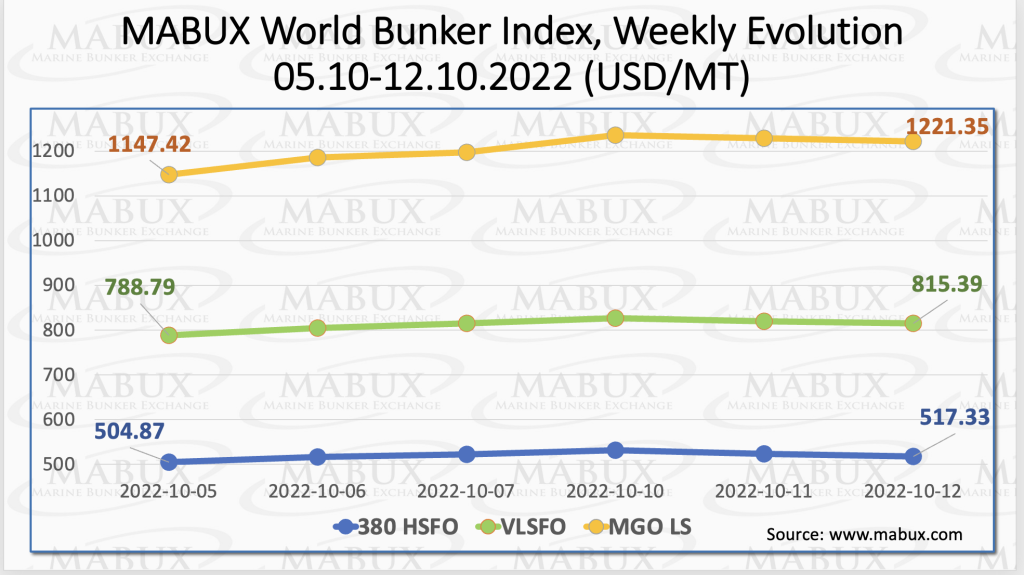

Over the Week 41, MABUX global bunker indices demonstrated firm upward trend. The 380 HSFO index rose by 12.46 USD: from 504.87 USD/MT last week to 517.33 USD/MT. The VLSFO index, in turn, went up by 26.60 USD: from 788.79 USD/MT to 815.39 USD/MT. The MGO Index has registered the most significant growth: plus 73.93 USD (from 1147.42 USD/MT to 1221.35 USD/MT), breaking the mark of 1200 USD again.

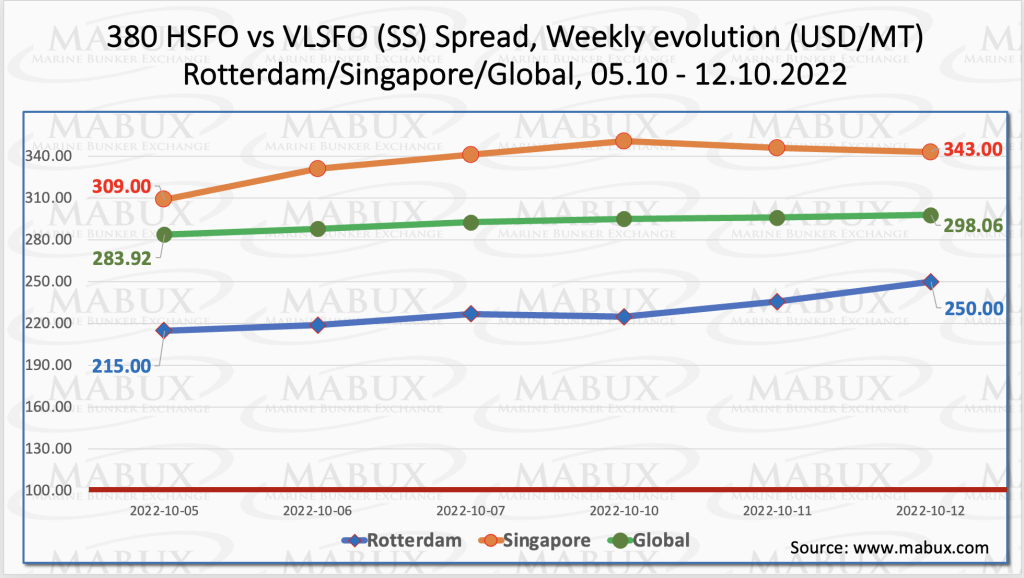

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – also continued rising over the Week 41 – plus $ 27.10 ($ 292.31 vs. $ 265.21 last week), closely approaching the mark of 300 USD. In Rotterdam, the average SS Spread reached $228.67 from $202.67 (up $26.00 last week). In Singapore, the average weekly price difference of 380 HSFO/VLSFO also increased: plus $40.50 ($336.83 vs. $296.33 last week). The growth of SS Spread indicates that the volatility of the global bunker market remains at a high level. More information is available in the Price Differences section of mabux.com.

