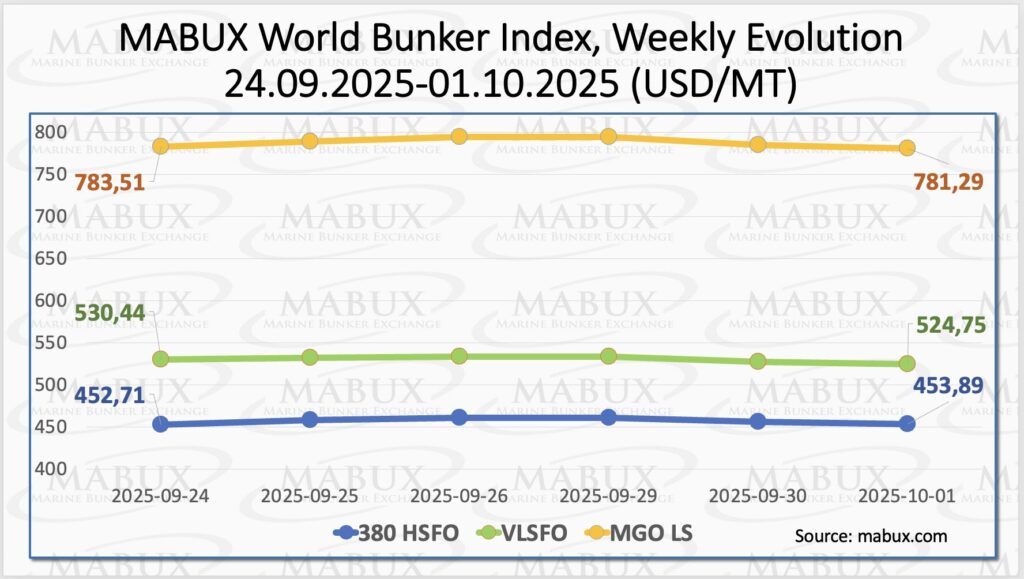

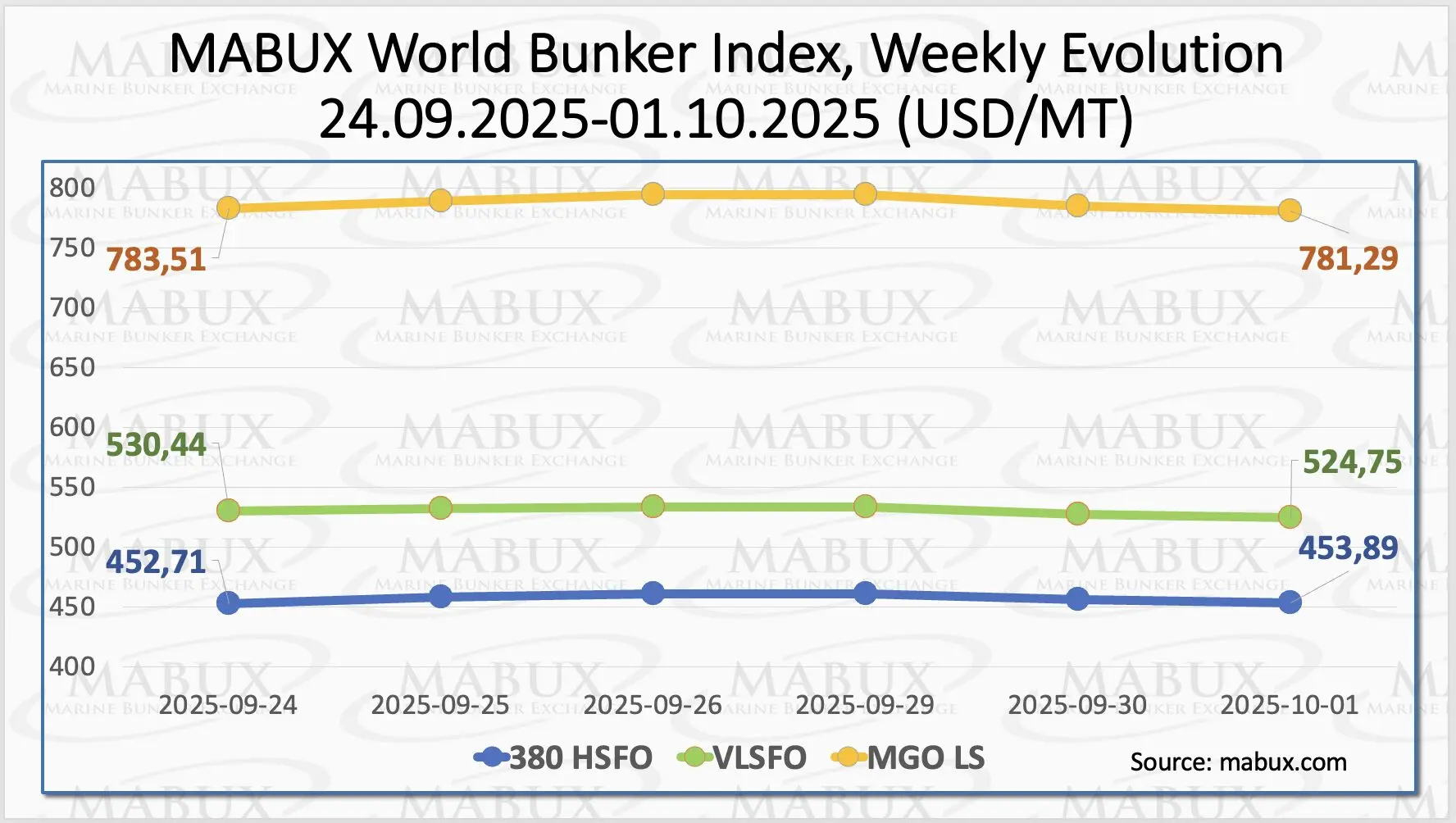

At the close of Week 40, global bunker prices under MABUX showed mixed dynamics without establishing a firm trend. The 380 HSFO index inched up by USD 1.18, rising from USD 452.71/MT to USD 453.89/MT. In contrast, the VLSFO index continued its decline, falling by USD 5.69 to USD 524.75/MT from USD 530.44/MT a week earlier.

The MGO index also moved lower, losing USD 2.22 to settle at USD 781.29/MT versus USD 783.51/MT previously. At the time of writing, the global bunker market was showing signs of an upward correction.

