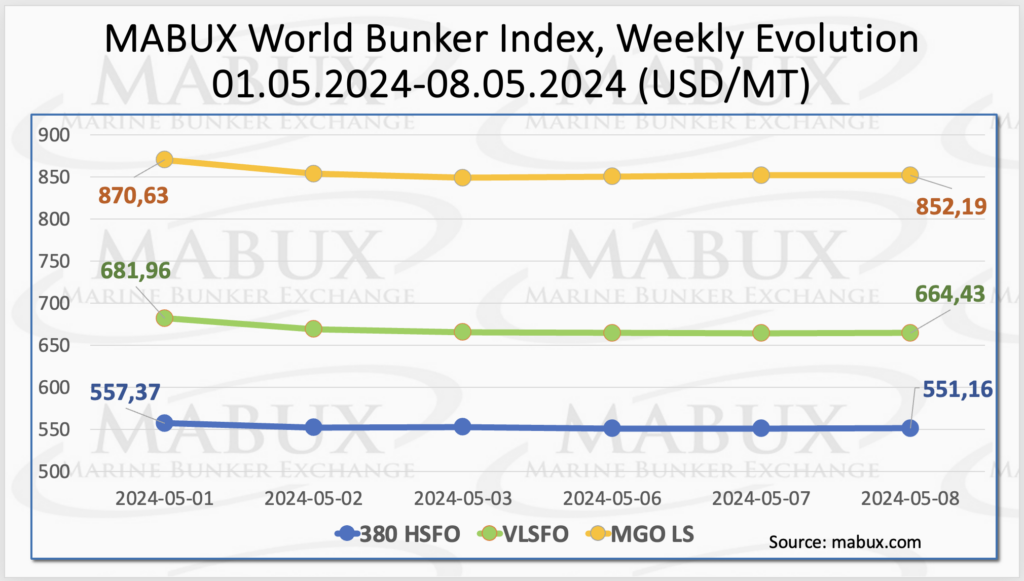

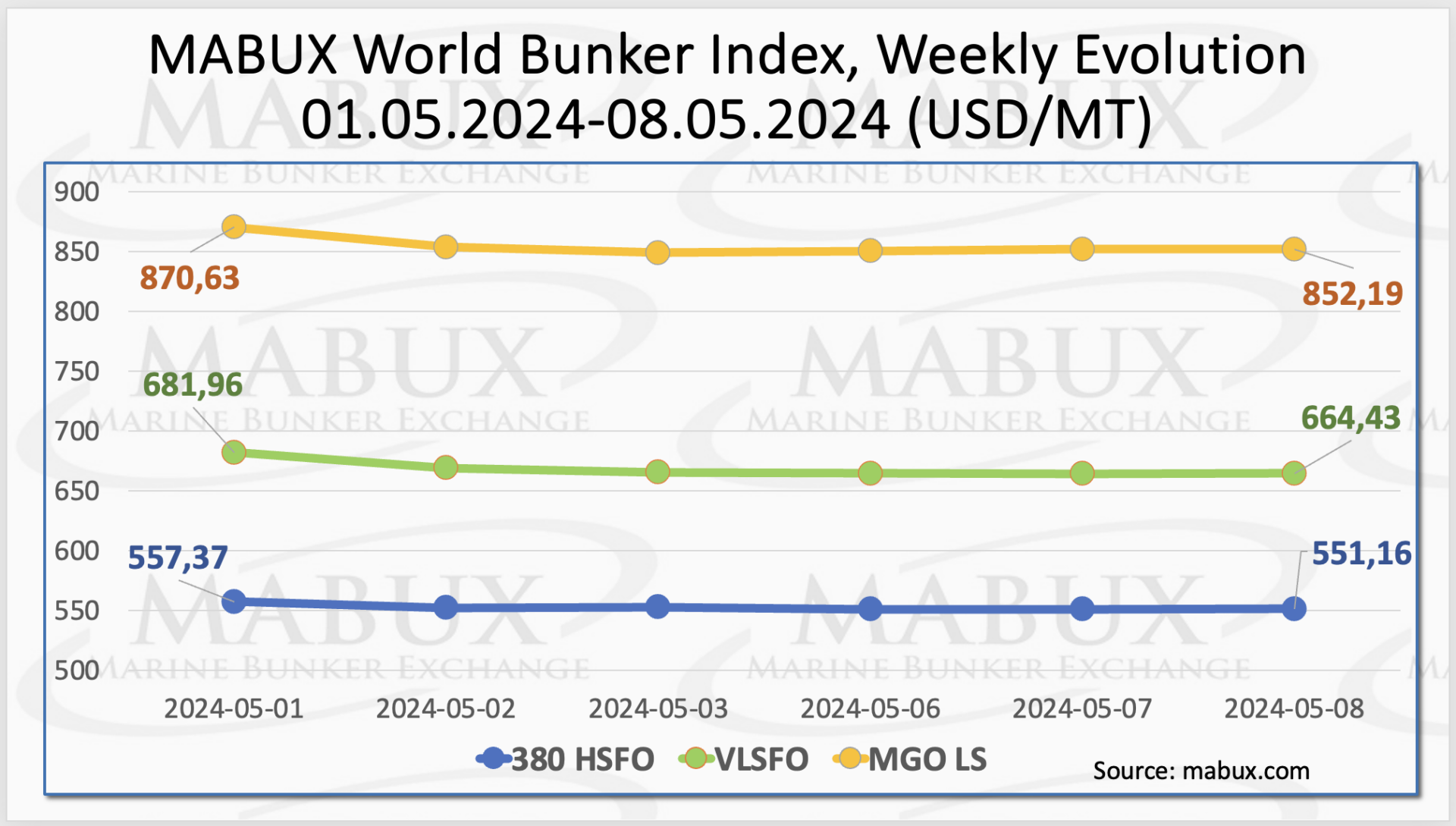

Over the Week 19, the MABUX global bunker indices showed a moderate decline. The 380 HSFO index dropped by 6.21 USD, sliding from 557.37 USD/MT last week to 551.16 USD/MT. Similarly, the VLSFO index saw a decrease of 17.53 USD, settling at 664.43 USD/MT compared to 681.96 USD/MT the previous week.

The MGO index also declined by 18.44 USD, from 870.63 USD/MT to 852.19 USD/MT). At the time of writing, a moderate downward trend continued in the global bunker market.

