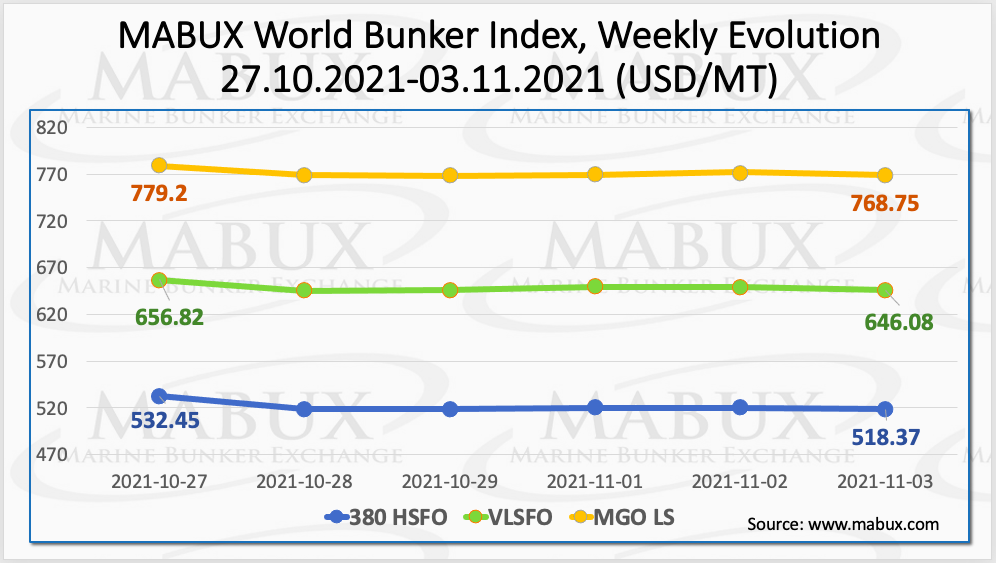

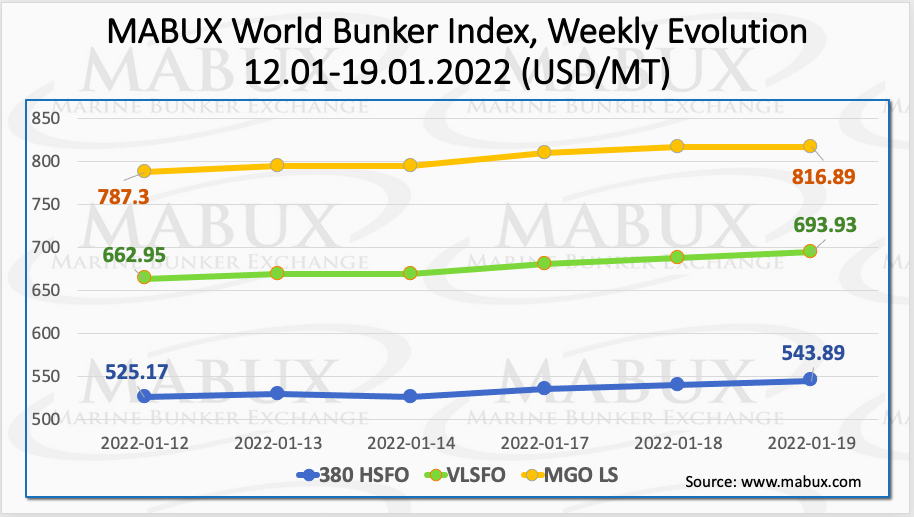

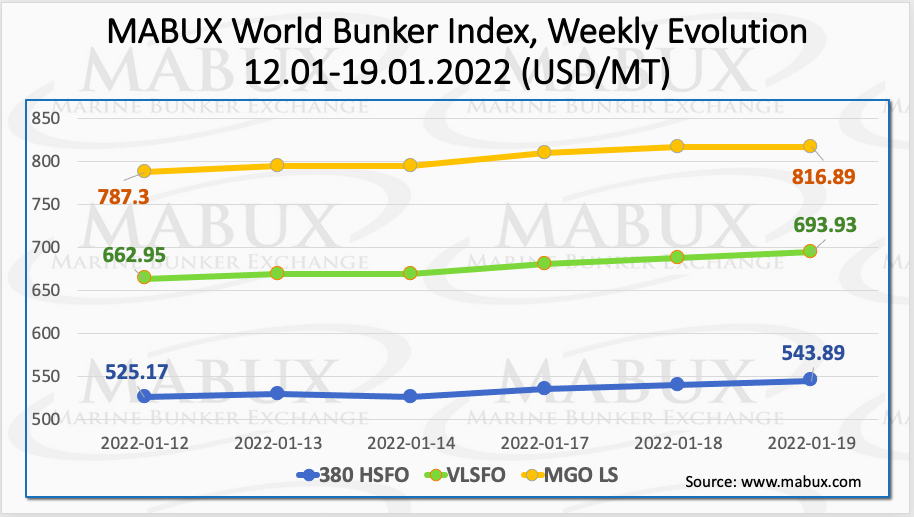

On a Week 03, the MABUX World Bunker Index continued its firm upward trend. The 380 HSFO Index rose by 18.72 USD: from 525.17 USD/MT to 543.89 USD/MT. The VLSFO Index gained 30.98 USD from 662.95 USD/MT to 693.93 USD/MT, while the MGO Index increased by 29.59 USD (from 787.30 USD/MT to 816.89 USD/MT). All three fuel Indexes topped October 2021 highs (380 HSFO – 542.16 USD/MT on 20.10, VLSFO – 657.89 USD/MT on 26.10; and MGO LS – 779.20 USD/MT on 27.10) and continue rising.

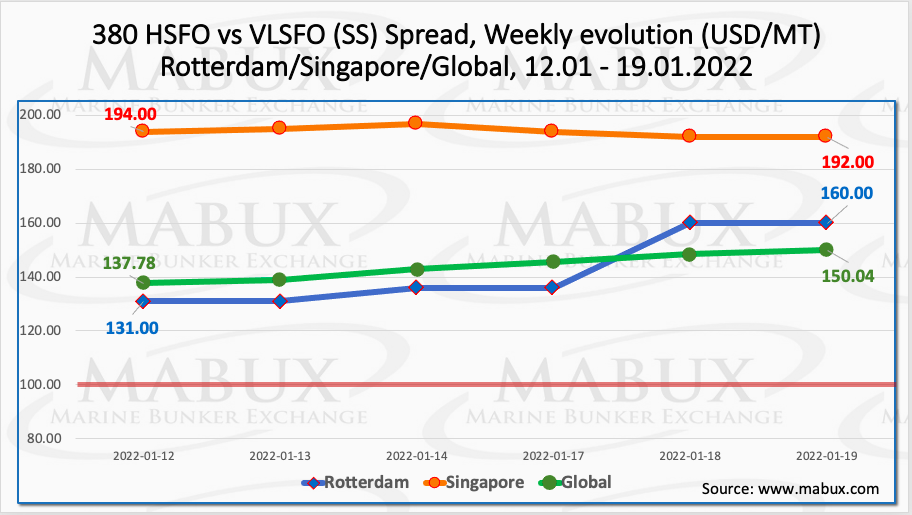

The weekly average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO — posted a gain of $9.38 during the week to over $140.00 ($143.96 vs. $134.58 last week). Meanwhile, in Rotterdam SS Spread widened even more: from $124.83 to $142.33 (up $17.50 compared to the last week). The average weekly SS Spread in Singapore also rose by $11.00 to $194.00 from $183.00 last week. The SS Spread is well above the $100 psychological mark at the largest hubs and continues to rise. More information is available in the “Price Difference” section of the website www.mabux.com.

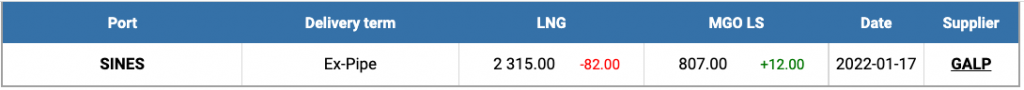

So far this month, the European Union has received U.S. natural gas volumes five times higher than Russia’s pipeline deliveries. Despite this, even with normal winter weather conditions, Europe faces storage inventories dropping to a record low of below 15 billion cubic meters (bcm) by the end of March. The price of LNG as marine fuel at the port of Sines (Portugal) on January 17 decreased further by 82 USD to 2315 USD / MT. The price of LNG still significantly exceeds the price of MGO LS (807 USD/MT as of January 19).

