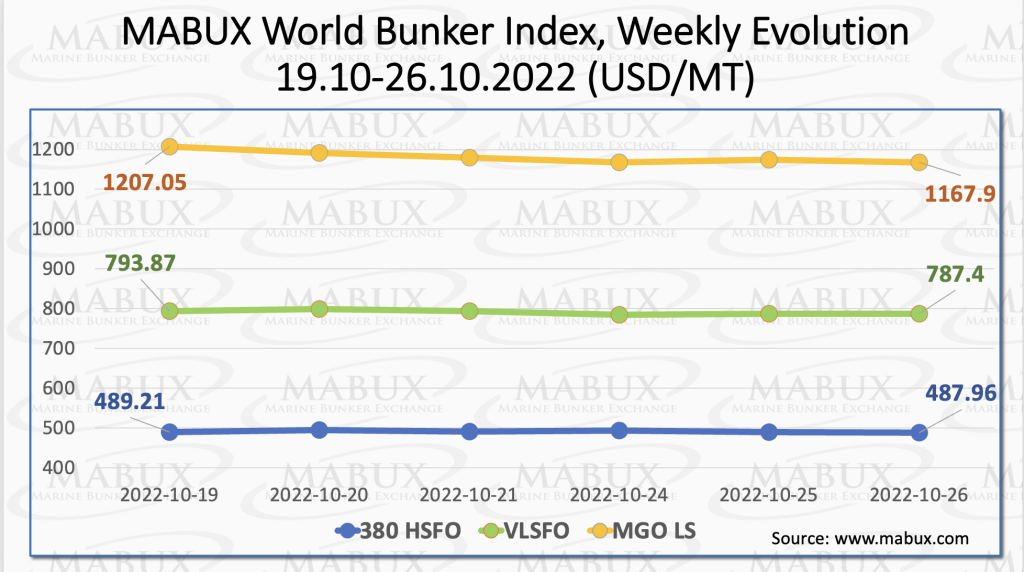

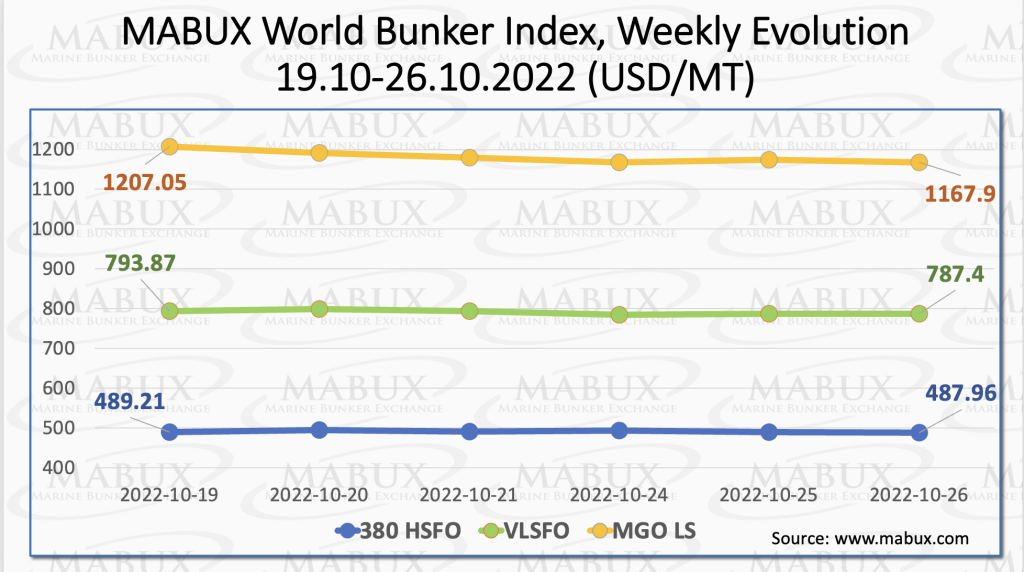

Over the Week 43, MABUX global bunker indices continued their moderate downward movement. The 380 HSFO index fell by 1.25 USD: from 489.21 USD/MT last week to 487.96 USD/MT. The VLSFO index, in turn, lost 6.47 USD: from 793.87 USD/MT to 787.40 USD/MT. The MGO index showed the most significant drop: minus 31.15 USD (from 1207.05 USD/MT to 1167.90 USD/MT), breaking through the 1200 USD – mark.