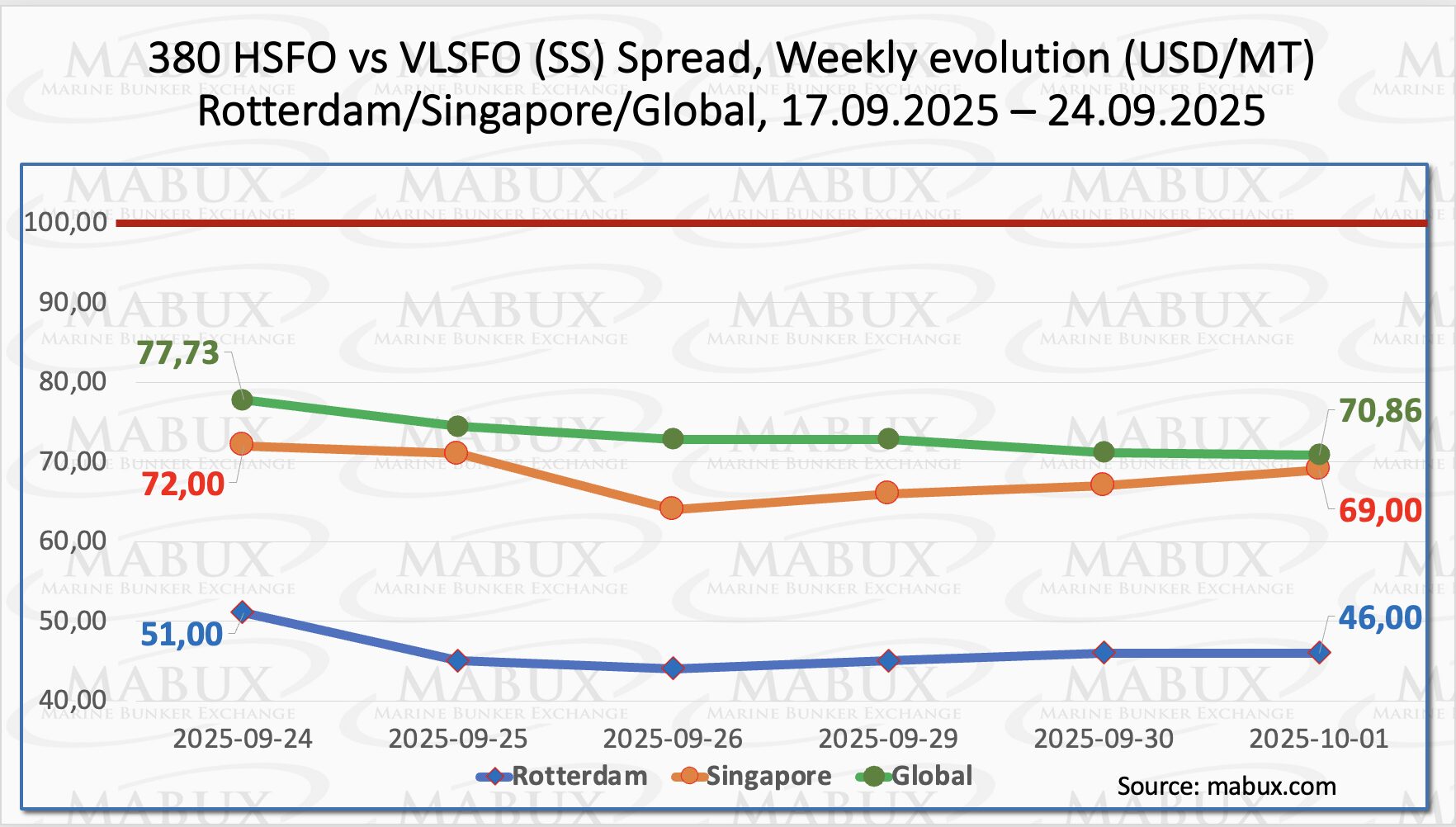

The MABUX Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – extended its decline, falling by $6.87 from $77.83 to $70.86, and remaining well below the psychological breakeven level of $100.00. The weekly average also moved lower by $8.43.

In Rotterdam, the SS Spread decreased by $5.00, slipping to $46.00 from $51.00 a week earlier, and dropping below the $50.00 mark for the first time since June 2025. The weekly average in the port declined more sharply by $16.00. In Singapore, the HSFO/VLSFO differential narrowed by $3.00 to $69.00 versus $72.00 last week, breaching the $70.00 mark. The port’s weekly average registered a loss of $9.33.

Overall, SS Spread indices have re-entered a downward phase, sharply reducing the profitability of the HSFO + Scrubber option compared to conventional VLSFO. However, we view this decline as temporary, with the likelihood of an upward correction within the next one to two weeks. Detailed figures are available in the “Differentials” section of mabux.com.

