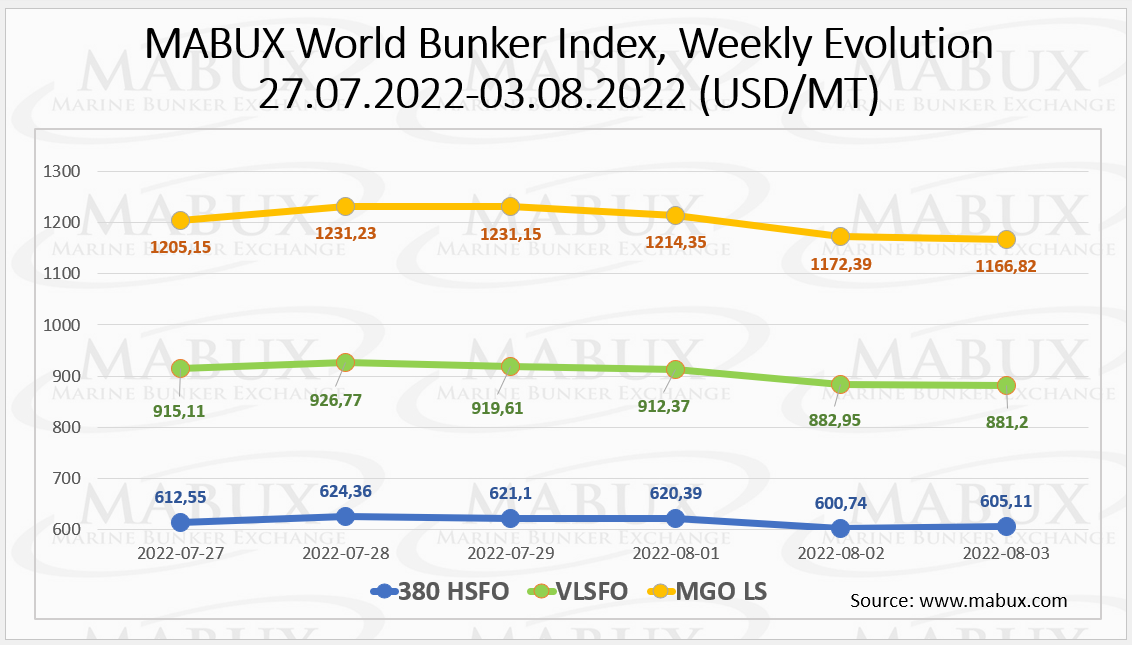

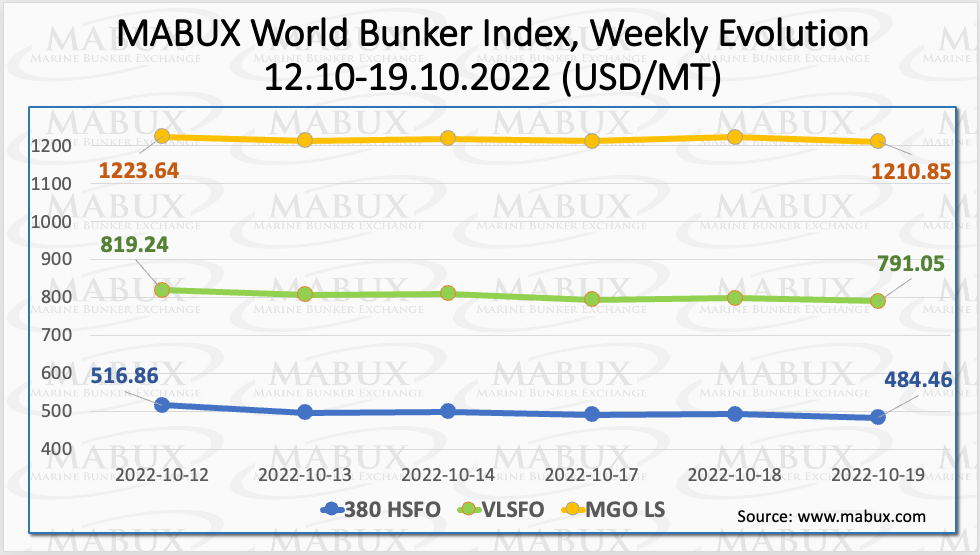

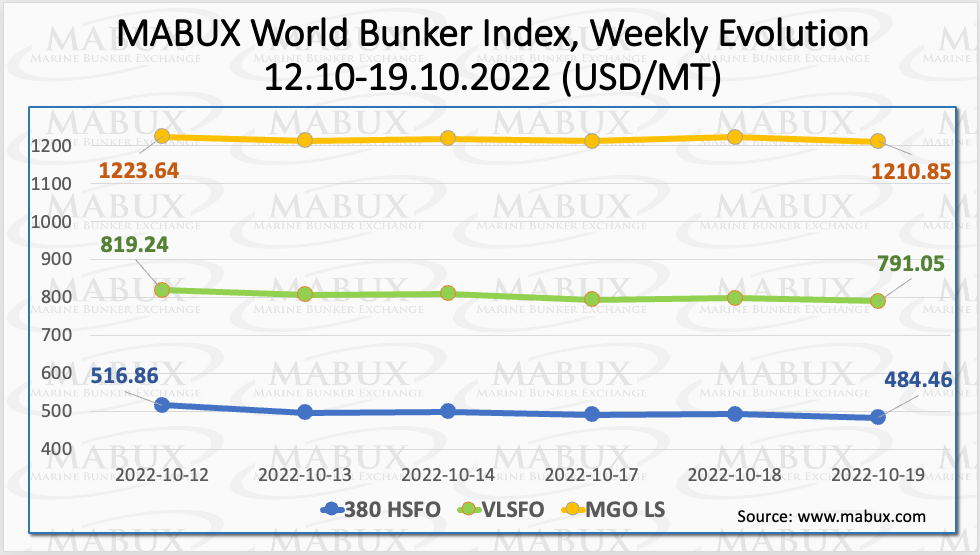

Over the Week 42, MABUX global bunker indices turned into a downward trend again. The 380 HSFO index fell by 32.40 USD: from 516.86 USD/MT last week to 484.46 USD/MT. The VLSFO index, in turn, decreased by 28.19 USD: from 819.24 USD/MT to 791.05 USD/MT. The MGO index lost 12.79 USD (from 1223.64 USD/MT to 1210.85 USD/MT), dropping back to the 1200 USD mark.

