2M Alliance members Maersk Line and Mediterranean Shipping Co. (MSC) have unveiled several measures recently to improve schedule reliability, which has deteriorated across the liner shipping industry in general due to congestion at many ports around the globe.

Measures Maersk and MSC are taking to boost reliability across their own network include splitting up two of their prominent pendulum services into four separate services, blanking sailings, and launching new services.

The 2M Alliance recently launched a revamped Asia-Europe Shogun/AE1 service and a separate transpacific Pearl/TP6 service. The two services previously operated as one combined pendulum service.

The 2M Alliance also recently launched a revamped Asia-Europe Lion/AE6 service and a separate transpacific Jaguar/TP2 service, which also previously operated as one combined pendulum service.

These four separate services commenced from Asia in late February and early March.

MSC said that these leaner rotations “should reduce exposure to some of the challenges in the current market environment.”

Additionally, the 2M Alliance’s Griffin/AE55 service blanked a sailing from Asia this week. The vessel that was supposed to sail, the MSC Alexandra, left Asia this week, but on the revamped Shogun/AE1 loop instead.

On the transatlantic trade, MSC revealed last week that the NEUATL1 (which Maersk calls the TA1) and the NEUATL3 (which Maersk calls the TA3) would be cascading by one week, thus resulting in the TA1/NEUATL1 blanking week 14 from Europe and week 16 from the U.S., and the TA3/NEUATL3 blanking week 11 from Europe and week 14 from the U.S./Mexico.

MSC also revealed that the Liverpool call and the first of the two calls on the rotation to the Port of New York & New Jersey would be temporarily suspended.

Maersk and MSC also have plans to launch a service in early May between Asia and the East Coast of North America called Palmetto by MSC and TP23 by Maersk, which they both said is expected to enhance schedule reliability. “The new transpacific East Coast service will include port calls in Vietnam and Yantian with a Panama Canal transit and direct connections to Savannah, Charleston and Newark in the U.S.,” Maersk said. “The service will replace the significant number of extra-loaders and ad-hoc routing solutions deployed in past months.”

The commencement is still subject to compliance with applicable regulatory requirements and more details on the service will be announced in due course, according to the carriers.

Meanwhile, MSC announced a dedicated MSC service between Southeast Asia and the U.S. West Coast, which it will call the Sentosa service.

The service is expected to start in early April with the MSC Ornella and have a rotation of Singapore, Tanjung Pelepas, Laem Chabang, Vung Tau, Long Beach, Shanghai, Ningbo, Xiamen and Singapore, MSC said.

“The addition of the Sentosa service is intended to improve the distribution of cargo flow across the various existing services and port terminals either side of the Pacific, enhancing schedule reliability in this region,” MSC said.

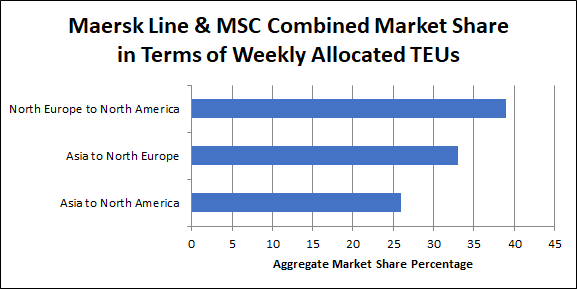

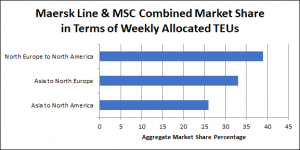

Being that Maersk and MSC hold a substantial weight on these major east-west trades, their schedule reliability measures should have a significant impact.

Data from BlueWater Reporting’s Carrier/Trade Route Deployment Report shows that the two carriers combined hold a 39% market share on the North Europe to North America trade in terms of weekly allocated TEUs, as well as a 33% combined share on the Asia to North Europe trade and a 26% share on the Asia to North America trade.