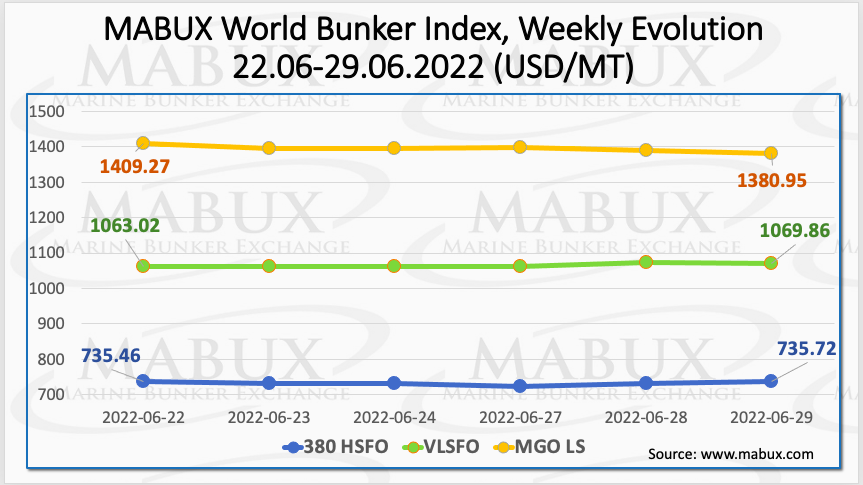

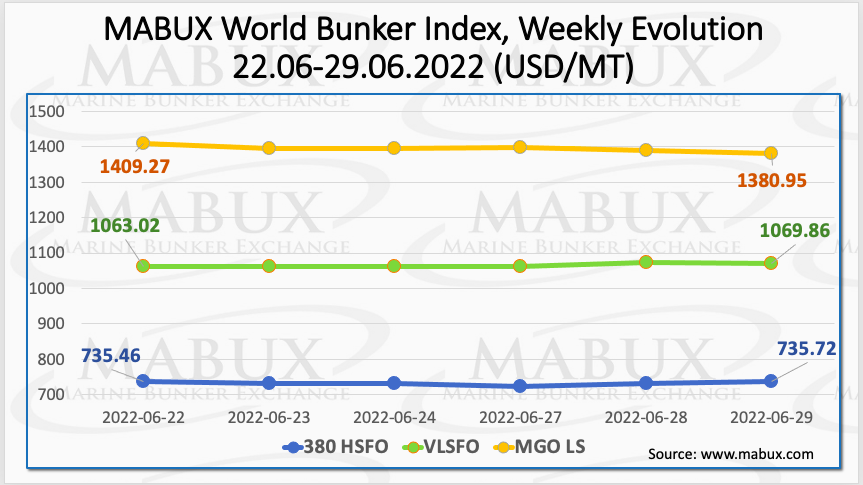

Over the Week 26, the world bunker indices did not have a firm trend and showed moderate irregular changes. The 380 HSFO index rose by a symbolic 0.26 USD: from 735.46 USD/MT to 735.72 USD/MT. The VLSFO index, in turn, went up by 6.84 USD: from 1063.02 USD/MT to 1069.86 USD/MT. The MGO index, on the contrary, dropped: minus 28.32 USD (from 1409.27 USD/MT to 1380.95 USD/MT), falling again below 1400 USD.

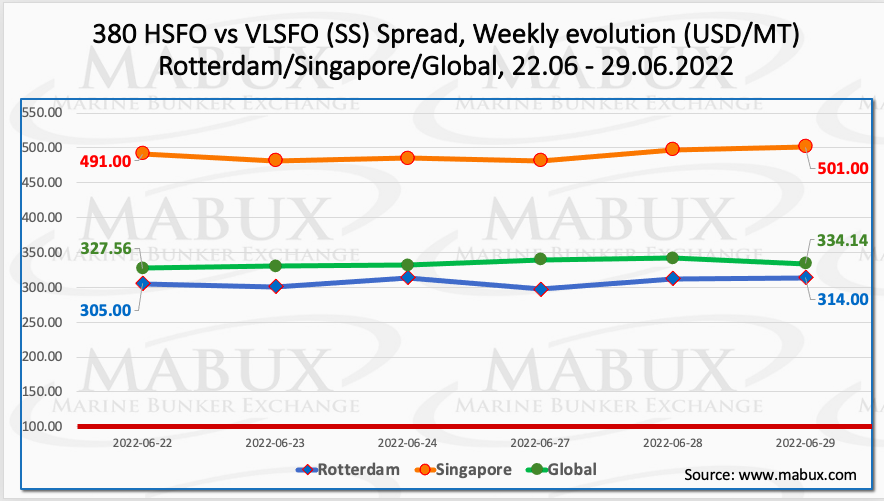

The Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its slight upward trend over the week – plus $ 5.41 ($ 334.20 versus $ 328.78 last week). In Rotterdam, the average SS Spread rose more significantly: $307.00 vs. $290.33 (up $16.67 from last week). In Singapore, the average weekly price difference of 380 HSFO/VLSFO also rose by $16.33, close again to $500: $489.83 vs. $473.50 last week. For more information, please visit the Price Difference section on mabux.com.

The Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its slight upward trend over the week – plus $ 5.41 ($ 334.20 versus $ 328.78 last week). In Rotterdam, the average SS Spread rose more significantly: $307.00 vs. $290.33 (up $16.67 from last week). In Singapore, the average weekly price difference of 380 HSFO/VLSFO also rose by $16.33, close again to $500: $489.83 vs. $473.50 last week. For more information, please visit the Price Difference section on mabux.com.

