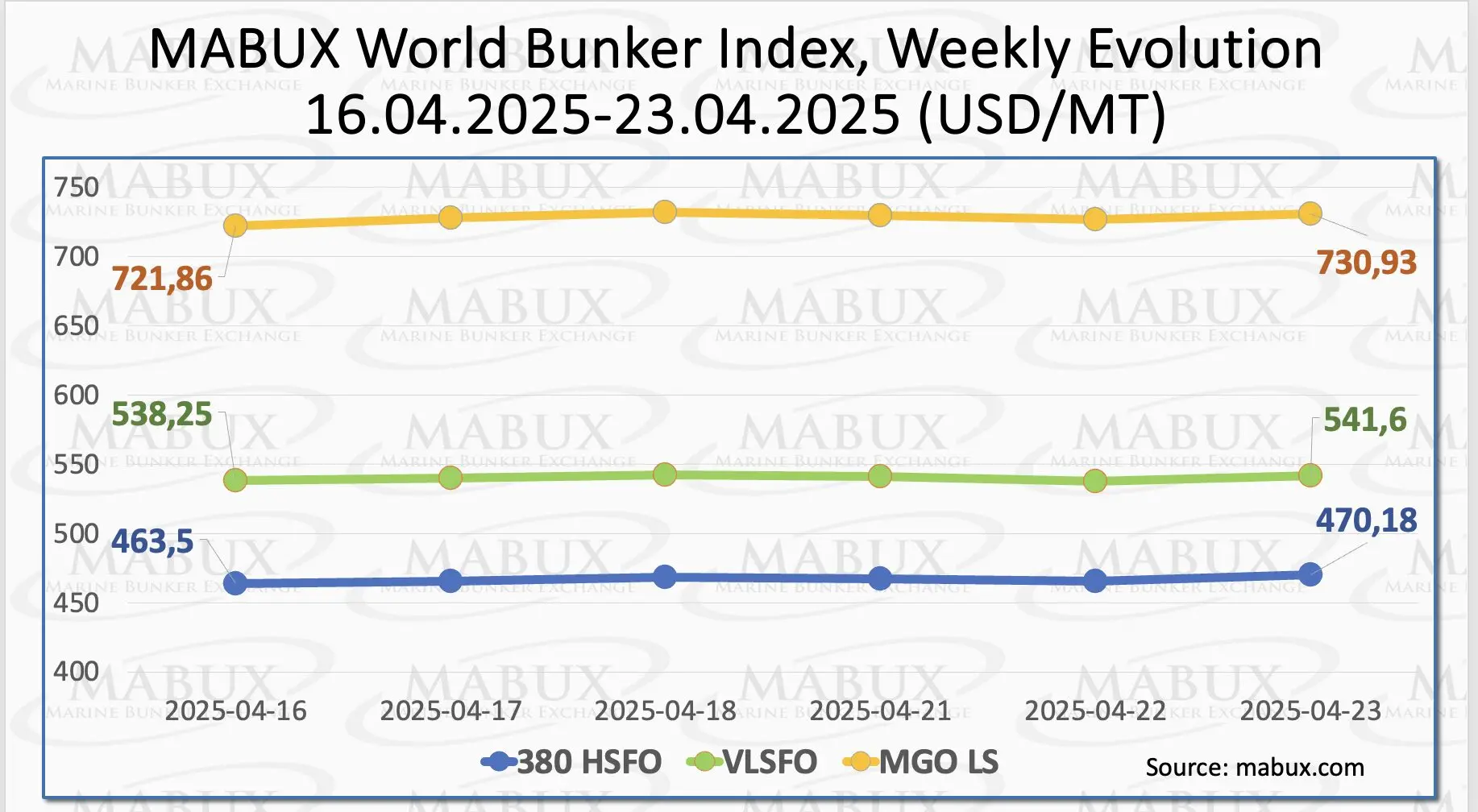

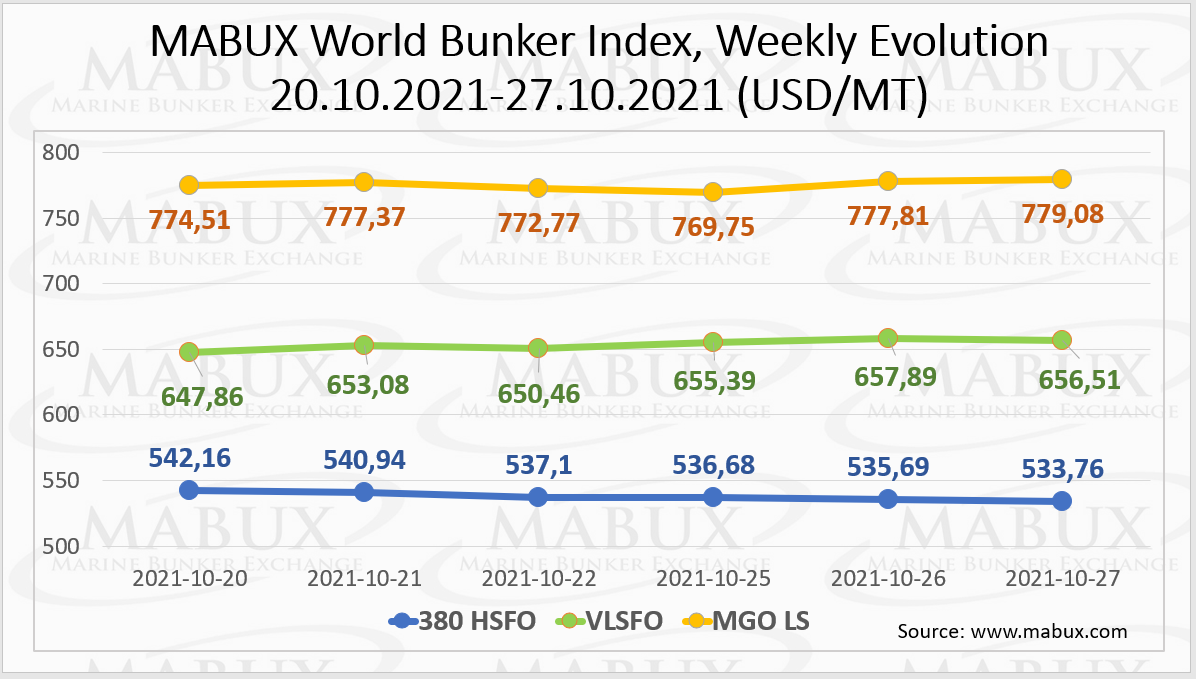

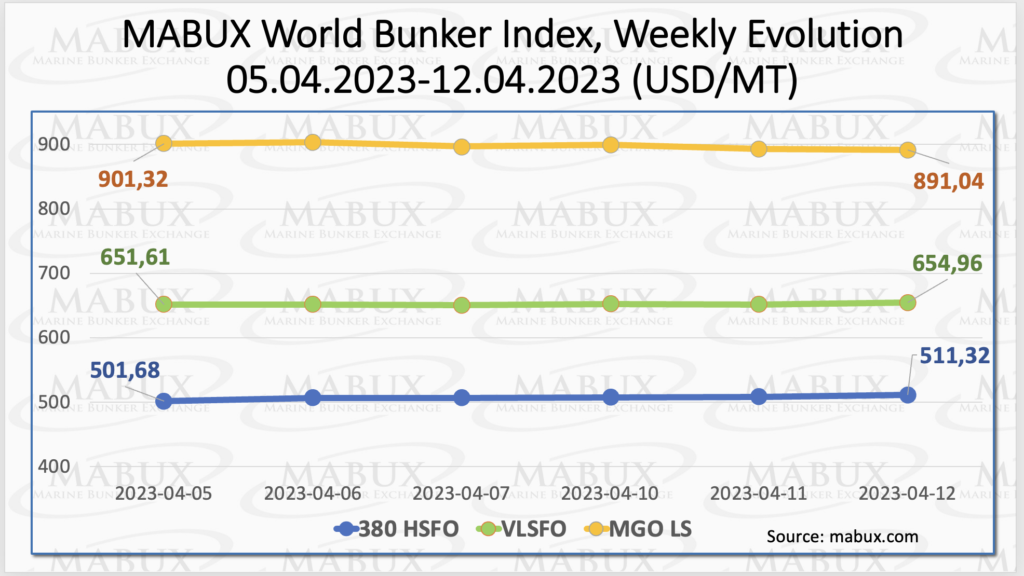

Over the Week 15, the global MABUX bunker indices did not show a firm trend and changed sideways. The 380 HSFO index rose by 9.64 USD from 501.68 USD/MT last week to 511.32 USD/MT, which is above the 500 USD mark. Similarly, the VLSFO index added 3.35 USD (654.96 USD/MT versus 651.61 USD/MT last week). The MGO index, on the contrary, experienced a decline of 10.28 USD to fall below 900 USD, reaching 891.04 USD/MT. Despite these changes, there was no clear or sustainable trend in the market at the time of writing.

