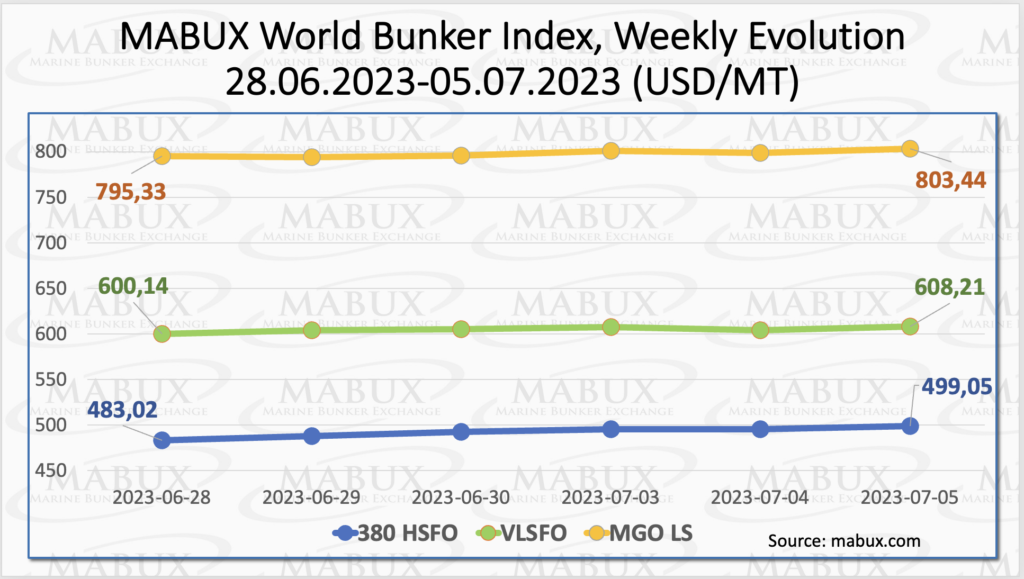

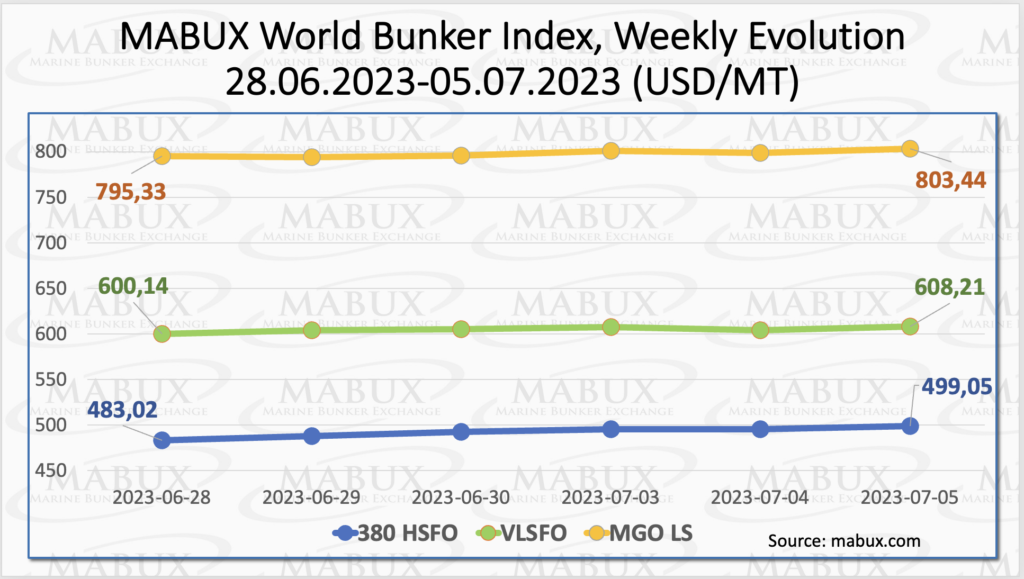

As of Week 27, the global MABUX bunker indices turned into moderate growth. The 380 HSFO index rose by $16.03, reaching $499.05 USD/MT compared to $483.02 USD/MT last week, coming close to the $500 mark once again. The VLSFO index increased by $8.07, with a current value of $608.21 USD/MT compared to $600.14 USD/MT last week. The MGO index also saw a gain of $8.11, surpassing the $800 mark and reaching $803.44 USD/MT, up from $795.33 USD/MT last week. At the time of writing, the uptrend continued to prevail in the market.