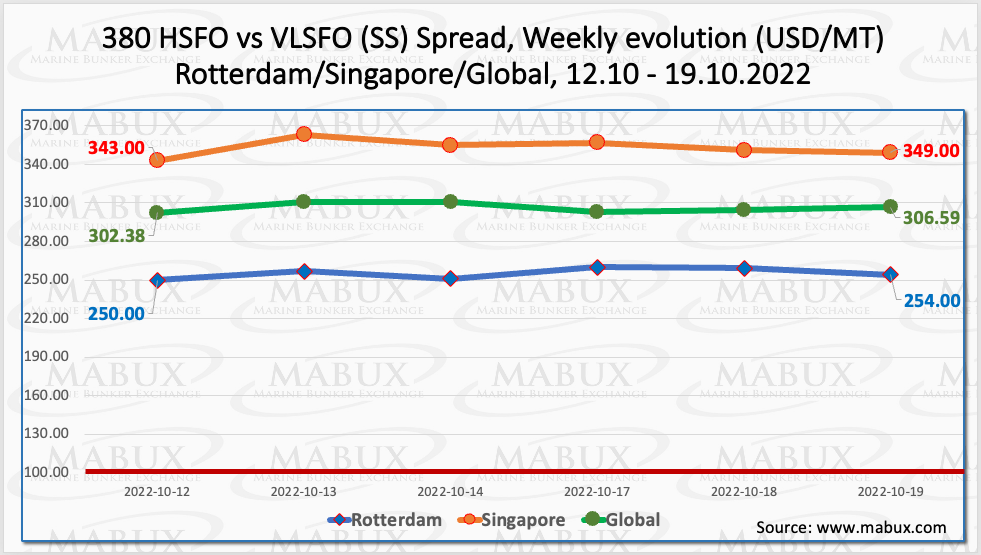

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – continued its upward movement over the Week 42 – plus $ 14.06 ($ 306.37 vs. $ 292.31 last week), breaking the mark of 300 USD. In Rotterdam, the average SS Spread rose to $255.17 from $228.67 (up $26.50 from last week). In Singapore, the average weekly price difference of 380 HSFO/VLSFO was also growing: plus $16.17 ($353.00 vs. $336.83 last week). The growth of SS Spread indicates that the volatility of the global bunker market remains at a high level. More information is available in the Price Differences section of mabux.com.

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – continued its upward movement over the Week 42 – plus $ 14.06 ($ 306.37 vs. $ 292.31 last week), breaking the mark of 300 USD. In Rotterdam, the average SS Spread rose to $255.17 from $228.67 (up $26.50 from last week). In Singapore, the average weekly price difference of 380 HSFO/VLSFO was also growing: plus $16.17 ($353.00 vs. $336.83 last week). The growth of SS Spread indicates that the volatility of the global bunker market remains at a high level. More information is available in the Price Differences section of mabux.com.

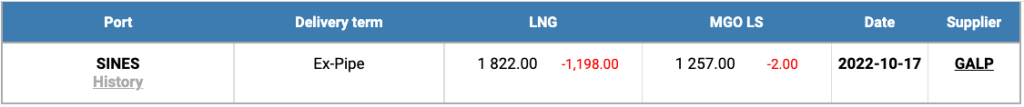

Gas prices in Europe have dropped from record highs and hit on Oct.17 the lowest level in three months as the European Commission continues to work on measures to limit price spikes in derivatives trading. The price of LNG as bunker fuel at the port of Sines (Portugal) dropped sharply by 1198 USD/MT to 1822 USD/MT on October 17 (versus 3020 USD/MT a week earlier). Thus, LNG prices approached the levels of traditional bunker fuel: the price of MGO LS in the port of Sines was quoted at 1257 USD/MT on October 17.

Gas prices in Europe have dropped from record highs and hit on Oct.17 the lowest level in three months as the European Commission continues to work on measures to limit price spikes in derivatives trading. The price of LNG as bunker fuel at the port of Sines (Portugal) dropped sharply by 1198 USD/MT to 1822 USD/MT on October 17 (versus 3020 USD/MT a week earlier). Thus, LNG prices approached the levels of traditional bunker fuel: the price of MGO LS in the port of Sines was quoted at 1257 USD/MT on October 17.

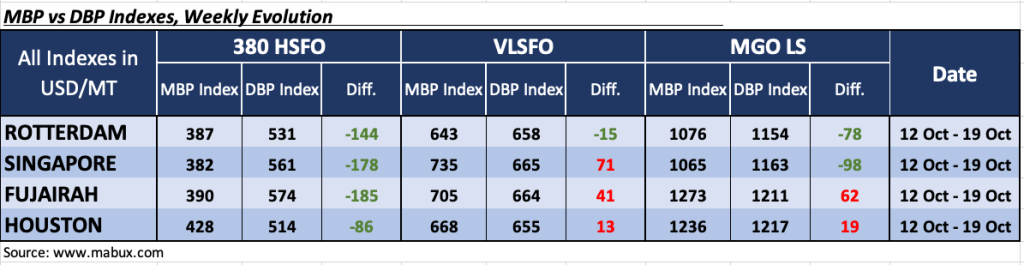

Over the Week 42, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed a noticable underestimation of 380 HSFO fuel in all four selected ports. Underprice premium continued to rise in all ports except Houston, and amounted to: Rotterdam – minus $144, Singapore – minus $178, Fujairah – minus $185 and Houston – minus $86.

