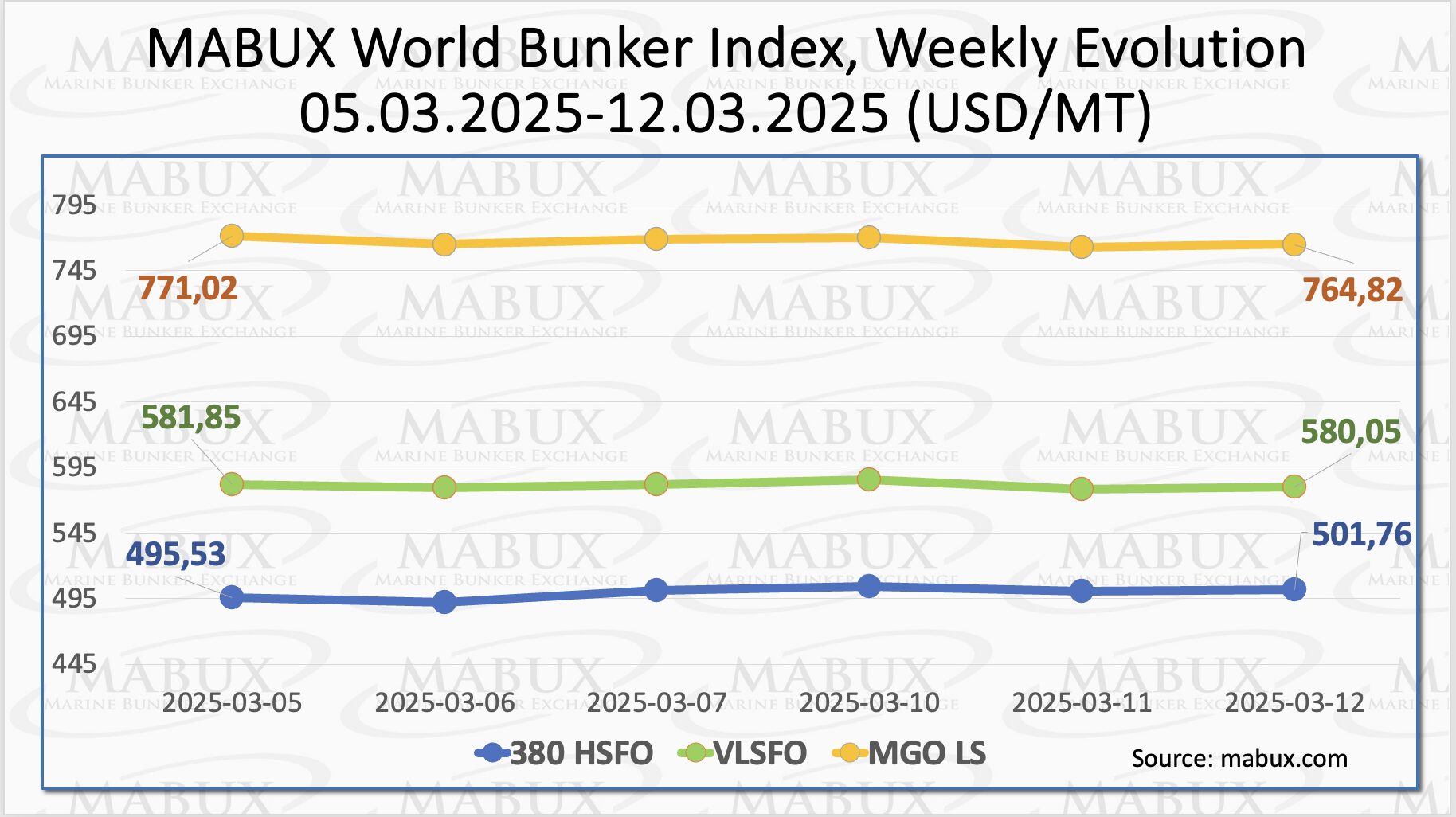

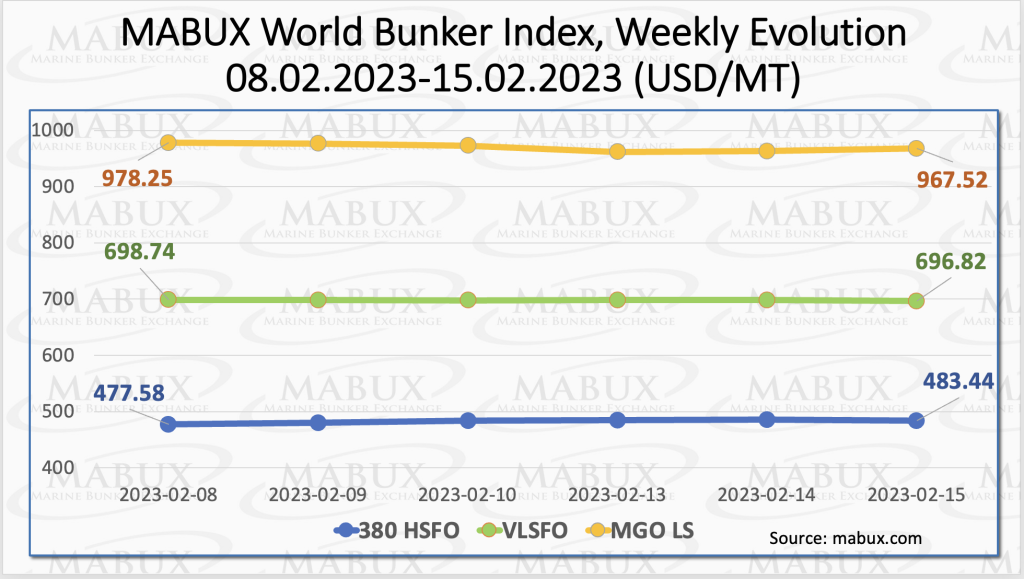

Over the Week 07, MABUX global bunker indices did not have a sustainable trend and changed sideways. The 380 HSFO index rose by 5.86 USD: from 477.58 USD/MT last week to 483.44 USD/MT. The VLSFO index, in turn, fell by a symbolic 1.92 USD (696.82 USD/MT versus 698.74 USD/MT last week), still being below 700 USD mark. The MGO index also showed a decrease: minus 10.73 USD (from 978.25 USD/MT last week to 967.52 USD/MT). At the time of writing, indices continued changing irregular in Global bunker market.

