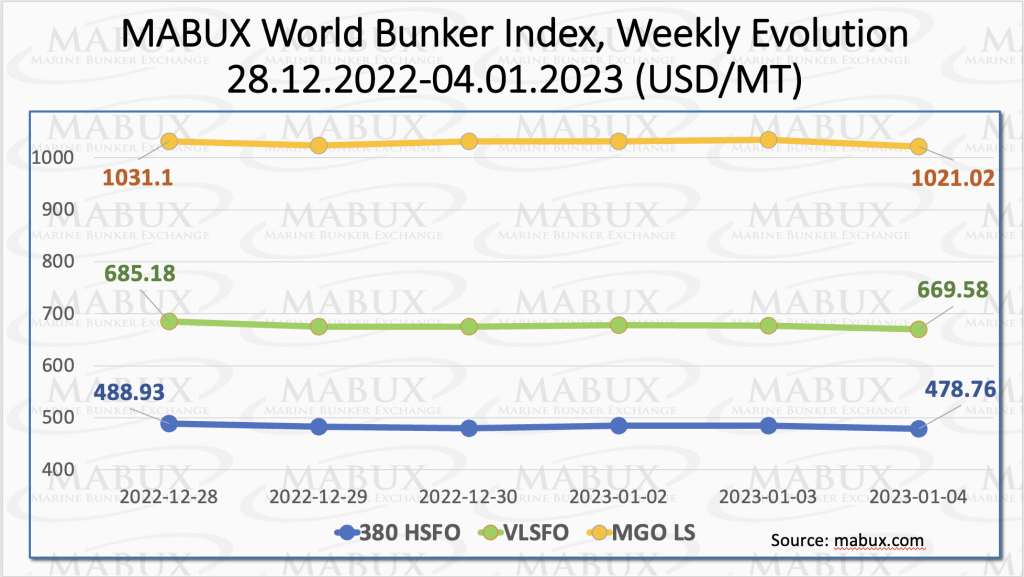

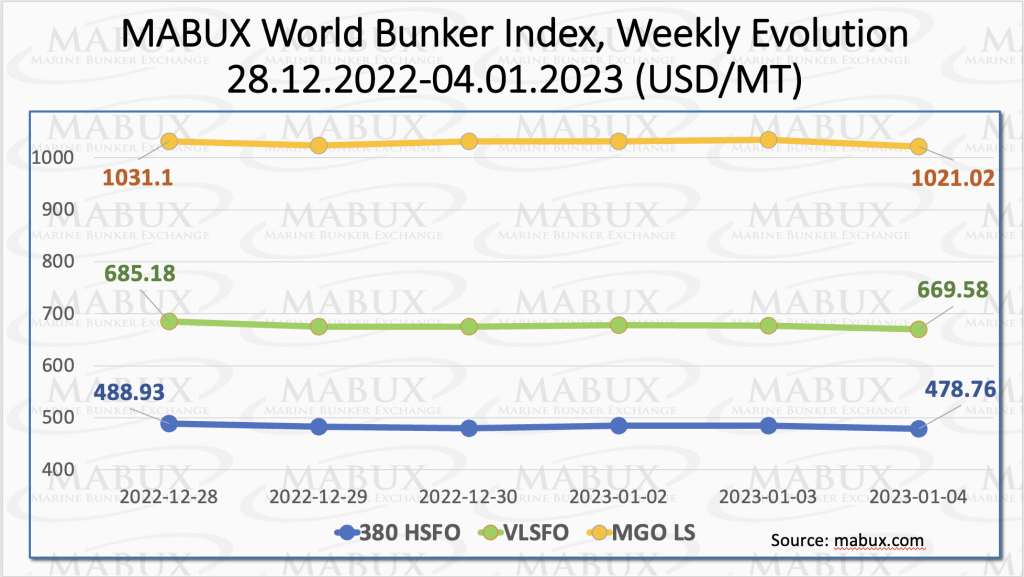

Over the Week 01, MABUX global bunker indices after taking a short pause began to decline. The 380 HSFO index fell by 10.17 USD: from 488.93 USD/MT last week to 478.76 USD/MT. The VLSFO index, in turn, lost 15.60 USD (669.58 USD/MT versus 685.18 USD/MT last week). The MGO index also fell by 10.08 USD (from 1031.10 USD/MT last week to 1021.02 USD/MT). At the moment, the downward trend in the global bunker market continues.

