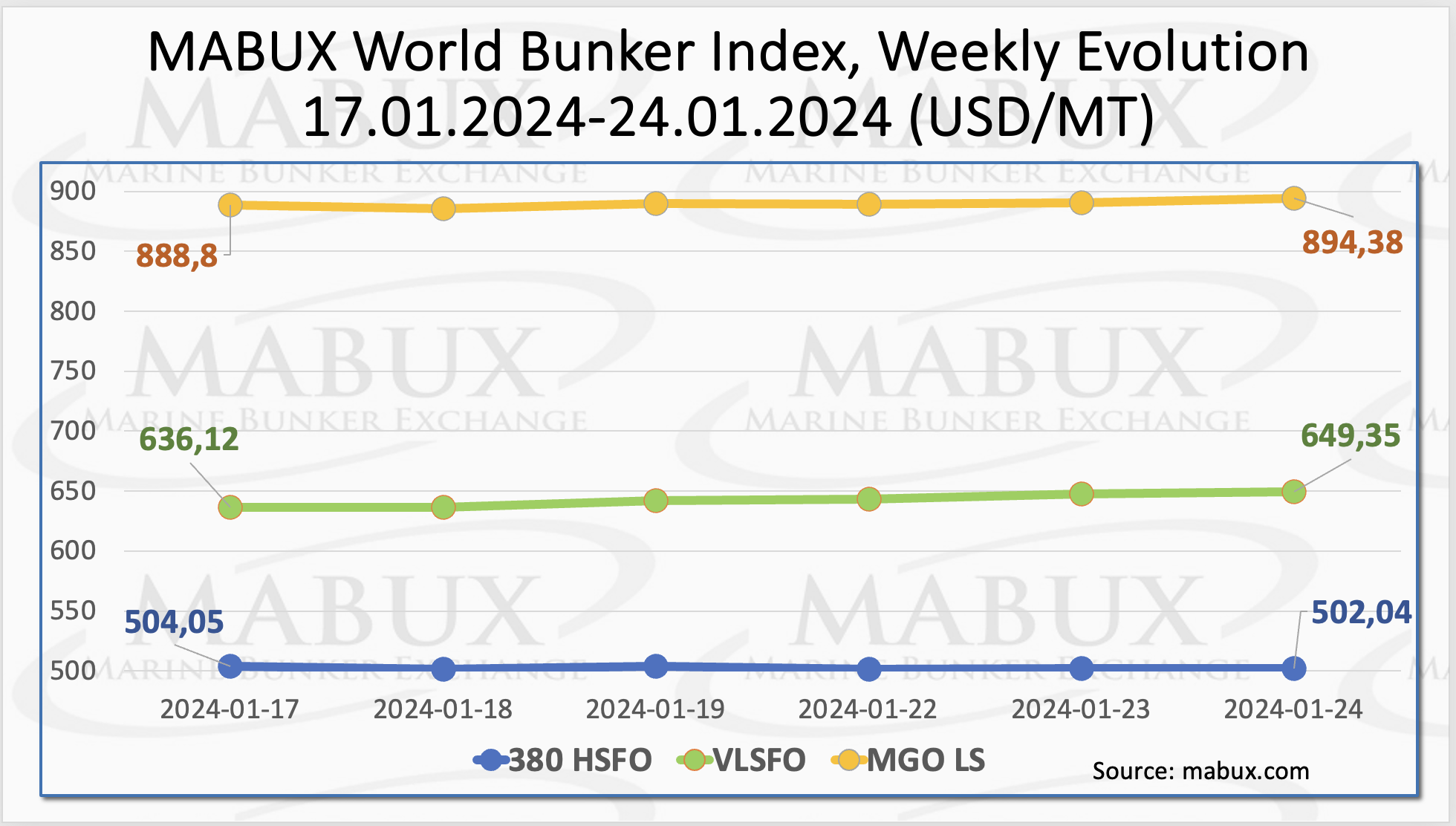

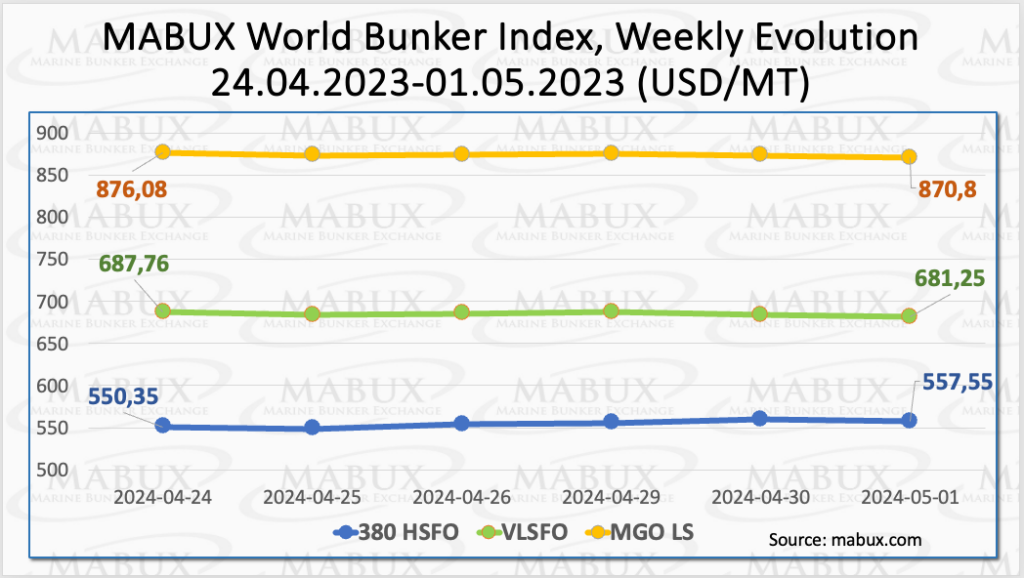

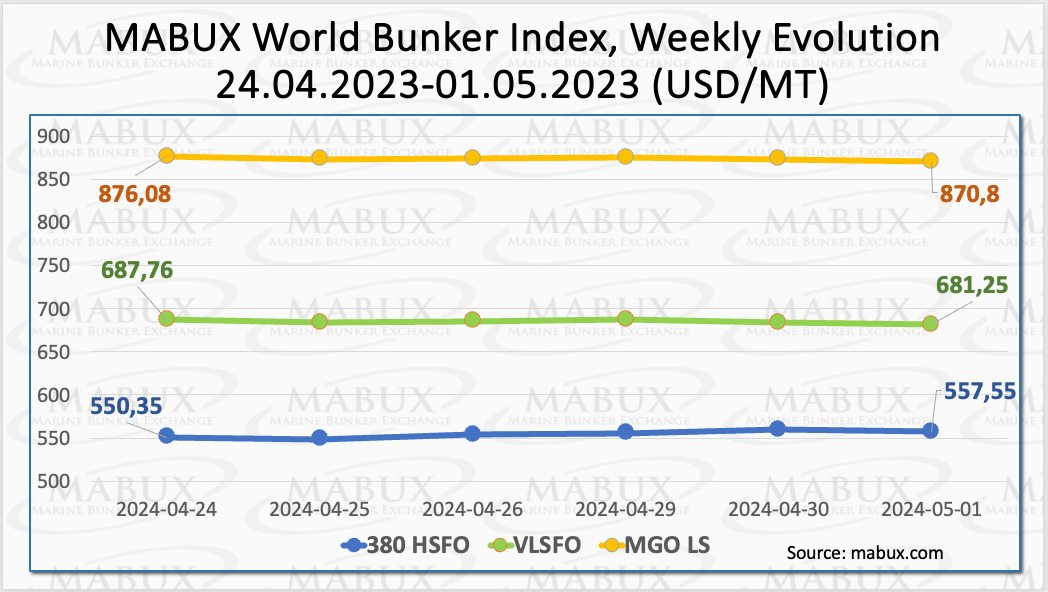

During the 18th week, the MABUX global bunker indices showed sideways movement without a sustained trend. The 380 HSFO index rose by 7.20 USD, climbing from 550.35 USD/MT last week to 557.55 USD/MT. Conversely, the VLSFO index continued to decline: minus 6.51 USD (681.25 USD/MT versus 687.76 USD/MT last week). The MGO index fell by 5.28 USD (from 876.08 USD/MT last week to 870.80 USD/MT). At the time of writing, world bunker indices were in a moderate decline trend.

