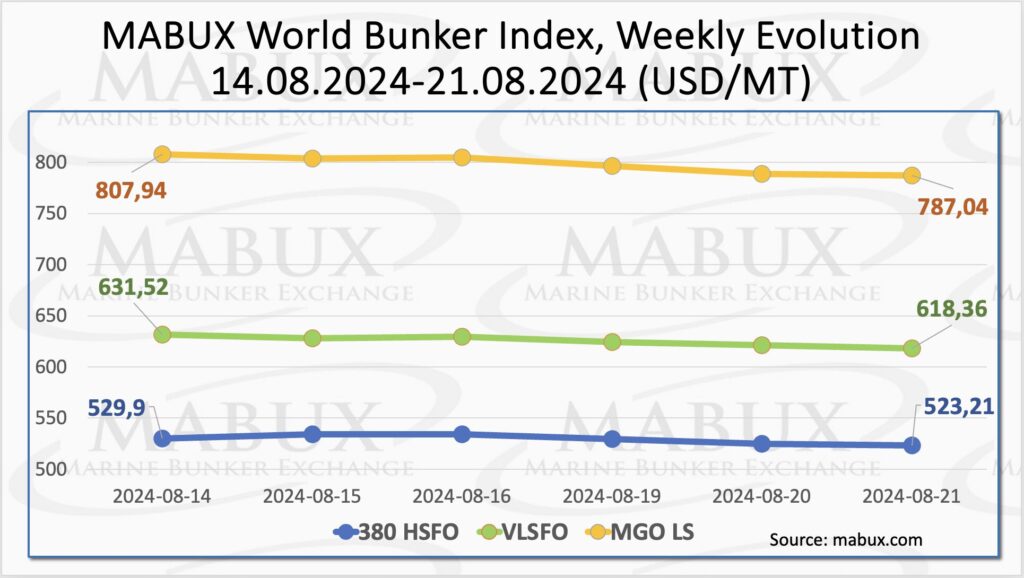

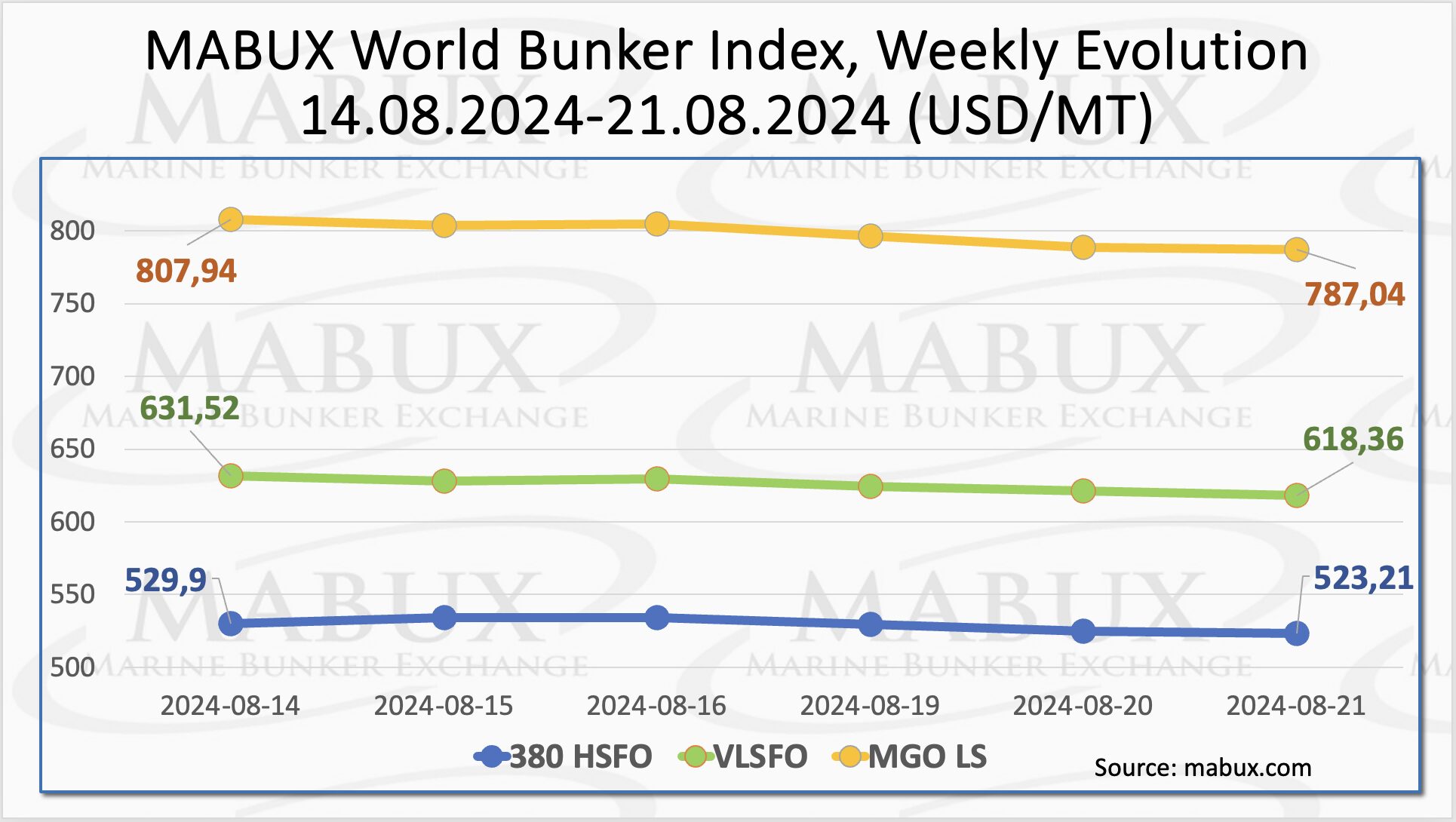

Over the Week 34, the MABUX global bunker indices resumed a moderate downward trend. The 380 HSFO index fell by 6.69 USD: from 529.90 USD/MT last week to 523.21 USD/MT. The VLSFO index decreased by 13.16 USD (618.36 USD/MT versus 631.52 USD/MT last week). The MGO index declined by 20.90 USD (from 807.94 USD/MT last week to 787.04 USD/MT), falling below the $800 mark once again. At the time of writing, there was no sustainable dynamics in bunker indices movements in the global bunker market.