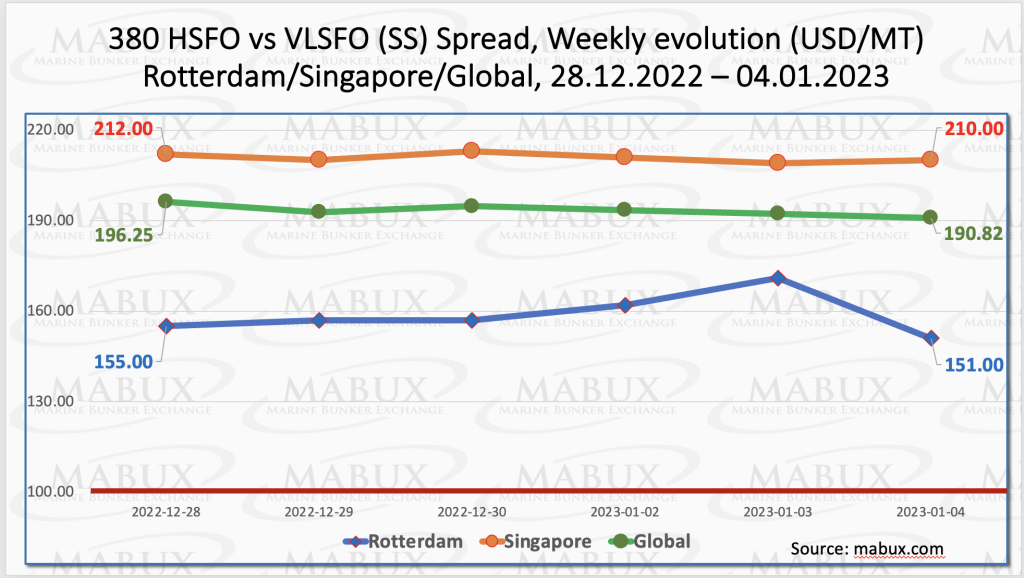

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – turned into narrowing trend over the Week 01 – minus $5.43 ($190.82 vs. $196.25 last week). In Rotterdam SS Spread was down $4.00 to $151.00 from $155.00 last week. In Singapore, the price difference of 380 HSFO/VLSFO also showed a decrease of $2.00 ($210.00 vs. $212.00 last week). We expect SS Spread may continue its moderate decline next week. More information is available in the “Differentials” section at mabux.com.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – turned into narrowing trend over the Week 01 – minus $5.43 ($190.82 vs. $196.25 last week). In Rotterdam SS Spread was down $4.00 to $151.00 from $155.00 last week. In Singapore, the price difference of 380 HSFO/VLSFO also showed a decrease of $2.00 ($210.00 vs. $212.00 last week). We expect SS Spread may continue its moderate decline next week. More information is available in the “Differentials” section at mabux.com.

Natural gas prices in Europe have plunged over the past few months. Meantime, 60 LNG tankers, or ~10% of the LNG vessels in the world, are currently sailing or anchored around Northwest Europe, the Mediterranean, and the Iberian Peninsula. Such vessels are considered floating LNG storage since they cannot unload, something that is impacting the price of natural gas and freight rates.

Natural gas prices in Europe have plunged over the past few months. Meantime, 60 LNG tankers, or ~10% of the LNG vessels in the world, are currently sailing or anchored around Northwest Europe, the Mediterranean, and the Iberian Peninsula. Such vessels are considered floating LNG storage since they cannot unload, something that is impacting the price of natural gas and freight rates.