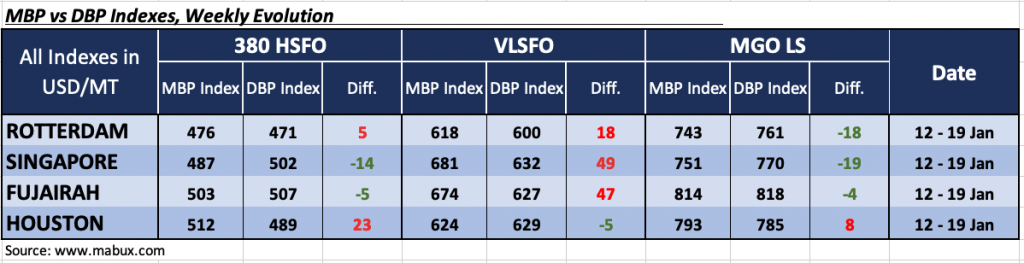

On a Week 03, the correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Bunker Prices (benchmark)) showed that 380 HSFO fuel grade was overpriced at two ports out of four selected (versus three out of four selected last week): in Rotterdam – plus $5 and in Houston – plus 23. In Singapore and Fujairah, the MABUX MBP/DBP Index registered an underestimation of 380 HSFO by $14 and $5 respectively. At the moment, the Index does not have a single trend in the global 380 HSFO market segment.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, remained overvalued in three ports out of four selected against two last week: Houston moved into the undercharge zone – minus $5. For other ports, the overcharge was registered as: plus $18 in Rotterdam, plus $49 in Singapore and plus $47 in Fujairah. Overpricing at three ports is still at significant levels.

As for MGO LS, the MABUX MBP/DBP Index recorded an underestimation of this type of fuel in three of the four selected ports: Fujairah (minus $4) added to Rotterdam (minus $18) and Singapore (minus $19). The only port where the MABUX MBP/DBP Index recorded an overpricing is Houston – plus $8.

A new study from Transport & Environment (T&E) has found that more than 25 million tonnes of CO2 emissions would be exempt from the European Union’s Emission Trading Scheme (ETS). As per Report, ‘arbitrary’ exemptions of ships such as those servicing oil and gas facilities, as well as yachts, will ‘undermine the EU’s shipping law’ and let ‘millions of tonnes of emissions off the hook.’ Last July the European Commission (EC) announced that the ETS would apply to all shipping emissions from vessels calling at an EU port on intra-EU voyages as well as 50% of emissions from extra-EU voyages and emissions while at berth in EU ports. The regulation applies to ships above 5,000 GT, although T&E highlighted that fishing and military vessels and ships such as those servicing offshore gas and oil vessels were exempt, ‘despite emitting more on average than bulk carriers and oil tankers.’ This means just over half of Europe’s ships are exempt from the proposal, ‘despite them accounting for nearly 20% of the EU’s shipping emissions.’

A new study from Transport & Environment (T&E) has found that more than 25 million tonnes of CO2 emissions would be exempt from the European Union’s Emission Trading Scheme (ETS). As per Report, ‘arbitrary’ exemptions of ships such as those servicing oil and gas facilities, as well as yachts, will ‘undermine the EU’s shipping law’ and let ‘millions of tonnes of emissions off the hook.’ Last July the European Commission (EC) announced that the ETS would apply to all shipping emissions from vessels calling at an EU port on intra-EU voyages as well as 50% of emissions from extra-EU voyages and emissions while at berth in EU ports. The regulation applies to ships above 5,000 GT, although T&E highlighted that fishing and military vessels and ships such as those servicing offshore gas and oil vessels were exempt, ‘despite emitting more on average than bulk carriers and oil tankers.’ This means just over half of Europe’s ships are exempt from the proposal, ‘despite them accounting for nearly 20% of the EU’s shipping emissions.’

Source: www.mabux.com