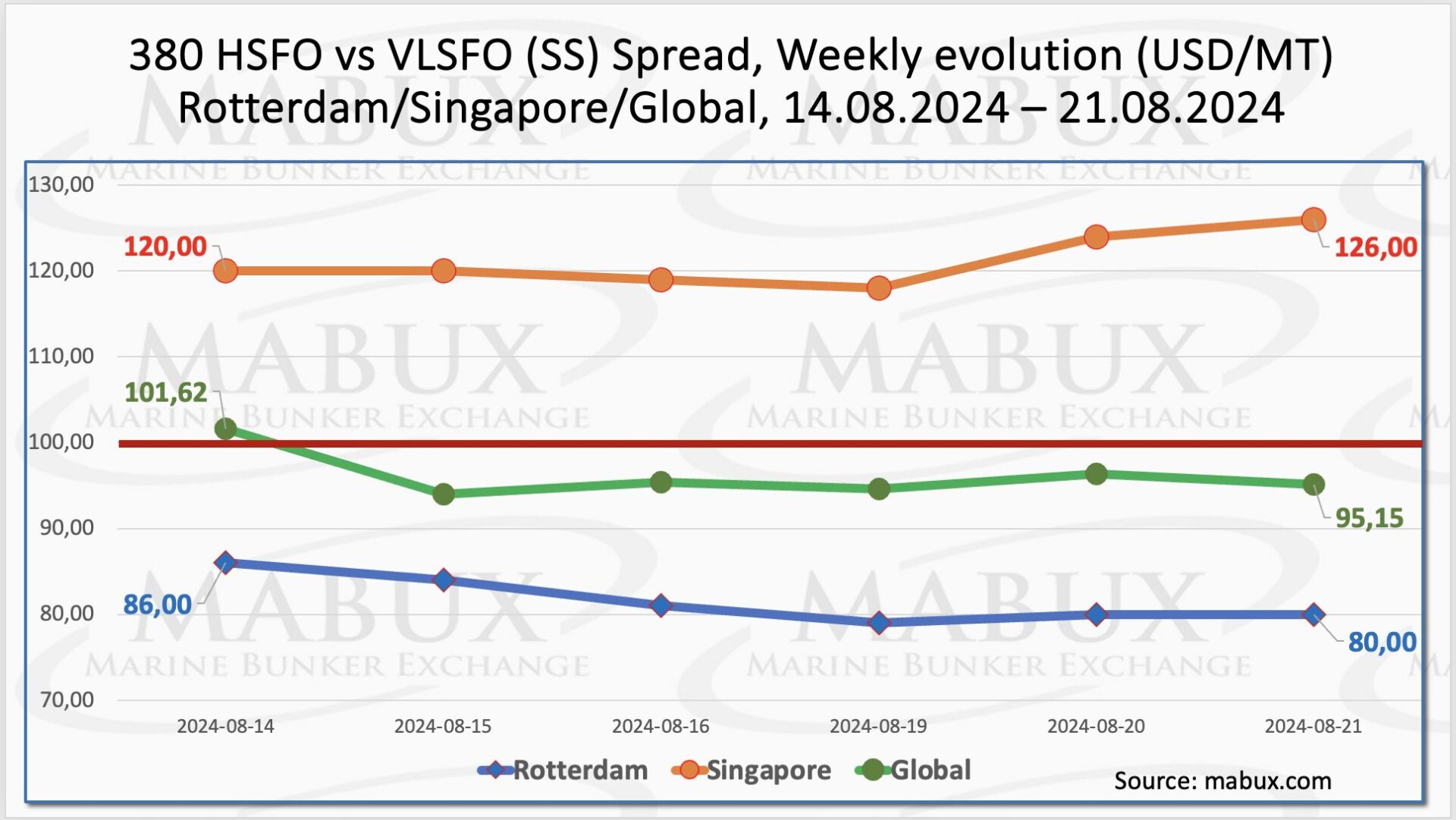

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – showed a moderate decrease over the week: minus $6.47 (95.15 versus $101.62 last week), dropping below $100.00 SS Breakeven point. The weekly average also decreased by $2.90. In Rotterdam, the SS Spread narrowed by $6.00 to $80.00 v.s. $86.00 last week and remained steadily below $100.00 threshold.

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – showed a moderate decrease over the week: minus $6.47 (95.15 versus $101.62 last week), dropping below $100.00 SS Breakeven point. The weekly average also decreased by $2.90. In Rotterdam, the SS Spread narrowed by $6.00 to $80.00 v.s. $86.00 last week and remained steadily below $100.00 threshold.

The weekly average in the port also declined by $9.16. Conversely, in Singapore, the 380 HSFO/VLSFO spread widened by $6.00: from $120.00 last week to $126.00, with the weekly average in the port rising by $7.34. Currently, there is no clear trend in the Global SS Spread and SS indices at the ports. The indexes may continue to fluctuate irregularly next week. More detailed information is available in the “Differentials” section of mabux.com.

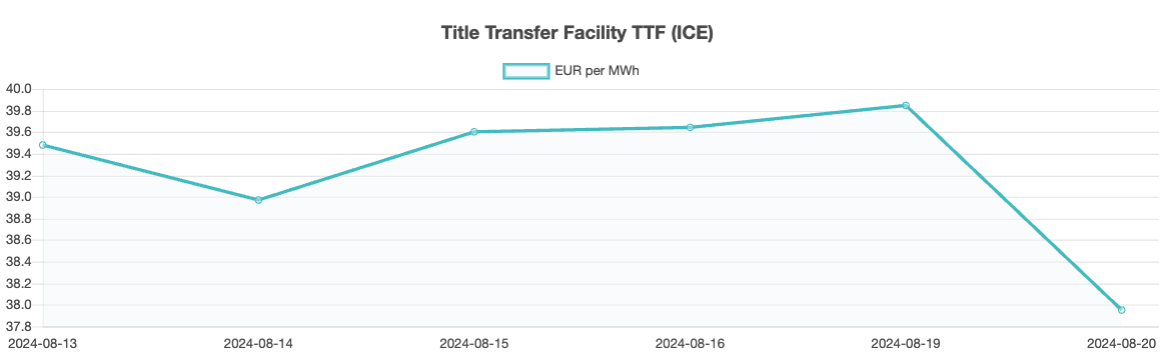

