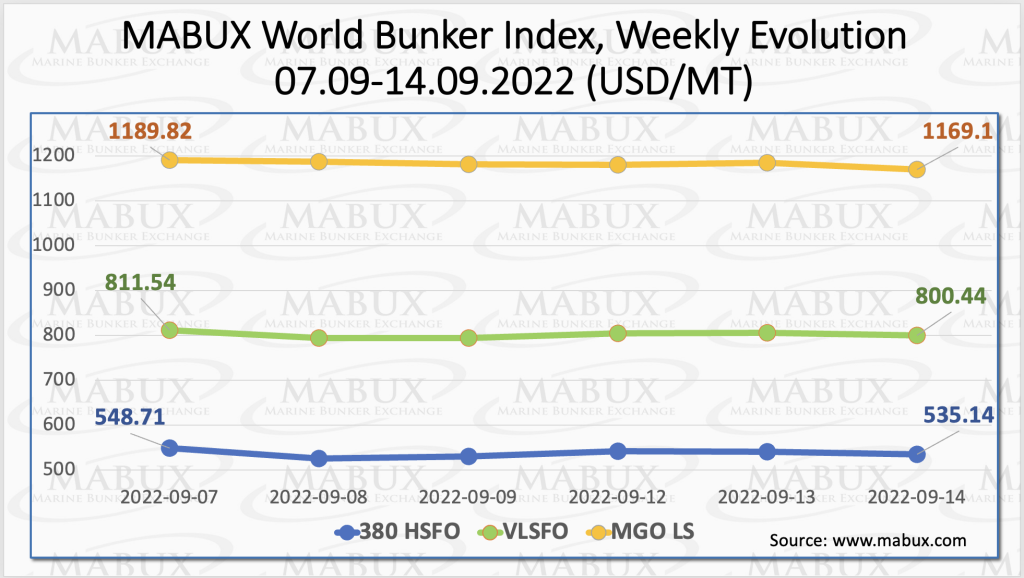

Over the Week 37, MABUX global bunker indices continued moderate sliding downward. The 380 HSFO index fell by another 13.57 USD: from 548.71 USD/MT last week to 535.14 USD/MT, gradually approaching the 500 USD mark. The VLSFO index, in turn, fell by 11.10 USD: from 811.54 USD/MT to 800.44 USD/MT. The MGO index lost 20.72 USD (from 1189.82 USD/MT to 1169.10 USD/MT), remaining below the 1200 USD mark for the second week.

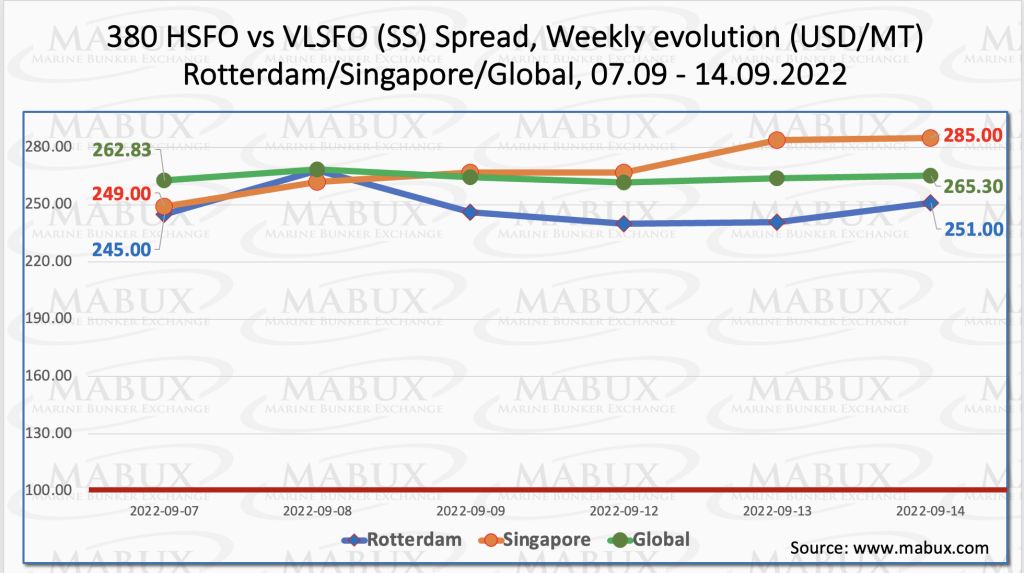

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – stopped downward trend and showed a moderate increase over the Week 37 – plus $6.00 ($264.43 vs. $258.43 last week). In Rotterdam, the average SS Spread rose more considerably: $248.50 vs. $212.17 (up $36.33 from last week). In Singapore, the average weekly price differential of 380 HSFO/VLSFO added plus $8.83 ($269.00 vs. $260.17 last week). The indicators of the Global SS Spread and the values of SS Spread in the largest hubs have converged significantly and are practically at the same level. More information is available in the Price Differences section of mabux.com.