Over the Week 42, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed a noticable underestimation of 380 HSFO fuel in all four selected ports. Underprice premium continued to rise in all ports except Houston, and amounted to: Rotterdam – minus $144, Singapore – minus $178, Fujairah – minus $185 and Houston – minus $86.

VLSFO fuel grade, according to MDI, was overvalued in three out of four ports selected: Singapore – plus $ 71, Fujairah – plus $ 41 and Houston – plus $ 13, with Houston moving again into the overpricing zone. The only undervalued port in the VLSFO segment was Rotterdam – minus $15.

In the MGO LS segment, MDI registered an underestimation in two of the four selected ports: Rotterdam – minus $ 78, Singapore – minus $ 98. Houston moved into the fuel overprice zone and joined Fujairah – plus $ 62 and plus $ 19 respectively. The underestimation premium decreased moderately, while overestimation rose.

At the Port of Singapore September sales on a month-on-month and year-on-year basis were relatively flat. Bunker sales for September 2022 were 3,967,600 mt, a 3.61% fall from August’s total and a 0.8% increase from September 2021. After a slight rally in July and August, marine gasoil sales continued the overall 2022 downwards trend in September, totalling 6,300 mt. This figure compares to 26,800 mt sold in September last year. The global bunker market is still in a state of high volatility with no sustainable trend, which entails irregular fluctuations of bunker indices about the present levels. September demand for LS 380 cSt dipped 5.6% on a month-on-month basis, totalling 1,944,400 mt. The monthly volume for this fuel was also down by 2.1% year-on-year. September sales for LS MGO were very much in line with August volumes – 329,400 mt versus 330,400 mt. There was a notable month-on-month rise in the sale of ‘other’ (non-specified) fuels last month. These fuels include LNG and biofuel and volumes in September reached 42,800 mt, compared to 32,600 mt in August this year.

At the Port of Singapore September sales on a month-on-month and year-on-year basis were relatively flat. Bunker sales for September 2022 were 3,967,600 mt, a 3.61% fall from August’s total and a 0.8% increase from September 2021. After a slight rally in July and August, marine gasoil sales continued the overall 2022 downwards trend in September, totalling 6,300 mt. This figure compares to 26,800 mt sold in September last year. The global bunker market is still in a state of high volatility with no sustainable trend, which entails irregular fluctuations of bunker indices about the present levels. September demand for LS 380 cSt dipped 5.6% on a month-on-month basis, totalling 1,944,400 mt. The monthly volume for this fuel was also down by 2.1% year-on-year. September sales for LS MGO were very much in line with August volumes – 329,400 mt versus 330,400 mt. There was a notable month-on-month rise in the sale of ‘other’ (non-specified) fuels last month. These fuels include LNG and biofuel and volumes in September reached 42,800 mt, compared to 32,600 mt in August this year.

The Port of Rotterdam has signed a Memorandum of Understanding (MoU) with the Port of Gothenburg to establish a ‘green corridor’ that will support sustainable shipping between the two maritime hubs. As part of the Green Corridor MoU the ports will establish a common framework for cooperation to stimulate the use of alternative fuels to support maritime decarbonisation. Both Rotterdam and Gothenburg are already actively involved in the development of more sustainable fuels for shipping. The Port of Gothenburg has supported methanol bunkering for RoPax ferries since 2015 and the Port of Rotterdam launched the world’s first barge-to-ship methanol bunkering operation in May 2021.

We expect global fuel indices to show moderate growth next week. Meantime, irregular fluctuations in Global bunker market will continue.

Source: www.mabux.com