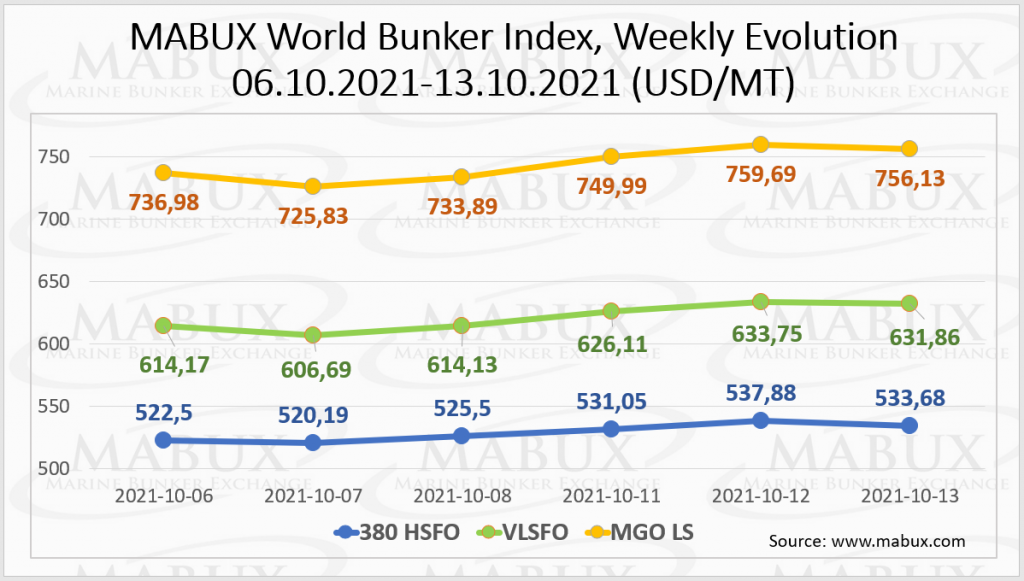

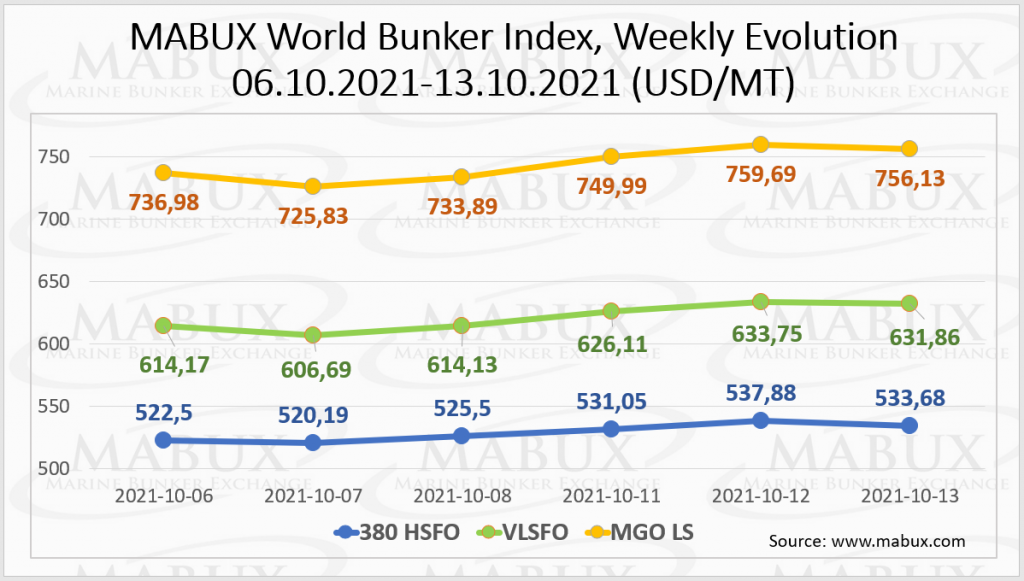

On a Week 41, the MABUX World Bunker Index continued its firm upward trend, but in a bit slightly manner that the week before. The 380 HSFO index rose by 11.18 USD : from 522.50 USD / MT to 533.68 USD / MT. The VLSFO index increased by 17.69 USD: from 614.17 USD / MT to 631.86 USD / MT, while the MGO index added 19.15 USD (the rise from 736.98 USD / MT to 756.13 USD / MT).

MABUX temporarily suspends publication of the MABUX ARA LNG Bunker Index as the LNG bunkering market has practically stalled due to falling demand caused by a sharp increase in gas prices in Europe. We believe the gas crisis is temporary and expect LNG bunkering operations to resume by the end of this year. The publication of the MABUX ARA LNG Bunker Index will resume as soon as the LNG bunker market recovers.

