Antonella Teodoro, MDS Transmodal assesses events beyond the pandemic that are affecting the dynamics of global containerised trade, including Brexit, WTO leadership or the US presidential elections.

THE pandemic is undeniably the single most important event to have affected global containerised trade this year, making 2020 the most challenging for international in many years.

Without the health crisis other major events would have registered bigger headlines around the globe; be it Brexit, the decision on the aircraft dispute by the World Trade Organisation, WTO leadership, the US presidential elections or progress on how to harmonise global tax legislation for digital corporations.

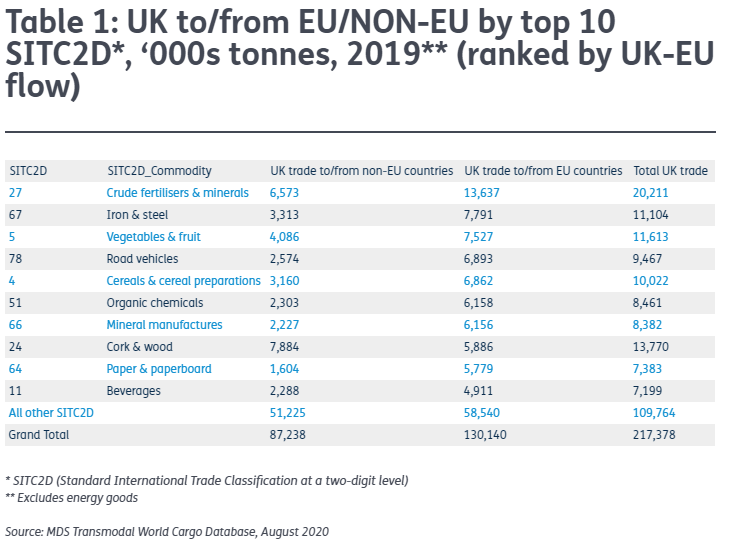

Regardless of whether the UK and the rest of the European trading partners will reach an agreement on their future trading relationship by the end of this year, trade barriers of some kind will be introduced from January 2021.

Should negotiations on a tariff-free and quota-free agreement fail, trade between the two parties will fall under the rules set by the WTO with each party entitled to set tariffs — or taxes — on imports from either party.

So, cars from the UK to the European Union could be charged at 10% of their value, with some agricultural goods being exposed to much higher tariffs (for instance the tariffs on dairy products could average more than 35% of their value).

The UK has the right to choose not to apply tariffs on goods imported from the EU, in which case this would also mean no tariffs on goods imported from every WTO member.

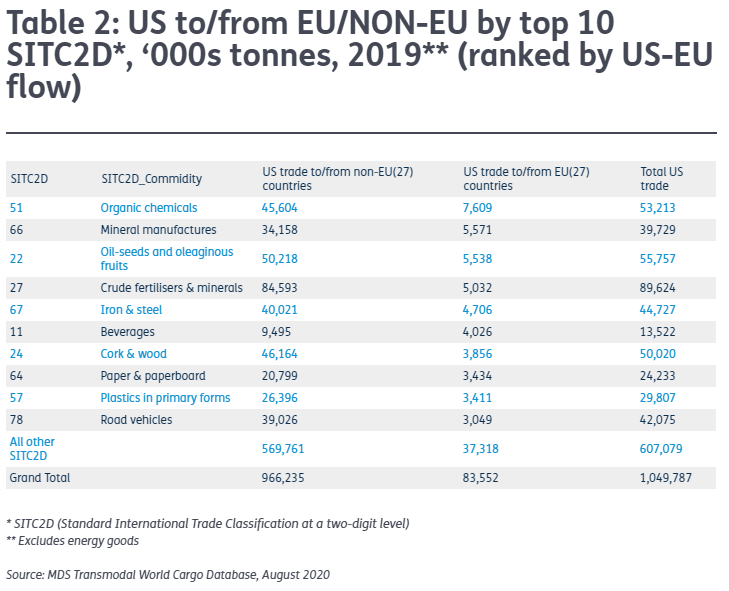

Last October, the WTO ruled that the US could target $7.5bn of imports from the EU over illegal subsidies to Airbus.

The EU has asked the WTO to be authorised to impose tariffs on $11.2bn products from the US for their illegal subsidies to Boeing Co.

At the end of September, Reuters reported that the WTO had authorised the EU to impose tariffs on US goods worth $4bn to retaliate against subsidies to Boeing Co BA.N.

Settlement of the 15-year dispute would bring an enormous relief to European exporters, currently under threat of US ‘tit-for-tat’ tariffs. The settlement would also be welcomed by the industries at the receiving end of the WTO-authorised tariffs.

Another reason for the world to keep its eyes on the WTO will be the race for its leadership, expected to be highly competitive on both an individual land national level.

The organisation, currently operating without a chief following Roberto Azevedo’s resignation in August, is under enormous pressure to reform, which is crucial to its survival.

In the past few years, various proposals have been put forward to the WTO, including stronger punitive measures against repetitive or intentional non-compliance by member states, and updates to the rules on self-classification for developing countries.

Should reform proposals fail to address member state requirements, one or more major economies could decide to leave the WTO, as President Donald Trump has already threatened.

Another event with the potential to affect global trade and that could exacerbate the impact of the pandemic on the global economy is the foreign taxation on US technology corporations such as Facebook and Google.

Countries around the world, mainly European, are aiming to reach a consensus on new tax rules for international digital firms that generate vast revenues in their territories. By contrast, Mr Trump and his administration consider this move as discrimination against US companies and has threatened retaliatory tariffs.