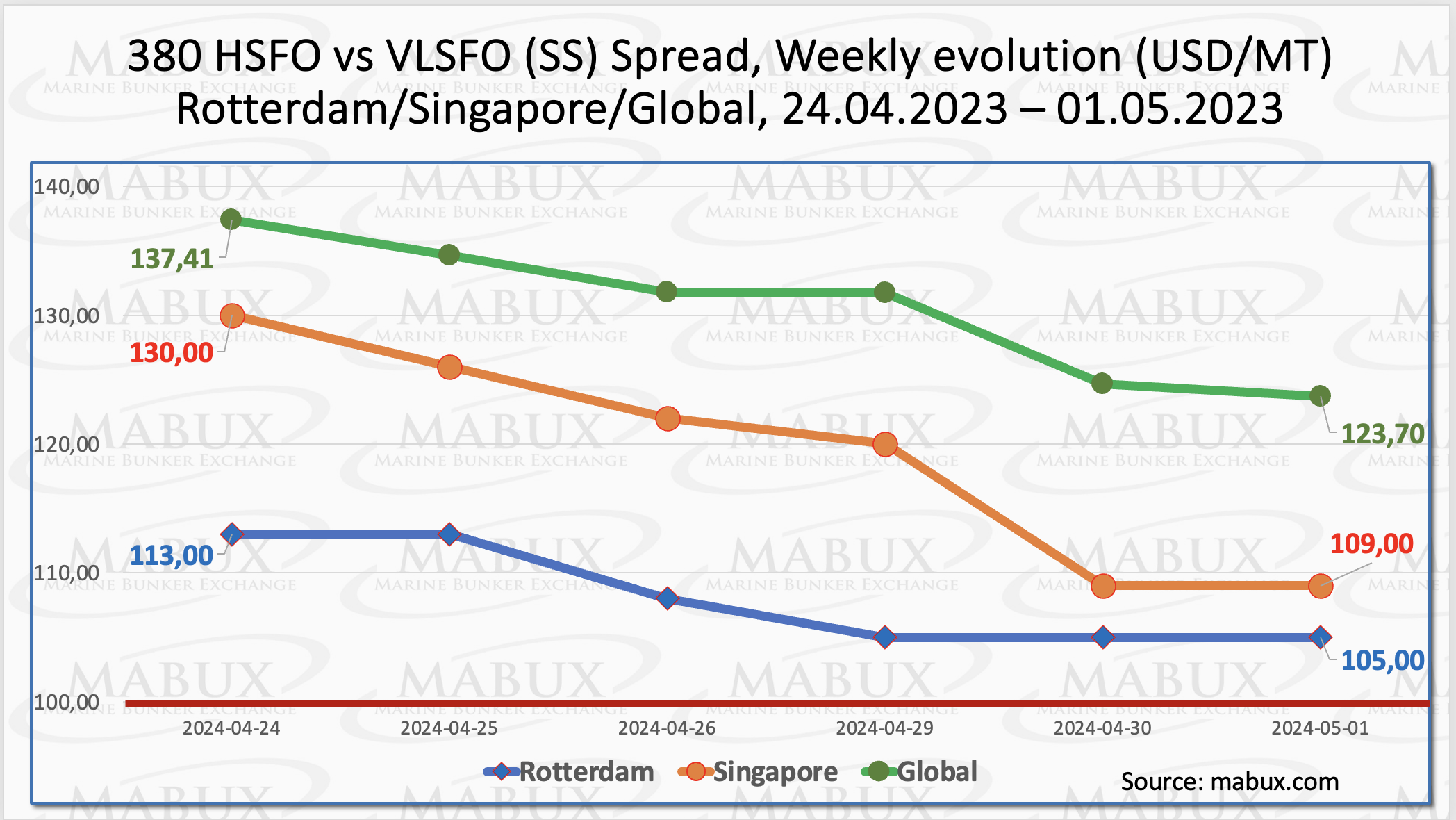

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued to decrease: minus $13.71 ($123.70 versus $137.41 last week). The weekly average also declined by $7.99. In Rotterdam, SS Spread dropped by $8.00 (from $113.00 last week to 105.00), nearing the $100.00 mark (SS Breakeven).

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued to decrease: minus $13.71 ($123.70 versus $137.41 last week). The weekly average also declined by $7.99. In Rotterdam, SS Spread dropped by $8.00 (from $113.00 last week to 105.00), nearing the $100.00 mark (SS Breakeven).

The port’s weekly average also fell by $11.50. Singapore saw the most significant decrease in the 380 HSFO/VLSFO price differential, down by $21.00 ($109.00 vs. $130.00 last week), with the weekly average down $11.50. We expect next week the SS Spread dynamics to continue downward trend. More information is available in the “Differentials” section of mabux.com.

Natural gas prices have reentered the 10-year range, reflecting sustained high inventory levels and reduced demand. Meanwhile, it’s anticipated that European LNG demand will peak in 2024, mainly due to decreases in structural gas demand prompted by the EU’s ambitious decarbonization objectives.

