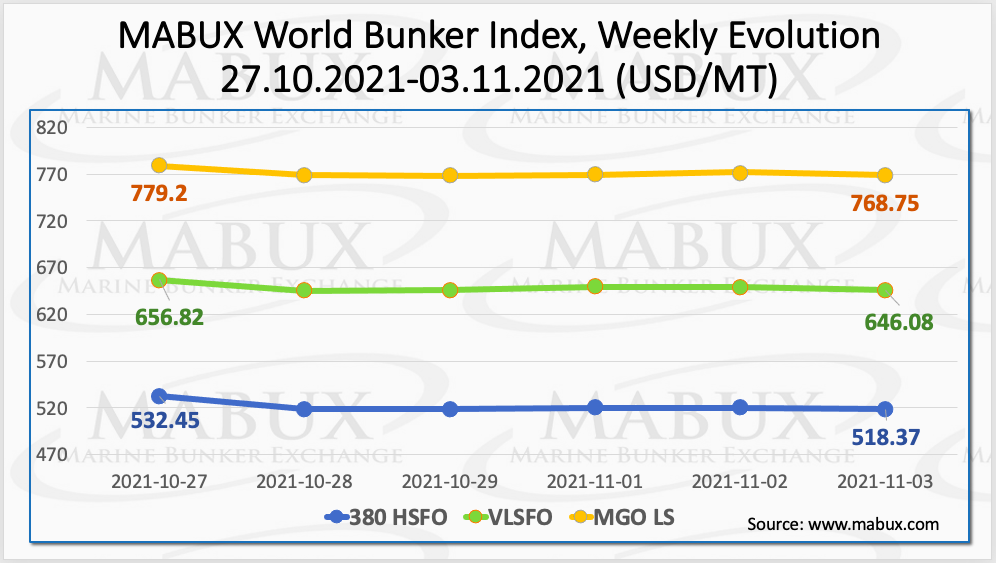

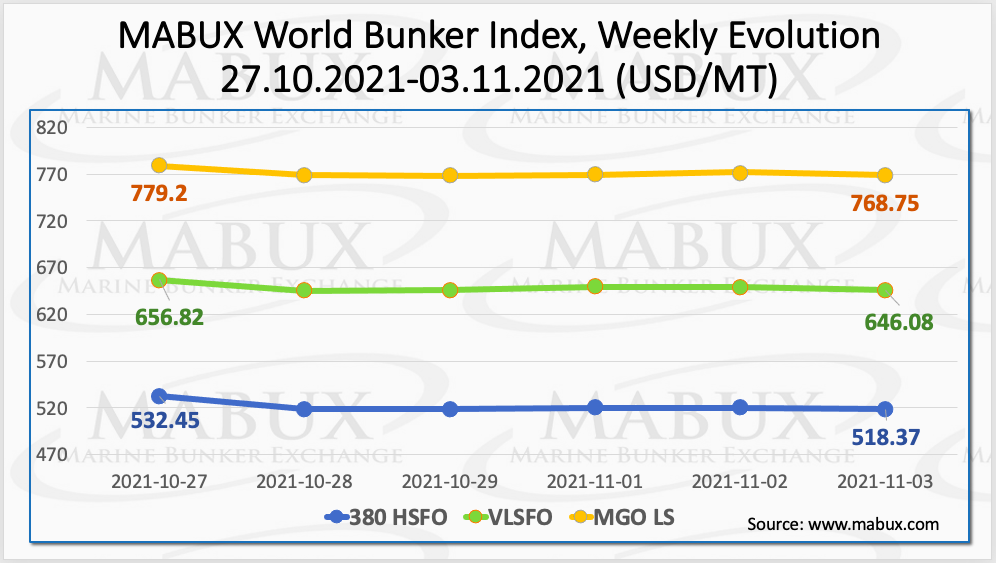

On a Week 44, the MABUX World Bunker Index turned into a directional decline. The 380 HSFO Index dropped by 14.08 USD: from 532.45 USD / MT to 518.37 USD / MT. The VLSFO Index lost 10.74 USD: from 656.82 USD / MT to 646.08 USD / MT, while the MGO Index decreased by 10.45 USD (down from 779.20 USD / MT to 768.75 USD / MT).

The gas prices in Europe retreat from all times highs amid a prospect of higher LNG supplies and potential higher supplies from Russia following the Putin’s statement last week. Gas prices have lowered for the whole curve in 2022 and there is further downside potential when Nord Stream 2 starts its operation. However, the market is likely to stay volatile in medium term and the demand will be largely driven by the weather and renewables output.

