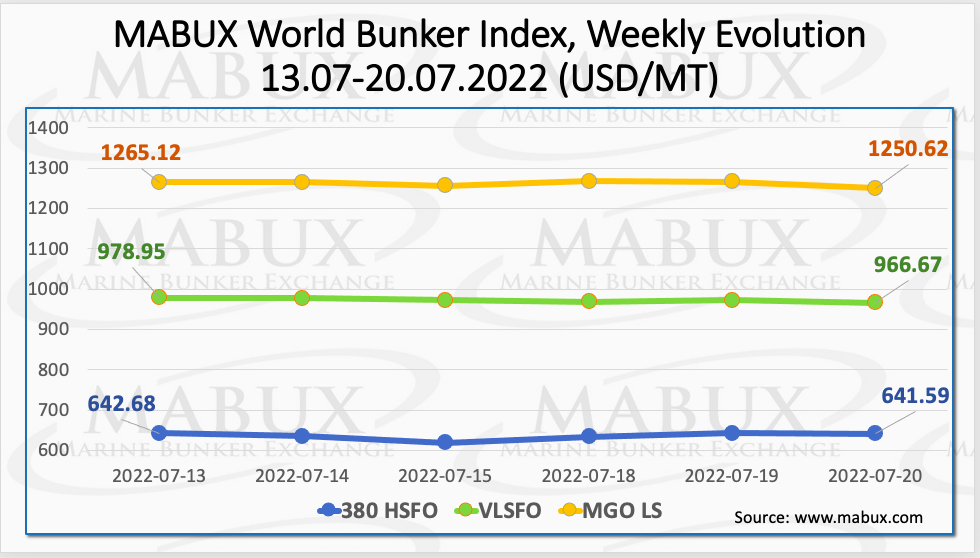

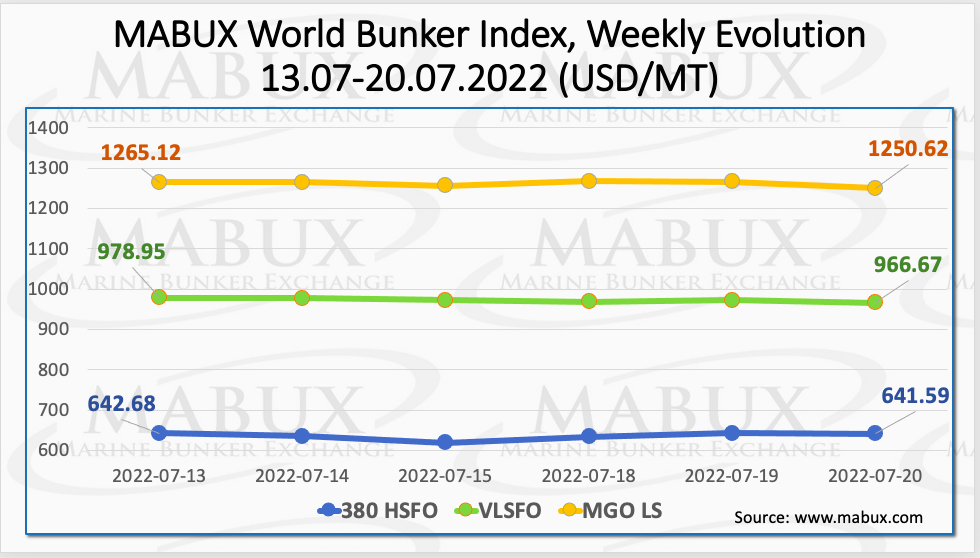

Global bunker indices continued moderate decline over the Week 29. The 380 HSFO index went negative by another 1.09 USD: from 642.68 USD/MT to 641.59 USD/MT. The VLSFO index, in turn, fell by 12.28 USD: from 978.95 USD/MT to 966.67 USD/MT. The MGO index also lost 14.50 USD (from 1265.12 USD/MT to 1250.62 USD/MT).