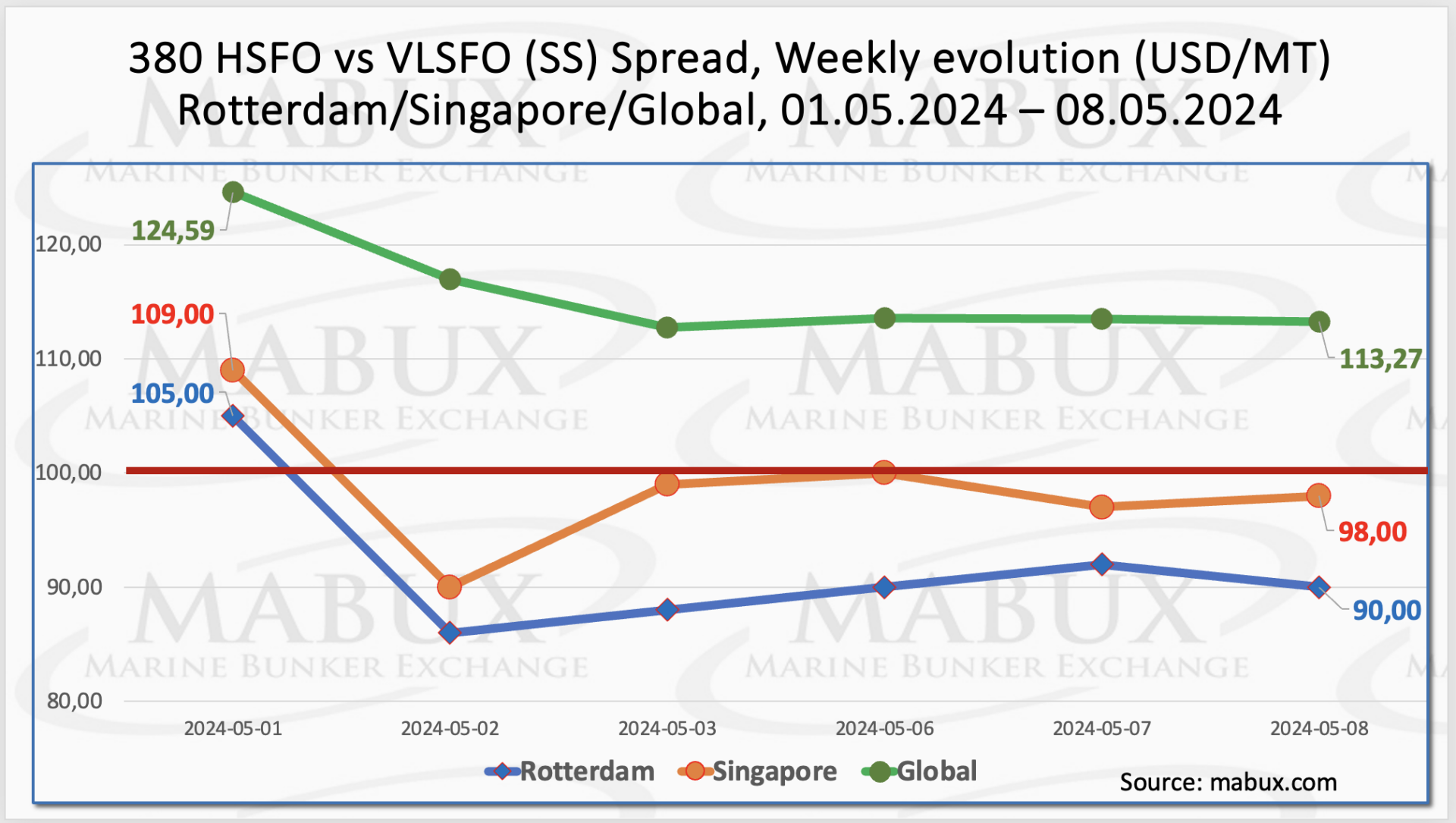

The MABUX Global Scrubber Spread (SS) – the price gap between 380 HSFO and VLSFO – continued its steady reduction: minus $11.32 ($113.27 versus $124.59 last week), nearing the $100 mark (SS Breakeven), while the weekly average also decreased by $14.89.

The MABUX Global Scrubber Spread (SS) – the price gap between 380 HSFO and VLSFO – continued its steady reduction: minus $11.32 ($113.27 versus $124.59 last week), nearing the $100 mark (SS Breakeven), while the weekly average also decreased by $14.89.

In Rotterdam, the SS Spread dipped below the $100 mark, down $15.00 (from $105.00 last week to 90.00), with the port’s weekly average also falling by $16.34. Similarly, in Singapore, the price difference for 380 HSFO/VLSFO decreased by $11.00 ($98.00 versus $109.00 last week) and the weekly average dropped by $20.50.

Consequently, SS Spread in two major ports was below the $100 mark, reigniting discussions about the profitability of using scrubbers with high-sulfur fuel oil (HSFO) versus direct use of low-sulfur fuel oil (VLSFO). We expect the downward trend in SS Spread to persist next week. More information is available in the “Differentials” section of mabux.com.

Cheniere Energy, the leading producer of liquefied natural gas (LNG) in the United States, anticipates robust global demand for natural gas in the foreseeable future, coinciding with an upcoming surge in supply. The company highlights an estimated additional 200 million tonnes of annual LNG output capacity slated to come online post-2025.

Cheniere Energy, the leading producer of liquefied natural gas (LNG) in the United States, anticipates robust global demand for natural gas in the foreseeable future, coinciding with an upcoming surge in supply. The company highlights an estimated additional 200 million tonnes of annual LNG output capacity slated to come online post-2025.

Cheniere projects a potential doubling of China’s demand for LNG exports within the next decade. Meanwhile, in the United States, electricity demand is projected to escalate by as much as 20% by 2030, potentially driving a surge in natural gas demand by up to 10 billion cubic feet per day.

Furthermore, Goldman Sachs forecasts that natural gas will capture 60% of the new electricity demand from data centers, surpassing the estimated 40% market share for renewables, thereby offering substantial benefits to gas pipeline operators.