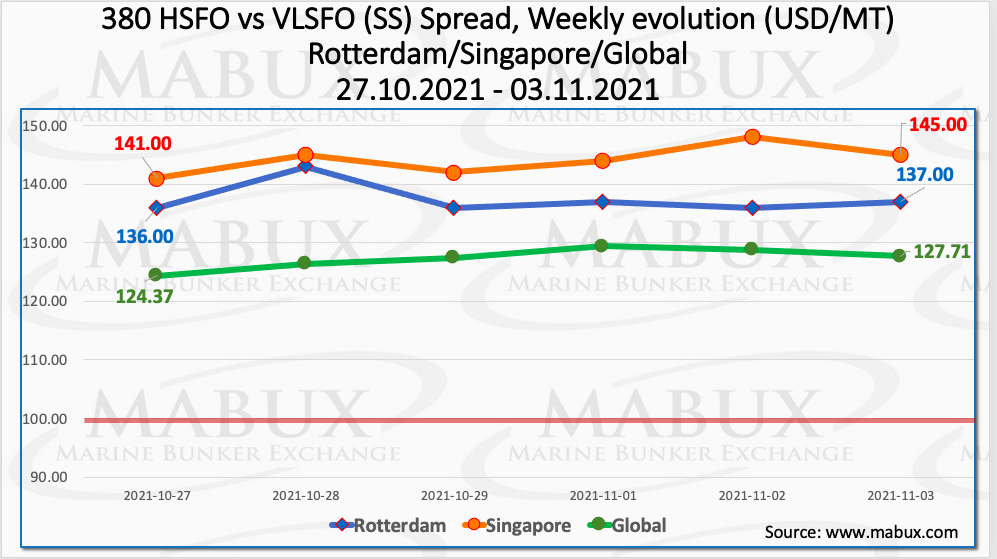

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued to rise moderately during the week, reaching $ 127.35 (versus $ 115.81 last week, plus $ 11.54). The weekly SS Spread average in Rotterdam also rose to $ 137.50 (up from $ 126.67 last week, plus $ 10.83), while the SS Spread average in Singapore added $ 23.84: $ 144.17 versus $ 120.33 last week. In general, all SS Spread indicators are currently consistently above the psychological mark of $ 100. More information is available in the Differentials section of the website www.mabux.com.

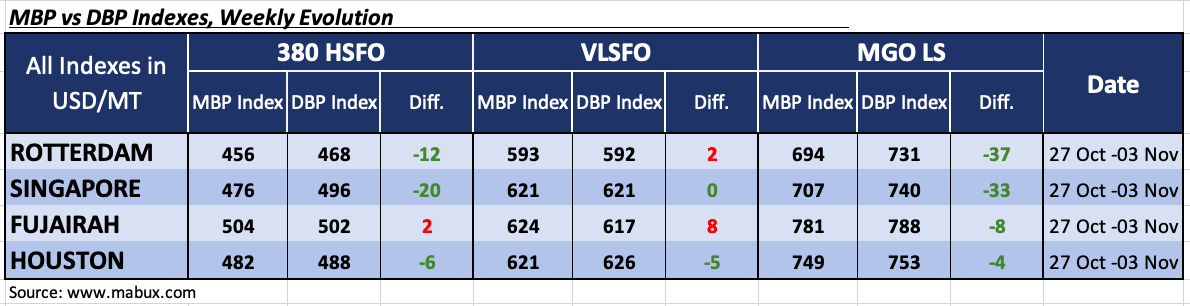

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel grade was overvalued in only one port – Fujairah (plus $ 2). In all other ports MABUX MBP / DBP Index registered underestimation: in Rotterdam – by minus $ 12, in Singapore – by minus $ 20; in Houston – by minus $ 6. It is assumed that the underpricing trend of the 380 HSFO will continue next week.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, was overpriced at two of the four selected ports. In Rotterdam, the overvaluation margin was plus $ 2 and in Fujairah – plus $ 8. In Singapore, there was registered a 100% MABUX MBP / DBP Index’s correlation and in Houston, on the contrary, this type of fuel was underestimated by minus $ 5. In general, the VLSFO indicators for all selected ports are close to 100% correlation mark.

On a Week 44, the MABUX MBP / DBP Index continued to register an undercharge of MGO LS fuel at all selected ports with the minimum rate in Houston (minus $ 4) and with the maximum in Rotterdam (minus $ 37).

The International Energy Agency has launched a new online resource which it says will bring together key energy and emissions indicators to provide an overview of the progress being made towards net zero emissions both globally and for individual countries. The IEA’s Energy Transitions hub includes a range of crucial metrics on emissions and clean energy from the array of global energy data that the Agency collects, processes and publishes. The data will be updated regularly and will be ‘freely available to everyone’. The new hub will also offer users a gateway to the IEA’s major energy transition tracking resources that combine data and analysis to provide insights into key global trends. This includes the Sustainable Recovery Tracker, which assesses the amount of recovery spending going towards clean energy investments, and the implications for energy emissions, transitions and employment.

Source: MABUX