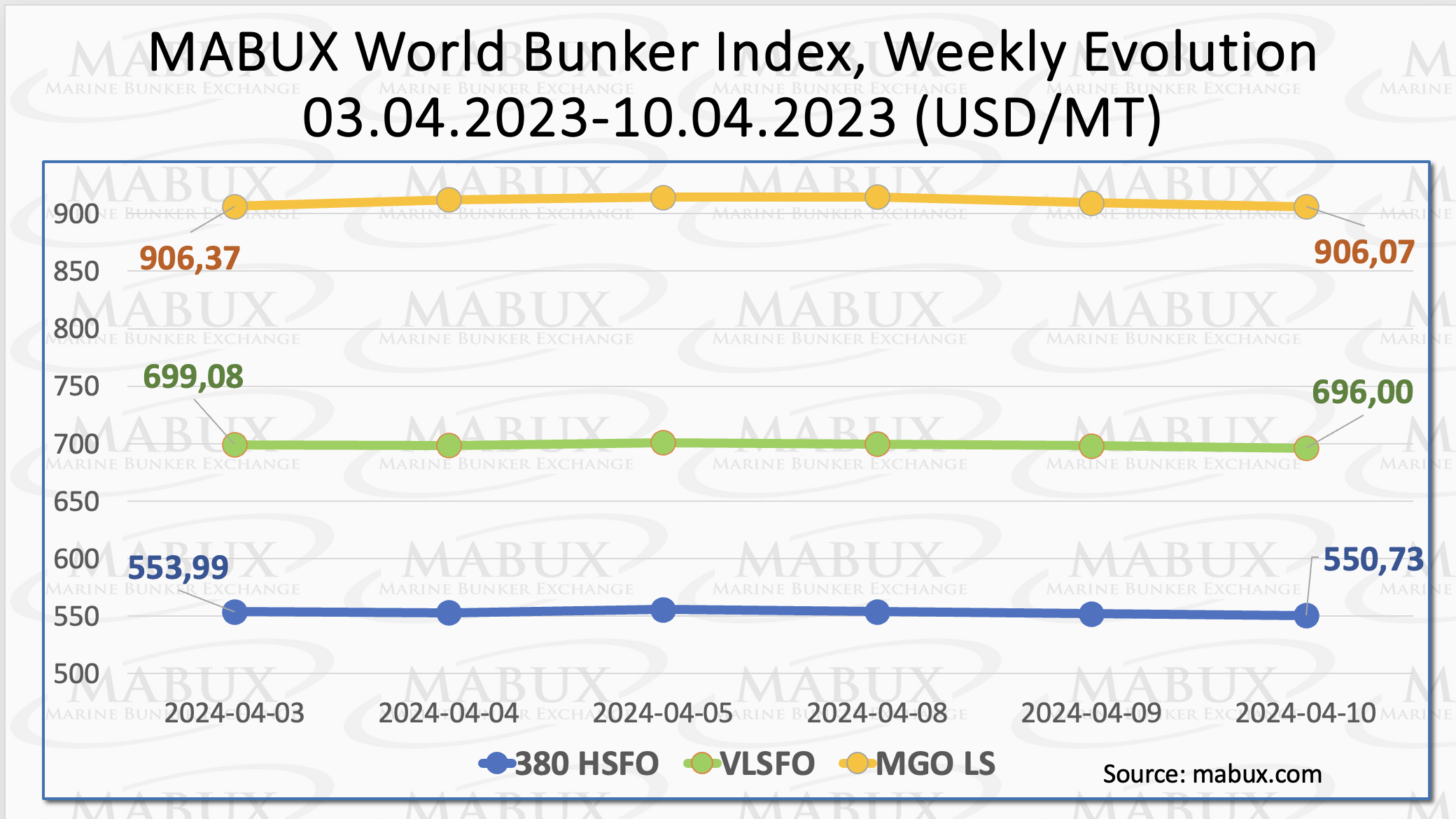

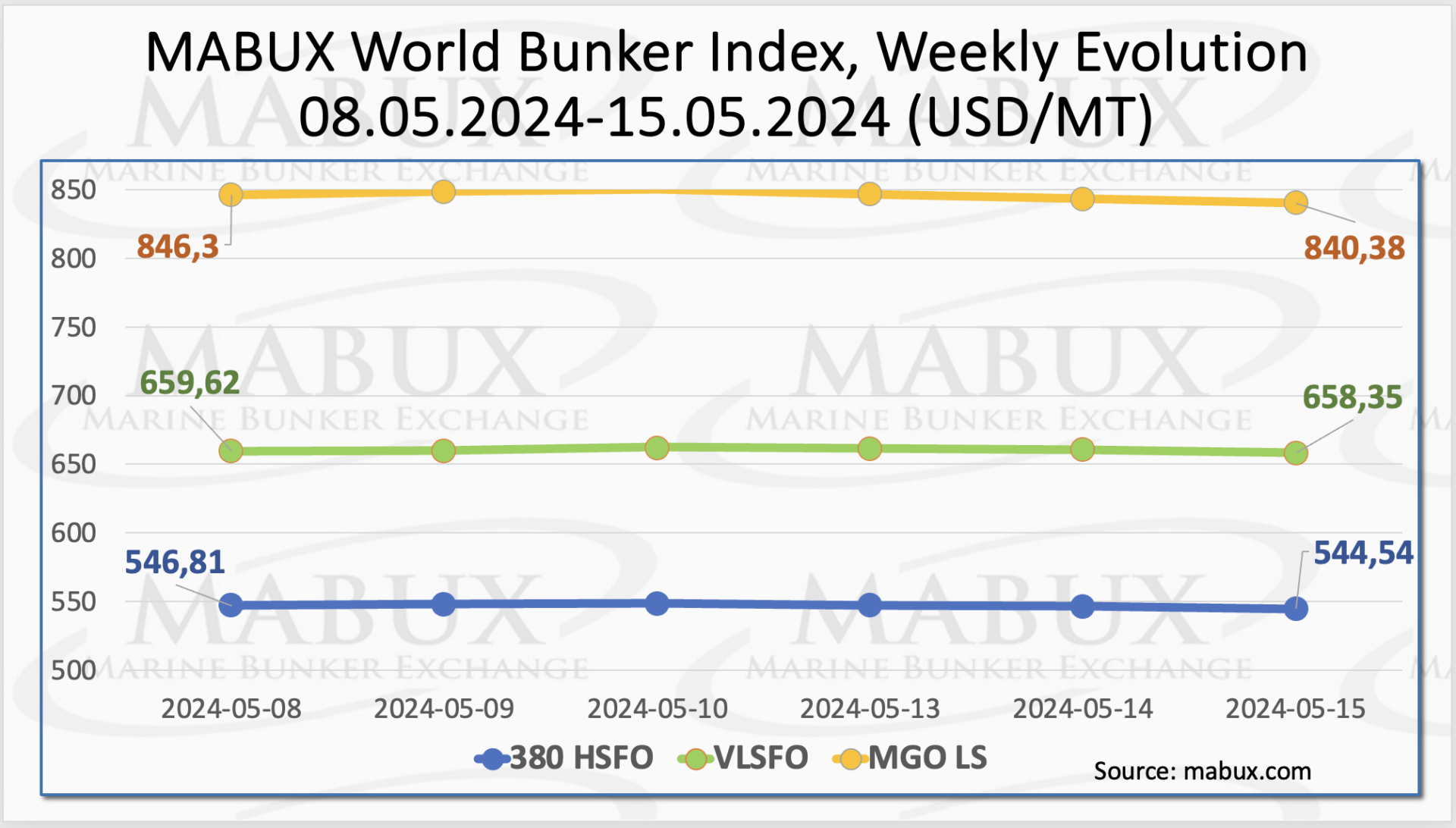

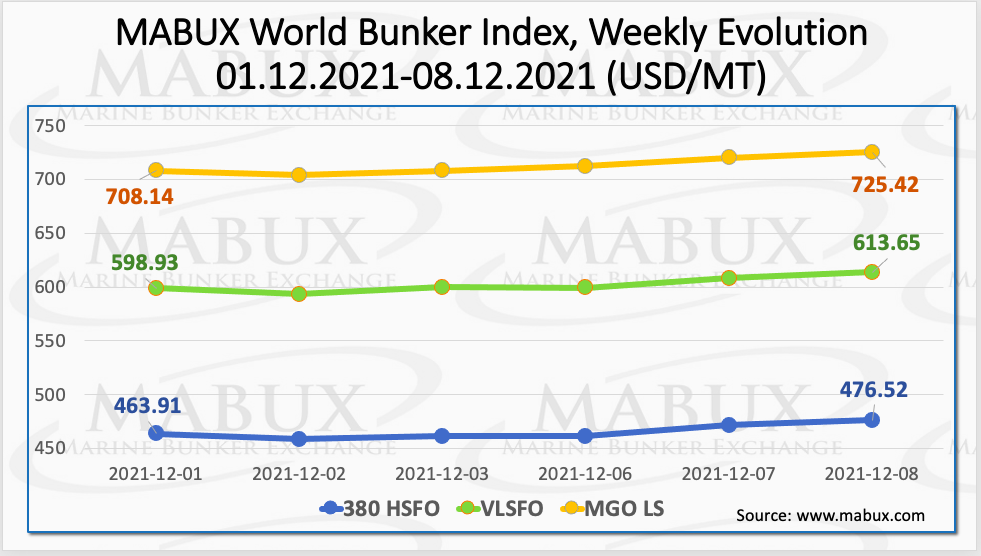

On a Week 49, the MABUX World Bunker Index resumed correctional upward trend. Index 380 HSFO increased by 12.61 USD: from 463.91 USD / MT to 476.52 USD / MT. The VLSFO index rose by 14.72 USD: from 598.93 USD / MT to 613.65 USD / MT, while the MGO index added 17.28 USD (from 708.14 USD / MT to 725.42 USD / MT).

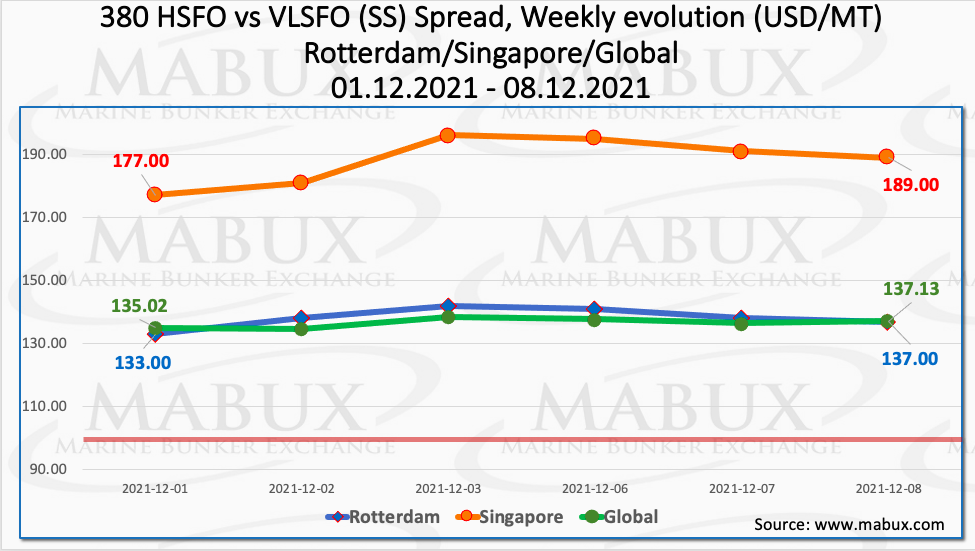

The weekly average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – rose by $ 2.10 ($ 136.61 versus $ 134.51 last week). At the same time, the average weekly SS Spread in Rotterdam reached $ 138.17 vs. $ 135.50 (plus $ 2.67). However, the fastest growing weekly average SS Spread was registered in Singapore – by $ 14.50 to $ 188.17 versus $ 173.67 last week. The gradual recovery of the global bunker market has returned the trend of widening price spread between major bunker fuels. More information is available in the Differentials section of the www.mabux.com website.