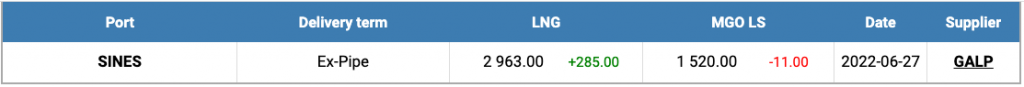

European benchmark gas prices jumped at the start of this week as Europe struggles to replace Russian gas losses to fill storage sites ahead of the winter. The price of LNG as bunker fuel in the port of Sines (Portugal) rose by 285 USD to 2963 USD/MT on June 27 (versus 2678 USD/MT a week earlier). LNG prices are still significantly higher than those of traditional bunker fuels, with the price of MGO LS at the port of Sines on June 27 being quoted at 1520 USD/MT.

European benchmark gas prices jumped at the start of this week as Europe struggles to replace Russian gas losses to fill storage sites ahead of the winter. The price of LNG as bunker fuel in the port of Sines (Portugal) rose by 285 USD to 2963 USD/MT on June 27 (versus 2678 USD/MT a week earlier). LNG prices are still significantly higher than those of traditional bunker fuels, with the price of MGO LS at the port of Sines on June 27 being quoted at 1520 USD/MT.

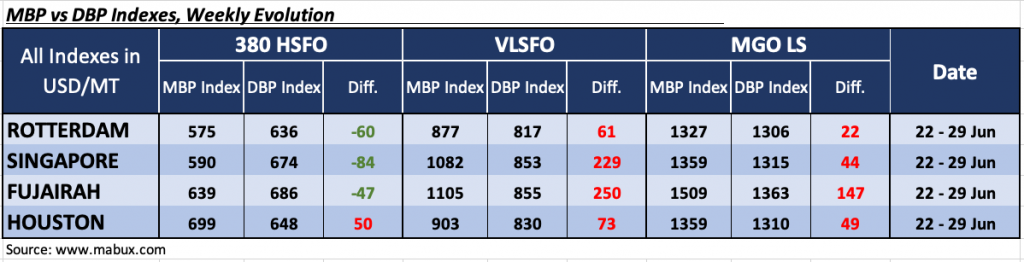

Over the week 26, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) continued to register an underestimation of 380 HSFO fuel grade in three ports out of four selected: Rotterdam – minus $ 60, Singapore – minus $ 84 and Fujairah – minus $47. Houston remains the only overpriced port – plus $ 50. MDI index did not have any single trend in the HSFO segment: in Rotterdam and Fujairah, the underprice ratio rose, while in Singapore it decreased. In Houston, the overprice premium rose as well.

Over the week 26, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) continued to register an underestimation of 380 HSFO fuel grade in three ports out of four selected: Rotterdam – minus $ 60, Singapore – minus $ 84 and Fujairah – minus $47. Houston remains the only overpriced port – plus $ 50. MDI index did not have any single trend in the HSFO segment: in Rotterdam and Fujairah, the underprice ratio rose, while in Singapore it decreased. In Houston, the overprice premium rose as well.

VLSFO fuel grade, according to MDI, remained overpriced at all four selected ports: plus $61 in Rotterdam, plus $229 in Singapore, plus $250 in Fujairah and plus $73 in Houston. Overprice premium rose in all ports, with the exception of Rotterdam. VLSFO fuel grade remains the most overvalued segment in the global bunker market, with Singapore and Fujairah over $200 mark.

As for MGO LS, over the week MDI registered an overcharge of this fuel in all selected ports: Rotterdam – plus $ 22, Singapore – plus $ 44, Fujairah – plus $ 147 and Houston – plus $ 49. Rotterdam and Singapore returned into the overcharge zone.

There are no significant changes registered in the correlation of market and benchmark digital MABUX (MDI) prices while the state of high volatility remains in global bunker market.

There are no significant changes registered in the correlation of market and benchmark digital MABUX (MDI) prices while the state of high volatility remains in global bunker market.

A shipping industry safety consortium has completed a collaborative study on the risks of future fuels which finds that of the four fuels reviewed, methanol poses the least overall risk across four defined categories, followed by LNG, hydrogen and ammonia. Methanol scored the lowest risk ratings within navigation-related scenarios, such as loss of manoeuvrability, excessive motions or a black-out at sea, as well as in scenarios related to ship operations (other than bunkering), notably cargo operations in case of damage to equipment or vent mast and crew changes during vessel handovers. Methanol also scored the lowest (that is, ‘broadly acceptable’) risk ranking in the external event scenario of hull breach from ship collision. However, within bunkering scenarios, such as leaks or loss of containment, LNG and hydrogen held ‘broadly acceptable’ risk scores. Besides, there are well established international regulations for the use of LNG as fuel on board ships, whereas for hydrogen, no such regulations or guidance are available for either its usage as fuel or storage in the marine environment. Ammonia scored ‘broadly acceptable’ risk as a potential source of ignition in the scenario of tug support or third-party vessel attendance at sea. However, some risks for ammonia as a fuel are classified as high (or ‘intolerable’) in navigation scenarios like grounding or collision leading to a hull breach, cargo operations in case of damage to equipment or vent mast, and leaks or loss of containment during bunkering.

We expect high volatility to continue in the global market next week. Bunker fuel prices may demonstrate sharp irregular fluctuations.

Source: www.mabux.com