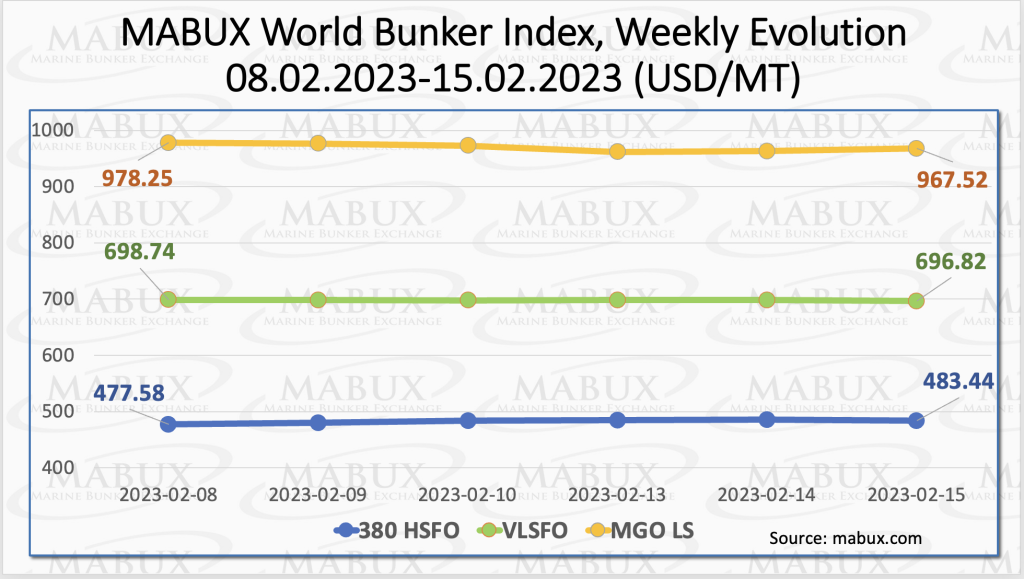

The Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – continued to decline for Week 07 – minus $7.78 ($213.38 vs. $221.16 last week), while the average also decreased by $13.47. In Rotterdam, SS Spread fell by $8.00 to $187.00 (vs. $195.00 the week before), remaining below the $200 mark. In Singapore, the 380 HSFO/VLSFO price difference declined the most: minus $15 to $240. The SS Spread weekly averages in Rotterdam and Singapore also fell by $7.00 and $22.50 respectively. Next week, we expect the SS Spread to continue downward trend. More information is available in the “Differentials” section at mabux.com.

The Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – continued to decline for Week 07 – minus $7.78 ($213.38 vs. $221.16 last week), while the average also decreased by $13.47. In Rotterdam, SS Spread fell by $8.00 to $187.00 (vs. $195.00 the week before), remaining below the $200 mark. In Singapore, the 380 HSFO/VLSFO price difference declined the most: minus $15 to $240. The SS Spread weekly averages in Rotterdam and Singapore also fell by $7.00 and $22.50 respectively. Next week, we expect the SS Spread to continue downward trend. More information is available in the “Differentials” section at mabux.com.

Milder weather, the end of a supply outage in Norway, and expectations of stronger winds in northwest Europe sent in the beginning of the week European benchmark natural gas prices down by 4% to the lowest level since September 2021. Recent data shows that across the EU, gas storage sites were 66.48% full as of February 11, well above the five-year average for this time of the year.

Milder weather, the end of a supply outage in Norway, and expectations of stronger winds in northwest Europe sent in the beginning of the week European benchmark natural gas prices down by 4% to the lowest level since September 2021. Recent data shows that across the EU, gas storage sites were 66.48% full as of February 11, well above the five-year average for this time of the year.

