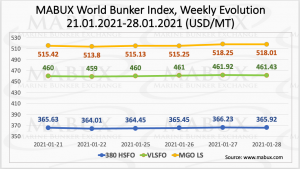

The World Bunker Index MABUX was steady over a week with no real firm trend. The 380 HSFO index rose slightly from 365.63 USD/MT to 365.92 USD/ MT (+0.29 USD), VLSFO added only 1.43 USD: from 460.00 USD/MT to 461.43 USD/MT while MGO gained 2.59 USD and changed from 515.42 USD/MT up to 518.01 USD/MT. The Global Scrubber Spread (SS) (price difference between 380 HSFOs and VLSFOs) was also stable: it added only 0.32 USD and averaged USD 95.28 (94.96 USD a week ago).

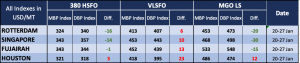

The correlation of MBP index (market bunker prices) vs DBP index (digital benchmark MABUX) in the four global largest hubs over the past week showed that 380 HSFO fuel remains moderately undervalued in three of four selected ports: Rotterdam (minus 16 USD), Singapore (minus 14 USD) and Fujairah (minus 1 USD).

In Houston, this type of fuel was slightly overestimated (plus 3 USD). Overall, the current trend shows a gradual rebalancing towards a moderate undercharging of heavy fuel in the global bunker market. The VLSFO fuel price, according to DBP Index, remained moderately overvalued in all selected ports, ranging from plus 6 USD (Rotterdam) to plus 23 USD (Houston). DBP Index also showed that MGO LS was undervalued in all ports ranging from minus USD 15 (Fujairah) to minus USD 30 USD (Singapore), with the exception of Houston (was overcharged by USD 12).

Scrubber Spread (SS): The difference in price between the traditional 380 HSFO and VLSFO remains one of the most important indices for predicting the future development trend of global shipping in terms of compliance with IMO emissions requirements.

One of the common ways of complying with IMO2020 emission requirements is use of scrubbers in combination with relatively cheap high-sulfur fuel oil: SS represents the economic attractiveness of such a solution.

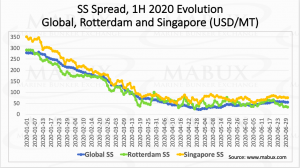

According to MABUX, SS fell in the first half of 2020 from $350 (Singapore) and from $290 (Rotterdam) to $50 (Apr.14, 2020) and to $25 (Apr.27, 2020) respectively, led to a sharp decrease in a number of scrubber orders as well as delays and cancellations of contracts for the installation of already ordered devices.

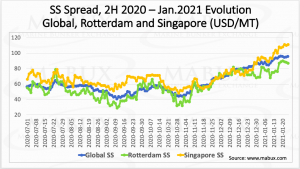

The second half of 2020 and early 2021 saw a gradual recovery in global bunker demand, supported by optimism for vaccines, which resulted in a moderate rise in bunker fuel prices and, as a consequence, gradual recovery of the SS spread. Although not reaching the levels of early 2020, on January 13, 2021, the SS index for Singapore surpassed the $ 100 mark with SS for Rotterdam coming close to that level as well. This rise indicates increased relevance of scrubbers’ solutions.

Current state of the oil futures market (with which the correlation of both types of fuel: 380 HSFO and VLSFO is traced) does not clarify further trends yet. However, the forecast price for Brent in 2021 at 60-65 dollars per barrel allows assuming that SS will continue growing moderately, reaching 120-130 dollars in the medium outlook.

Whether it will be enough for increased demand for scrubber solution – time will tell. Future availability of 380 HSFO introduces uncertainty too, especially in context of actively discussed potential tightening of ecological requirements to marine fuels. In the meantime, the statistics from DNV GL on operating and ordered scrubbers does not look too optimistic so far: 2019 – 3154 ships, 2020 – 4389 ships and 2021 – 4555 ships, which is only 7.5% of the total number of global commercial fleets.

Source: Mabux

Follow on Twitter:

[tfws username=”MAbuxAB” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]