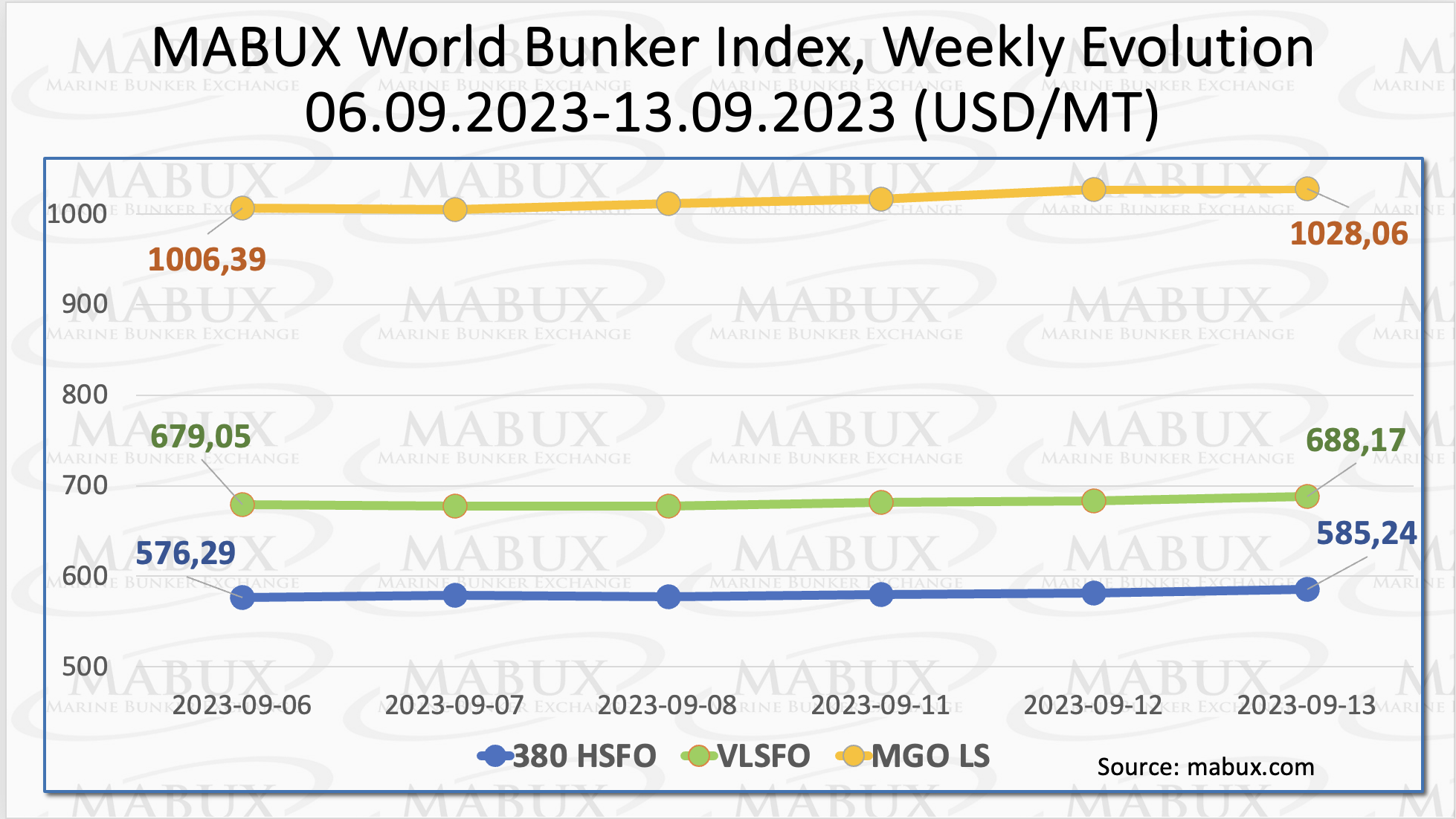

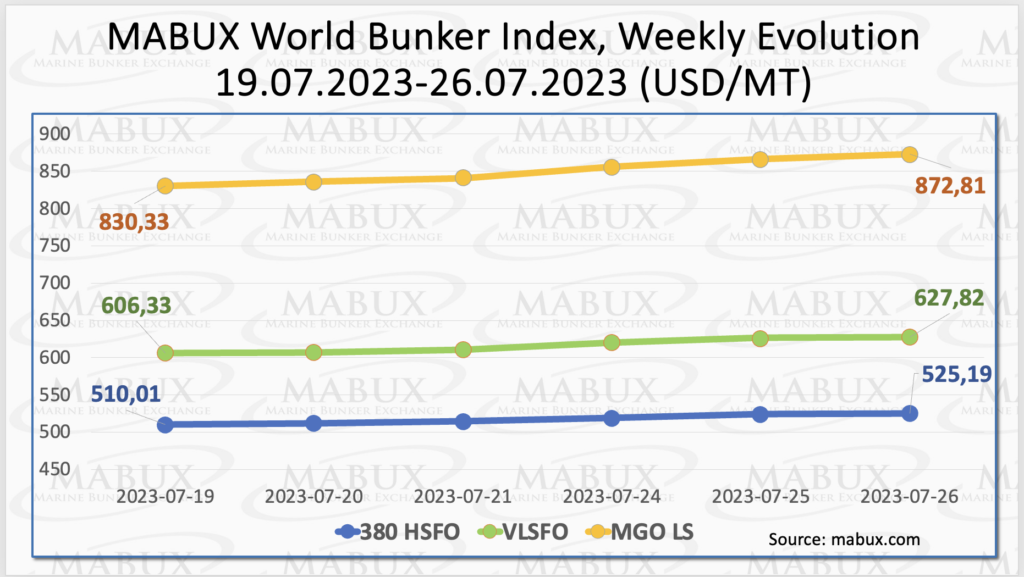

During Week 30, the MABUX global bunker indices displayed a firm upward trend. The Index 380 HSFO experienced an increase of 15.18 USD, rising from 510.01 USD/MT the previous week to 525.19 USD/MT. Similarly, the Index VLSFO saw a substantial gain of 21.49 USD, climbing from 606.33 USD/MT to 627.82 USD/MT. Additionally, the Index MGO exhibited a significant rise of 42.48 USD, going from 830.33 USD/MT to 872.81 USD/MT. At the time of writing the uptrend prevailed in Global bunker market.