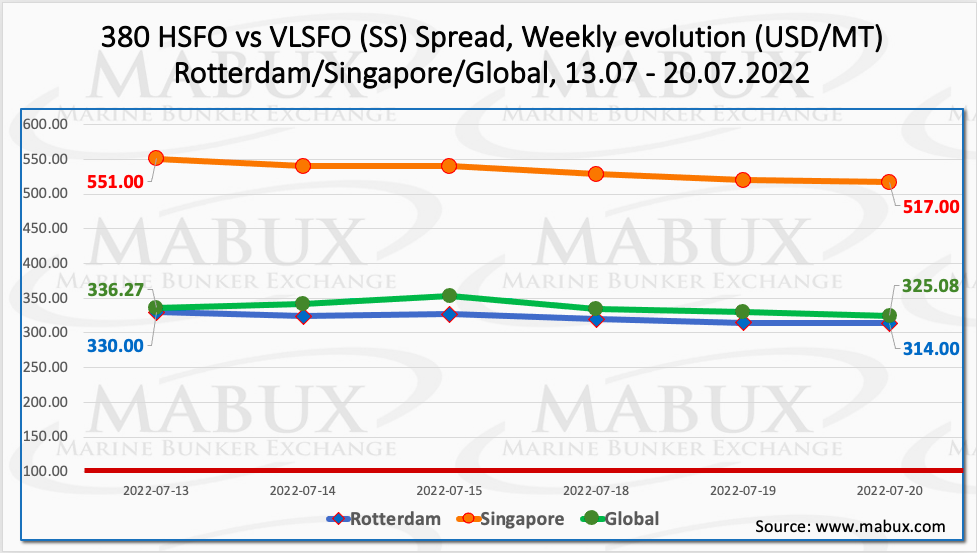

Following further decline of fuel prices, the Global Scrubber Spread (SS) weekly average – the difference in price between 380 HSFO and VLSFO – also continued its slight downtrend for the second week in a row – minus $ 5.70 ($ 336.82 vs. $ 342.52 last week). In Rotterdam, the SS Spread average also turned down: $321.67 vs. $330.17 (down $8.50 from last week). The average weekly price difference of 380 HSFO/VLSFO also continued to decline in Singapore: minus $2.67 ($532.83 vs. $535.50 last week). More information is available in the Price Differences section of mabux.com.

Following further decline of fuel prices, the Global Scrubber Spread (SS) weekly average – the difference in price between 380 HSFO and VLSFO – also continued its slight downtrend for the second week in a row – minus $ 5.70 ($ 336.82 vs. $ 342.52 last week). In Rotterdam, the SS Spread average also turned down: $321.67 vs. $330.17 (down $8.50 from last week). The average weekly price difference of 380 HSFO/VLSFO also continued to decline in Singapore: minus $2.67 ($532.83 vs. $535.50 last week). More information is available in the Price Differences section of mabux.com.

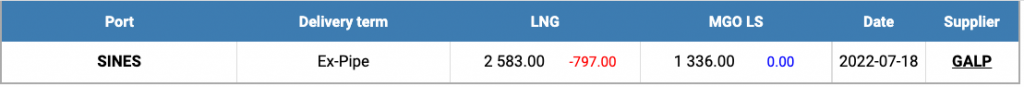

Natural gas prices in Europe declined slightly over the week 29. LNG as bunker fuel in the port of Sines (Portugal) fell by 797 USD/MT on July 18 to 2583 USD/MT (versus 3380 USD/MT a week earlier). LNG prices are still significantly higher than those of traditional bunker fuels: the price of MGO LS at the port of Sines was quoted on July 20 at 1336 USD/MT.

Natural gas prices in Europe declined slightly over the week 29. LNG as bunker fuel in the port of Sines (Portugal) fell by 797 USD/MT on July 18 to 2583 USD/MT (versus 3380 USD/MT a week earlier). LNG prices are still significantly higher than those of traditional bunker fuels: the price of MGO LS at the port of Sines was quoted on July 20 at 1336 USD/MT.

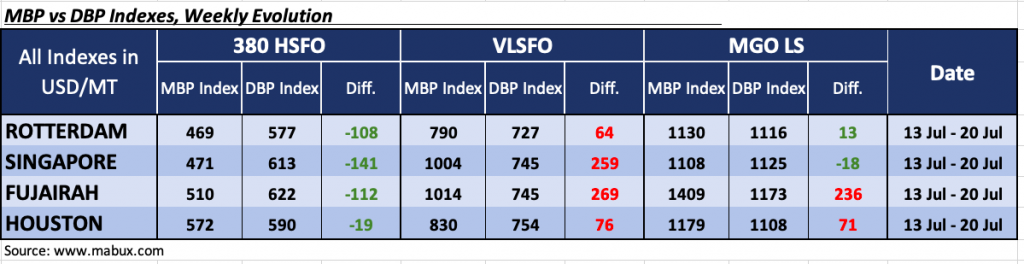

Over the Week 29, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) continued to demonstrate an undercharge of 380 HSFO fuel in all four ports selected: Rotterdam – minus $108, Singapore – minus $141, Fujairah – minus $112 and Houston – minus $19. Underestimation premium of HSFO fuel in all ports continue to widen.