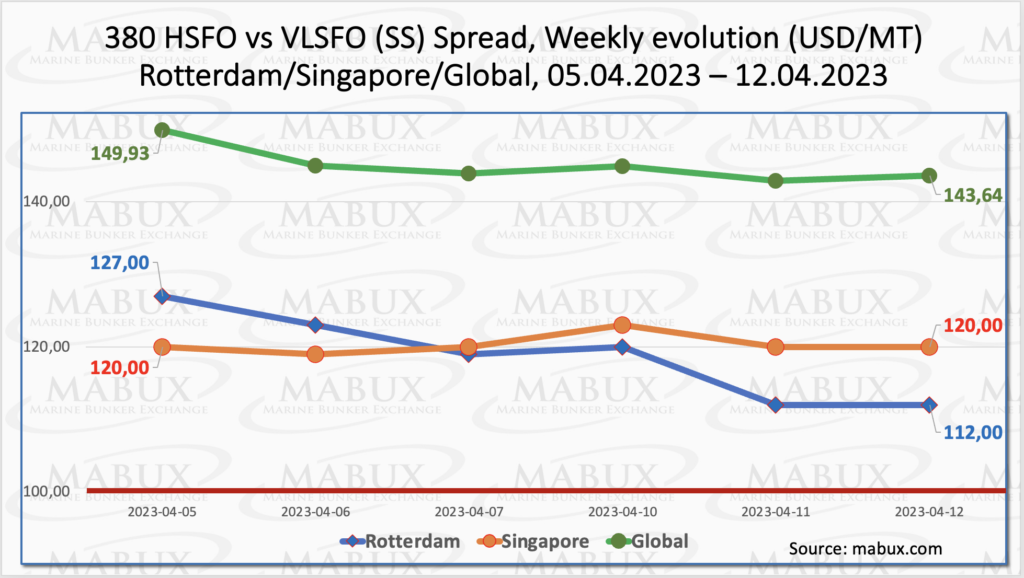

The Global Scrubber Spread (SS) – the difference between 380 HSFO and VLSFO – continued to decline during Week 15, falling by minus $6.29 to $143.64 from $149.93 in the previous week. The weekly average also decreased by $8.20. In Rotterdam, the SS Spread dropped by $15.00 to $112.00 (vs. $127.00 last week), coming close to the psychological $100 mark. The SS Spread weekly average in Rotterdam showed a decline of minus $22.67. Meanwhile, in Singapore, the 380 HSFO/VLSFO price difference remained at $120, with the weekly average losing $11.84. The data suggests that the SS Spread has the potential for further reduction next week, given the current market situation. More information is available in the “Differentials” section of mabux.com.

The Global Scrubber Spread (SS) – the difference between 380 HSFO and VLSFO – continued to decline during Week 15, falling by minus $6.29 to $143.64 from $149.93 in the previous week. The weekly average also decreased by $8.20. In Rotterdam, the SS Spread dropped by $15.00 to $112.00 (vs. $127.00 last week), coming close to the psychological $100 mark. The SS Spread weekly average in Rotterdam showed a decline of minus $22.67. Meanwhile, in Singapore, the 380 HSFO/VLSFO price difference remained at $120, with the weekly average losing $11.84. The data suggests that the SS Spread has the potential for further reduction next week, given the current market situation. More information is available in the “Differentials” section of mabux.com.

LNG spot prices have come down 80% from their peak levels in 2022, but forecasts now expect prices to increase again, not only because of Asia, but also due to summer demand, as hydropower levels are set to drop. It could be the time for EU planners to start to hedge risk through long-term contracts again in order to avoid the negative consequences of another price shock.

LNG spot prices have come down 80% from their peak levels in 2022, but forecasts now expect prices to increase again, not only because of Asia, but also due to summer demand, as hydropower levels are set to drop. It could be the time for EU planners to start to hedge risk through long-term contracts again in order to avoid the negative consequences of another price shock.