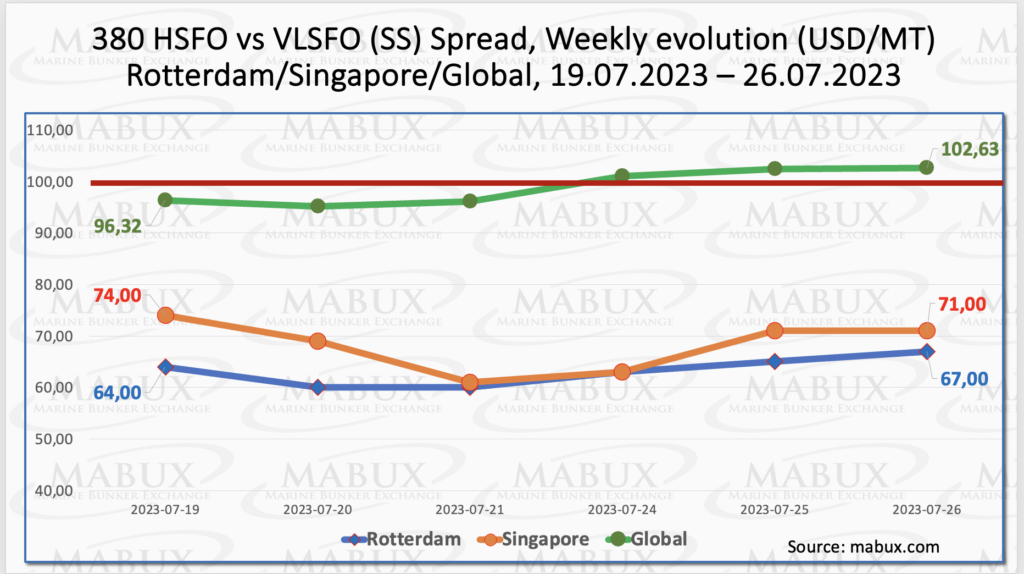

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – slightly increased and crossed the 100 USD mark, reaching plus $6.31 ($102.63 vs. $96.32 the previous week). However, the weekly average symbolically decreased by $0.86. In the port of Rotterdam, the SS Spread widened by $3, from $64.00 to $67.00, while the weekly average of SS Spread in Rotterdam grew by $0.50. In Singapore, the price difference between 380 HSFO and VLSFO continued to narrow, decreasing by $3.00 ($71.00 vs. $74.00 the previous week). The weekly average decrease in Singapore was more significant, amounting to $29.66. The reduction in the SS Spread seems to have slowed down at the moment. Despite this, the index readings below $100 (SS breakeven) at the major hubs indicate that using conventional VLSFO bunker fuels remains more profitable than opting for the combination of HSFO and scrubbers. More information is available in the “Differentials” section of mabux.com.

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – slightly increased and crossed the 100 USD mark, reaching plus $6.31 ($102.63 vs. $96.32 the previous week). However, the weekly average symbolically decreased by $0.86. In the port of Rotterdam, the SS Spread widened by $3, from $64.00 to $67.00, while the weekly average of SS Spread in Rotterdam grew by $0.50. In Singapore, the price difference between 380 HSFO and VLSFO continued to narrow, decreasing by $3.00 ($71.00 vs. $74.00 the previous week). The weekly average decrease in Singapore was more significant, amounting to $29.66. The reduction in the SS Spread seems to have slowed down at the moment. Despite this, the index readings below $100 (SS breakeven) at the major hubs indicate that using conventional VLSFO bunker fuels remains more profitable than opting for the combination of HSFO and scrubbers. More information is available in the “Differentials” section of mabux.com.

As per WoodMac, the long-term outlook on global LNG demand is bullish. Additional 100 million metric tonnes per annum (mmtpa) of capacity will be required to meet demand growth by the mid-2030s. This is a 25% increase compared to current global LNG supply and on top of the supply that has already been sanctioned. Asia will be the driving force of demand in the long term, despite the current European rush to secure LNG to replace Russian gas. New supply – especially from Qatar and the United States – is set to hit the market in 2025-2026: around 80% of new LNG supply by 2030 will come from those two major LNG exporters.

As per WoodMac, the long-term outlook on global LNG demand is bullish. Additional 100 million metric tonnes per annum (mmtpa) of capacity will be required to meet demand growth by the mid-2030s. This is a 25% increase compared to current global LNG supply and on top of the supply that has already been sanctioned. Asia will be the driving force of demand in the long term, despite the current European rush to secure LNG to replace Russian gas. New supply – especially from Qatar and the United States – is set to hit the market in 2025-2026: around 80% of new LNG supply by 2030 will come from those two major LNG exporters.

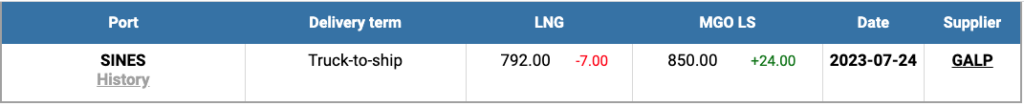

The cost of LNG as bunker fuel at the port of Sines (Portugal) has continued its decline, reaching 792 USD/MT on July 24, which is 7 USD lower than the previous week. Notably, on July 25, the price difference between LNG and conventional fuel favored LNG, showing a gap of 58 USD: MGO LS was quoted at 850 USD/MT on that day in the port of Sines. For further details, additional information is accessible in the LNG Bunkering section of mabux.com.

