The China to North America trade will experience substantially less blanked sailings around China’s National Day Golden Week holiday in October this year compared to in 2019 as consumer demand across North America holds strong.

Several prominent North American ports have recently seen a rebound in loaded container imports, not only due to peak season, but also from businesses still restocking their inventories in the wake of lockdowns earlier this year and consumers spending more on goods and less on services due to the pandemic.

“One view of the experts from an economic side shows that we’re not going to plays, we’re not going to the movies or ballgames. We’re not purchasing services like our holiday or vacation travel. There seems to be more of our savings going towards purchasing at the retail level,” Gene Seroka, Executive Director of the Port of Los Angeles said during a September media briefing.

Jonathan Gold, Vice President of Supply Chain and Customs Policy at the National Retail Federation, also agreed this was the case, noting how retail sales have remained strong for many holidays this year, including Independence Day, Mother’s Day, Father’s Day, and even during the back to school shopping season, which spurred more spending on electronics and homeschooling supplies.

The Port of Los Angeles, the busiest container port not only on the U.S. West Coast, but for all of the U.S., handled 516,286 TEUs of loaded imports in August, up 13% from a month earlier and up 18% from a year earlier, according to data from the port.

Although the Port of New York & New Jersey, the busiest U.S. East Coast port, still has yet to publish its August throughput figures, the Port of Savannah, the second busiest U.S. East Coast port, also recorded a similar trend. A total of 227,537 TEUs of loaded imports were handled at the Port of Savannah in August, up 23% from a month earlier and up 5% from a year earlier, according to Georgia Ports Authority data.

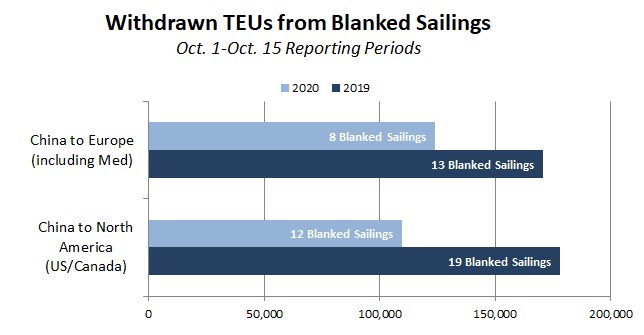

BlueWater Reporting’s Blanked Sailings Report shows that 109,806 TEUs are expected to be withdrawn on the China to North America (U.S. and Canada) trade from Oct. 1-Oct. 15, a 38% decline from the 178,141 TEUs of capacity that were withdrawn on the trade during the corresponding 2019 period, as illustrated in the chart below.

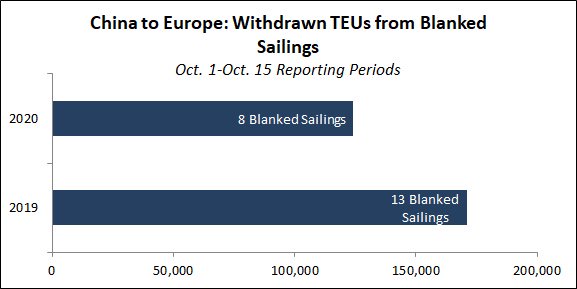

The China to Europe trade is also expected to see a substantial drop in the amount of TEU capacity withdrawn during the first half of October this year compared to last, but not to the same extent as the China to North America trade.

BlueWater Reporting estimates 124,059 TEUs will be withdrawn on the China to Europe (including North Europe and the Mediterranean) trade from Oct. 1-Oct. 15, 27% less than the 170,857 TEUs that were withdrawn on the trade during the same period last year, as illustrated in the chart below.

Source: Hailey Desormeaux, BlueWater Reporting