Natural gas prices have reentered the 10-year range, reflecting sustained high inventory levels and reduced demand. Meanwhile, it’s anticipated that European LNG demand will peak in 2024, mainly due to decreases in structural gas demand prompted by the EU’s ambitious decarbonization objectives.

The ongoing construction of 19 global liquefaction projects is poised to augment LNG production by approximately 200 million tonnes by 2030, equivalent to half of the current annual trade volume. Notably, around 75% of the LNG import capacity added in the EU since 2022 consists of Floating Storage and Regasification Units (FSRUs).

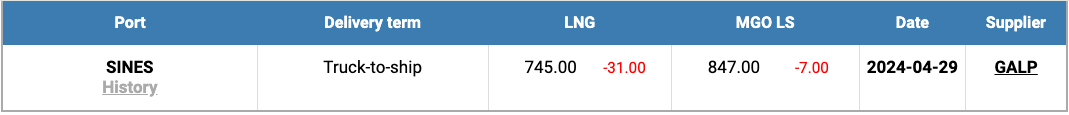

The price of LNG as bunker fuel in the port of Sines (Portugal) has dipped, hitting 745 USD/MT on April 29, marking a decrease of 31 USD compared to the previous week. However, during the same period, the price gap between LNG and conventional fuel widened, favoring LNG by 102 USD on April 29, compared to 77 USD the week before. On that day, MGO LS was quoted at 847 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of mabux.com.

