The COVID-19 pandemic’s spread is taking center stage again and markets are getting increasingly worried about the long duration of European lockdown and about the new restrictions in China. Border closures, social distancing measures and shutdowns will continue to constrain fuel demand until vaccines are more widely distributed.

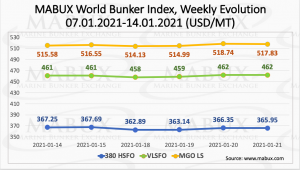

The World Bunker Index MABUX displayed irregular fluctuations over a week. As a result, the 380 HSFO index fell from 367.25 USD/MT to 365.95 USD/ MT (-1.30 USD), VLSFO added 1.00 USD: from 461.00 USD/MT to 462.00 USD/MT while MGO gained 2.25 USD and changed from 515.58 USD/MT up to 517.83 USD/MT. The Global Scrubber Spread (SS) (price difference between 380 HSFOs and VLSFOs) continue firm widening trend: it has risen by 6.40 USD and averaged USD 94.96 (88.56 USD a week ago).

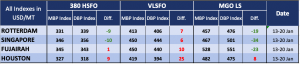

Correlation of MBP Index (Market Bunker Prices) vs DBP Index (Digital Bunker Prices) in the four global largest hubs over the past week showed that 380 HSFO fuel remains undervalued in two ports: Rotterdam – by 9 USD and Singapore – by 10 USD, while being slightly overcharged in Fujairah and Houston by 1 and 12 UDSD respectively. VLSFO fuel, according to DBP Index, was still slightly overpriced in all selected ports ranging from plus 6 USD (Singapore) to plus 25 USD (Houston). DBP Index also showed that MGO LS was undervalued in all ports ranging from minus 19 USD (Rotterdam) to minus 34 USD (Singapore), with the exception of Houston (overvalued by 8 USD).

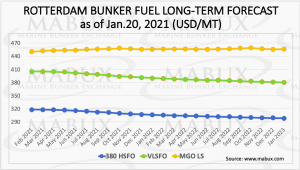

Despite the continued moderate growth in bunker prices in early 2021, this trend is largely hampered by the high rate of coronavirus pandemic and related concerns about a recovery in energy demand. Pressed by this factor, the MABUX long-term forecast until January 2023 for the port of Rotterdam (based on active oil-futures contracts as of Jan.20, 2021) shows a possible reversal of the 380 HSFO and VLSFO indices into a moderate downward trend, while prices for MGO LS remain quite stable. Thus, it is too early to speak about a sustainable recovery on the bunker market.

We expect that in 2021 VLSFO and MGO LS will remain the main types of bunker fuel with a fairly stable demand. Despite concerns regarding the availability of the new conventional VLSFO fuel in the first half of 2020, this problem has now been completely resolved in the vast majority of ports worldwide. Also, by the end of 2020, quality issues of the VLSFO were mainly resolved.

Traditional high-sulfur fuel 380 HSFO will retain its segment in the market in 2021. The gradual rise in the SS index again added to the attractiveness of using scrubbers in combination with the 380 HSFO. However, in the medium term, one should hardly expect an increase in demand for this type of fuel, both in terms of the further availability of 380 HSFOs and in view of the likely tightening of restrictions to use non-ecological fuels, discussions on which have already entered into an active phase.

As for alternative types of bunkering fuel, primarily LNG, despite the significant results achieved in 2020 in creating the infrastructure for LNG bunkering (at the end of 2020, LNG bunkering was available in 96 ports of the world, and in 55 ports LNG bunkering terminals were under construction), it is still premature to talk about a significant growth in this segment of the global bunker market in 2021. According to DNV GL, there was no significant growth of the LNG fleet in 2020: 305 vessels versus 276 vessels in 2019. In 2021, the LNG fleet is expected to grow to 445 vessels, but this only amounts to about 1% of the world’s total commercial fleet.

Overall, we expect better results for the global bunker market in 2021, as the roll-out of coronavirus vaccination programs could stimulate global economic activity, which in turn could ultimately lead to higher refinery runs and growing demand for all types of fuels, including marine fuels.

Source: Mabux

Follow on Twitter

[tfws username=”MabuxAB” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]