Over the Week 29, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) continued to demonstrate an undercharge of 380 HSFO fuel in all four ports selected: Rotterdam – minus $108, Singapore – minus $141, Fujairah – minus $112 and Houston – minus $19. Underestimation premium of HSFO fuel in all ports continue to widen.

VLSFO fuel, according to MDI, remained, on the contrary, overpriced in all four selected ports: plus $64 in Rotterdam, plus $259 in Singapore, plus $269 in Fujairah and plus $76 in Houston. Here, the MDI index did not have any firm trend: the overcharge premium decreased slightly in Rotterdam, Singapore and Fujairah, but increased in Houston. VLSFO fuel is still the most overvalued segment of the global bunker market.

As for MGO LS grade, MDI index registered a fuel overcharge in three ports out of four selected: Rotterdam again returned to the overcharge zone: plus $ 13. MGO LS fuel was also overpriced in Fujairah – plus $ 236 and in Houston – plus $71. Singapore was the only port where the MDI index registered underpricing – minus $18. MDI recorded a trend for a gradual increase of both underestimation and overestimation premiums.

The Port of Amsterdam says that sea and river cruise ships will be able to connect to shore power at the Walstroom passenger terminal in 2025, and shore-power enabled vessels will be given priority when docking at the terminal. The Port has already started work on the design phase of the shore power installation in conjunction with the grid operator Liander. The port received a European subsidy for this phase, and it is expected that the European tender process will start after the summer, so that both sea cruise and river cruise ships will be able to use shore power at the Passenger Terminal Amsterdam (PTA) from the start of the cruise season in 2025.

The Port of Amsterdam says that sea and river cruise ships will be able to connect to shore power at the Walstroom passenger terminal in 2025, and shore-power enabled vessels will be given priority when docking at the terminal. The Port has already started work on the design phase of the shore power installation in conjunction with the grid operator Liander. The port received a European subsidy for this phase, and it is expected that the European tender process will start after the summer, so that both sea cruise and river cruise ships will be able to use shore power at the Passenger Terminal Amsterdam (PTA) from the start of the cruise season in 2025.

Fujairah’s bunker sales in June were more than 13% down on the previous month and down around 3% year-on-year. The Middle East bunkering hub accounted for a total of 647,184 cubic metres (cbm) of marine fuel and 5,036 cbm of lubricants. The main grade, 380cst low sulphur fuel oil, accounted for 482,926 cbm and sales of 380cst marine fuel oil (the higher sulphur fuel, which can used by scrubber-equipped ships) were 132,690 cbm. The 180cst low sulphur fuel oil grade accounted for 372 cbm. On the distillate side, sales of low sulphur marine gasoil were 29,909 cbm and (higher sulphur) marine gasoil sales were 1,287 cbm.

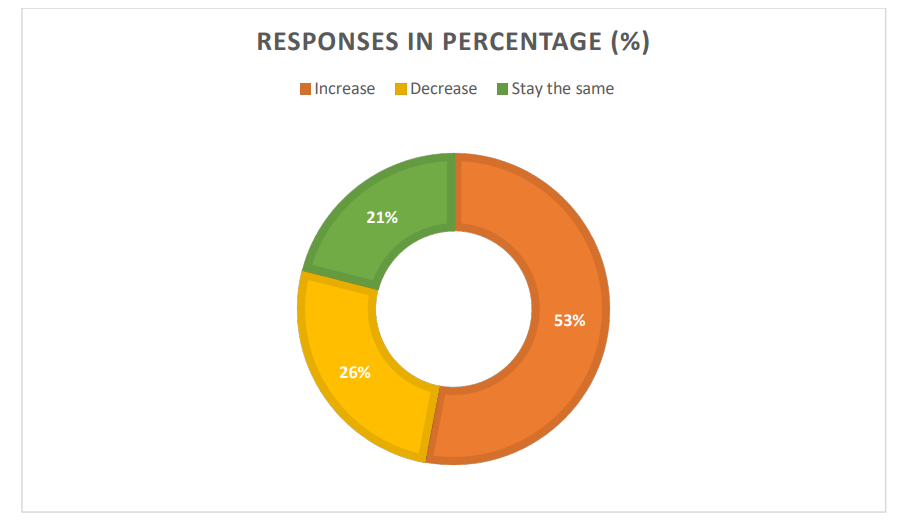

We expect global bunker indices to continue slight downward trend next week.

Source: www.mabux.com