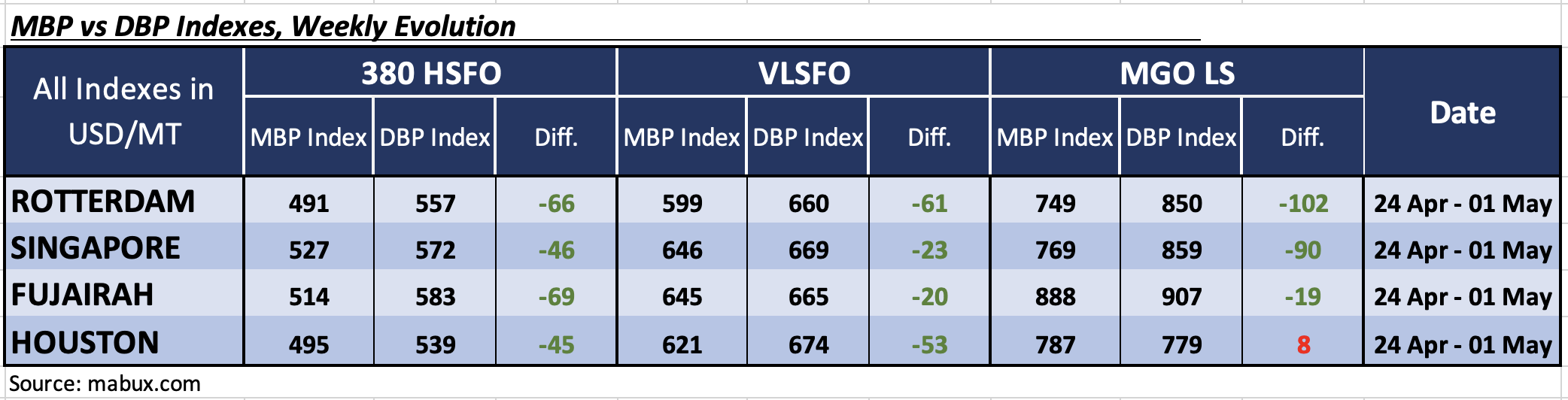

In Week 18, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) indicated the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In Week 18, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) indicated the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all selected ports remained undervalued. Weekly averages fell by 3 points in Rotterdam, 7 points in Singapore, 8 points in Fujairah, and 10 points in Houston. Fuel underestimation levels across all ports are gradually decreasing.

In the VLSFO segment, according to the MDI, all ports were undercharged, with average weekly levels increasing by 8 points in Rotterdam, 5 points in Singapore, 7 points in Fujairah, and 8 points in Houston.

In the MGO LS segment, Houston continued to be the only overvalued port, with the average weekly overprice level down by 4 points. All other ports were undervalued. Weekly averages increased by 4 points in Rotterdam but decreased by 8 points in Fujairah. The MDI index in Singapore remained unchanged, while in Rotterdam, it surpassed the $100 mark again.

At the end of the week, the balance of overvalued/undervalued ports in all market segments remained unchanged. Despite the ongoing trend towards bunker fuel underpricing, underpricing levels in the 380 HSFO and MGO LS segments are gradually declining.

At the end of the week, the balance of overvalued/undervalued ports in all market segments remained unchanged. Despite the ongoing trend towards bunker fuel underpricing, underpricing levels in the 380 HSFO and MGO LS segments are gradually declining.

For more insights on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on mabux.com.

According to the Bureau Veritas VeriFuel report, fuel viscosity exhibited an upward trend throughout 2023 for both very low sulfur fuel oil (VLSFO) and DMA 0.1% grades. In the case of high sulfur fuel oil (HSFO), the average viscosity in Q4 2023 was recorded at 312 cSt, with 1.8% of fuels falling outside ISO 8217 parameters.

Notably, viscosity and water content were identified as the primary reasons for off-spec HSFO in Q4. Zhoushan experienced a significant increase in catfines (≥ 30 mg/kg) over the last three quarters of 2023, escalating from 0% in Q2 to 22% in Q3 and 69% in Q4. Conversely, catfines decreased in Gothenburg from 73% in Q2 to 47% in Q3 and eventually reached 0% in Q4. Port-wise, Piraeus exhibited a high percentage of off-spec HSFO in Q4, with 11% being out of specification.

As for DMA, water content and appearance issues (not clear and bright) were the main culprits for off-spec in Q4. In the ARA region, average viscosity remained notably high throughout the year, exceeding 5 cSt for each quarter and peaking at 5.36 cSt in Q4. In the VLSFO segment, the global average viscosity has been steadily increasing, rising from 115 cSt in Q1 2021 to 167 cSt in Q4 2023. Particularly in Piraeus, there was a significant surge in viscosity from 95 cSt in Q1 2023 to 229 cSt in Q4.

We expect next week the world bunker indices to continue irregular changes with no a firm trend.

Source: MABUX