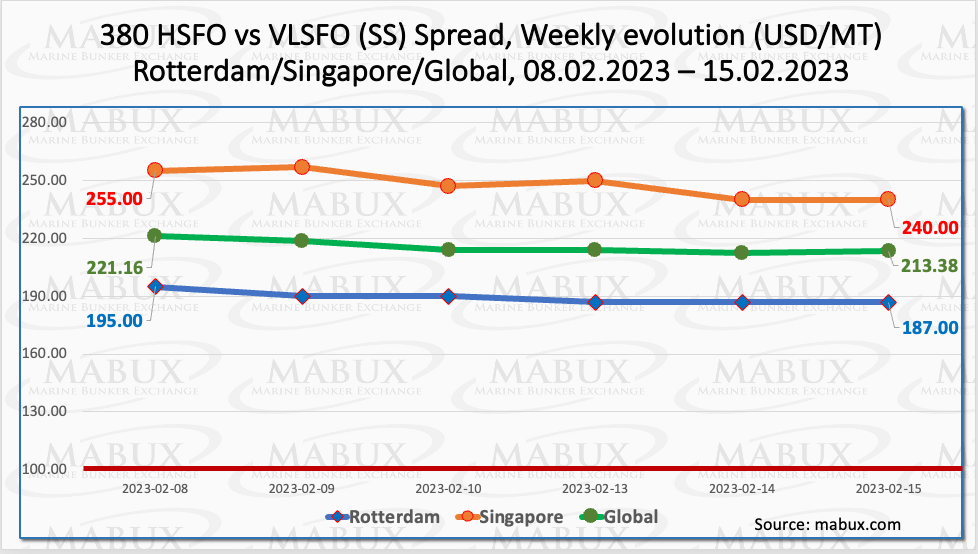

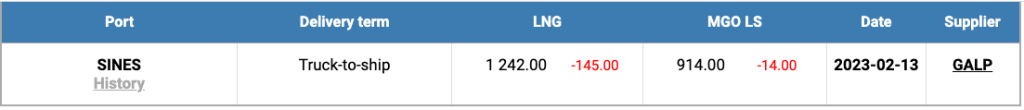

The price of LNG as bunker fuel at the port of Sines (Portugal) decreased marginally again and reached 1242 USD/MT on February 13 (minus 145 USD compared to the previous week). The price difference between LNG and conventional fuel on February 13 was 328 USD: MGO LS at the port of Sines was quoted at 914 USD/MT that day. The price difference is gradually decreasing. We expect this trend to continue next week.

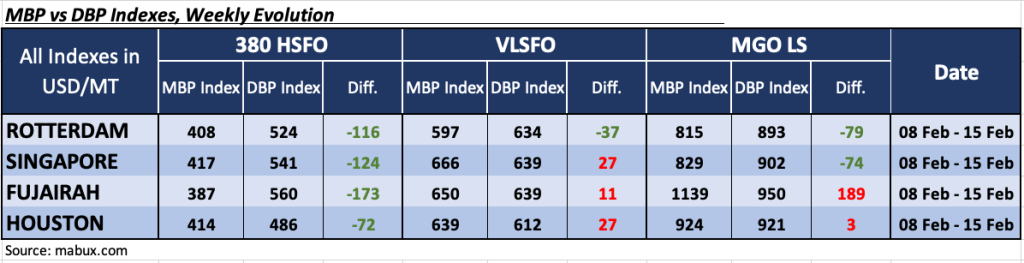

Over the Week 07, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered underestimation of fuel 380 HSFO at all four selected ports. The underestimation average did not change significantly and amounted to: in Rotterdam – minus $ 116, in Singapore – minus $ 124, Fujairah – minus $ 173 and in Houston – minus $ 72.

Over the Week 07, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered underestimation of fuel 380 HSFO at all four selected ports. The underestimation average did not change significantly and amounted to: in Rotterdam – minus $ 116, in Singapore – minus $ 124, Fujairah – minus $ 173 and in Houston – minus $ 72.

In the VLSFO segment, according to MDI, three selected ports: Singapore, Fujairah and Houston, were still in the overprice zone: plus $27, plus $11 and plus $27, respectively. Rotterdam remained the only port underpriced port: minus $37. Overprice premium has been declining, while underprice has grown marginally.

In the MGO LS segment, there are two ports in the overcharge zone: Fujairah and Houston, plus $189 and plus $3, respectively. In the other two ports, the MDI registered MGO LS underpricing: Rotterdam – minus $ 79, Singapore – minus $ 74. The most significant change in this bunker fuel segment was a decrease of overcharge average in Houston by 36 points.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

It was a solid start to the year for bunker sales at the world’s largest marine fuel hub with Singapore posting an 8.6% year-on-year (y-o-y) increase in volumes. Some 4,376,900 metric tonnes (mt) of marine fuel were sold last month compared to 4,029,000 mt in January 2022. Last month’s total was also 3.8% up on the 4,214,900 mt registered in December. Several sources highlighted an increase in cheaper Russian fuel oil entering the Singapore market. The Price Cap Coalition (G7, EU, Australia) ban on Russian crude oil took effect in December and a ban on Russian petroleum came into force earlier this month. The 2,298,300 mt of low sulphur fuel oil (LSFO) 380 cSt was more than any month during 2022, although marine fuel oil 380 cSt fell marginally on the month, from 1,265,800 mt in December, to 1,221,100 mt in January. Elsewhere, the 313,700 mt of low sulphur marine gasoil sales represented the highest monthly total for that particular grade since the 329,400 mt recorded in September. The rise in bunker sales was also reflected by an increase in calls for marine fuel. Last month saw 3,447 vessels call the Port of Singapore for bunkers – 4.1% up on December.

The global bunker market awaits the formation of a sustainable trend. We expect irregular fluctuations to prevail in the market next week.

Source: www.mabux.com