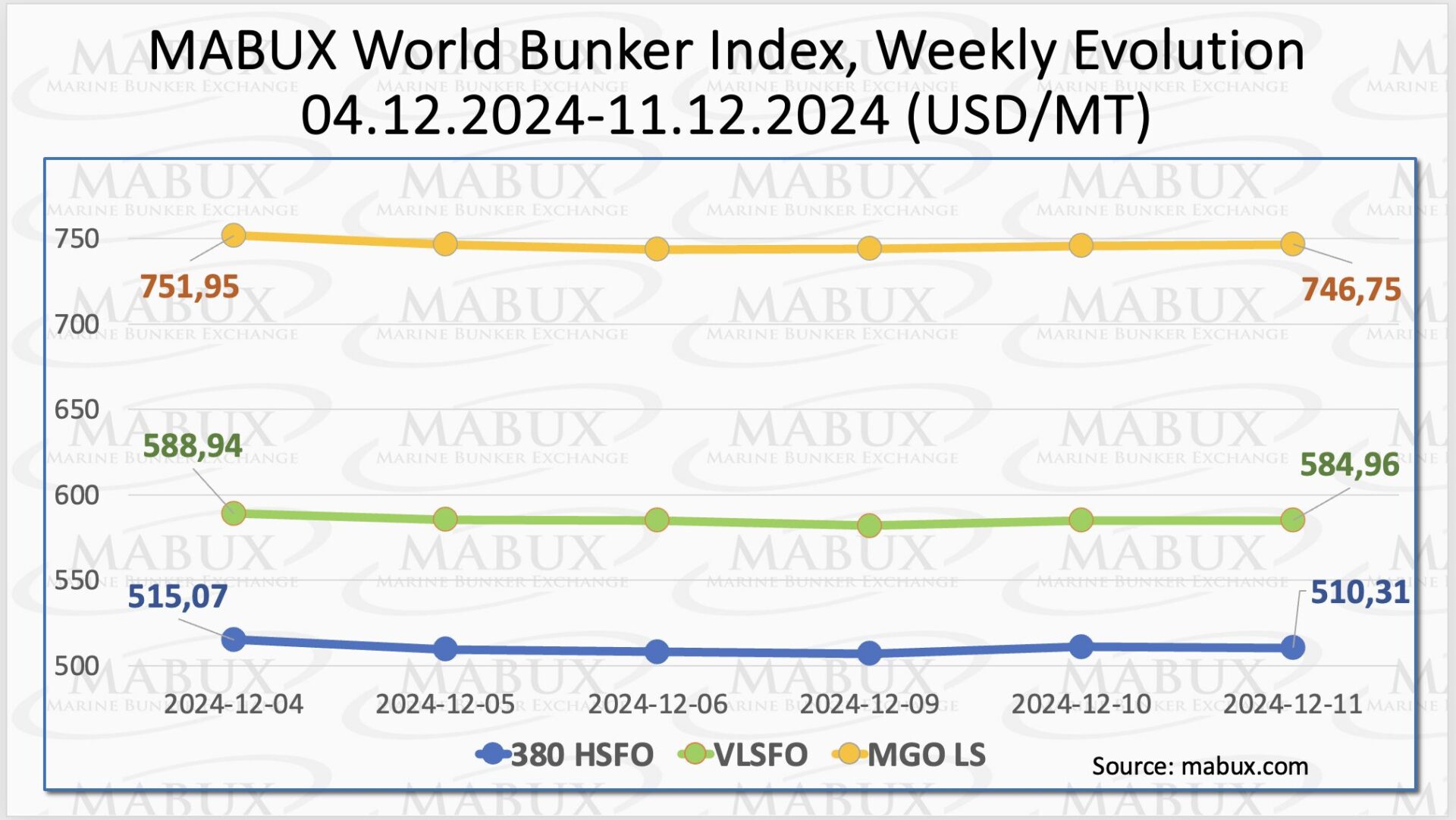

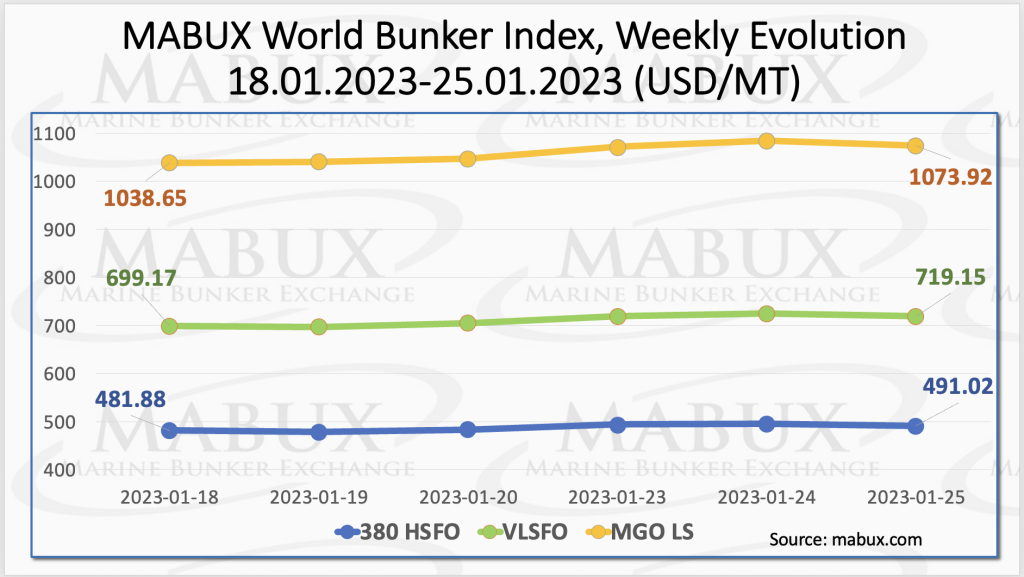

Over the Week 04, MABUX global bunker indices continued sustainable upward trend. The 380 HSFO index rose by 9.14 USD: from 481.88 USD/MT last week to 491.02 USD/MT, coming closer again to 500 USD mark. The VLSFO index added 19.98 USD (719.15 USD/MT versus 699.17 USD/MT last week), having overcome the psychological point of 700 USD. The MGO index also increased by 35.37 USD (from 1038.65 USD/MT last week to 1073.92 USD/MT. At the moment, the global bunker market retains the potential for further uptrend.

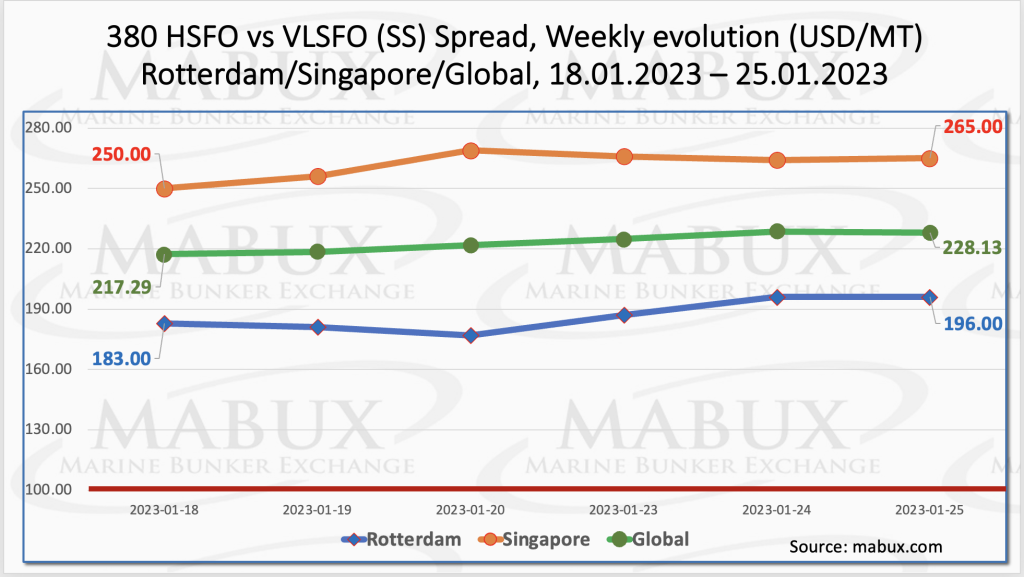

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – continued widening over the Week 04 – plus $10.84 ($228.13 vs. $217.29 last week). In Rotterdam, SS Spread rose by $13.00 to $196.00 (vs. $183.00 last week), coming close to $200 mark. In Singapore, the price differential of 380 HSFO/VLSFO increased by $15.00 ($265.00 vs. $250.00 last week). The SS Spread weekly averages in Rotterdam and Singapore also added $8.67 and $26.50 respectively. More information is available in the “Differentials” section at mabux.com.

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – continued widening over the Week 04 – plus $10.84 ($228.13 vs. $217.29 last week). In Rotterdam, SS Spread rose by $13.00 to $196.00 (vs. $183.00 last week), coming close to $200 mark. In Singapore, the price differential of 380 HSFO/VLSFO increased by $15.00 ($265.00 vs. $250.00 last week). The SS Spread weekly averages in Rotterdam and Singapore also added $8.67 and $26.50 respectively. More information is available in the “Differentials” section at mabux.com.

Europe’s natural gas prices had slumped to the level last seen before the conflict in Ukraine. Mild weather, ample volumes of gas in storage sites—well above the five-year average for this time of the year—and continued LNG imports have dragged gas prices lower in recent weeks.