According to RBC Capital Markets, planned closures of Norwegian LNG terminals for scheduled maintenance, coupled with supply concerns stemming from conflicts in the Middle East and Ukraine, are expected to support natural gas and LNG prices in the short term. However, in the medium to long term, gas prices may stabilize as new LNG terminals come online, adding additional volumes to the market.

According to RBC Capital Markets, planned closures of Norwegian LNG terminals for scheduled maintenance, coupled with supply concerns stemming from conflicts in the Middle East and Ukraine, are expected to support natural gas and LNG prices in the short term. However, in the medium to long term, gas prices may stabilize as new LNG terminals come online, adding additional volumes to the market.

Meantime, as of August 21, the filling rate in European gas storage facilities continued to grow, reaching 90.02%. By the end of Week 34, the European gas benchmark TTF shifted to a moderate decline: minus 1.523 EUR/MWh (37.957 EUR/MWh versus 39.480 EUR/MWh last week).

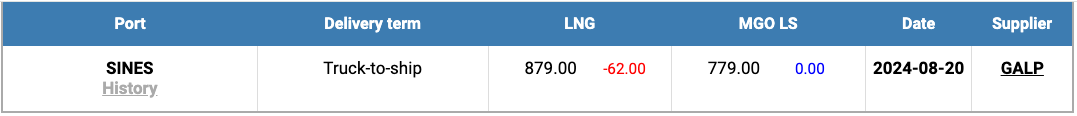

The price of LNG as bunker fuel in the port of Sines (Portugal) fell by $62 by the end of the week compared to the previous week, reaching $879 per metric ton (MT) on August 20.