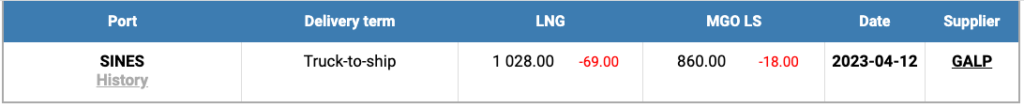

The price of LNG as bunker fuel in the port of Sines (Portugal) again moderately decreased and reached 1028 USD/MT on April 12 (minus 69 USD compared to the previous week). The difference in price between LNG and conventional fuel on April 12 was 168 USD: MGO LS in the port of Sines was quoted at 860 USD/MT that day. The price difference is gradually decreasing. We expect this trend to continue next week. More information is available in the LNG Bunkering section at mabux.com.

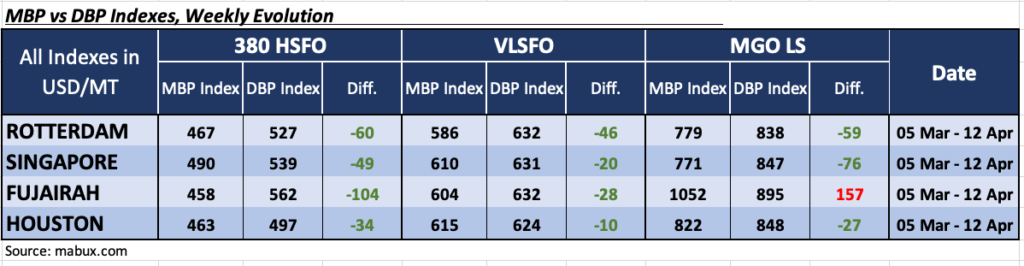

Over the Week 15, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered an undervaluation of 380 HSFO fuel at all four selected ports. The weekly average showed a reduction at all ports except Fujairah, which was up by one point at minus $104. In Rotterdam, Singapore and Houston, the MDI showed minus $60, minus $49 and minus $34, respectively.

Over the Week 15, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered an undervaluation of 380 HSFO fuel at all four selected ports. The weekly average showed a reduction at all ports except Fujairah, which was up by one point at minus $104. In Rotterdam, Singapore and Houston, the MDI showed minus $60, minus $49 and minus $34, respectively.

In the VLSFO segment, according to MDI, underestimation of fuel was registered at all selected ports, including Houston, which was in the overestimation zone the previous week. The underprice ratios were as follows: Rotterdam – minus $46, Singapore – minus $20, Fujairah – minus $28 and Houston – minus 10. The undercharge weekly average for all ports increased moderately. This suggests that VLSFO prices may have been lower than the digital benchmark at these ports, indicating a possible buying opportunity for shipowners. However, it’s important to note that the MDI is just one measure of the market, and other factors may be influencing prices and market trends as well.

There are still three underpriced ports in the MGO LS segment: Rotterdam, Singapore and Houston. Average weekly undervaluation levels declined moderately to minus $59 in Rotterdam, minus $76 in Singapore and minus $27 in Houston. In contrast, Fujairah remains the only overvalued port – plus $ 157.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

The International Maritime Organization (IMO) has discussed the ‘dangerous practice’ of ship-to-ship transfers in the open ocean and the methods used to obscure ship identities and turning off AIS transponders. According to a notice posted by IMO on Tuesday (4 April): ‘The IMO Legal Committee was informed that a fleet of between 300 and 600 tankers primarily comprised of older ships, including some not inspected recently, having substandard maintenance, unclear ownership and a severe lack of insurance, was currently operated as a “dark fleet” or “shadow fleet” to circumvent sanctions and high insurance costs.’ The Committee considered that this ‘increased the risk of oil spill or collision’ and ‘could also result in a participating shipowner evading its liability under the relevant liability and compensation treaties’. The IMO notice added that Committee considered that ship-to-ship transfers in the high seas were ‘high risk activities that undermined the international regime with respect to maritime safety, environmental protection and liability and compensation needed to be urgently addressed’.

The bunker fuel market remains uncertain and subject to volatility, with various factors potentially impacting prices in the coming weeks. We do not expect drastic changes of bunker indices in near-term outlook.

Source: www.mabux.com