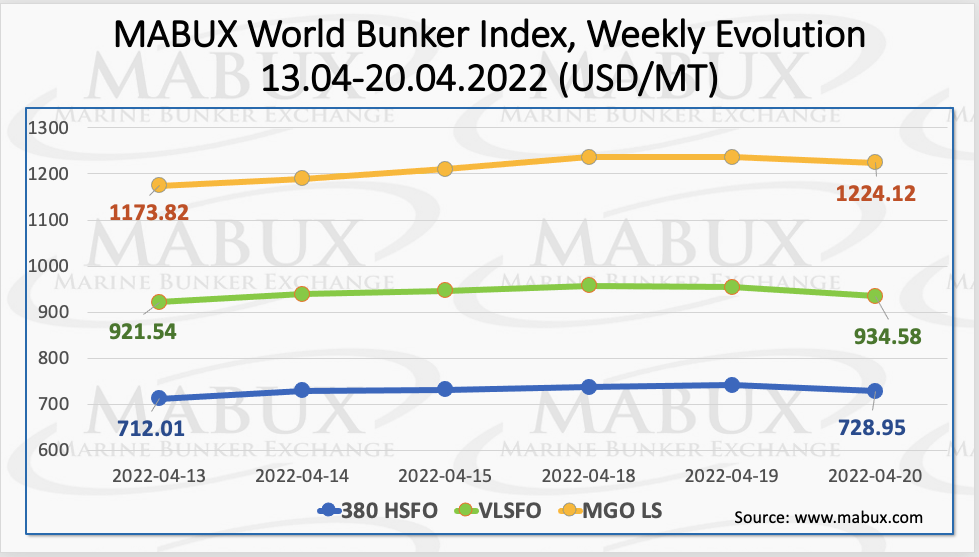

High volatility remains in the global bunker market, accompanied by sharp irregular changes of bunker indices. Over the Week 16, MABUX Bunker Index switched again to firm upward evolution. The 380 HSFO Index rose by 16.94 USD: from 712.01 USD/MT to 728.95 USD/MT. The VLSFO Index went up by 13.04 USD: from 921.54 USD/MT to 934.58 USD/MT. The MGO Index showed the most significant growth – by 50.30 USD (from 1173.82 USD/MT to 1224.12 USD/MT), due to a sharp decline in Russian oil products’ supplies in the global bunker market.

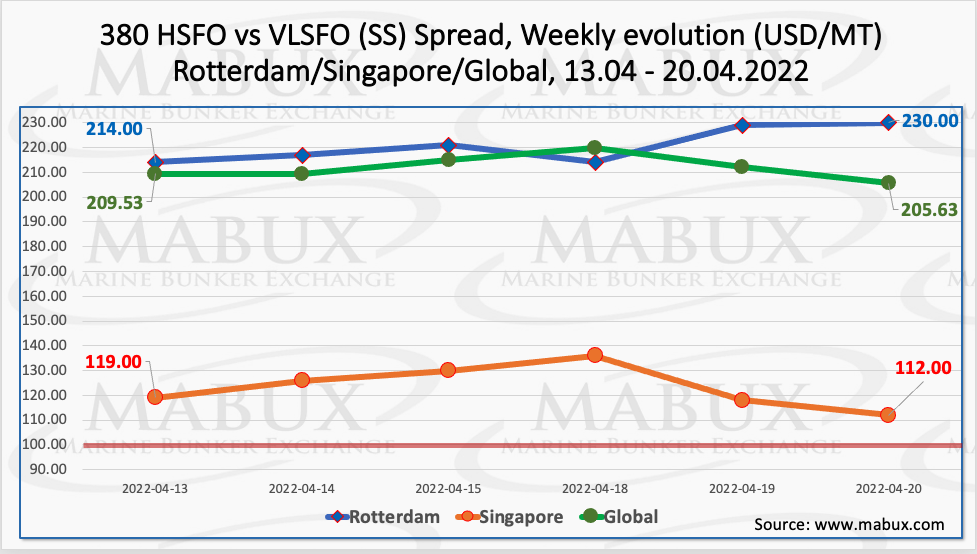

The Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its moderate decline in a week – minus $3.41 ($211.91 versus $215.32 last week). In Rotterdam, the average value of SS Spread, on the contrary, rose slightly from $208.83 to $220.83 (plus $12.00 compared to last week). Meantime, the 380 HSFO/VLSFO price difference at the Port of Singapore continues to shrink sharply, with the average down another $23.83 (from $147.33 to $123.50) and in absolute value the SS Spread has dropped to $112.00 as of April 20. Thus, SS Spread in Singapore came close to the $100 mark. More information is available in the Price Differences section of mabux.com.

The Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its moderate decline in a week – minus $3.41 ($211.91 versus $215.32 last week). In Rotterdam, the average value of SS Spread, on the contrary, rose slightly from $208.83 to $220.83 (plus $12.00 compared to last week). Meantime, the 380 HSFO/VLSFO price difference at the Port of Singapore continues to shrink sharply, with the average down another $23.83 (from $147.33 to $123.50) and in absolute value the SS Spread has dropped to $112.00 as of April 20. Thus, SS Spread in Singapore came close to the $100 mark. More information is available in the Price Differences section of mabux.com.

As per the International Energy Agency’s (IEA) estimation, the global demand for natural gas is set to ‘decline slightly’ this year as a result of higher prices and market disruptions caused by Russia’s invasion of Ukraine. The IEA had previously forecast a 1% growth in its quarterly update published in January. The new downward revision to the forecast amounts to 50 billion cubic metres (cbm), the equivalent of about half of last year’s US LNG exports. The IEA noted that average spot LNG prices in Asia during the 2021-22 heating season were more than four times their five-year average. In Europe, spot LNG prices were five times their five-year average, in spite of a mild winter. The IEA also noted that Russia has been Europe’s largest natural gas supplier, meeting 33% of the region’s demand in 2021, up from 25% in 2009. The IEA forecast that natural gas consumption in Europe will fall by close to 6%. In Asia, however, natural gas consumption is expected to grow by 3% in 2022, and the Americas, Africa and the Middle East are expected to be affected less directly by gas market volatility, as they principally rely on domestic gas production.

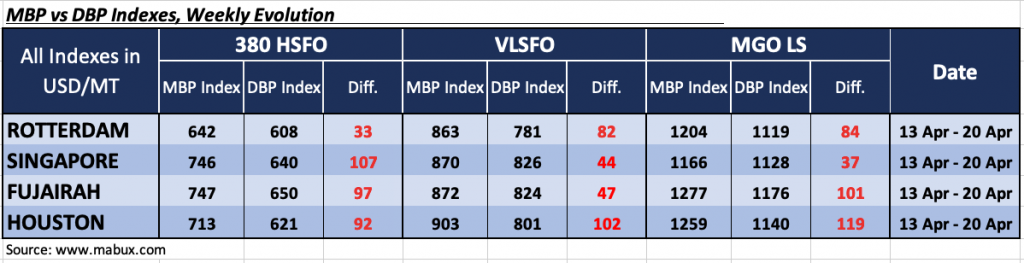

Over the Week 16, the average correlation of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) did not change significantly: all major bunker fuels are in the zone of significant overpricing in all selected ports. Thus, 380 HSFO fuel’s overcharge margins at the end of the week were registered as: in Rotterdam – plus $ 33 (plus $ 69 last week), in Singapore – plus $ 107 (plus $ 98), in Fujairah – plus $ 97 (plus $ 91) and in Houston – plus $92 (plus $89). In the 380 HSFO segment, MABUX MBP/DBP Index did not have any firm trend and changed irregular.

VLSFO fuel grade, according to MABUX MBP/DBP Index, was also overpriced in all selected ports: plus $82 (plus $119) in Rotterdam, plus $44 (plus $71) in Singapore, plus $47 (plus $86) in Fujairah and plus $102 (plus $127) in Houston. Overcharge ratio in the VLSFO segment declined slightly.

As for MGO LS, the MABUX MBP/DBP Index also registered an overpricing of this type of fuel over the week in all four selected ports: Rotterdam – plus $84 (plus $80 a week earlier), Singapore – plus $37 (minus $30), Fujairah – plus $101 (plus $112) and Houston – plus $119 (plus $146). Here, MABUX MBP/DBP Index also did not have a firm dynamics and changed irregular.

We do not expect any drastic changes in the global bunker market’s trends until the conflict in Ukraine is resolved. Sharp multidirectional changes in bunker prices will continue.

We do not expect any drastic changes in the global bunker market’s trends until the conflict in Ukraine is resolved. Sharp multidirectional changes in bunker prices will continue.

Source: www.mabux.com