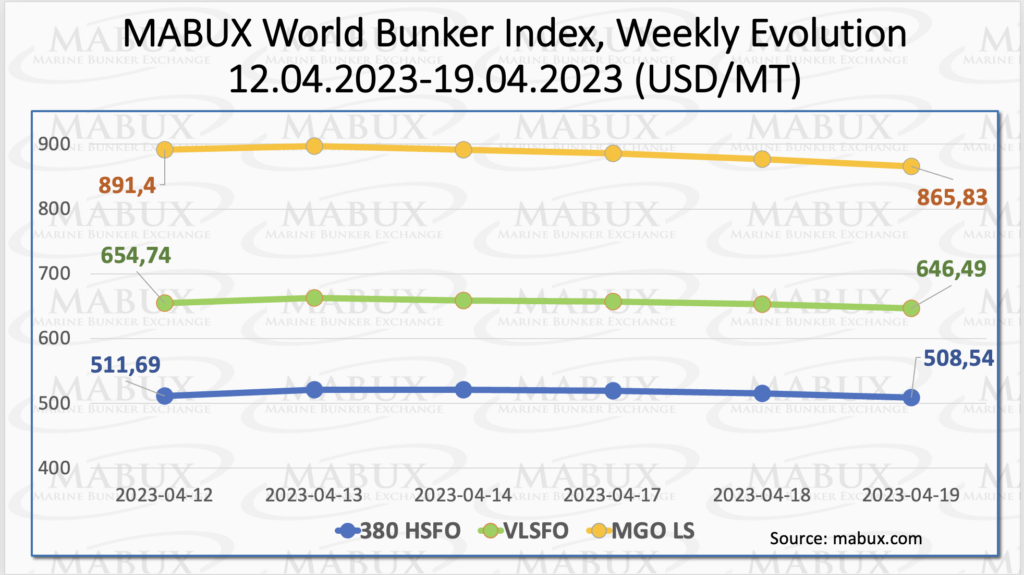

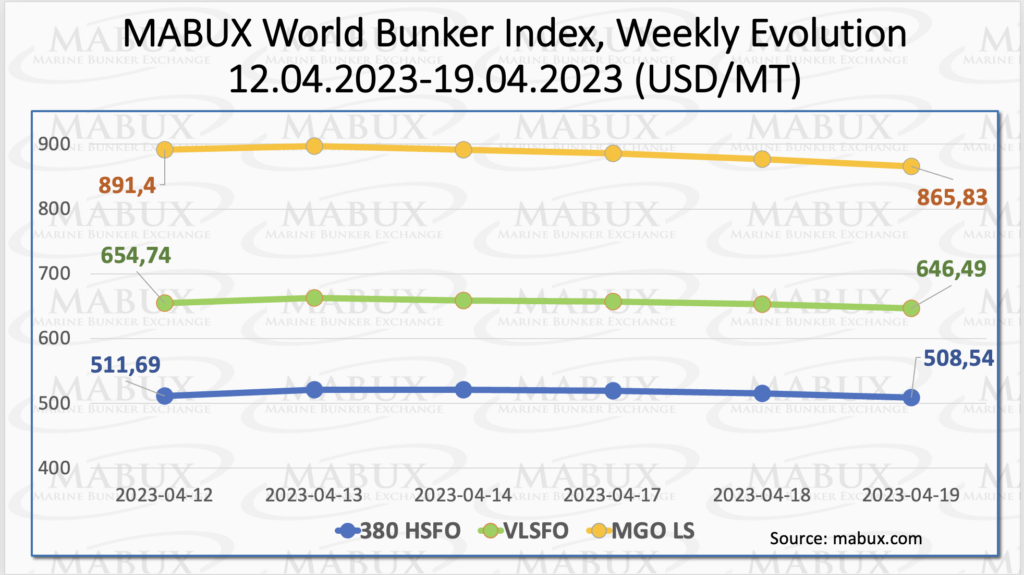

Over the Week 16, the global MABUX bunker indices experienced a sustained downward trend. The 380 HSFO index fell by 3.15 USD: from 511.69 USD/MT last week to 508.54 USD/MT, and is approaching the 500 USD mark. The VLSFO index, in turn, also decreased by 8.25 USD (646.49 USD/MT versus 654.74 USD/MT last week). The MGO index saw a larger decrease of 25.57 USD (from 891.40 USD/MT last week to 865.83 USD/MT). At the time of writing, downwards dynamics prevailed in the market.