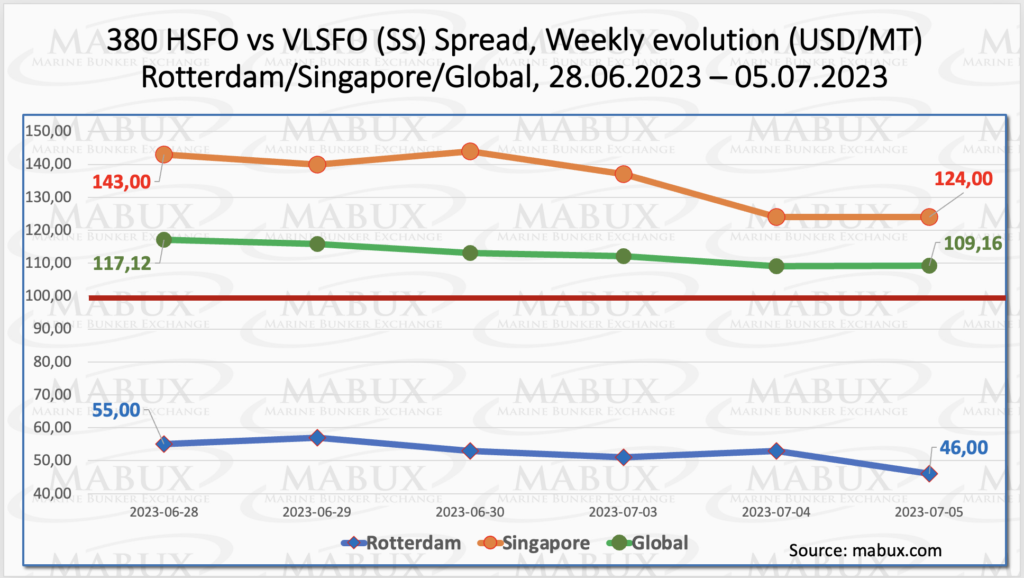

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – has been steadily declining and decreased by $7.96 to $109.16 USD ($117.12 last week). This decrease brings the SS closer to the breakeven mark of $100. Meantime, the weekly average also decreased by $8.87. In Rotterdam, the SS Spread fell by another $9.00 to reach $46.00, marking the lowest level since November 9, 2020. (The all-time minimum for the SS Spread in Rotterdam was recorded on April 27, 2020, at $25). The weekly average of SS Spread in Rotterdam also decreased by $3.67. In Singapore, the difference in the price of 380 HSFO/VLSFO dropped by $19.00 ($124 vs. $143.00 last week), while the average weekly value narrowed by $18.84. The significant reduction in the SS Spread in Northern Europe continues to drive the increased adoption of LNG as an alternative bunker fuel. For more detailed information, please refer to the “Differentials” section of mabux.com.

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – has been steadily declining and decreased by $7.96 to $109.16 USD ($117.12 last week). This decrease brings the SS closer to the breakeven mark of $100. Meantime, the weekly average also decreased by $8.87. In Rotterdam, the SS Spread fell by another $9.00 to reach $46.00, marking the lowest level since November 9, 2020. (The all-time minimum for the SS Spread in Rotterdam was recorded on April 27, 2020, at $25). The weekly average of SS Spread in Rotterdam also decreased by $3.67. In Singapore, the difference in the price of 380 HSFO/VLSFO dropped by $19.00 ($124 vs. $143.00 last week), while the average weekly value narrowed by $18.84. The significant reduction in the SS Spread in Northern Europe continues to drive the increased adoption of LNG as an alternative bunker fuel. For more detailed information, please refer to the “Differentials” section of mabux.com.

There has been a continuous decline in natural gas prices in the EU recently. One of the primary reasons for this price drop is the decrease in European natural gas demand. Compared to the previous year, Europe has been purchasing significantly less natural gas. This can be attributed to the fact that Europe’s storage caverns have limited capacity, and there is still a substantial amount of gas left over from the previous year. However, concerns have been raised regarding the upcoming year and heating season, as it will present a real test for gas supplies. During the first half of the previous year, Europe received full volumes of Russian gas, which were used to fill up the storage caverns. This year, the amount of Russian gas entering Europe is considerably smaller, limited to the gas transited via Ukraine and Turkey, which only represents a fraction of the previous total. Considering the combination of reduced gas production in the United States and increased demand anticipated for the winter heating season, there is a possibility that gas prices might rise. However, this outcome depends on whether the upcoming winter experiences mild temperatures like the previous one. If the temperatures remain mild, it is likely that the gas prices will not increase significantly, following a similar pattern as last winter.

