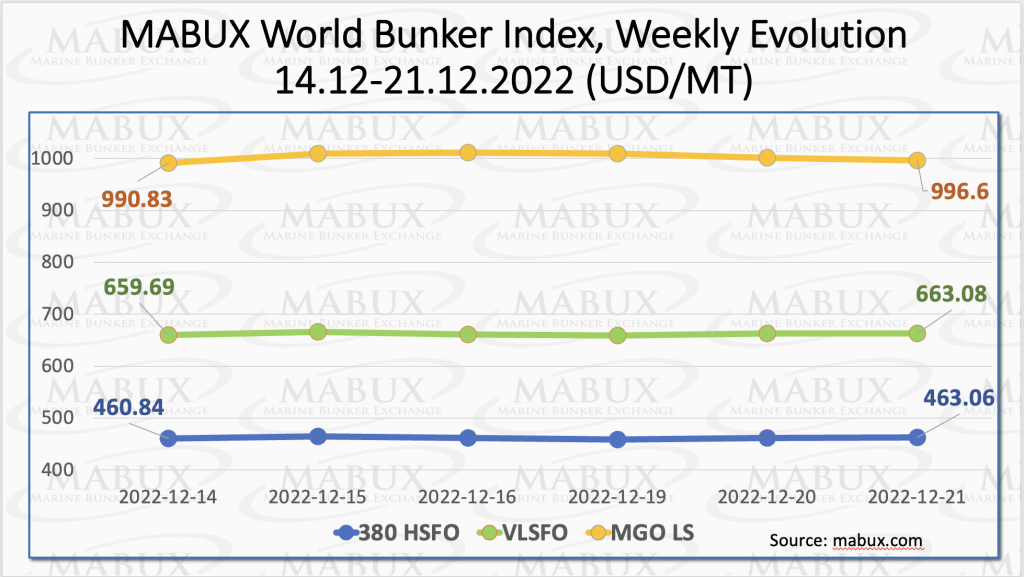

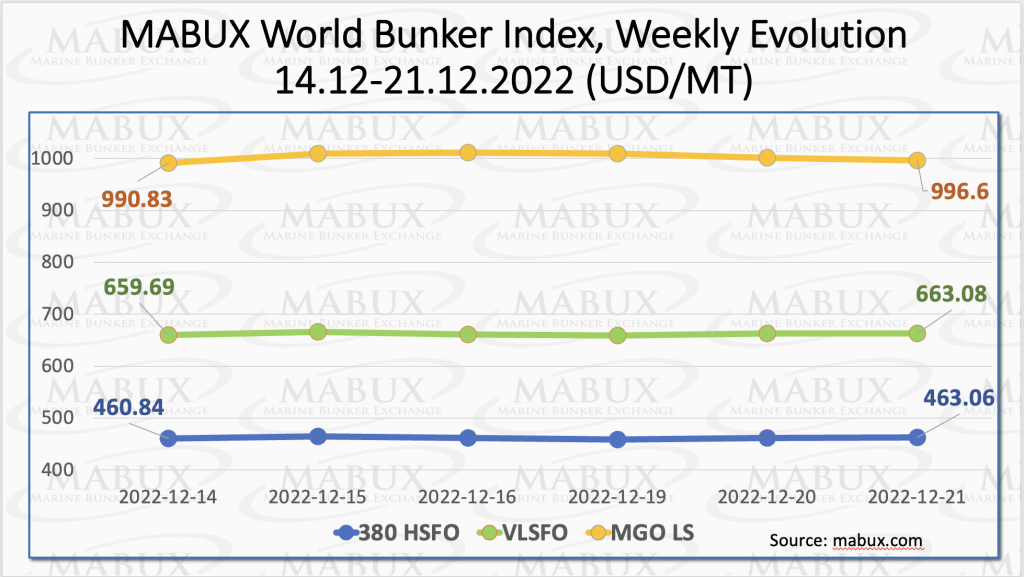

Over the Week 51, MABUX global bunker indices stopped declining and switched to moderate upward correction. The 380 HSFO index rose by 2.22 USD: from 460.84 USD/MT last week to 463.06 USD/MT. The VLSFO index added 3.39 USD (663.08 USD/MT versus 659.69 USD/MT last week).