The price of LNG as bunker fuel in the port of Sines (Portugal) fell by $62 by the end of the week compared to the previous week, reaching $879 per metric ton (MT) on August 20.

Meanwhile, the price difference between LNG and conventional fuel decreased to $100 in favor of MGO LS, down from $166 the previous week. On this day, MGO LS was quoted at $779 per MT in the port of Sines. More detailed information is available in the LNG Bunkering section on mabux.com.

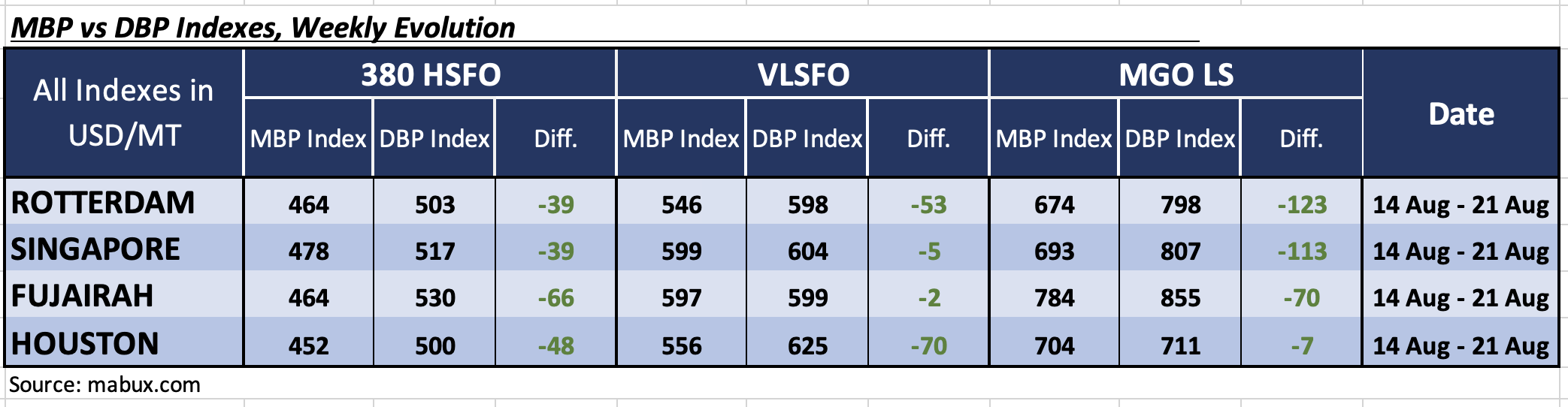

In Week 34, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) continued to register underpricing of all types of bunker fuel across the world’s four largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

In Week 34, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) continued to register underpricing of all types of bunker fuel across the world’s four largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

Throughout the week, the balance of overvalued/undervalued ports did not change significantly, remaining in the undercharge zone. We expect this dynamic to persist into next week.

Throughout the week, the balance of overvalued/undervalued ports did not change significantly, remaining in the undercharge zone. We expect this dynamic to persist into next week.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on mabux.com.

According to Bureau Veritas, statistics for the second quarter of 2024 indicate a continued increase in the average global viscosity of high sulphur fuel oil (HSFO), along with a rise in sulphur content for this grade, reaching its highest level since April 2023. In Q2 2024, only 1.7% of HSFO samples were off-spec globally, the lowest level since Q2 2022.

On a port-by-port basis, Algeciras and ARA both recorded sulphur content exceeding 3% in Q2, at 3.01% and 3.06%, respectively. Notable quarter-on-quarter increases in viscosity were observed at Gibraltar (rising from 304 to 337) and Hong Kong (from 314 to 351). For off-spec HSFO as per ISO 8217, Fujairah reported 7.7% in Q2, up from 5.3% in Q1, while Malta registered 12.5%, compared to 11.1% in Q1.

The viscosity of very low sulphur fuel oil (VLSFO) also continues to rise, with the global quarterly average reaching 166 in Q2, up from 115 in Q1. By June, viscosity had increased to 170, compared to 163 in April and 166 in May. In Q2, there were no significant changes in the quality of DMA 0.10%.

However, appearance (non-clear and bright) and water content were the leading causes of off-spec samples during the quarter. The pour point (≥ 0) saw a quarter-on-quarter increase in the ARA region (from 1.2% to 7.3%) and rose from 0% in Q1 in Hong Kong to 4.2%.

We expect that next week the global bunker market to continue experiencing irregular fluctuations in indices without a steady trend.

Source: MABUX