Discussions on finding a solution were underway, however, the US withdrew from talks in June reducing the likelihood of an early resolution.

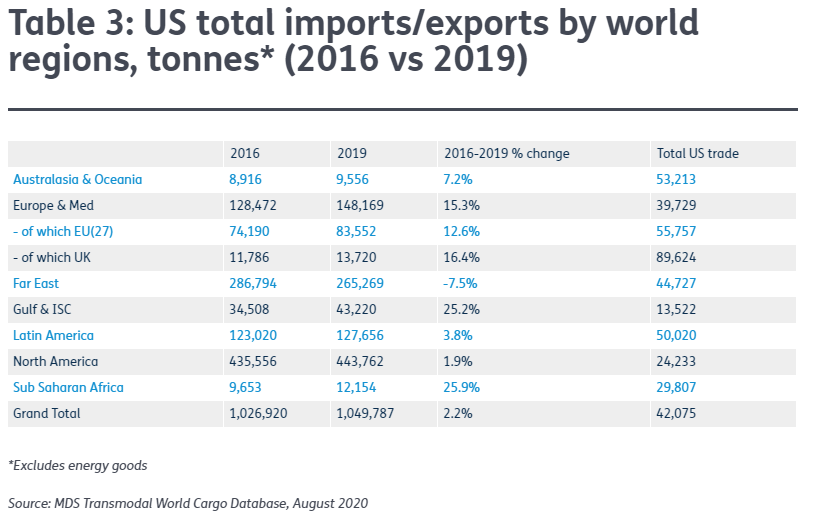

The size of the impact of any or all the above events on global trade will also be influenced by the outcome of next month’s US Presidential election.

Should Mr Trump win a second term there is the potential for an escalation in the geopolitical fight between the US and China for global leadership, which will likely lead to an increase in US tariffs on foreign trade.

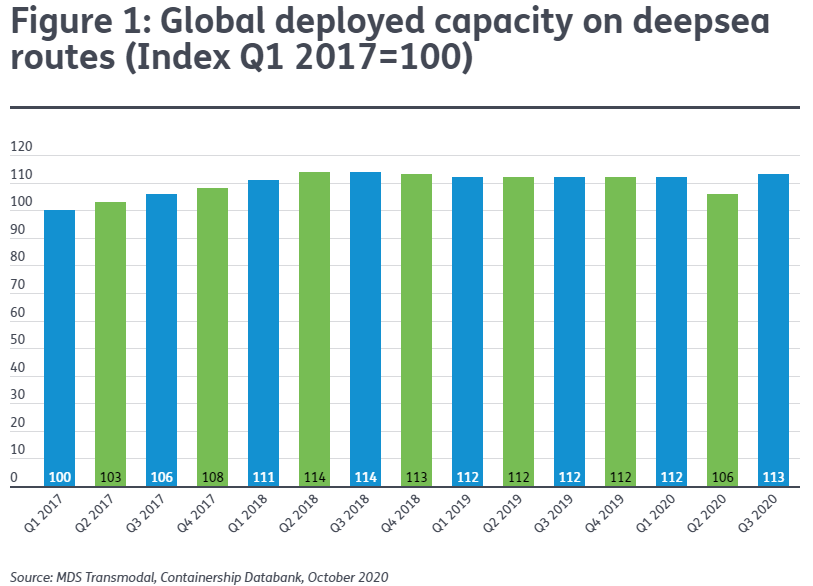

Based on the data available at the beginning of October, we observe that, after a contraction of circa 3% in the capacity offered on the deepsea market in the first half of 2020 (compared with the same period of 2019), in the third quarter carriers have increased their offer with deployed capacity now marginally higher than the capacity offered this time last year (see Figure 1 above).

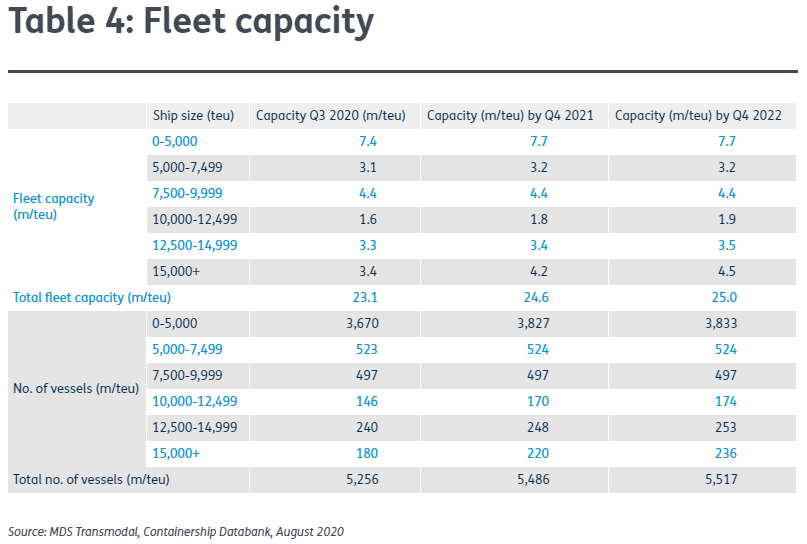

Looking at ships on order, lines are showing a willingness to put more capacity into the container shipping market. We estimate an increase of more than 6% in the total fleet capacity in teu terms by the end of 2021 and a further increase of circa 2% in 2022; unsurprisingly, we expect the percentage of ships of 15,000 teu or more to increase the most (21.8% by 2021).

Source: Antonella Teodoro, MDS Transmodal.

Follow on Twitter:

[tfws username=”MdsTransmodal” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]