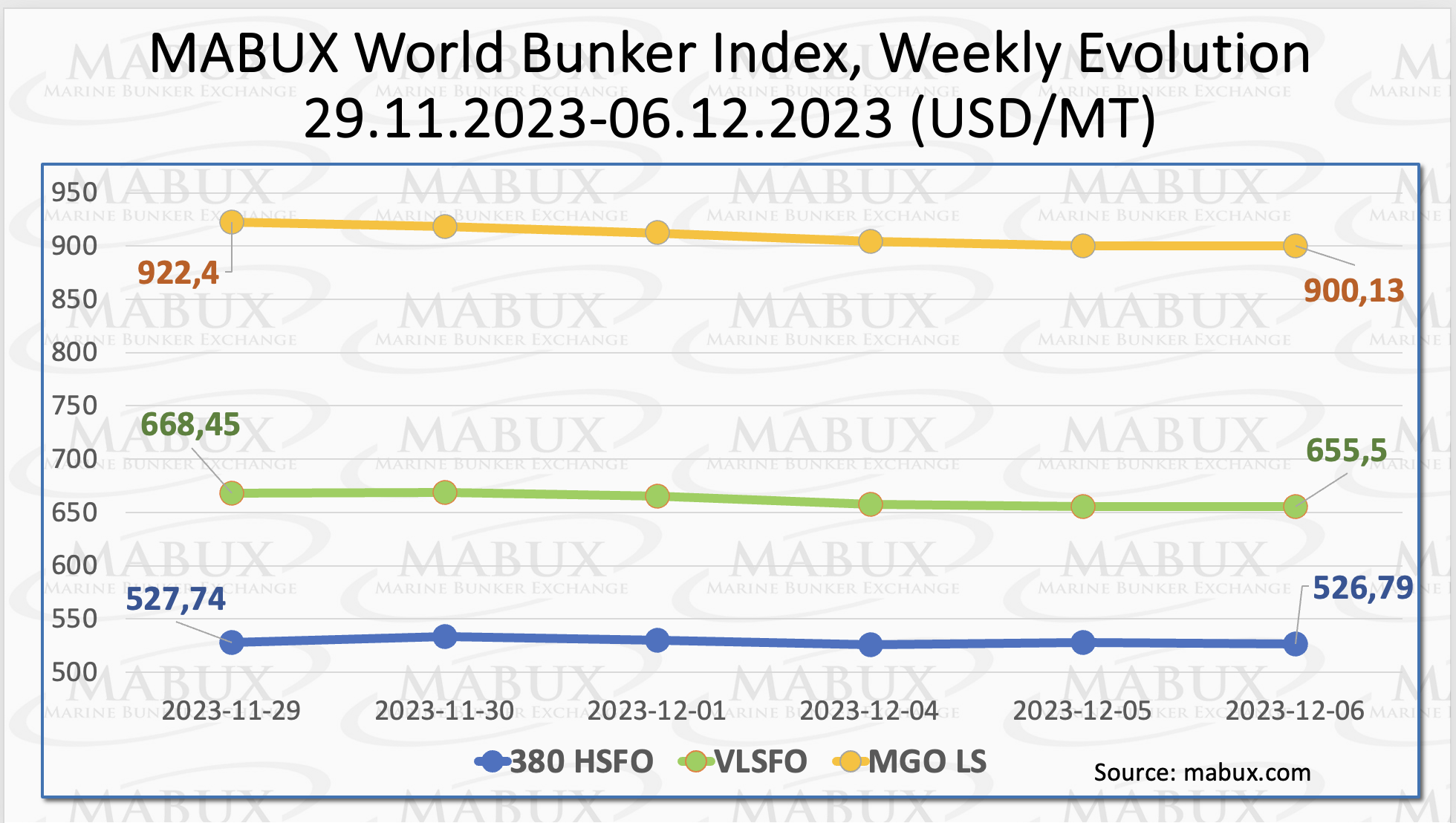

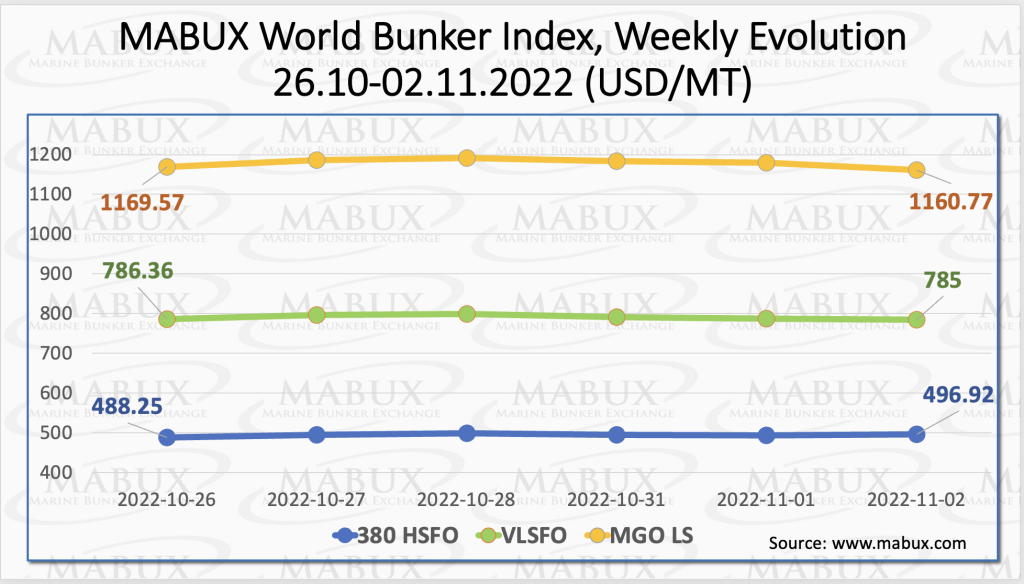

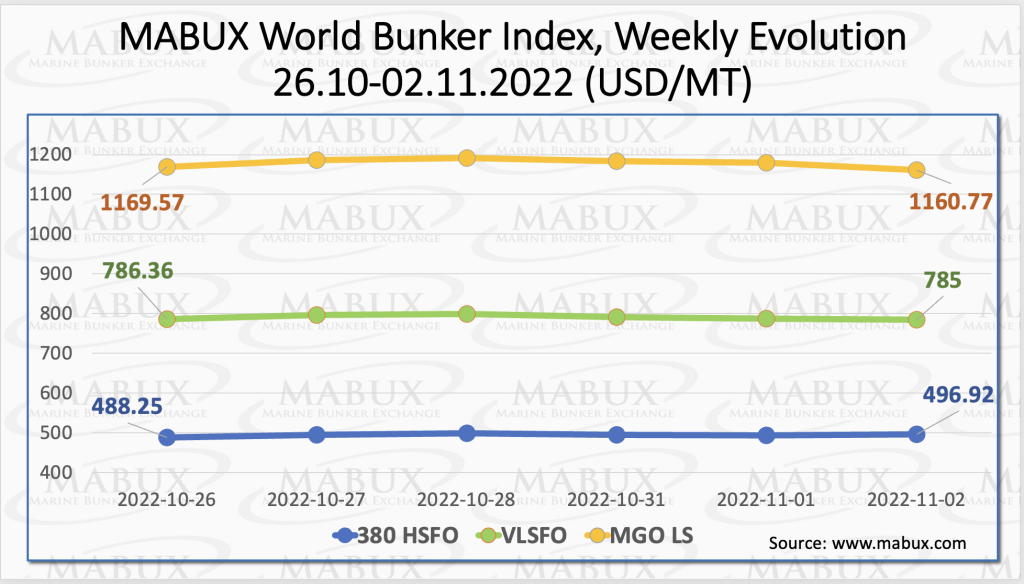

Over the Week 44, MABUX global bunker indices did not show a sustainable trend. The 380 HSFO index rose by 8.67 USD: from 488.25 USD/MT last week to 496.92 USD/MT. The VLSFO index, in turn, fell by 1.36 USD: from 786.36 USD/MT to 785.00 USD/MT. The MGO index also dropped by minus 8.80 USD (from 1169.57 USD/MT to 1160.77 USD/MT). There were no significant changes of indices registered over the week.