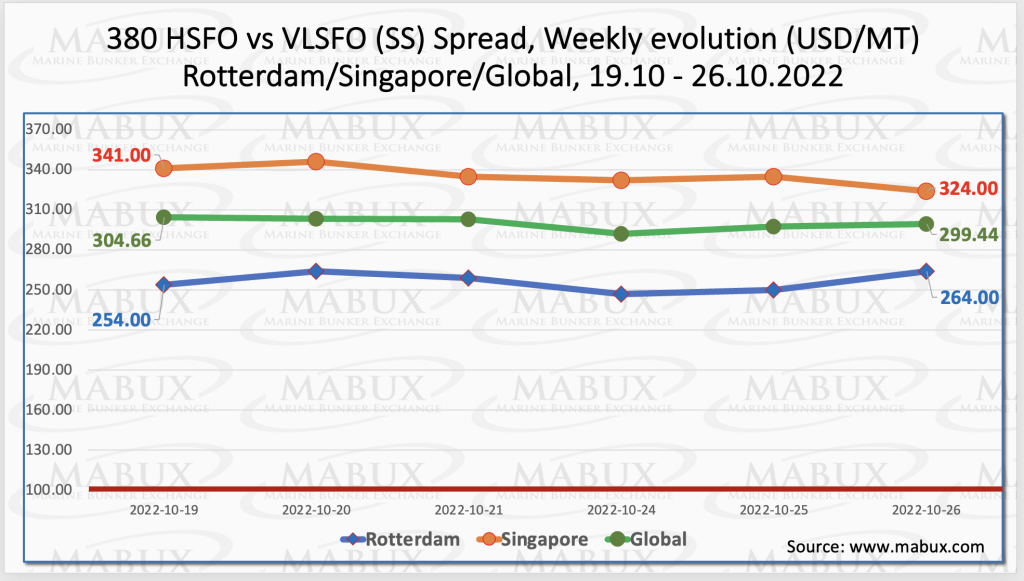

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – showed a downward reversal over the Week 43 – minus $6.44 ($299.93 vs. $306.37 last week), falling again below $300. In Rotterdam, the average SS Spread rose by a nominal $1.16 to $256.33 from $255.17 last week. In Singapore, the average weekly price difference of 380 HSFO/VLSFO dropped by $17.50 ($335.50 vs. $353.00 last week). Thus, during the Week 43, SS Spread did not have a sustainable trend. More information is available in the Differentials section of mabux.com.

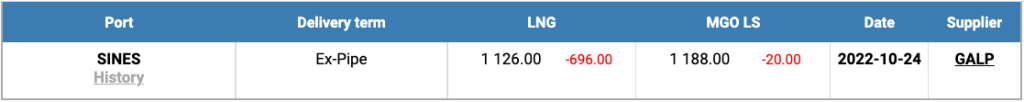

European countries have reported that their gas storage facilities have been filled at higher than usual levels before the start of winter. Yet more LNG cargos are arriving in Europe. As a result, the price of LNG as bunker fuel at the port of Sines (Portugal) continued its sharp decline on October 24 and reached 1126 USD/MT (minus 696 USD compared to the previous week). Thus, the LNG price fell below the level of MGO LS at the port of Sines for the first time since June 2021. On October 24, the price of MGO LS in the port of Sines was quoted at 1188 USD/MT.

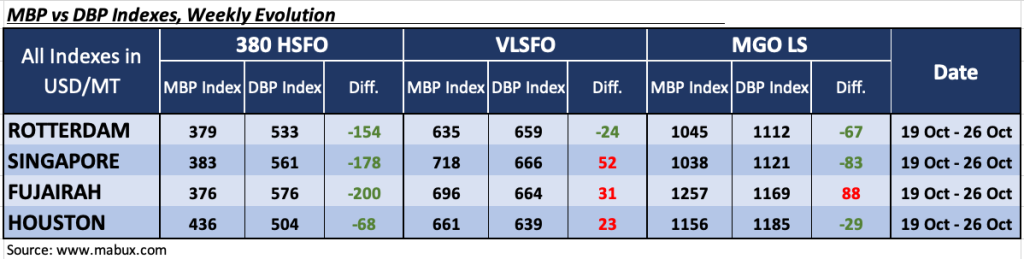

Over the Week 43, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) continued to register underpricing of 380 HSFO fuel in all four selected ports. Underestimation margins changed irregular, increasing in Rotterdam – minus $154 and Fujairah – minus $200, and decreasing in Houston to minus $68. In Singapore, the undercharge ratio of this fuel grade has not changed.

VLSFO fuel grade, according to MDI, was overpriced in three out of four ports selected: Singapore – plus $52, Fujairah – plus $31 and Houston – plus $23. The overcharge dynamics did not have a firm trend. The only underpriced port in the VLSFO segment rtemained Rotterdam – minus $24.

In the MGO LS segment, MDI registered the return of the port of Houston to the undercharge zone – minus $ 29, where it joined Rotterdam (minus $ 67), and Singapore (minus $ 83). Fujairah remained the only overvalued port in this fuel segment – plus $ 88.

The Port of Rotterdam’s throughput of 351 million tonnes for the first nine months of 2022 was almost the same as the volume that was recorded at the three-quarter-way point of last year – but there were ‘big changes’ in the ‘energy landscape’. the Port of Rotterdam Authority pointed out the superficial no-change-here impression given by throughput stability belies the ‘underlying major differences’ – as this year has been marked by ‘the war in Ukraine, the sanctions against Russia, and the changes in global energy flows’. As a results of these trends, the port authority said, ‘considerably higher volumes of coal and LNG were imported as alternatives to Russian natural gas’ – while container transhipment has decreased, ‘especially as a result of the loss of trade with Russia’. The Port of Rotterdam Authority said it expects transhipment volume for 2022 to be of the same level as that of last year.

The global bunker market is waiting for the formation of a sustainable bunker trend, while fuel indices to continue irregular fluctuations.

Source: www.mabux.com