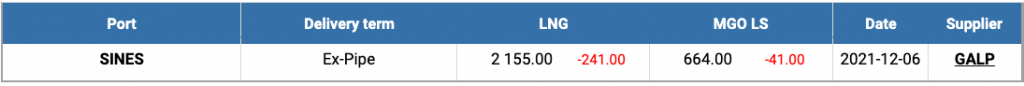

Expectations of milder weather in many parts of Europe this week, as well as stable pipeline gas supply from Russia and more LNG cargoes set to arrive in the region, have dragged down the key natural gas prices in recent days. As a result, the price of LNG as a marine fuel at the port of Sines (Portugal) on December 6 decreased by 241 USD and reached 2155 USD / MT (vs. 2396 USD / MT a week ago). The LNG price exceeds the price of MGO LS in the port by 1481 USD (664 USD / MT as of 06.12), which still leaves LNG unattractive for the shipowners planning to switch to alternative bunker fuels.

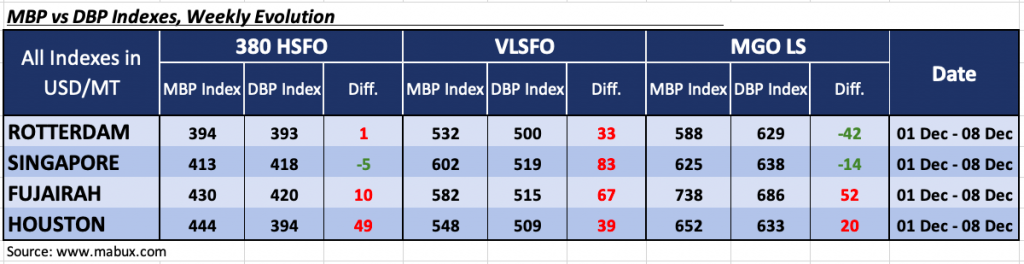

On a Week 49, there were significant changes in the correlation between the MABUX MBP Index (Market Bunker Prices) and the MABUX DBP Index (MABUX Digital Bunker Price benchmark). As a result, all fuel grades showed fairly high overcharge margins in almost all four world largest hubs. In particular, 380 HSFO fuel was overvalued in three out of four ports: in Rotterdam – plus $ 1, in Fujairah – plus $ 10 and in Houston – plus $ 49. The only port where the MABUX MBP / DBP Index continues to register underpricing is Singapore – minus $ 5.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, was significantly overpriced in all selected ports: plus $ 33 in Rotterdam, plus $ 83 in Singapore, plus $ 67 in Fujairah and plus $ 30 in Houston. While in Fujairah and Houston, the overpricing ratio increased by 12 and plus 9 points, respectively, in Rotterdam the Index surged by 24 points and in Singapore – by 27 points.

Regarding MGO LS, the MABUX MBP / DBP Index recorded an overcharge of this fuel grade in two out of four ports selected: in Fujairah – plus $ 52 and in Houston – plus $ 20. In all other ports, MGO LS grade was underestimated: in Rotterdam – minus $ 42 and in Singapore – minus $ 14. The most significant change was the increase in the overcharge ratio in Fujairah by 21 points.

Marine fuel volumes at the Port of Rotterdam in Q3 2021 increased by 9.8% year-on-year to reach 2.44 million metric tonnes (mt), with sales of high sulphur fuel oil (HSFO) showing a strong 15.8% y-o-y rise. In total, sales of conventional bunker fuel (HSFO/MGO/MDO) grew by 4.1% quarter-on-quarter, while sales for the first nine months of 2021 totalled 5.75 million mt, a 4.1% upswing on the same period last year. LNG volumes continue to show strong and consistent growth, with sales of 213,250 cubic metres (cbm) in Q3, a 35.8% quarterly rise and a 338.5% y-o-y increase. Sales of LNG for Q3 alone also exceeded sales for the whole of 2020 by some 2,919 cbm. Meantime, no sales of methanol were recorded during Q3. In Q2, a single 250 mt stem of this bunker fuel was registered.

Source: www.mabux.com