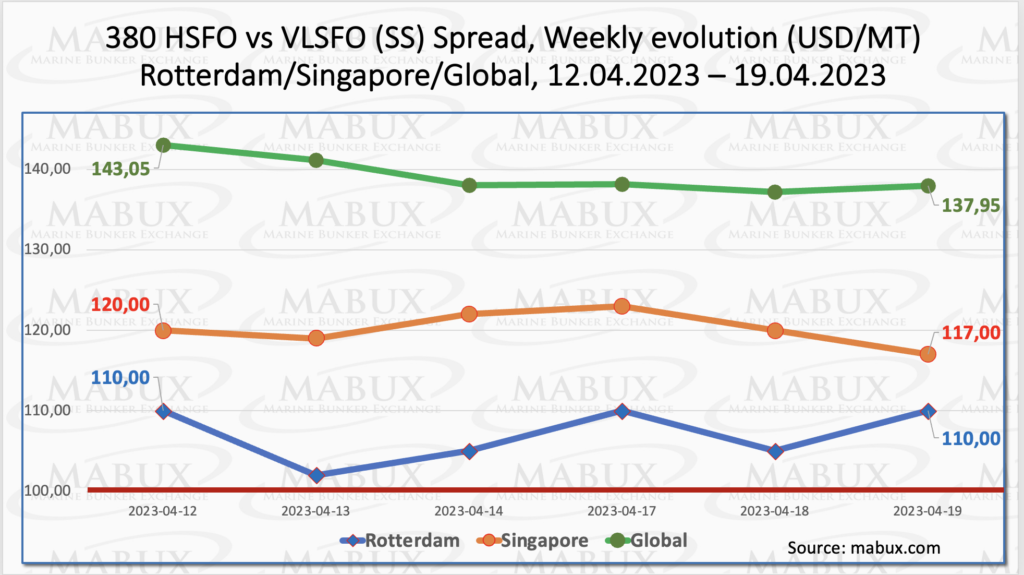

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued its firm decline in Week 16 – minus $5.10 ($137.95 vs. $143.05 last week). At the same time, the weekly average also decreased by $5.81. In Rotterdam, SS Spread remained unchanged at $110.00, staying close to the psychological mark of 100 USD. The SS Spread weekly average in Rotterdam decreased by another $11.83. In Singapore, the price difference between 380 HSFO and VLSFO dropped by $3.00 ($117 vs. $120.00 last week). The average weekly value practically did not change, with a symbolic decrease of $0.16. We expect SS Spread will continue to decline in the next week. For more information, you can refer to the “Differentials” section of mabux.com.

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued its firm decline in Week 16 – minus $5.10 ($137.95 vs. $143.05 last week). At the same time, the weekly average also decreased by $5.81. In Rotterdam, SS Spread remained unchanged at $110.00, staying close to the psychological mark of 100 USD. The SS Spread weekly average in Rotterdam decreased by another $11.83. In Singapore, the price difference between 380 HSFO and VLSFO dropped by $3.00 ($117 vs. $120.00 last week). The average weekly value practically did not change, with a symbolic decrease of $0.16. We expect SS Spread will continue to decline in the next week. For more information, you can refer to the “Differentials” section of mabux.com.

The recent statistics shows Europe has failed to secure enough long-term LNG contracts to offset cut-off Russian gas imports. This may prove costly next winter and could sharply tighten the market. The European Union considers natural gas as a bridge fuel in the transition to renewable energy, and buyers generally struggle to commit to long-term contracts. This means that Europe might be forced to buy more from the spot markets like it did in 2022, which in turn is likely to push prices up.

The recent statistics shows Europe has failed to secure enough long-term LNG contracts to offset cut-off Russian gas imports. This may prove costly next winter and could sharply tighten the market. The European Union considers natural gas as a bridge fuel in the transition to renewable energy, and buyers generally struggle to commit to long-term contracts. This means that Europe might be forced to buy more from the spot markets like it did in 2022, which in turn is likely to push prices up.

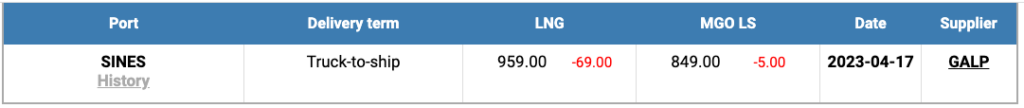

The price of LNG as bunker fuel in the port of Sines (Portugal) continued sliding and reached 959 USD/MT on April 17 (minus 69 USD compared to the previous week). The difference in price between LNG and conventional fuel on April 17 narrowed to 119 USD: MGO LS in the port of Sines was quoted at 849 USD/MT that day. We expect the narrowing of price difference to continue next week. More information is available in the LNG Bunkering section at mabux.com.