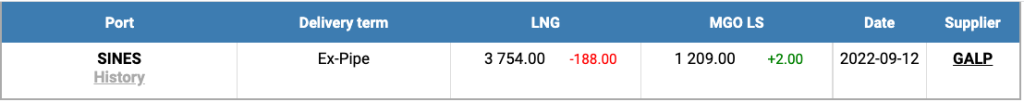

Higher nuclear power generation in France and more solar and wind supply out of Germany eased Europe’s prompt power prices this week. Despite the brief relief, the EU continues to consider ways of capping power and, possibly, gas prices in a bid to help struggling consumers and businesses. Price for LNG as a bunker fuel at the port of Sines (Portugal) fell on September 12 by another 188 USD/MT to 3754 USD/MT (versus 3942 USD/MT a week earlier). LNG prices are still more than three times higher than the most expensive type of traditional bunker fuel: the price of MGO LS at the port of Sines was quoted on September 14 at 1209 USD/MT.

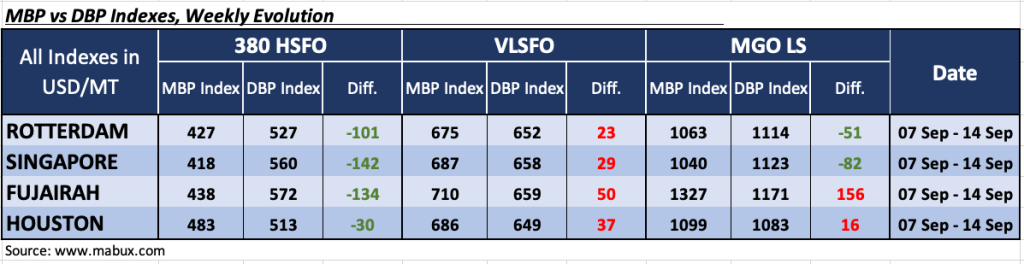

Over the Week 37, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an underpricing of 380 HSFO fuel grade in all four selected ports. The underestimation margins continued to grow and amounted for: Rotterdam – minus $101, Singapore – minus $142, Fujairah – minus $134 and Houston – minus $30.

VLSFO fuel grade, according to MDI, remained, on the contrary, overpriced in all selected ports: plus $23 in Rotterdam, plus $29 in Singapore, plus $50 in Fujairah and plus $37 in Houston. In this fuel segment, the MDI index did not have any firm dynamics: the overprice premium up in Rotterdam and Singapore, but down in Fujairah and Houston.

In the MGO LS segment, MDI registered overpricing in two ports out of four selected over the Week 37: Fujairah – plus $ 150 and Houston – plus 18. In Rotterdam and Singapore, MGO LS fuel remained undervalued: minus $ 51 and minus $ 82. Undercharge margins as well as overcharge ones rose slightly in all ports except Houston.

The Port of Amsterdam has decided not to implement a bunker licensing scheme for conventional fuels. Rotterdam introduced a bunker licensing scheme for these fuels in February 2021 – but the scheme did not extend to Amsterdam. The Port of Amsterdam said that as it received almost no complaints in the port area, neither on quantity nor on quality, and the results of the feedback asked for aboard ships during their stay in the port showed the same picture, it was decided not to implement a bunker licensing scheme in Amsterdam for now. Nevertheless, the Port of Amsterdam would consider introducing such a scheme if there was sufficient demand and the focus of such a scheme would go beyond fuel quantity.

The Maritime and Port Authority of Singapore (MPA) has reported a 1.1% year-on-year (y-o-y) increase in bunker sales for August. Some 4,116,300 metric tonnes (mt) of marine fuel were sold last month compared to 4,071,900 mt in August 2021. Last month’s total, however, was marginally down on the 4,120,600 mt registered in July, which remains the highest monthly total of the year to date. The most popular fuel grade, low sulphur fuel oil 380 cSt, saw its highest monthly sales total of the year at 2,059,500 mt, while sales of low sulphur marine gasoil (330,400 mt) also rose on the month. However, marine fuel oil 380 cSt (1,227,500 mt), low sulphur fuel oil 100 cSt (397,100 mt), low sulphur fuel oil 180 cSt (53,900 mt), marine gasoil (11,300 mt) and marine fuel oil 500 cSt (2,900 mt) sales all saw month-on-month (m-o-m) decreases.

The global bunker market is still in a state of high volatility with no sustainable trend, which entails irregular fluctuations of bunker indices about the present levels.

Source: www.mabux.com