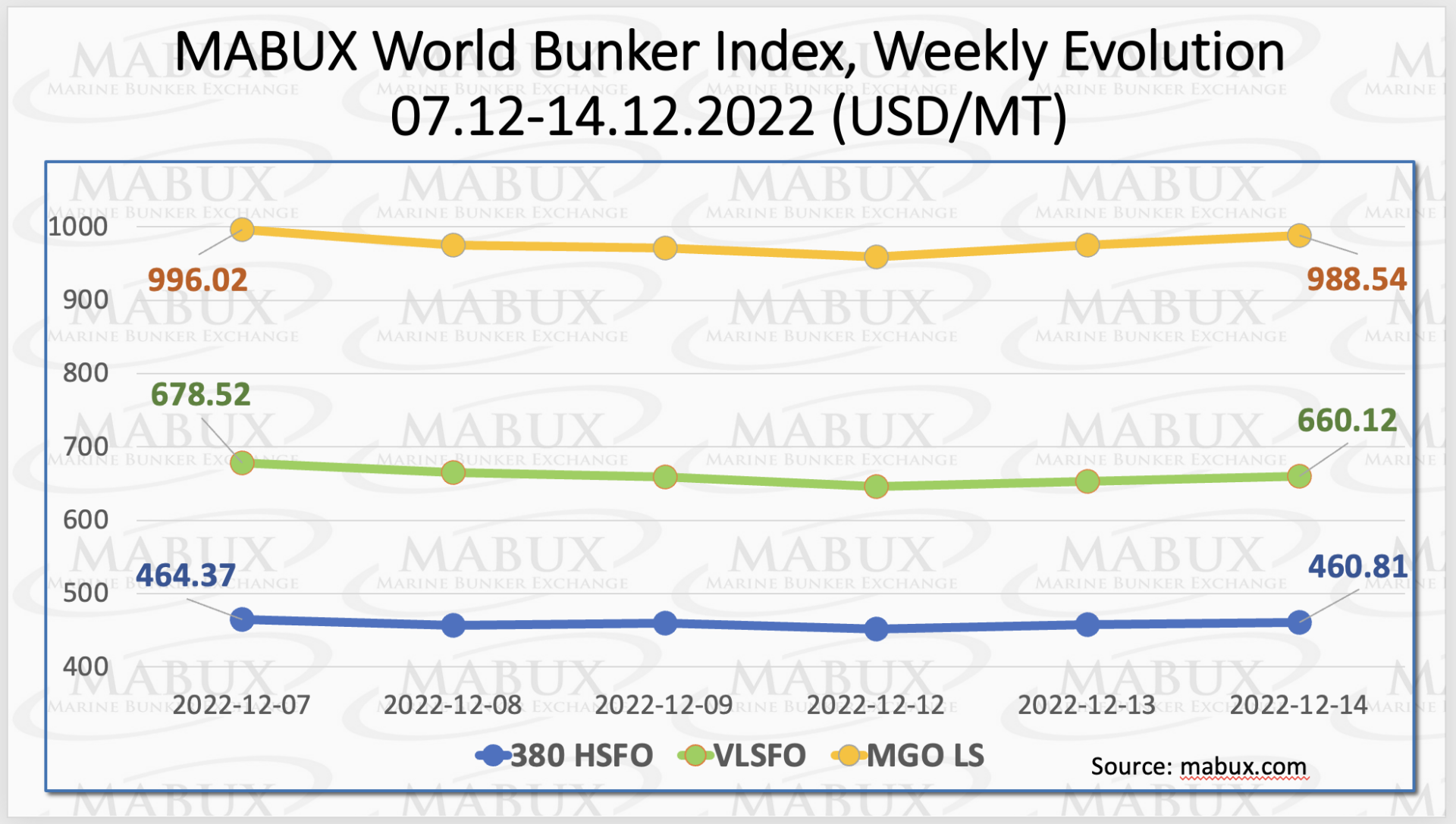

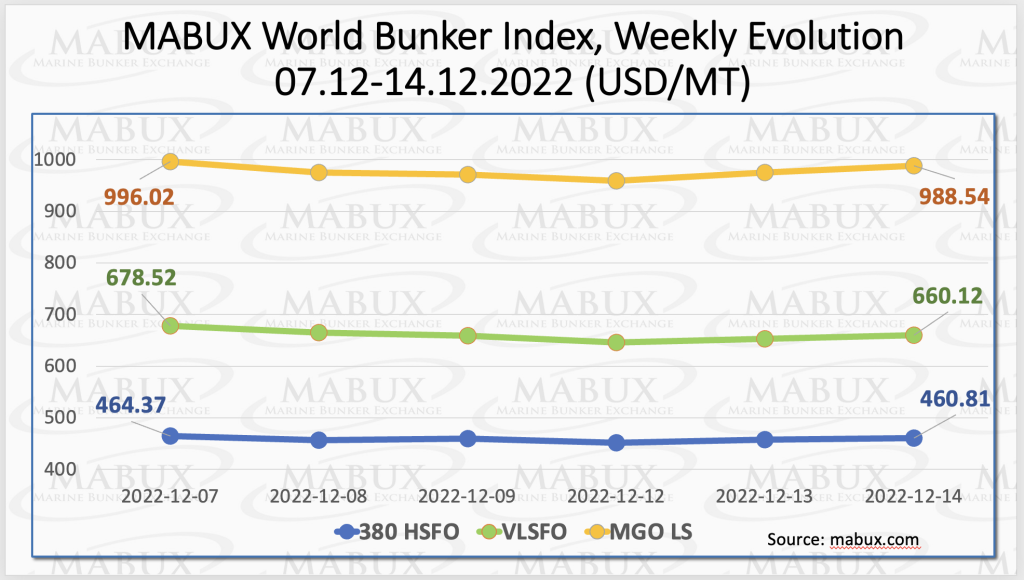

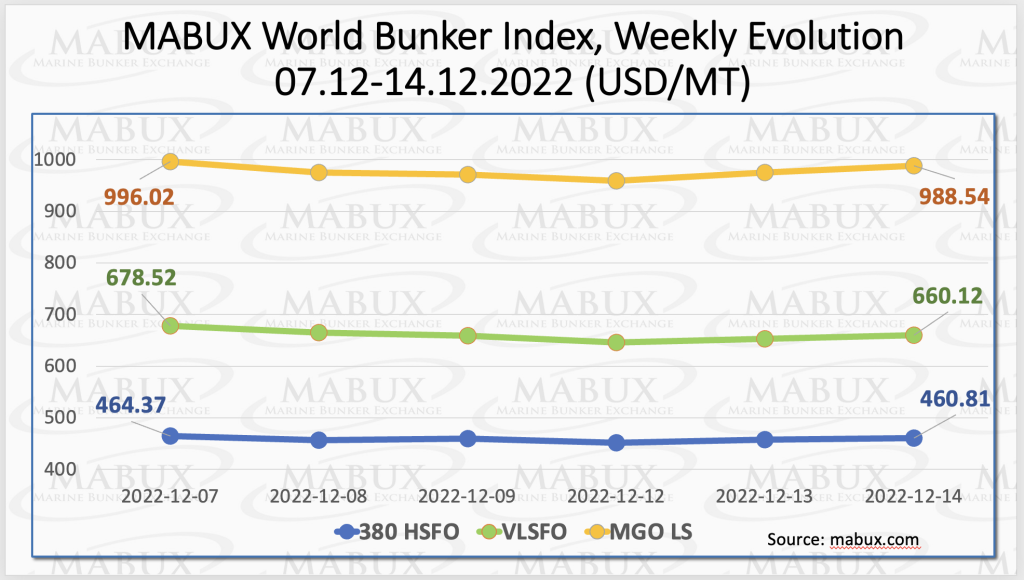

As expected, MABUX global bunker indices continued firm declining over the Week 50. However, there are signs of slight upward correction last few days. As a result, the 380 HSFO Index fell by 3.56 USD from 464.37 USD/MT last week to 460.81 USD/MT. The VLSFO Index, in turn, fell by 18.40 USD (660.12 USD/MT versus 678.52 USD/MT last week). The MGO Index also lost 7.47 USD (from 996.02 USD/MT last week to 988.54 USD/MT), breaking through the psychological mark of 1000 USD.