The MGO index also increased by 5.77 USD (from 990.83 USD/MT last week to 996.60 USD/MT), remaining close to the psychological mark of 1000 USD. However, the emerging growth of the indices has not yet transformed into a firm uptrend.

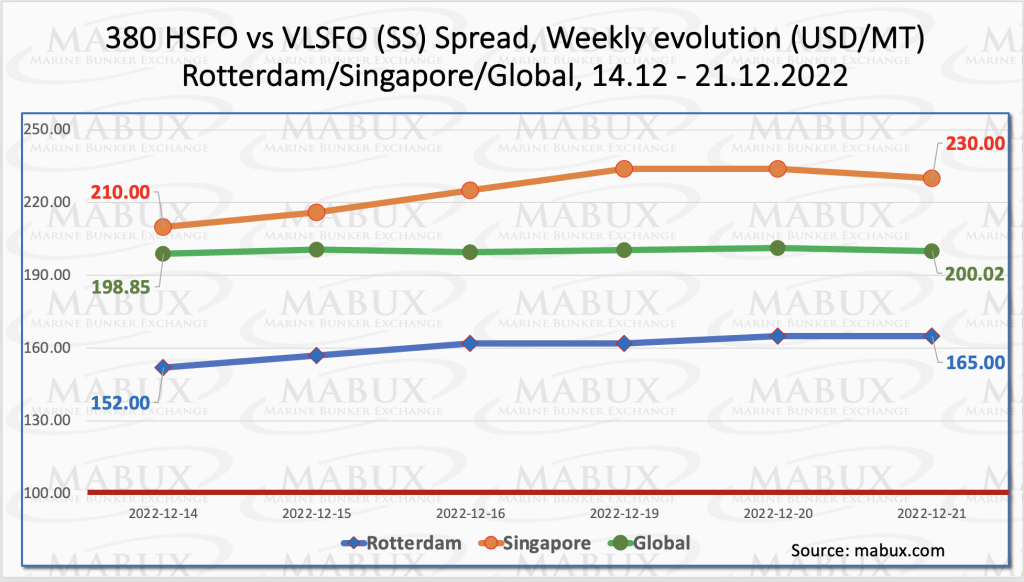

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – also showed a slight increase over the Week 51 – plus $ 1.17 ($ 200.02 vs. $ 198.85 last week), remaining at the $ 200 mark.

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – also showed a slight increase over the Week 51 – plus $ 1.17 ($ 200.02 vs. $ 198.85 last week), remaining at the $ 200 mark.

In Rotterdam, SS Spread added $13.00 to $165.00 from $152.00 last week. In Singapore, the 380 HSFO/VLSFO price differential showed the most significant increase of $20.00 ($230.00 vs. $210.00 last week). We expect SS Spread does not have significant changes next week due to the start of the New Year holidays. More information is available in the “Differentials” section at mabux.com.

The EU finally agreed on Dec.19 to set a price cap on natural gas to protect consumers from excessive price spikes and limit inflationary pressure and industrial damage to European economies. The price cap, however, could limit Europe’s capacity to continue to draw most of the global spot LNG supply.

The EU finally agreed on Dec.19 to set a price cap on natural gas to protect consumers from excessive price spikes and limit inflationary pressure and industrial damage to European economies. The price cap, however, could limit Europe’s capacity to continue to draw most of the global spot LNG supply.

Some EU member states such as Germany and the Netherlands had reservations about a price cap, concerned that a market intervention and a ceiling on prices would take away Europe’s key advantage in attracting LNG supply this year—higher prices than in Asia.