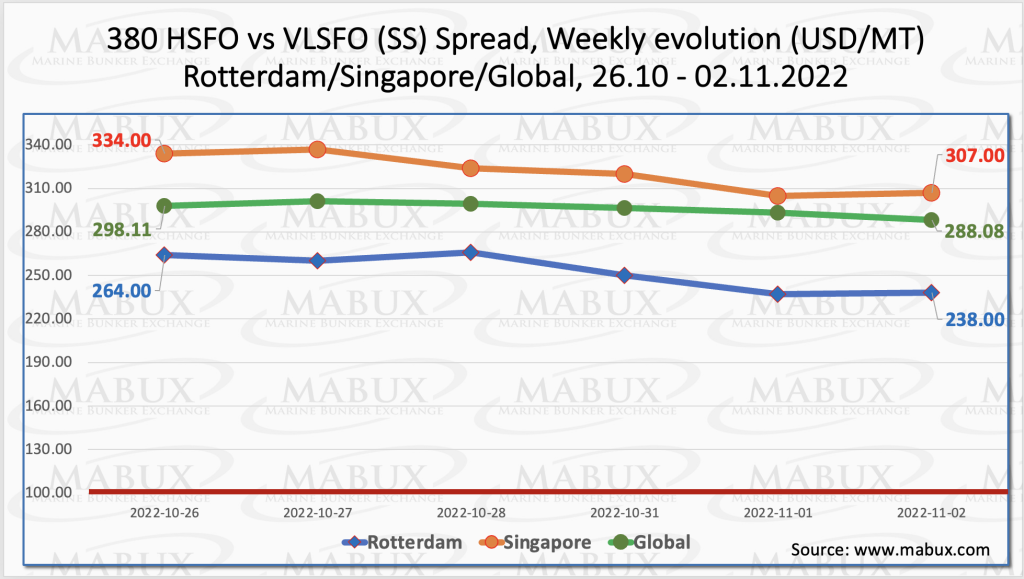

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – continued its moderate decline through week 44 – minus $3.72 ($296.21 vs. $299.93 last week), still below $300 mark. In Rotterdam, the average SS Spread also fell by $3.83 to $252.50 from $256.33 last week. In Singapore, the average weekly difference in the price of 380 HSFO/VLSFO decreased more significantly: by $14.33 ($321.17 vs. $335.50 last week). We expect the moderate reduction of SS Spread will continue next week. More information in the Differentials section at mabux.com.

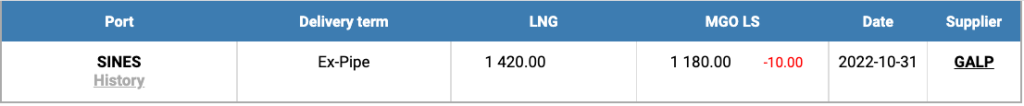

The gas supply and demand situation looks more or less under control right now. Prices in Europe are down significantly, and exports are not rising as fast as they were in early 2022 because Europe’s storage facilities are full. Nevertheless, the price of LNG as bunker fuel in the port of Sines (Portugal) showed a moderate increase again on October 31 and reached 1420 USD/MT (plus 214 USD compared to the previous week). Thus, the price of LNG once again exceeded the cost of the most expensive traditional bunker fuel. On October 31, the price of MGO LS in the port of Sines was quoted at 1180 USD/MT.

The gas supply and demand situation looks more or less under control right now. Prices in Europe are down significantly, and exports are not rising as fast as they were in early 2022 because Europe’s storage facilities are full. Nevertheless, the price of LNG as bunker fuel in the port of Sines (Portugal) showed a moderate increase again on October 31 and reached 1420 USD/MT (plus 214 USD compared to the previous week). Thus, the price of LNG once again exceeded the cost of the most expensive traditional bunker fuel. On October 31, the price of MGO LS in the port of Sines was quoted at 1180 USD/MT.