As per S&P Global Commodity Insights, natural gas is the only fossil fuel projected to increase its share of the energy mix in the U.S., China, and India by 2050, even as global oil and coal consumption declines. The report highlights that scalability and commercial hurdles remain the key barriers to moving directly from coal to renewables, positioning natural gas as a critical bridge in the global energy transition. S&P Global also projects that renewables will grow from just 4% of global energy supply today to 20% by 2050.

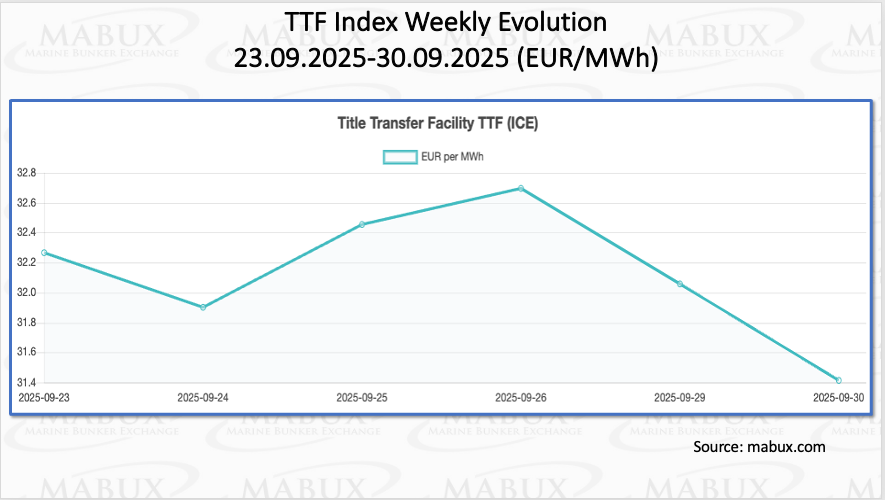

As of September 30, European regional gas storage facilities stood at 82.59% capacity, up 1.76% from the previous week. This level is 11.26% higher than at the beginning of the year (71.33%), although the pace of injection remains relatively modest. By the close of Week 40, the European TTF gas benchmark posted a moderate decline of €0.854/MWh, settling at €31.411/MWh compared with €32.265/MWh a week earlier.