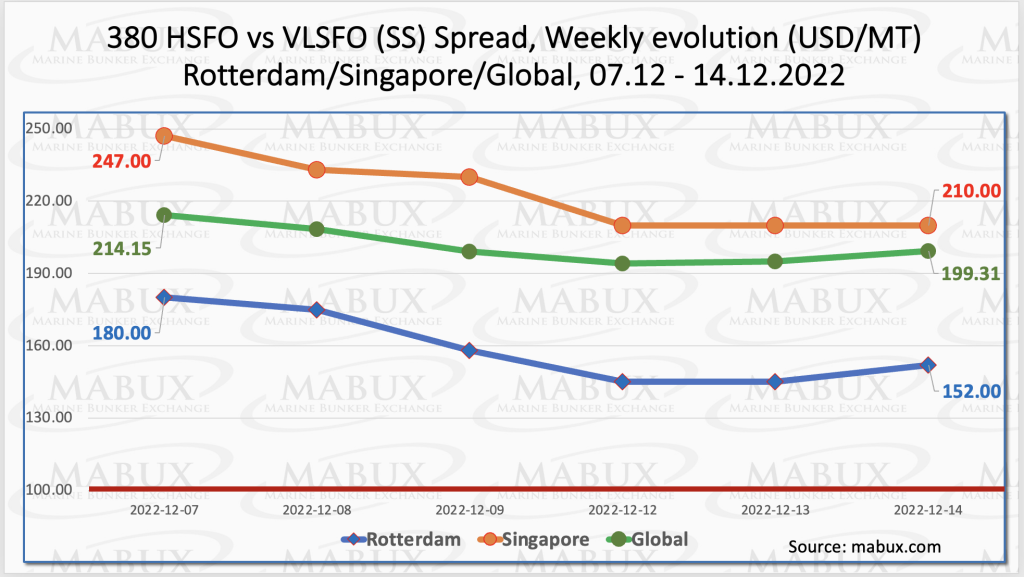

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – resumed its decline over the week 50 – minus $ 14.84 ($ 199.31 vs. $ 214.15 last week), breaking through the psychological $ 200 mark. In Rotterdam, SS Spread also fell by minus $28.00 to $152.00 from $180.00 last week, coming close to $150. In Singapore, the 380 HSFO/VLSFO price differential showed the most significant decrease – by $37.00 ($210.00 from $247.00 last week). We expect SS Spread to continue shrinking next week. More information is available in the “Differentials” section at mabux.com.

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – resumed its decline over the week 50 – minus $ 14.84 ($ 199.31 vs. $ 214.15 last week), breaking through the psychological $ 200 mark. In Rotterdam, SS Spread also fell by minus $28.00 to $152.00 from $180.00 last week, coming close to $150. In Singapore, the 380 HSFO/VLSFO price differential showed the most significant decrease – by $37.00 ($210.00 from $247.00 last week). We expect SS Spread to continue shrinking next week. More information is available in the “Differentials” section at mabux.com.

Demand for LNG floating storage and regasification units (LNG-FSRUs) has increased sharply this year, with Europe facing an energy supply squeeze as Russia has progressively cut pipeline gas flows. Currently, there are 48 FSRUs in operation globally, all but six of them are locked into term charters. The EU has lined up plans for as many as 19 new FSRU projects at an estimated cost of €9.5bn. The biggest beneficiaries are Korean shipbuilding who managed to book 46% more orders so far, YoY. And the government’s goal is for the country to grab 75% of the market share by 2030.

Demand for LNG floating storage and regasification units (LNG-FSRUs) has increased sharply this year, with Europe facing an energy supply squeeze as Russia has progressively cut pipeline gas flows. Currently, there are 48 FSRUs in operation globally, all but six of them are locked into term charters. The EU has lined up plans for as many as 19 new FSRU projects at an estimated cost of €9.5bn. The biggest beneficiaries are Korean shipbuilding who managed to book 46% more orders so far, YoY. And the government’s goal is for the country to grab 75% of the market share by 2030.

