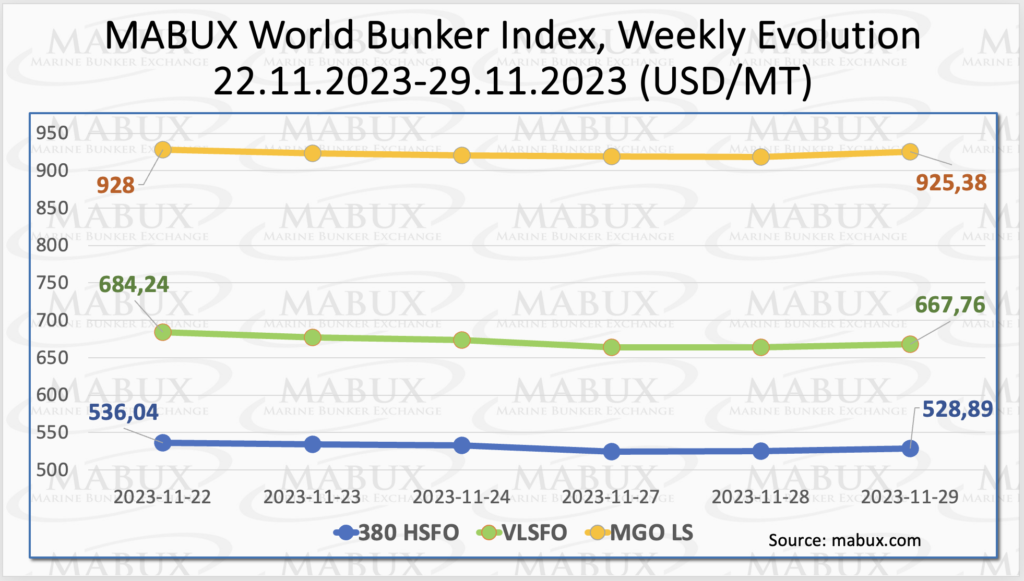

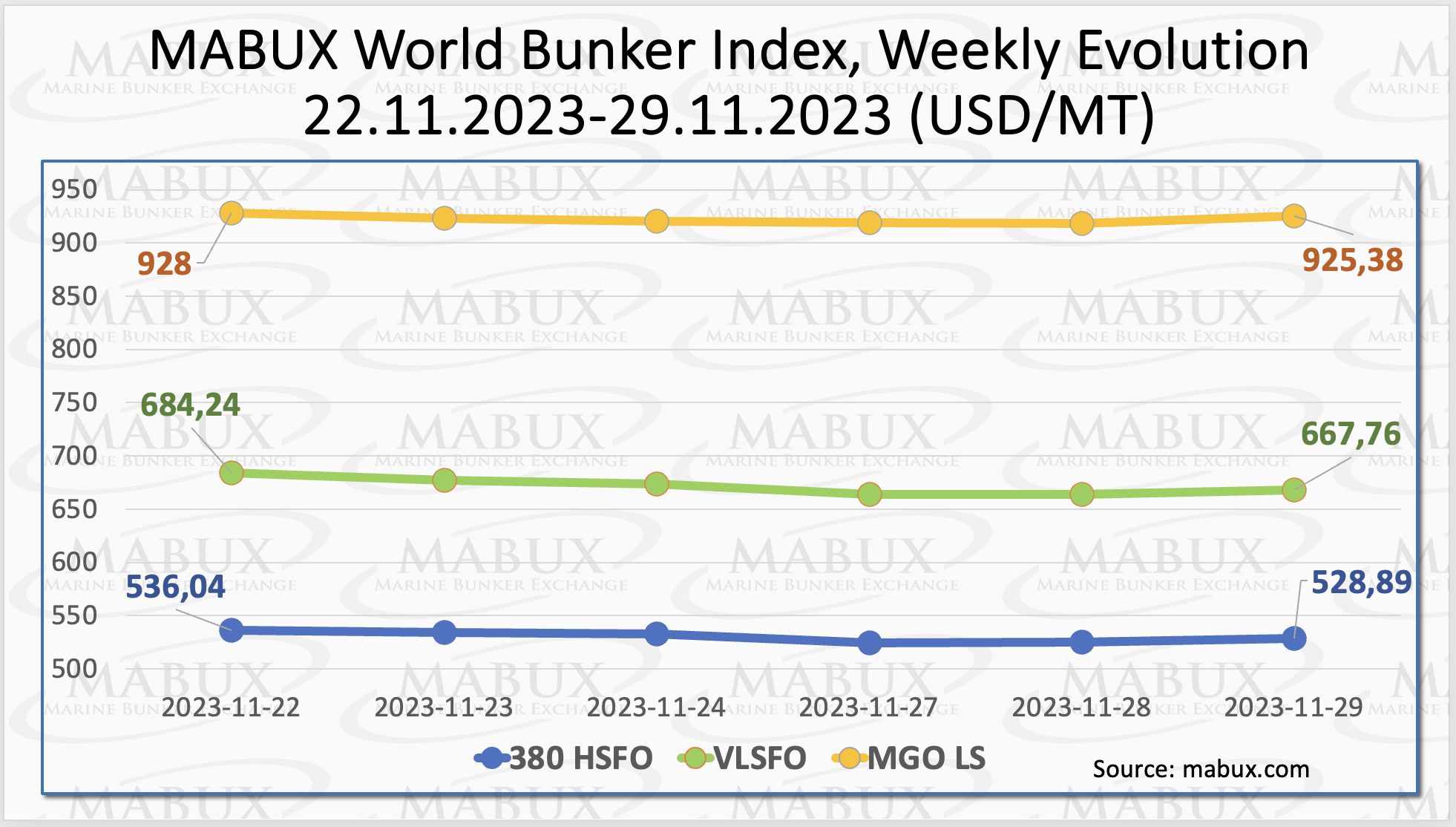

During Week 48, the MABUX global bunker indices experienced a modest decline. The 380 HSFO index decreased by 7.15 USD, moving from 536.04 USD/MT last week to 528.89 USD/MT, although it remained above the $500 mark. The VLSFO index, in turn, lost 16.48 USD (667.76 USD/MT versus 684.24 USD/MT last week). The MGO index also fell by 2.62 USD (from 928.00 USD/MT last week to 925.38 USD/MT). At the time of writing, no clear trend in the market has emerged.