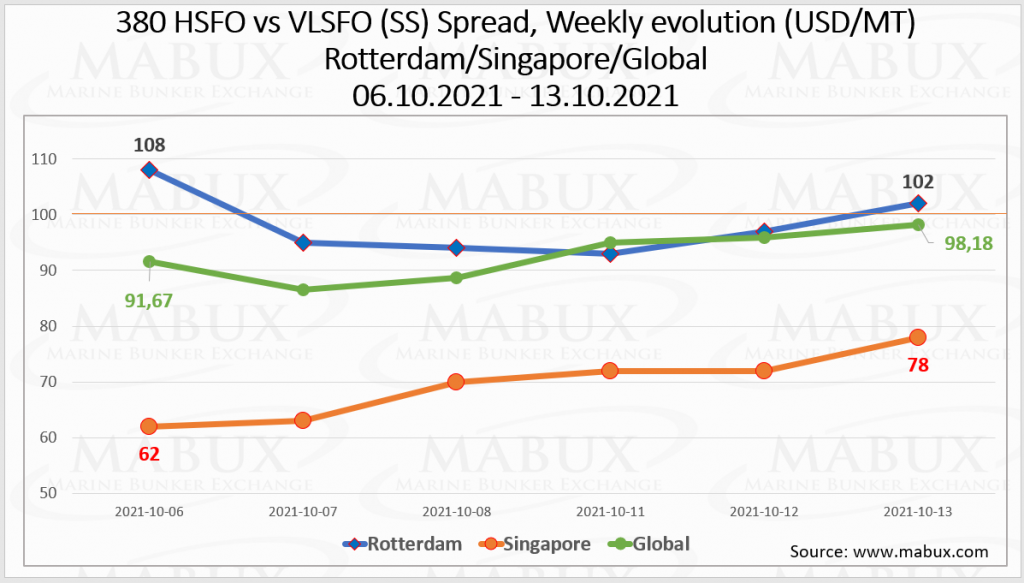

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued a slight decline during the week and amounted to $ 92.65 (versus $ 93.35 last week). Meantime, the average weekly SS Spread in Rotterdam declined and now is a little below the $ 100 mark: $ 98.17 (against $ 110.33 last week, minus $ 12.16). The average SS Spread in Singapore, on the contrary, continued to decline and is well below the psychological mark of $ 100: $ 69.50 versus $ 71.33 last week (minus $ 1.33). More information is available in the Differentials section of www.mabux.com.

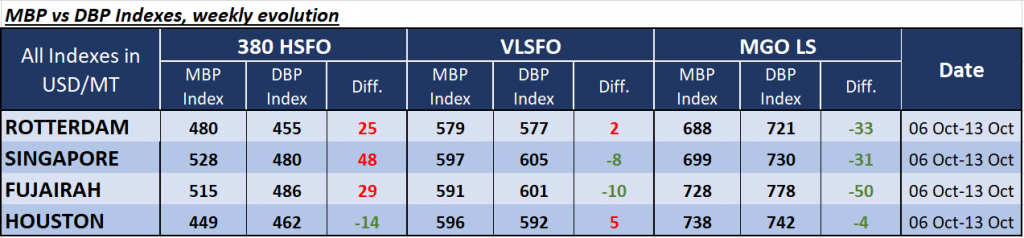

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was overvalued in all selected ports (except of Houston), where the Index recorded an underpricing of $ 14 (vs. minus $ 16 a week earlier). In other ports, 380 HSFO was overcharged: in Rotterdam – plus $ 25, in Singapore – plus $ 48 and in Fujairah – plus $ 29.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, was in the undervaluation zone in two out of four selected ports: in Singapore by minus $ 8, in Fujairah by minus $ 10. In Rotterdam and Houston this fuel grade was overvalued by $2 and $5 respectively.

The MABUX MBP / DBP Index also recorded an undercharge of MGO LS fuel at all selected ports: minimum value in Houston (minus $ 4), maximum value in Fujairah (minus $ 50).

Overall, MGO LS HSFO remains the only fuel type with undercharge status.

A rapid replacement of fossil fuels with renewable fuels based on green hydrogen and advanced biofuels could enable to cut up to 80% of CO2 emissions attributed to international maritime shipping by mid-century, a new report by the International Renewable Energy Agency (IRENA) finds. Renewable fuels should contribute at least 70% of the sector’s energy mix in 2050, IRENA’s A Pathway to Decarbonise the Shipping Sector by 2050 shows, outlining a roadmap for the global shipping sector in line with the global 1.5°C climate goal.

Source: MABUX