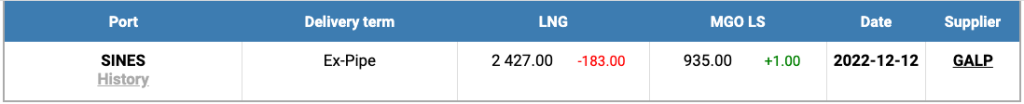

The price of LNG as bunker fuel at the port of Sines (Portugal) fell to 2427 USD/MT on December 12 (minus 183 USD compared to the previous week). However, the price of LNG surpasses that one of the most expensive traditional bunker fuels by 1492 USD: on November 12, the price of MGO LS at the port of Sines was quoted at 935 USD/MT.

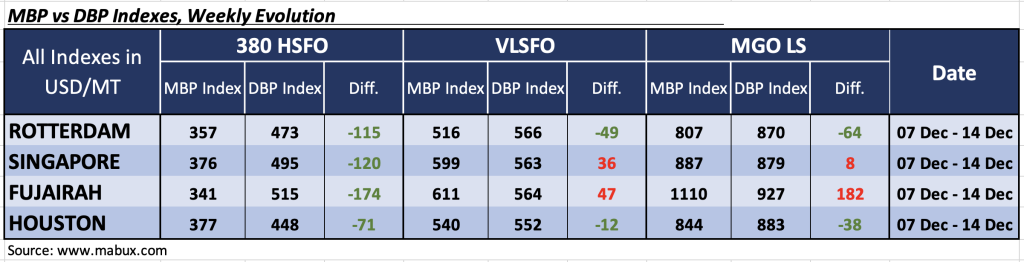

Over the Week 50, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) kept underpricing status of 380 HSFO fuel grade in all four selected ports. Undercharge ratio decreased slightly in all ports except for Houston (here undervaluation was average $2 up.) and showed: in Rotterdam – minus $115, Singapore – minus $120, Fujairah – minus $174 and in Houston – minus $71.

Over the Week 50, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) kept underpricing status of 380 HSFO fuel grade in all four selected ports. Undercharge ratio decreased slightly in all ports except for Houston (here undervaluation was average $2 up.) and showed: in Rotterdam – minus $115, Singapore – minus $120, Fujairah – minus $174 and in Houston – minus $71.

In the VLSFO segment, according to MDI, Singapore and Fujairah are still overvalued: plus $36 and plus $47, respectively. In Rotterdam and Houston, this type of fuel was underestimated by an average minus $49 and minus $12. The underpricing rose, while the overpricing changed irregular.

In the MGO LS segment, MDI continued to register fuel underpricing in two out of four selected ports: Rotterdam – minus $64 and Houston – minus $38. Singapore and Fujairah remained in the overcharge zone: plus $8 and plus $182, respectively. The undercharge premium has decreased, while overestimation has increased.

More information on the correlation between market prices and the digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and the digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

In a newly-published Technology Trends report, classification society ABS examines a broad range of ‘cutting edge’ maritime tech, including alternative fuels such as hydrogen, nuclear power and electrification, autonomy, artificial intelligence and onboard carbon capture. In addition to explaining the new technologies and their applicability to the maritime sector, the report sets out ‘a timeline for key technological milestones on the journey to net-zero emissions and digitalisation’. The report sees considerable potential for hydrogen as a marine fuel – but tempered this with the observation that ‘replacing traditional carbon-based fuels will take time’ and ‘decades of technological advancement and production scaling’. The idea of using nuclear power for ships outside the naval sphere has been gaining traction in recent years and the report considers that ‘the potential exists for a portion of the world’s commercial fleet to adopt nuclear power as a zero-emission energy solution in the future’.

The Global fuel market is still waiting for Russia’s reaction to the price cap imposed by the European Union on December 05 on Russian oil. In this situation, we expect the downtrend in the global bunker market may continue next week.

Source: www.mabux.com