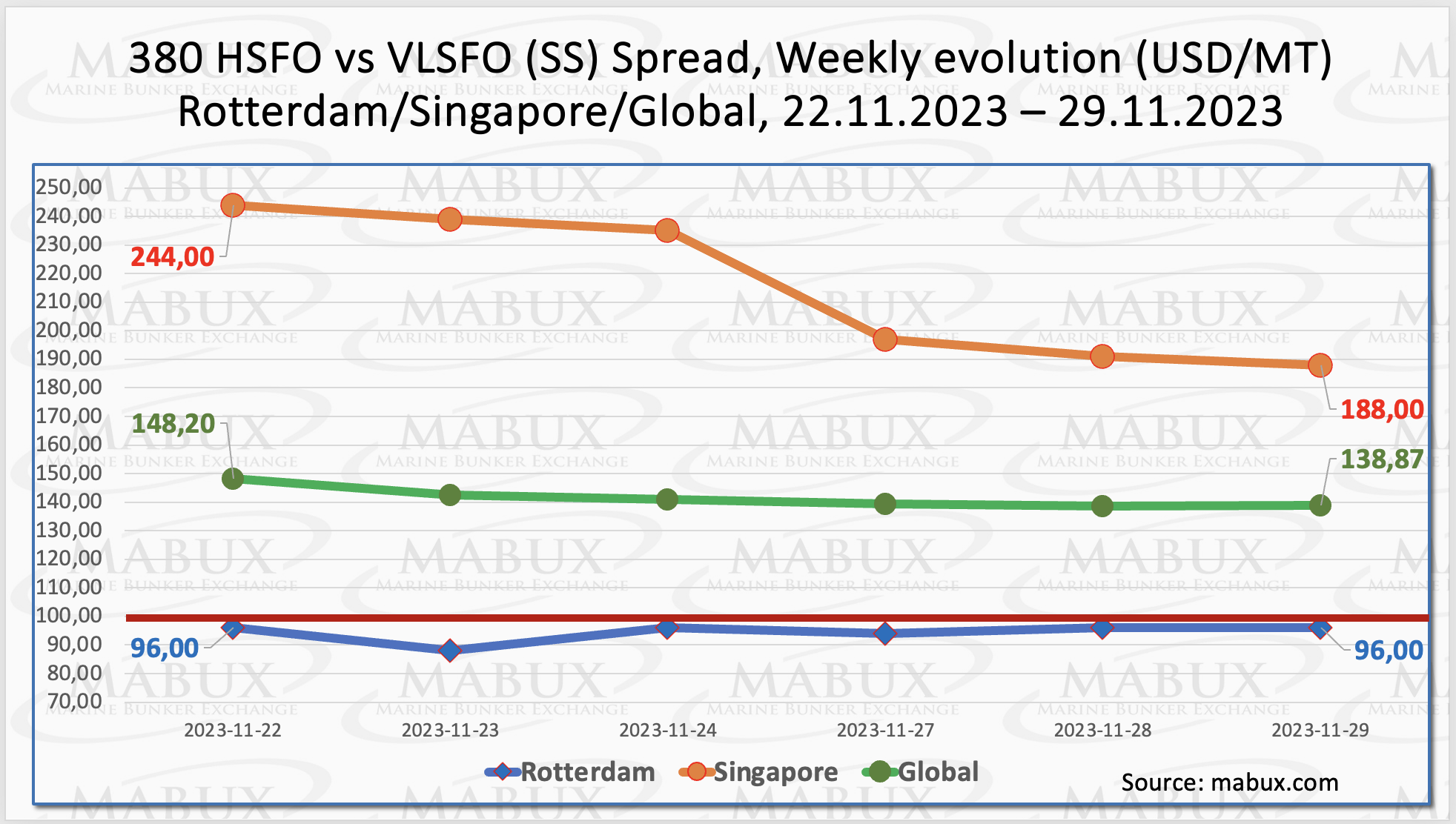

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – showed a moderate decrease, standing at minus $9.33 ($138.87 compared to $148.20 last week), still above the $100.00 breakeven mark for SS Spread. However, the weekly average showed an increase of $5.51. In Rotterdam, the SS Spread remained unchanged at $96 for the week, staying below the $100 mark, with a weekly average decrease of $2.50. Singapore experienced the most significant reduction in the 380 HSFO/VLSFO price difference, reaching minus $56 ($188.00 versus $244.00 last week), falling below the $200 mark for the first time since October 27. The weekly average in Singapore also decreased by $16.16. We expect the trend towards a moderate reduction in SS Spread will continue next week. More information is available in the “Differentials” section of mabux.com.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – showed a moderate decrease, standing at minus $9.33 ($138.87 compared to $148.20 last week), still above the $100.00 breakeven mark for SS Spread. However, the weekly average showed an increase of $5.51. In Rotterdam, the SS Spread remained unchanged at $96 for the week, staying below the $100 mark, with a weekly average decrease of $2.50. Singapore experienced the most significant reduction in the 380 HSFO/VLSFO price difference, reaching minus $56 ($188.00 versus $244.00 last week), falling below the $200 mark for the first time since October 27. The weekly average in Singapore also decreased by $16.16. We expect the trend towards a moderate reduction in SS Spread will continue next week. More information is available in the “Differentials” section of mabux.com.