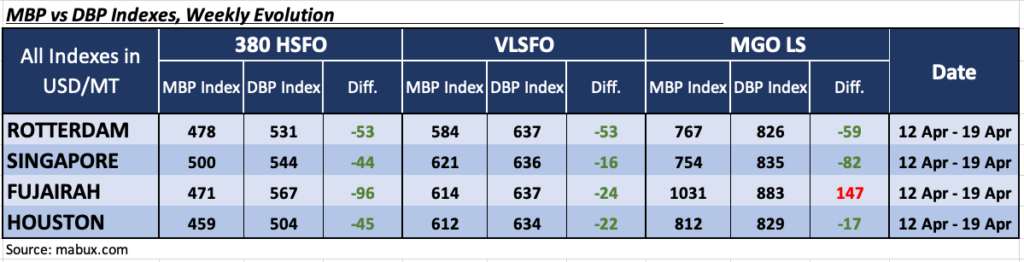

During Week 16, the MDI index (which measures the correlation of MABUX market bunker prices (MBP Index) versus the MABUX digital bunker benchmark (DBP Index), registered an underpricing of 380 HSFO fuel at all four selected ports. The average weekly undervaluation margins decreased in three out of four ports, except for Houston where it increased by $9 to reach minus $45.). In Rotterdam, Singapore and Fujairah, the MDI registered minus $53, minus $44 and minus $96, respectively.

During Week 16, the MDI index (which measures the correlation of MABUX market bunker prices (MBP Index) versus the MABUX digital bunker benchmark (DBP Index), registered an underpricing of 380 HSFO fuel at all four selected ports. The average weekly undervaluation margins decreased in three out of four ports, except for Houston where it increased by $9 to reach minus $45.). In Rotterdam, Singapore and Fujairah, the MDI registered minus $53, minus $44 and minus $96, respectively.

In the VLSFO segment, according to MDI, underestimation of fuel was registered at all selected ports. The undervaluation ratios were as follows: Rotterdam – minus $53, Singapore – minus $16, Fujairah – minus $24 and Houston – minus 22. The average underprice margins increased moderately in Rotterdam and Houston, while they decreased in Singapore and Fujairah compared to the previous week.

Over the Week 16, in the MGO LS segment, there were three underpriced ports: Rotterdam, Singapore, and Houston. The average weekly undervaluation levels did not show a clear trend and were recorded as minus $59 in Rotterdam, minus $82 in Singapore and minus $17 in Houston. Fujairah remains the only overvalued port – plus $ 147.

For more detailed information on the correlation between market prices and the MABUX digital bunker benchmark, you can refer to the “Digital Bunker Prices” section at mabux.com. The section is likely to provide additional insights, data, and analysis on bunker fuel prices and their correlation with the digital benchmark.

For more detailed information on the correlation between market prices and the MABUX digital bunker benchmark, you can refer to the “Digital Bunker Prices” section at mabux.com. The section is likely to provide additional insights, data, and analysis on bunker fuel prices and their correlation with the digital benchmark.

As per the Maritime and Port Authority of Singapore (MPA), the 4,175,300 metric tonnes (mt) of marine fuel sales at the Port of Singapore last month represents a 10.8% increase on the 3,769,700 mt recorded in March 2022. Last month’s total was also 10% up on the 3,794,300 mt recorded in February. Low sulphur fuel oil (VLSFO) 380 cSt sales (1,960,500 mt) accounted for around half of all marine fuel sales at the world’s biggest bunker hub. The 1,235,200 mt of marine fuel oil 380 cSt sales represents the highest monthly total of the year. Sales of low sulphur marine gasoil (315,500 mt) saw year-to-date highs as well. During the first three months of the year, a total of 12,346,500 mt of marine fuel was sold at the Port of Singapore – 9.2% up on the 11,302,700 mt recorded in the same period in 2022. A total of 3,476 vessels called for bunkers last month – 456 more than March 2022 and 413 more than February.

The global bunker market lacks clear drivers for the formation of a sustainable trend. We expect bunker indices to change irregularly next week. It is also advisable to stay updated with the latest news and market analysis to make well-informed decisions in this dynamic market environment.

Source: www.mabux.com