The Suez Canal has been blocked by a large container ship, but last year’s drop in world trade volumes is still the bigger problem for supply chains.

With supply chains already under pressure, a large container ship has now literally blocked one of world trade’s major routes.

Shipping capacity between Europe and Asia was already squeezed during the Covid-19 crisis, with high rates of ship cancellations as the pandemic began and shortages of containers and slower handling speeds continuing to affect world trade volumes.

The immediate impact of delays in the canal will centre on European – Asian trade, adding delays to already disrupted supply chains affecting oil and refined products’ supplies.

But the route is significant to world trade as a whole, with around 10% of world trade by tonnage and 9% of the world’s seaborne oil (equivalent to 5.5 million barrels of oil per day) passing through the Suez Canal over the course of a year.

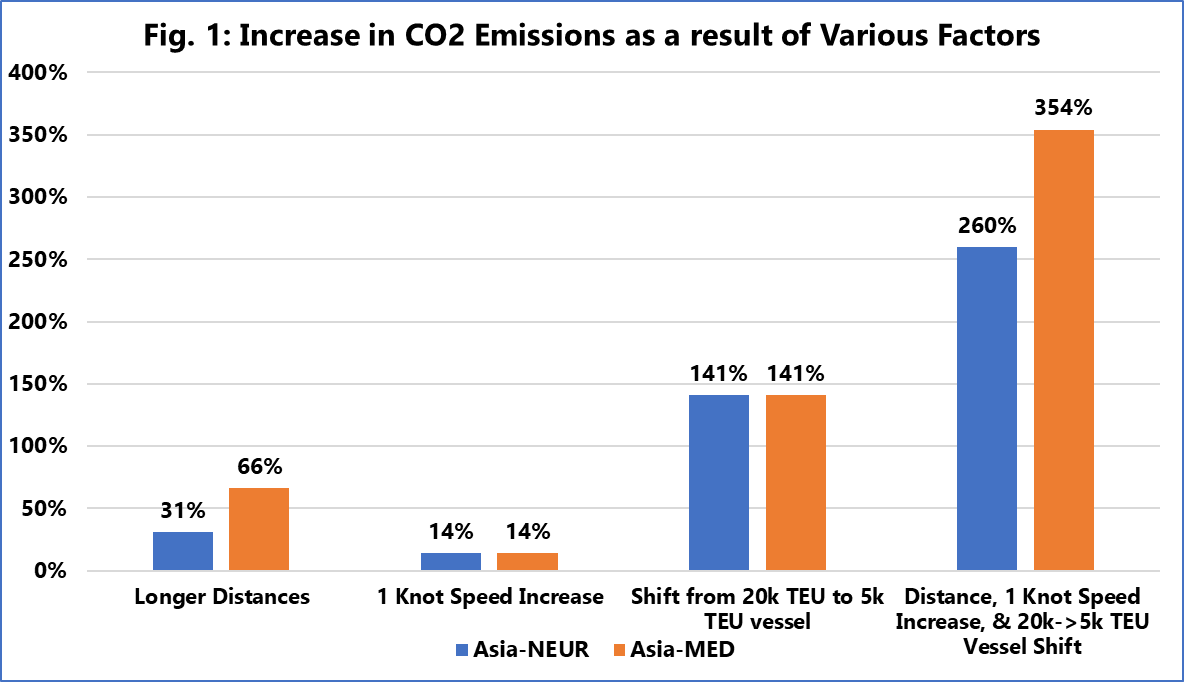

As delays extend, shipping liners may opt to re-route vessels via the Cape of Good Hope, increasing transit times by a third but avoiding the uncertainty of how long the problem will take to resolve and for backlogs to pass through the canal.

As the Suez Canal Authority works to free the canal, traffic is building up, and missing inputs will disrupt supply chains.

But delays measured in days are normal in container shipping (depending on the route), and in the current context of much more acute capacity pressures at some ports, this setback on its own will not do much to trade volumes or cause much further harm to supply chains.

The ongoing effects of shipping liners’ route choices, including container shortages and limits on port handling speeds, are likely to be more visible in production and trade data in the months ahead.

Image credit: Shutterstock

Source: Joanna Konings, ING

Follow on Twitter:

[tfws username=”joannaing2″ height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]