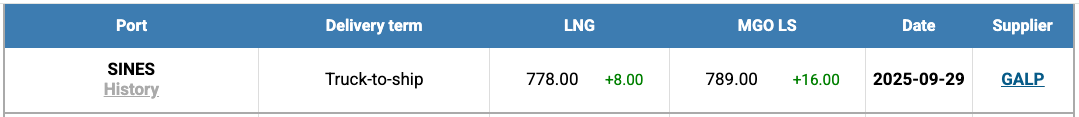

The price of LNG as a bunker fuel at the port of Sines (Portugal) rose by 8.00 USD this week, reaching USD 778/MT compared to USD 770/MT last week. Despite this increase, the price differential shifted in favor of LNG: the gap widened to USD 11 in favor of LNG, from USD 9 in favor of conventional fuel the previous week.

On the same day, MGO LS was quoted at USD 789/MT at Sines. Further details are available in the LNG Bunkering section of mabux.com.

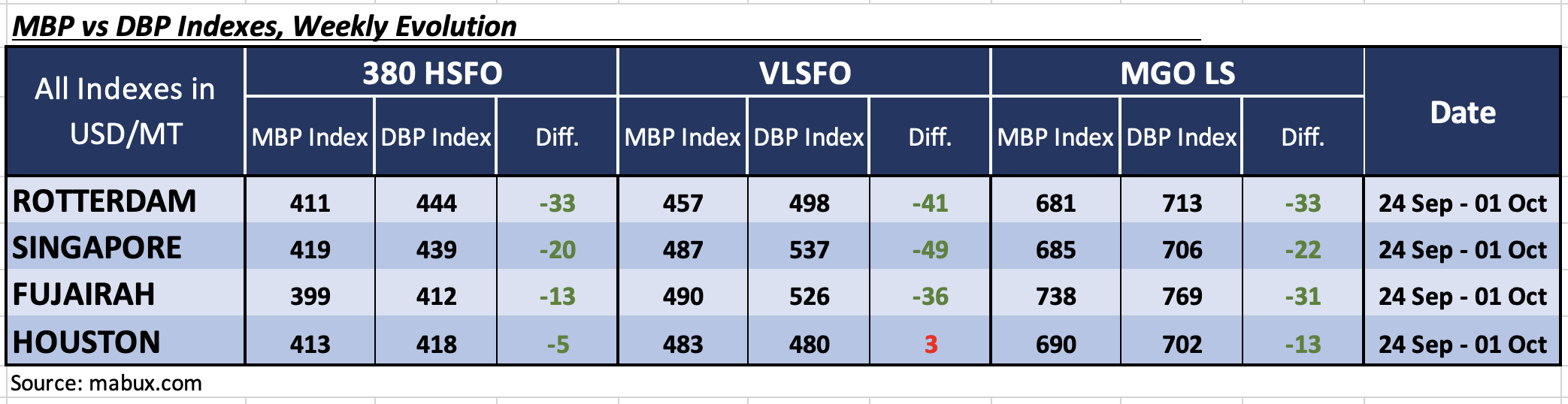

At the close of Week 40, the MABUX Market Differential Index (MDI) – the ratio of market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP) – reflected the following price dynamics across the key hubs of Rotterdam, Singapore, Fujairah, and Houston:

No major shifts were observed in the balance of overvalued and undervalued ports. In both the 380 HSFO and VLSFO segments, MDIs continued to edge closer to full correlation with the digital benchmark, while undervaluation remained the prevailing trend. Looking ahead, we expect a gradual erosion of undervaluation premiums in the coming week.

More detailed information on the correlation between market prices and the MABUX digital benchmark is available in the Digital Bunker Prices section on mabux.com.

A new study by the UCL Energy Institute, the Global Maritime Forum, and Climate High-Level Champions has found that the shipping industry remains off track to meet its target of sourcing at least 5% of its fuel from zero-emission sources by 2030. The analysis includes green ammonia, e-methanol, and green hydrogen, but excludes LNG and biofuels.

The report highlights a widening gap between demand and investment compared with advances in fuel technology and production. The analysis assesses the sector’s progress toward adopting 5–10% scalable zero-emission fuels (SZEF) by 2030.

It notes that the order book for SZEF-capable vessels is expanding too slowly, with only about one-third of the capacity needed to achieve the 5% target likely to materialize by 2030. This shortfall equates to roughly 9 million tonnes of fuel oil equivalent, or around 400 large container ships able to run on zero-emission fuels.

On the financial side, the study observes that despite some early gains, momentum has slowed considerably, as investment continues to flow disproportionately into conventional fossil-fuel-powered ships.

The global bunker market should remain relatively stable next week, although signs of a sustained upward correction may appear by the end of the period.

Source: MABUX