Europe’s natural gas prices had slumped to the level last seen before the conflict in Ukraine. Mild weather, ample volumes of gas in storage sites—well above the five-year average for this time of the year—and continued LNG imports have dragged gas prices lower in recent weeks.

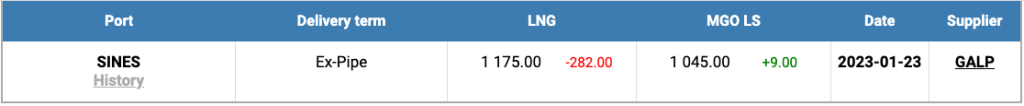

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline for the seventh week in a row and reached 1175 USD/MT on January 23 (minus 282 USD compared to the previous week). The price difference between LNG and conventional fuel on January 23 was 130 USD: MGO LS at the port of Sines was quoted at 1045 USD/MT that day. We expect that the trend towards a further narrowing of price difference between LNG and conventional fuel will continue next week.

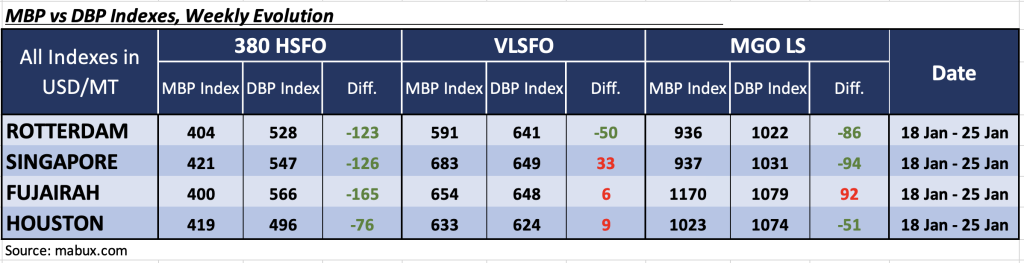

During the Week 04, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered underestimation of 380 HSFO fuel in all four selected ports. Underprice ratio rose slightly and reached the following levels: in Rotterdam – minus $ 123, Singapore minus $126, Fujairah minus $165 and Houston minus $76.

During the Week 04, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered underestimation of 380 HSFO fuel in all four selected ports. Underprice ratio rose slightly and reached the following levels: in Rotterdam – minus $ 123, Singapore minus $126, Fujairah minus $165 and Houston minus $76.

In the VLSFO segment, according to the MDI, Fujairah moved into the overprice zone and joined Singapore and Houston. Fuel overprice margins were registered as plus $6, plus $33, and plus $9, respectively. Thus, at the moment, Rotterdam remains the only port where VLSFO is underpriced: minus $50.

In the MGO LS segment, the only overvalued port is still Fujairah: plus $ 92. The overprice premium there is gradually decreasing. In all other ports, the MDI registered an underpricing of MGO LS: Rotterdam – minus $ 86, Singapore – minus $ 94 and Houston – minus $ 51. The underprice ratio continued to grow moderately.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

Deliveries of residual fuel oil in the US were 221,000 barrels per day (b/d) in December, which reflected decreases of 21.4% m/m from November and 48.8% year-on-year (y-o-y). Last month’s figure represented the lowest level since April 2021, data published by the American Petroleum Institute (API) showed. ‘The demand for residual fuel oil as a marine bunker fuel apparently decreased with the continued drop in container shipping activities, which also corresponded with the Baltic Dry shipping rate index having fallen by 7.7% m/m in December.’ However, deliveries of residual fuel oil in the US for 2022 as a whole rose 6.4% on the year, from 314,000 b/d in 2021 to 334,000 b/d.

The VeriFuel in its Q4 2022 very low sulphur fuel oil (VLSFO) statistics reports that average global VLSFO viscosity rose to reach 157 cSt in the final quarter, and the figures also highlight a two-year upwards trend in viscosity, starting from 115 in Q1 2021. The highest monthly level for viscosity was 162, recorded in December. VLSFO sulphur content was 0.46%, compared to the 0.45% seen in the first three quarters of the year. At 2.3%, the percentage of off-spec fuel samples reached the quarterly highest of the year in Q4. In the ARA region, viscosity rose over the year, from 142 in Q1 to 173 in Q4. In this market, the percentage of off-spec VLSFOs rose to 5% in the final quarter. This was the highest of the year, with sulphur, water and density noted as contributory factors. Other Q4 off-spec spikes were seen in Busan, where the presence of water contributed to 5.6% of samples being deemed as off-spec.

The global bunker market retains growth potential ahead of the implementation of the EU ban on Russian oil products set to come into force on February 05. We expect bunker prices to continue their uptrend next week.

Source: www.mabux.com