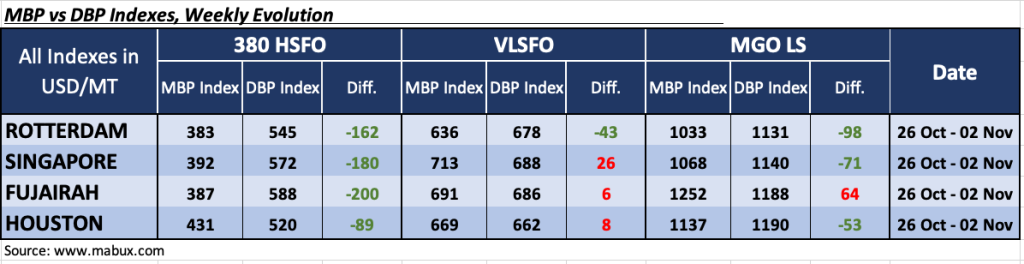

Over the week 44, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) continued to underestimate 380 HSFO fuel in all four selected ports. Underprice ratio changed insignificantly, rising in Rotterdam – minus $162 and Houston – minus $89. In Singapore and Fujairah, the undercharge premium of this fuel grade has not changed.

Over the week 44, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) continued to underestimate 380 HSFO fuel in all four selected ports. Underprice ratio changed insignificantly, rising in Rotterdam – minus $162 and Houston – minus $89. In Singapore and Fujairah, the undercharge premium of this fuel grade has not changed.

VLSFO fuel grade, according to MDI, was overpriced in three out of four selected ports: Singapore – plus $26, Fujairah – plus $6 and Houston – plus $8. Overprice margins continued to decline and approached 100 percent correlation with the market prices. The only underestimated port in the VLSFO segment was Rotterdam – minus $43.

In the MGO LS segment, MDI registered an underestimation of fuel in three ports out of four selected: Rotterdam – minus $ 98, Singapore – minus $ 71 and Houston – minus $ 53. Fujairah remained the only overvalued port in this fuel segment – plus $ 64.

In its latest World Energy Outlook (WEO), the International Energy Agency (IEA) has suggested that the global energy crisis triggered by Russia’s invasion of Ukraine is ‘causing profound and long-lasting changes that have the potential to hasten the transition to a more sustainable and secure energy system’. The IEA said that the current energy crisis is ‘delivering a shock of unprecedented breadth and complexity’; and ‘the biggest tremors have been felt in the markets for natural gas, coal and electricity – with significant turmoil in oil markets as well’. The IEA also noted that: ‘For the first time, global demand for each of the fossil fuels [coal, oil and gas] shows a peak or plateau across all WEO scenarios, with Russian exports in particular falling significantly as the world energy order is reshaped’. The agency said that in a WEO scenario based on today’s prevailing policy settings: ‘Coal use falls back within the next few years, natural gas demand reaches a plateau by the end of the decade, and rising sales of electric vehicles (EVs) mean that oil demand levels off in the mid-2030s before ebbing slightly to mid-century.

In its latest World Energy Outlook (WEO), the International Energy Agency (IEA) has suggested that the global energy crisis triggered by Russia’s invasion of Ukraine is ‘causing profound and long-lasting changes that have the potential to hasten the transition to a more sustainable and secure energy system’. The IEA said that the current energy crisis is ‘delivering a shock of unprecedented breadth and complexity’; and ‘the biggest tremors have been felt in the markets for natural gas, coal and electricity – with significant turmoil in oil markets as well’. The IEA also noted that: ‘For the first time, global demand for each of the fossil fuels [coal, oil and gas] shows a peak or plateau across all WEO scenarios, with Russian exports in particular falling significantly as the world energy order is reshaped’. The agency said that in a WEO scenario based on today’s prevailing policy settings: ‘Coal use falls back within the next few years, natural gas demand reaches a plateau by the end of the decade, and rising sales of electric vehicles (EVs) mean that oil demand levels off in the mid-2030s before ebbing slightly to mid-century.

No sustainable trend is registered in Global Bunker market so far. We expect irregular changes of bunker indices to continue next week.

Source: www.mabux.com