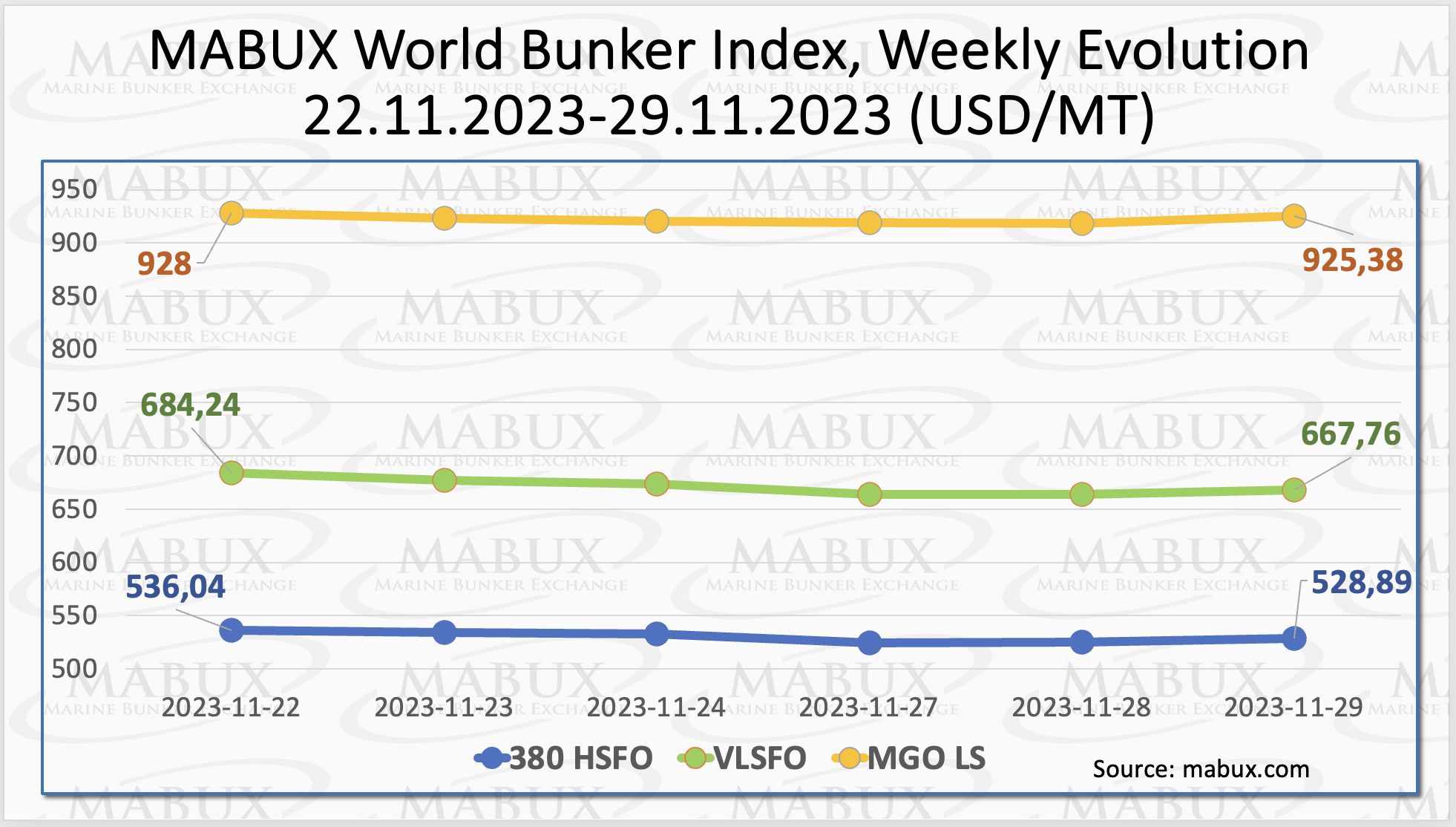

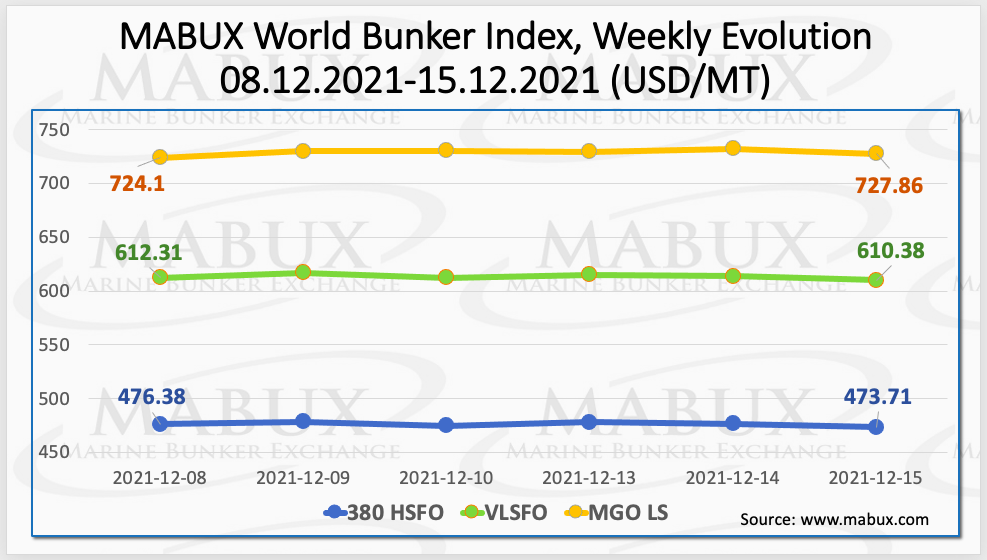

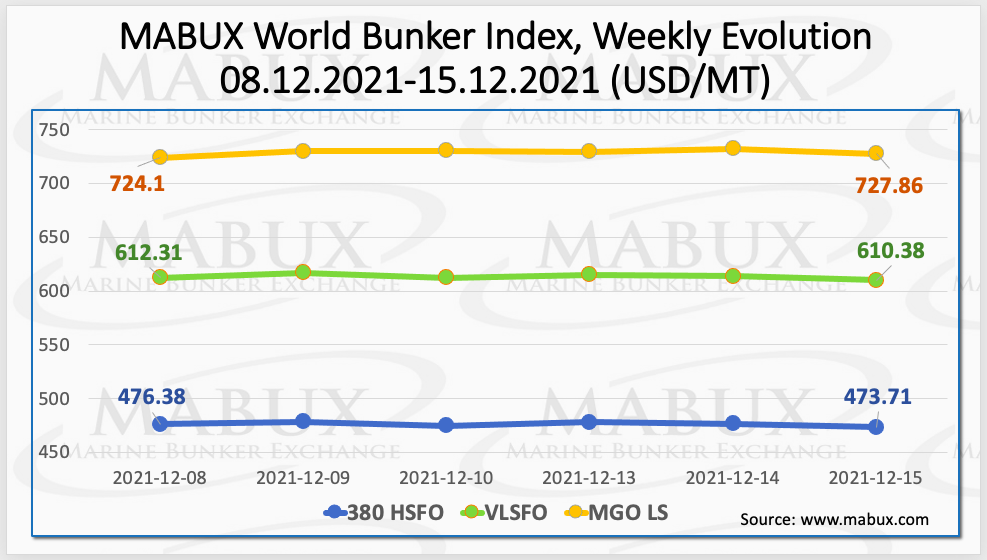

On a Week 50, the MABUX World Bunker Index showed insignificant and irregular changes. The HSFO 380 Index dropped by 2.67 USD: from 476.38 USD / MT to 473.71 USD / MT. The VLSFO index lost 1.93 USD: from 612.31 USD / MT to 610.38 USD / MT, while the MGO index rose by 3.76 USD (from 724.10 USD / MT to 727.86 USD / MT).