Europe’s weakened natural gas demand during autumn is experiencing a resurgence, driven by lower-than-usual temperatures across most regions and an anticipated freeze extending until early December. The updated weather forecast, particularly in Germany—the largest economy and natural gas consumer in Europe—predicts colder temperatures this weekend and into the next week. Despite these developments, the market remains relatively calm compared to last year, primarily attributed to the still abundant inventories at EU gas storage facilities. As of November 22, EU storage levels reached 98.4% capacity. Meanwhile, Europe’s gas prices began to climb last week as market attention shifted towards winter supply risks. Natural gas traders are actively assessing potential risks to European gas supply this winter, with weather conditions emerging as the most significant variable for traders, suppliers, and governments.

Europe’s weakened natural gas demand during autumn is experiencing a resurgence, driven by lower-than-usual temperatures across most regions and an anticipated freeze extending until early December. The updated weather forecast, particularly in Germany—the largest economy and natural gas consumer in Europe—predicts colder temperatures this weekend and into the next week. Despite these developments, the market remains relatively calm compared to last year, primarily attributed to the still abundant inventories at EU gas storage facilities. As of November 22, EU storage levels reached 98.4% capacity. Meanwhile, Europe’s gas prices began to climb last week as market attention shifted towards winter supply risks. Natural gas traders are actively assessing potential risks to European gas supply this winter, with weather conditions emerging as the most significant variable for traders, suppliers, and governments.

