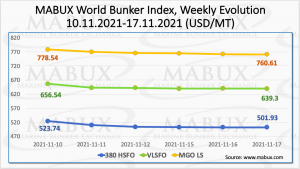

On Week 46, the MABUX World Bunker Index demonstrated a firm decline. The 380 HSFO Index dropped by 21.81 USD: from 523.74 USD / MT to 501.93 USD / MT. The VLSFO index fell by 17.24 USD: from 656.54 USD / MT to 639.30 USD / MT, while the MGO index lost 17.93 USD (from 778.54 USD / MT to 760.61 USD / MT).

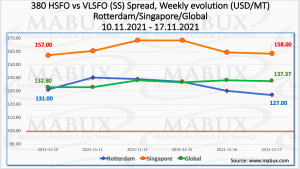

The weekly average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued to rise during the week and reached $ 135.92 (versus $ 128.41 last week, plus $ 7.51). At the same time, the average SS Spread in Rotterdam remained practically unchanged, lingered at the level of $ 134 (minus $ 0.67 compared to the previous week), and the average SS Spread in Singapore, on the contrary, added $ 11.67 and reached $ 161.67 vs. $ 150.00 last week.

The gradual growth of SS Spread and the steady surpassing of the psychological mark of $ 100 have increased the profitability of scrubber retrofits. According to DNV GL, the total number of vessels with scrubbers (in operation and on order) in 2021 will be 4,584, compared to 4,368 in 2020 and 3,167 in 2019. More information is available in the Differentials section of the www.mabux.com website.

The European gas prices remain unstable. The recent upward driver came from Gazprom with no booking additional gas transit capacity via Ukraine or via the Polish section of the Yamal-Europe pipeline for December, while the company has booked short-term transit capacities and started refilling its European storage facilities last week. Anyway, extra supplies promised by Russia have so far been negligible and Norwegian flows have been reduced because of heavy maintenance. The future of Nord Stream-2 is still unclear.

Correlation MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was undervalued in two out of four ports: Rotterdam (minus $ 17) and in Singapore (minus $ 15). In Fujairah and Houston, the MABUX MBP / DBP Index recorded an overcharge of plus $ 12 and plus $ 3, respectively.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, has been overpriced in two out of four ports: in Rotterdam by minus $ 5 and in Houston by minus $ 11. In Singapore and Fujairah, an overpricing by $ 24 was recorded for each port.

With regard to MGO LS, the MABUX MBP / DBP Index continued to register overpricing of this fuel grade in two ports: in Fujairah – by plus $ 14 and in Houston – by plus $ 11. However, MGO LS is still undervalued in Rotterdam – minus $ 40 and in Singapore – minus $ 27.

All in all, the MABUX MBP / DBP Index correlation shows that a firm trend for all fuel grades is still in the stage of formation.

Over 20 countries – Australia, Belgium, Canada, Chile, Costa Rica, Denmark, Fiji, Finland, France, Germany, Ireland, Italy, Japan, Morocco, Netherlands, New Zealand, Norway, Spain, Sweden, the UK and the US – have signed the Clydebank Declaration to develop at least six green shipping corridors between two or more ports by 2025 and more by 2030. Corridors would arise from partnerships between willing ports and operators to decarbonize specific shared maritime routes, the declaration said. Voluntary participation by operators was a significant element for successful green shipping corridors.

Over 200 businesses across the shipping value chain had committed to scaling and commercializing zero emission vessels and fuels by 2030 and on the demand side, Amazon, Ikea, Michelin, Unilever, Patagonia have announced they will only buy zero carbon freight from 2040. With electrification not seen as feasible, the choices for zero carbon shipping fuels are green methanol, liquid hydrogen and ammonia.

Source: www.mabux.com