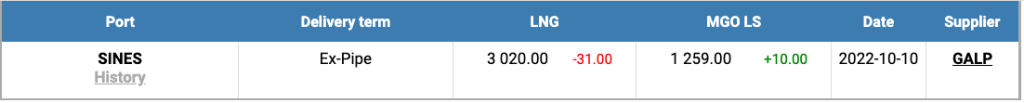

Europe’s natural gas prices dropped to the lowest level in three months on Oct. 10 as LNG imports climbed while weather forecasts pointed to a milder-than-expected autumn. Price of LNG as bunker fuel at the port of Sines (Portugal) fell by 31 USD/MT to 3020 USD/MT on October 10 (versus 3051 USD/MT a week earlier) while prices for traditional bunker fuel grades rose significantly. However, LNG prices are still more than 2.3 times higher than that of the most expensive conventional bunker fuel: MGO LS at the port of Sines was quoted on October 10 at 1259 USD/MT.

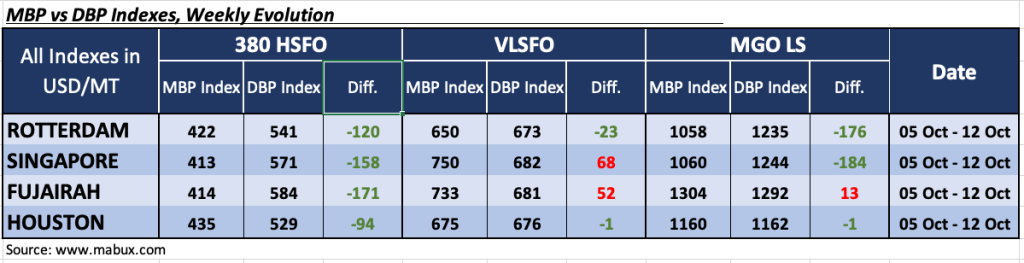

Over the Week 41, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an underestimation of 380 HSFO fuel grade in all four selected ports. The underpricing margins continued to grow and amounted for: Rotterdam – minus $120, Singapore – minus $158, Fujairah – minus $171 and Houston – minus $94.

VLSFO fuel grade, according to MDI, was undervalued in two out of four hubs selected: Rotterdam – minus $ 23 and Houston – minus $ 1, with Houston moving into the undercharge zone only at the end of the week. In Singapore and Fujairah, the MDI registered an overpricing of VLSFO by plus $68 and plus $52, respectively. In this bunker fuel segment, the undercharge premium increased slightly, while the overcharge one did not change significantly.

In the MGO LS segment, MDI registered underpricing in three ports out of four selected: Rotterdam – minus $ 176, Singapore – minus $ 184 and Houston – minus $ 1. Fujairah remains the only overvalued port – plus $ 13. The undervaluation ratio grew moderately, while the overcharge has been significantly reduced.

SEA-LNG forecasted the average cost for delivered bio-LNG will fall by 30% by 2050 compared to today’s values, ‘mainly driven by the reduced cost of producing biomethane in large-scale anaerobic digestion plants’. This makes bio-LNG one of the cheapest sustainable alternative marine fuels’, compared to biomethanol and electro-fuels, including e-ammonia and e-methanol. The report also found that that pure bio-LNG could cover up to 3% of the total energy demand for shipping fuels by the end of the decade. This figure rises to 13% in 2050. Meanwhile, if it is considered as a drop-in fuel blended with fossil LNG, bio-LNG could cover up to 16% and 63% of the total energy demand in 2030 and 2050, respectively, assuming a 20% blending ratio. Furthermore, the report highlights that the uptake of bio-LNG in shipping will be linked to the widespread use of biomethane across other sectors. This will require national and international standards for biomethane injection into gas grids, plus a commonly accepted certificates of origin scheme to efficiently trade biomethane in its gaseous and liquefied forms and to minimise transportation costs.

The global bunker market is still in a state of high volatility with no sustainable trend, which entails irregular fluctuations of bunker indices about the present levels.

Source: www.mabux.com