Europe’s energy systems were already put to the first real test this month amid an Arctic blast that swept through most of northwestern Europe, bringing freezing temperatures, snow in the UK, and depressing wind speeds in Germany. Meantime, natural gas storage sites in the EU started to drain, with storage at 84% as of December 17.

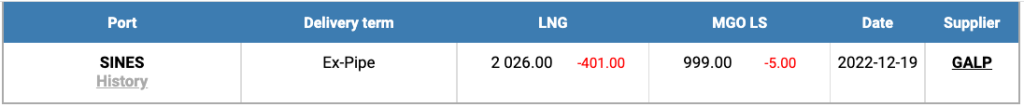

The price of LNG as bunker fuel at the port of Sines (Portugal) fell further to 2026 USD/MT on December 19 (minus 401 USD compared to the previous week). However, the price of LNG still surpasses that one of the most expensive traditional bunker fuels by 1027 USD: on November 19, the price of MGO LS at the port of Sines was quoted at 999 USD/MT.

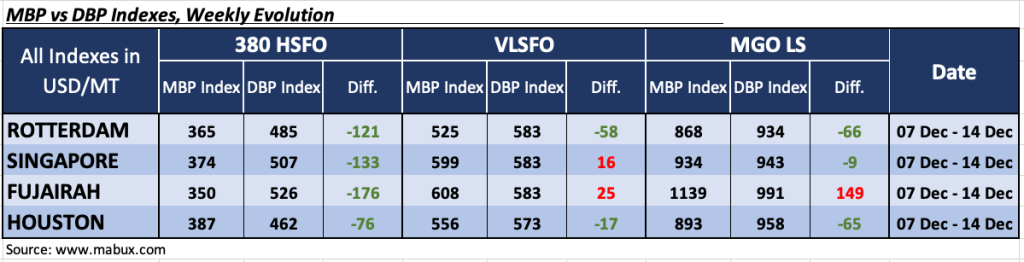

Over the Week 51, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered underestimation of 380 HSFO fuel grade in all four selected ports.

Over the Week 51, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered underestimation of 380 HSFO fuel grade in all four selected ports.

Underprice ratio slightly increased in all ports. The undercharge margins were registered as: in Rotterdam – minus $ 121, Singapore – minus $ 133, Fujairah – minus $ 176 and in Houston – minus $ 76.

In the VLSFO segment, according to MDI, Singapore and Fujairah are still overvalued. The overcharge ratio moderately decreased and amounted to plus $16 and plus $25, respectively. In Rotterdam and Houston, this type of fuel was underestimated by an average of minus $58 and minus $17. The underestimation has increased slightly.

In the MGO LS segment, Singapore moved into the undercharge zone with minus $ 9. Thus, according to the MDI, except Singapore, Rotterdam – minus $ 66 and Houston – minus $ 65 also remain underestimated over the week. The only overvalued port is Fujairah: plus $149. Undercharge premium has risen, while overprice one has declined.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

Berlin-based NGO, NABU, said the decision of the International Maritime Organization (IMO) to designate the Mediterranean as a Sulphur Emission Control Area (SECA) during MEPC 79 is a ‘crucial step which will lead to improved air quality for 150 million people around the Mediterranean. Littoral countries agreed to the designation of a 0.10% SECA in the region last December – and this proposal was later approved at MEPC 78 in June.

Adopted yesterday (15 December) at MEPC 79, the regulation is expected to enter into force in May 2024 with the new limit taking effect on 1 May 2025. At the same time NABU expressed disappointment that a regulation that covers nitrogen oxides in the region is yet to be enforced.

The climate NGO said a combined SOx and NOx ECA as established in North America and in northern Europe would improve air quality further while also ‘boosting the necessary shift towards climate-friendly e-fuels based on renewable energy’.

We do not expect any drastic changes of bunker indices since New Year holidays have started. Irregular changes with no sustainable trend will prevail in Global Bunker Market next week.

Source: www.mabux.com