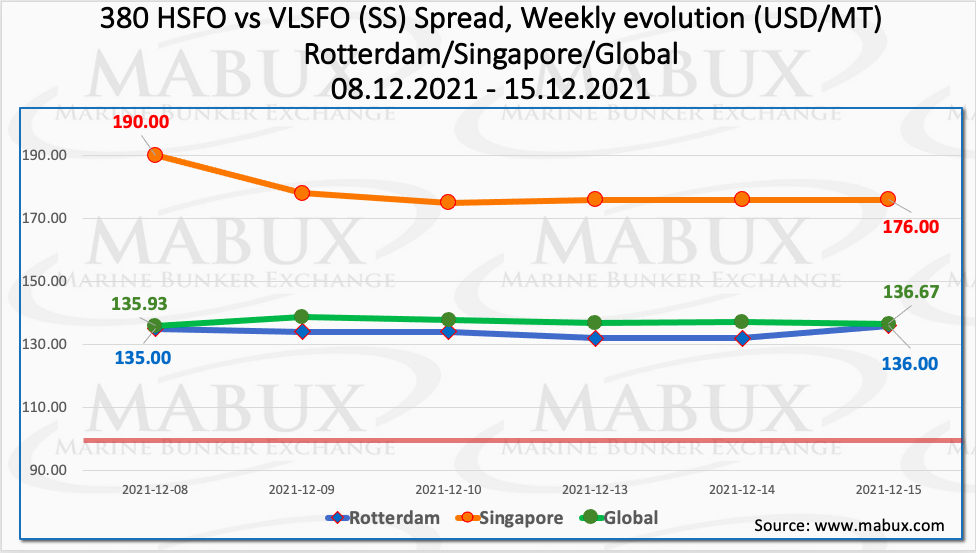

The weekly average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – remained stable during the week: a slight increase by $ 0.54 ($ 137.15 versus $ 136.61 last week). At the same time, the average weekly SS Spread in Rotterdam fell to $ 133.83 versus $ 138.17 (minus $ 4.34 compared to the week before). The average weekly SS Spread in Singapore showed a more significant decline – by $ 9.67 to $ 178.50 vs. $ 188.17 last week. The current fluctuations in the SS Spread are nevertheless keeping the indicator consistently above the psychological mark of $ 100. More information is available in the Differentials section of the website www.mabux.com.

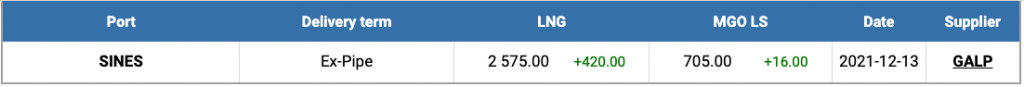

A combination of Russia’s inactive Nord Stream 2 pipeline and cooler weather forecast through the end of December sparked a rally in European natural gas futures. As a result, prices for LNG as a marine fuel at the port of Sines (Portugal) on December 13 rose by 420 USD to 2,575 USD / MT (versus 2,155 USD / MT a week earlier). The price of bunker LNG exceeds the price of MGO LS in the port of Sinesh by USD 1,870 (USD 705 / MT as of December 13). LNG is still not cost competitive with traditional bunker fuels.

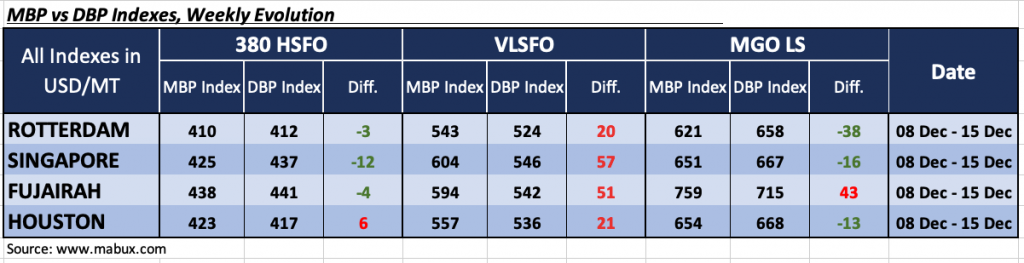

On a Week 50, the MABUX MBP Index (Market Bunker Prices) vs. MABUX DBP Index (MABUX Digital Bunker Benchmark) correlations return to the underpricing segment in all four world’s largest hubs. In particular, 380 HSFO fuel was underestimated in three out of four ports: in Rotterdam – minus $ 3, in Singapore – minus $ 12 and in Fujairah – minus $ 4. Houston was the only port where the MABUX MBP / DBP Index registered an overcharge: plus $ 6. In general, the 380 HSFO MBP / DBP Index is close to 100% correlation in all the selected ports.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, remained significantly overpriced in all selected ports: plus $ 20 in Rotterdam, plus $ 57 in Singapore, plus $ 51 in Fujairah and plus $ 21 in Houston. However, there was also a decrease of overcharge margins at all the ports compared to the previous week.

As for MGO LS, the MABUX MBP / DBP Index recorded an undercharge of this fuel grade in three out of four ports selected: in Rotterdam by minus $ 38, in Singapore by minus $ 16 and in Houston by minus $ 13 in Fujairah by plus $ 52 and in Houston by $ 20 plus. Only in Fujairah, according to the MABUX MBP / DBP Index, MGO LS was overpriced by $ 43.

The Mediterranean is set for more stringent sulphur limits after the littoral countries agreed to the designation of a 0.10% sulphur emission control area (MedECA) in the region. The decision was taken at the meeting of the contracting parties of the Barcelona Convention in Antalya last week. Once the proposal has gone through the necessary steps at the IMO, the MedECA is expected to be in force in January 2025 – 10 years after similar SECAs were established in northern Europe and the Americas. However, a regulation on nitrogen emissions (NOx) from ships will not be included in the submission to the IMO – though the countries agreed to work on NOx in the next two years which could potentially bring about a NOx ECA.

Source: www.mabux.com