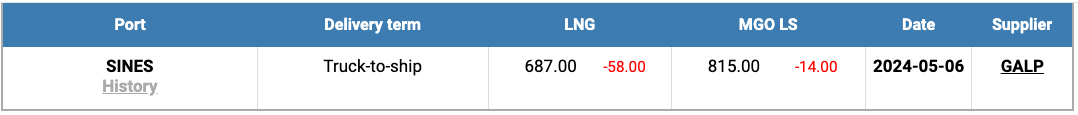

The price of LNG as bunker fuel in the port of Sines (Portugal) continued its downward trend, reaching 687 USD/MT on May 06, marking a decrease of 58 USD compared to the previous week. Meanwhile, the price gap between LNG and conventional fuel widened on May 06, now standing at 128 USD in favor of LNG, compared to 102 USD a week earlier. MGO LS was quoted at 815 USD/MT in the port of Sines on that day. For further details, visit the LNG Bunkering section on mabux.com.

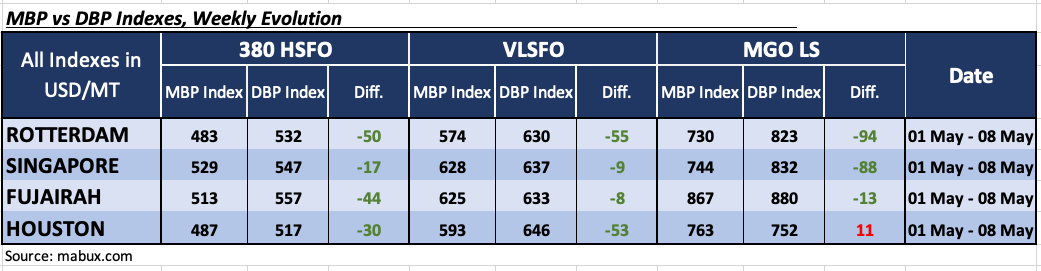

In Week 19, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) observed the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In Week 19, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) observed the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all selected ports were in the undercharge zone. Weekly averages fell by 16 points in Rotterdam, 29 points in Singapore, 25 points in Fujairah and 15 points in Houston. Thus, the trend towards reducing undervaluation in the 380 HSFO segment continues.

In the VLSFO segment, all ports remained undervalued according to the MDI, with average weekly levels declining by 6 points in Rotterdam, 14 points in Singapore, and 12 points in Fujairah. The MDI index in Houston remained unchanged, while in Singapore and Fujairah, they approached the 100% correlation mark between market price and the MABUX digital benchmark.

In the MGO LS segment, Houston continued to be the only overvalued port, with the average weekly overpricing increasing by 3 points. All other ports were undervalued. Average weekly levels declined by 8 points in Rotterdam, 2 points in Singapore, and 6 points in Fujairah. The MDI index in Rotterdam dropped below the $100 mark again.

By week’s end, the balance of overvalued/undervalued ports across all market segments stayed constant. Nevertheless, the overall trend of decreasing undervaluation levels for all types of bunker fuel on the global market persisted.

By week’s end, the balance of overvalued/undervalued ports across all market segments stayed constant. Nevertheless, the overall trend of decreasing undervaluation levels for all types of bunker fuel on the global market persisted.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on mabux.com.

According to DNV, there were 23 new orders for alternative-fueled vessels registered last month, with methanol comprising 12 of them. The class society emphasized that all methanol orders originated from the tanker segment, which historically showed low adoption of alternative fuels.

In the first four months of the year, 93 new orders for alternative-fueled vessels were recorded, with methanol-fueled ships accounting for over half at 47. April saw seven orders for LNG-fueled vessels and four for ammonia-fueled ships.

DNV observes that April’s figures, following a sluggish March, confirm a growing trend towards alternative-fueled vessels, particularly in the tanker segment. Methanol leads in the number of orders for 2024, totaling 47—a 42% increase compared to the same period in 2023. Notably, four new orders for ammonia-fueled vessels were placed in April, in addition to the five ordered in the first quarter of 2024.

We anticipate a downward trend forming in the global bunker market. Next week, global bunker indices may show a moderate decline.

Source: MABUX