As China grapples with the zero COVID policy and resulting lockdowns, the demand for containers declines amidst the busiest peak season shipping. The interesting trend from the month of August has been the 36% increase in the average container prices and 21% increase in the one-way leasing rates for the container in the Southeast Asian Countries.

This trend of rising container prices and leasing rates validates the strategy of ‘China Plus One’ by companies as the demand for containers rises in Vietnam, Malaysia, Singapore among other South-Asian countries.

From July to August, for 20DCs in China, the average prices fell by 10% from $2106 to $1890 on the Container xChange platform. And for 40 HCs, from July to August, the prices fell about 11% from $3800 to $3384. Furthermore, the average leasing rates for containers (all types, all conditions) from China to rest of the world fell from $1454 in July to $1080 in August. These market trends strongly indicates that demand from the US and Europe has softened.

Southeast Asian ports witness a 36% rise in average trading prices; signs of diversification of supply chains

Container xChange platform shows that the average trading prices for ports in Southeast Asia saw a 36% rise in from $2300 in July to $3133 in August.

Further the stretch from Southeast Asia to the US, the average leasing rates for cargo- worthy containers rose from $607 in July to $738 in August. According to China’s recent official customs data, exports from the country has seen a soft rise of only 7.1% below than customs expectations of a 13% rise.

For 20DCs, the average trading prices in the South-east Asian region rose from $1951 in July to $2056 in August.

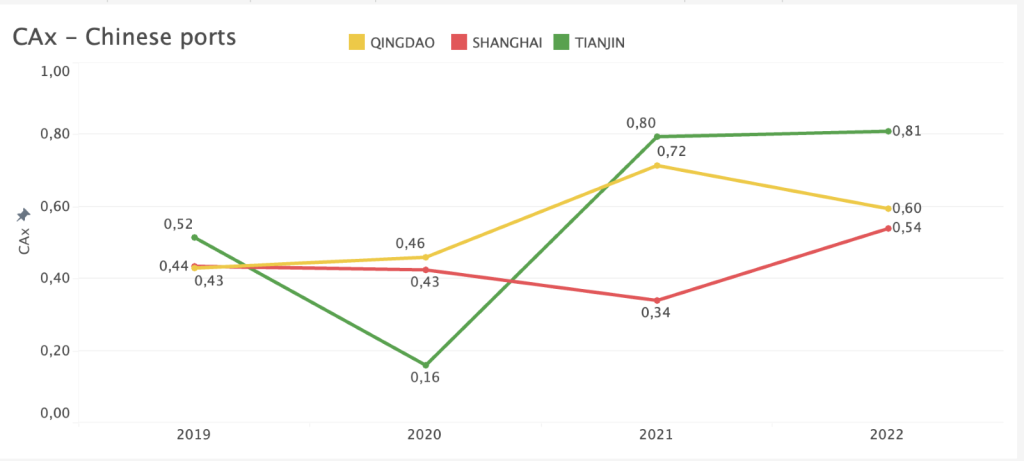

Shanghai maintained a CAx score of above 0.58. In week 35, major ports in China such as Qingdao and Tianjin scored high on the container availability index (CAx). Qingdao had scores of above 0.8 while Tianjin maintained numbers above 0.7. These high scores indicate less demand for export containers than full imports at these ports and decreased container rental fees, and this trend is predicted to continue.

Whereas, in pre-covid times in 2019 week 35, Shanghai had a CAx score of 0.44, Qingdao was at 0.44, and Tianjin was at 0.52 indicating more containers left these ports than the ones entered.

To put things to perspective, with consumption patterns altering, amidst tighter financial conditions caused by high inflation, the foreign demand for Chinese goods has started to see a dent.

Further, according to recent media reports, the manufacturing and production have taken a hit in China which has led to the global supply chain resorting to alternative South-east Asian countries like Singapore, Malaysia, Vietnam among others.

Global traders and manufactures find South-east Asia an attractive alternative for China plus one strategy

Commenting on the recent global trading routes diverting to alternative South-East Asian countries, Christian Roeloffs, co-founder and CEO, Container xChange, said, “The growth of containerised trade in South-east Asia indicates a favourable trade environment for shippers and exporters in the region.

For global container shipping companies that are looking to diversify their cargo trade lanes from linear to more distributed (diversified) routes, countries like Malaysia, Vietnam, and Singapore are emerging as strong contenders, more so for a China plus one strategy in the long term”.

“The industry is witnessing perils of reliance on linear supply chains over the past two years. The growing possibilities of adding more South-east Asia countries to the emerging trading routes will reduce the dependence of containerized trade on only one or two countries, therefore minimizing the impact on global supply chains”, he added.

Source: Container xChange