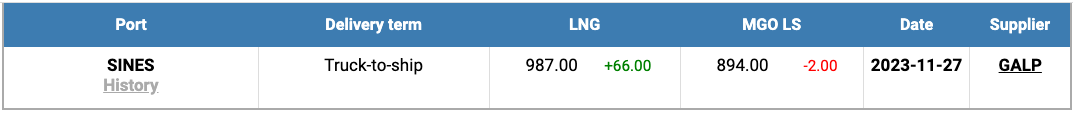

The price of LNG as bunker fuel in the port of Sines (Portugal) has continued its upward trend, reaching 987 USD/MT on November 27. This marks a notable increase of 66 USD compared to the previous week. At the same time, the difference in price between LNG and conventional fuel on November 27 increased sharply again: 93 USD in favor of MGO versus 23 USD a week earlier: MGO LS was quoted on this day in the port of Sines at 894 USD/MT. More information is available in the LNG Bunkering section of mabux.com.

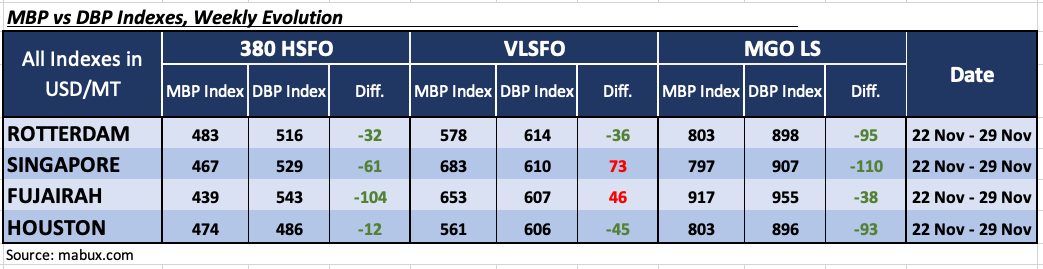

In the 48th week, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) recorded the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 48th week, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) recorded the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports remained undervalued. The weekly average increased by 1 point in Rotterdam and 4 points in Houston but decreased by 1 point in Singapore and 6 points in Fujairah. In Fujairah, the underpricing of this type of fuel continues surpassing the $100 mark.

For the VLSFO segment, according to the MDI, Singapore and Fujairah were in the overcharge zone, with the average premium declining by 17 points in Singapore and 19 points in Fujairah. In Rotterdam and Houston, VLSFO remained undervalued. Average levels of underpricing increased by 4 points in both ports.

In the MGO LS segment, all ports remained undervalued. The weekly average showing a decrease in Rotterdam by 2 points, but an increase in Singapore by 9 points, in Fujairah by 12 points and in Houston by 27 points. Singapore consistently showed undervaluation above $100, while Rotterdam and Houston approached this mark closely.

All in all, changes in the MDI index across major hubs were minor, indicating a relatively stable market.

All in all, changes in the MDI index across major hubs were minor, indicating a relatively stable market.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of mabux.com.

The European Community Shipowners’ Association (ECSA) has expressed satisfaction with the European Parliament’s rejection of the proposed Carbon Correction Factor (CCF) for trucks. Earlier, ECSA had cautioned that implementing the CCF could artificially drive up demand for biofuels and renewable liquid and gaseous fuels of non-biological origin (RFNBOs) in the trucking sector, potentially diverting essential quantities away from shipping. According to ECSA’s statement, the emphasis should be on sustainable and scalable renewable fuels to facilitate the decarbonization of the shipping industry. However, the current insufficient availability of such fuels poses a significant hurdle in achieving this goal. In order to meet the ambitious 1.5°C target set by the Paris Agreement, substantial efforts are required to ensure the accessibility of clean and affordable fuels for the shipping sector. ECSA is urging both the Council and the Parliament to resist unnecessary additional incentives during the negotiations for truck CO2 standards. They stress that diverting attention and resources away from the maritime industry could hinder progress toward achieving environmental objectives. The decision of the European Parliament has also garnered support from Danish Shipping, which echoes ECSA’s concerns regarding the potential broadening of the definition of climate-neutral fuels.

We expect irregular changes in world bunker indices in the coming week as the market awaits the formation of a stable trend.

Source: www.mabux.com