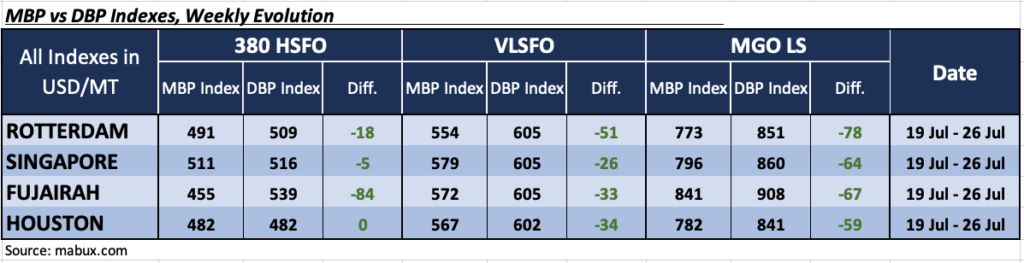

During Week 30, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index)) registered underestimations for all fuel in the selected ports of Rotterdam, Singapore, Fujairah and Houston. This indicates that the market prices for bunker fuels were lower than the values suggested by the digital benchmark.

During Week 30, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index)) registered underestimations for all fuel in the selected ports of Rotterdam, Singapore, Fujairah and Houston. This indicates that the market prices for bunker fuels were lower than the values suggested by the digital benchmark.

In the 380 HSFO segment, the average weekly undervaluation margins increased by 1 point in Rotterdam and 2 points in Fujairah but fell by 7 points in Singapore. In Houston, the MDI showed a 100 percent correlation between market prices and the digital bunker benchmark, suggesting that prices were accurately aligned with the benchmark in this port.

In the VLSFO segment, the MDI data indicated an average underprice ratio increase of 2 points in Rotterdam, 3 points in Singapore, 4 points in Fujairah, and 1 point in Houston.

In the MGO LS segment, the MDI recorded widening average undervaluation levels in Rotterdam by 8 points, in Singapore by 1 point, in Fujairah by 19 points, and in Houston by 8 points.

Slight weekly changes in the MDI index indicated a stabilization of the global bunker market at the achieved values. For further information on the correlation between market prices and the MABUX digital benchmark, please refer to the “Digital Bunker Prices” section on mabux.com.

Slight weekly changes in the MDI index indicated a stabilization of the global bunker market at the achieved values. For further information on the correlation between market prices and the MABUX digital benchmark, please refer to the “Digital Bunker Prices” section on mabux.com.

Sales of conventional and bio-blended bunker fuels totalled 2.56 million tonnes in Q2 at the Port of Rotterdam: eased up from the 2.43 million tonnes sold in Q1. Sales of bio-blended fuels accounted for 7.2% of total Q2 sales. On a grade-by-grade basis, Q2 sales of very low sulphur fuel oil (VLSFO) were 906,388 tonnes, down from the 984,034 tonnes sold in the first quarter of the year and also down from 920,233 tonnes sold in Q2 2022. Bio-blended VLSFO volumes totalled 144,970 tonnes in Q2, an increase from the 125,982 tonnes sold in Q1 this year. Sales of high sulphur fuel oil (HSFO) are holding up well in 2023. In Q2 they totalled 847,189 tonnes, compared to 809,871 tonnes in Q1 and 718,325 tonnes in the same period in 2022. Marine gasoil (MGO) volumes were 253,748 tonnes in Q2 2023, compared to 258,137 tonnes in Q1 and 269,833 in the same period last year. Sales of LNG surged by nearly 109% quarter on quarter to reach 265,982 cubic metres (cbm) in Q2. This also compares to the 112,069 cbm sold in Q2 2022. Second quarter LNG sales were also the highest quarterly total since Q3 2021 (212,719 cbm). At the half year stage, LNG sales totalled 265,892 cbm in 2023, compared to 214,648 cbm in 2022, which indicates that the impact of price volatility and concerns over gas supplies following Russia’s invasion of Ukraine last February may have played out. There have been no sales of methanol as a bunker fuel in Rotterdam in 2023 so far. In the second half of 2022, methanol volumes totalled 1,500 tonnes.

We expect that the global bunker indexes may continue their upward movement in the upcoming week.

Source: www.mabux.com