There has been a continuous decline in natural gas prices in the EU recently. One of the primary reasons for this price drop is the decrease in European natural gas demand. Compared to the previous year, Europe has been purchasing significantly less natural gas. This can be attributed to the fact that Europe’s storage caverns have limited capacity, and there is still a substantial amount of gas left over from the previous year. However, concerns have been raised regarding the upcoming year and heating season, as it will present a real test for gas supplies. During the first half of the previous year, Europe received full volumes of Russian gas, which were used to fill up the storage caverns. This year, the amount of Russian gas entering Europe is considerably smaller, limited to the gas transited via Ukraine and Turkey, which only represents a fraction of the previous total. Considering the combination of reduced gas production in the United States and increased demand anticipated for the winter heating season, there is a possibility that gas prices might rise. However, this outcome depends on whether the upcoming winter experiences mild temperatures like the previous one. If the temperatures remain mild, it is likely that the gas prices will not increase significantly, following a similar pattern as last winter.

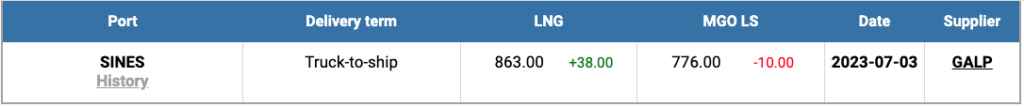

The price of LNG as a bunker fuel in the port of Sines (Portugal) has once again increased, reaching $863 USD/MT on July 03. This marks an increase of $38 USD compared to the previous week. The price difference between LNG and conventional fuel has also grown on July 03, with MGO being quoted at $776 USD/MT in the port of Sines. This amounts to a difference of $87 USD in favor of MGO over LNG. For further details, you can find more information in the LNG Bunkering section of mabux.com.

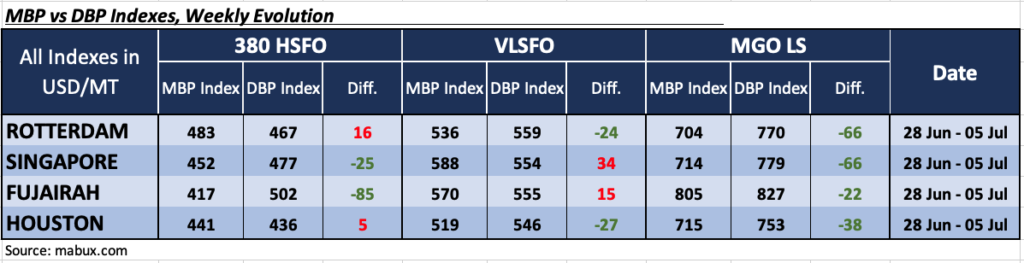

During Week 27, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index)) registered an underestimation of 380 HSFO fuel in two out of the four selected ports: Singapore and Fujairah. In Singapore, the weekly underpricing average decreased by 8 points, while in Fujairah, it increased by 3 points. Rotterdam and Houston, on the other hand, continued to be overvalued. In Houston, the average overcharge increased by 4 points, while in Rotterdam, there was no change.

During Week 27, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index)) registered an underestimation of 380 HSFO fuel in two out of the four selected ports: Singapore and Fujairah. In Singapore, the weekly underpricing average decreased by 8 points, while in Fujairah, it increased by 3 points. Rotterdam and Houston, on the other hand, continued to be overvalued. In Houston, the average overcharge increased by 4 points, while in Rotterdam, there was no change.

In the VLSFO segment, based on MDI data, Singapore and Fujairah remained overvalued ports. The weekly overcharge average decreased by 10 points. Rotterdam and Houston, on the contrary, were in the underestimation zone, with the average ratio rising within 3-6 points.

In the MGO LS segment, MDI registered underestimation in all four selected ports. The average undervaluation levels widened in Rotterdam and Fujairah by $2 and $4, respectively, while in Houston, it narrowed by $7. In Singapore, there was no change in the MDI.

More information on the correlation between market prices and MABUX digital bunker benchmark is available in “Digital Bunker Prices” section on mabux.com.

More information on the correlation between market prices and MABUX digital bunker benchmark is available in “Digital Bunker Prices” section on mabux.com.

According to DNV, some 55 vessels with alternative fuel propulsion were ordered in June, with the container segment accounting for most new orders. Of these 55, 26 were for LNG fuelled vessels and 29 for methanol powered vessels (including retrofits). Container vessels constituted almost half of the LNG fuelled ships ordered last month, bringing the total count for LNG fuelled container vessels past the 250 mark. For methanol, container vessels made up nearly 80% of the new orders, bringing the total count of methanol fuelled container vessels past the 100 mark. DNV noted that last month saw the first order for a methanol driven vessel within the tanker segment that was not a methanol carrier. So far this year the total order figure for alternative fuel vessels stands at 128.

We expect the moderate uptrend in the Global bunker market to continue next week.

Source: www.mabux.com