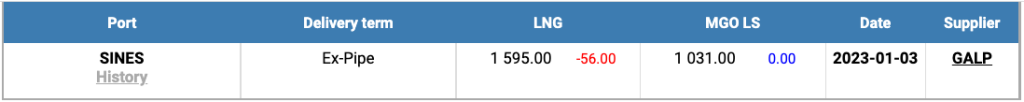

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline and reached 1595 USD/MT as of January 03 (minus 56 USD compared to the previous week). Thus, the LNG price continues to approach the cost of conventional bunker fuel grade: on January 03, the price of MGO LS at the port of Sines was quoted at 1031 USD/MT.

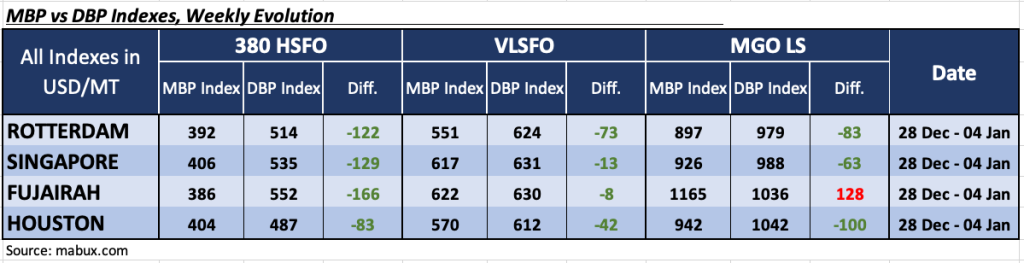

During the Week 01, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) remained fuel 380 HSFO underestimated in all four selected ports. Meantime, underestimation average showed an increase in all ports and amounted to: in Rotterdam – minus $122, Singapore – minus $129, Fujairah – minus $166 and in Houston – minus $83.

During the Week 01, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) remained fuel 380 HSFO underestimated in all four selected ports. Meantime, underestimation average showed an increase in all ports and amounted to: in Rotterdam – minus $122, Singapore – minus $129, Fujairah – minus $166 and in Houston – minus $83.

In the VLSFO segment, according to MDI, Singapore and Fujairah moved back into the underprice zone. Thus, this type of fuel is currently undervalued in all four selected ports. Underprice ratio widened slightly over the week: Rotterdam – minus $ 73, Singapore – minus $ 13, Fujairah – minus $ 8 and Houston – minus $ 42.

In the MGO LS segment, Fujairah remains the only overvalued port: plus $128. In all other ports, the MDI index recorded an undervaluation of MGO LS: Rotterdam – minus $ 83, Singapore – minus $ 63 and Houston – minus $ 100. Undercharge premium increased, while overcharge one dropped.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

Russia plans to increase its diesel exports in January before European Union sanctions on crude oil start in February. Fuel shipments from Russia’s ports in the Baltic and Black Sea are set to increase to 2.68 million tonnes in January, good for an 8% month-on-month increase from December’s volume and the highest export rate since January 2020. The European Union will ban Russian oil product imports by Feb. 5. This follows a ban on Russian crude that took effect in December. Exports of Russia’s flagship Urals crude blend from the Baltic Sea ports will, however, fall to around 5 million tonnes this month from 6 million tonnes in November, due to an EU embargo on Russian oil and a Western price cap, according to Reuters calculations. Some estimates have predicted it could fall as low as 4.7 million tonnes. The $60 per barrel price cap introduced by the European Union, G7 nations, and Australia allows non-EU countries to import seaborne Russian crude oil, but prohibits shipping, insurance, and reinsurance companies from handling cargoes of Russian crude unless it is sold for under $60.

Vessels calling at Israeli ports will need to burn bunkers with a sulphur content not exceeding 0.10% under new regulations taking effect next month. The new rules will enter into force on 23 February, 2023. Last month the 79th Marine Environment Protection Committee (MEPC) adopted a proposal to designate the Mediterranean as a Sulphur Emission Control Area (SECA). The regulation, which will require ships without emission abatement technology to burn fuel with a 0.10% maximum sulphur content, is expected to enter into force in May 2024, with the new limit taking effect on 1 May 2025.

Oil edged lower during the week, weighed down by concerns about weak demand due to the state of the global economy and rising COVID cases in China. We expect bunker prices will follow crude oil general trend and drift lower next week.

Source: www.mabux.com