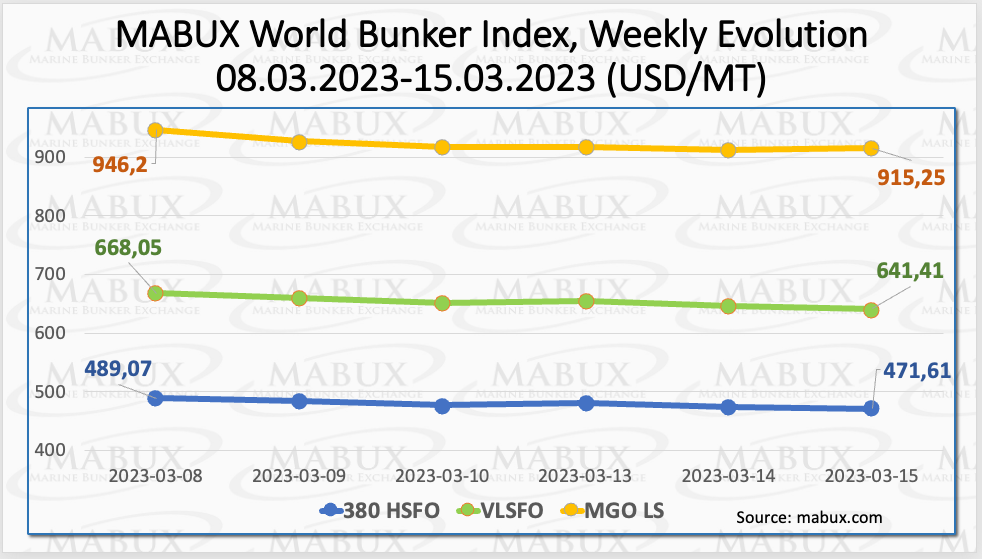

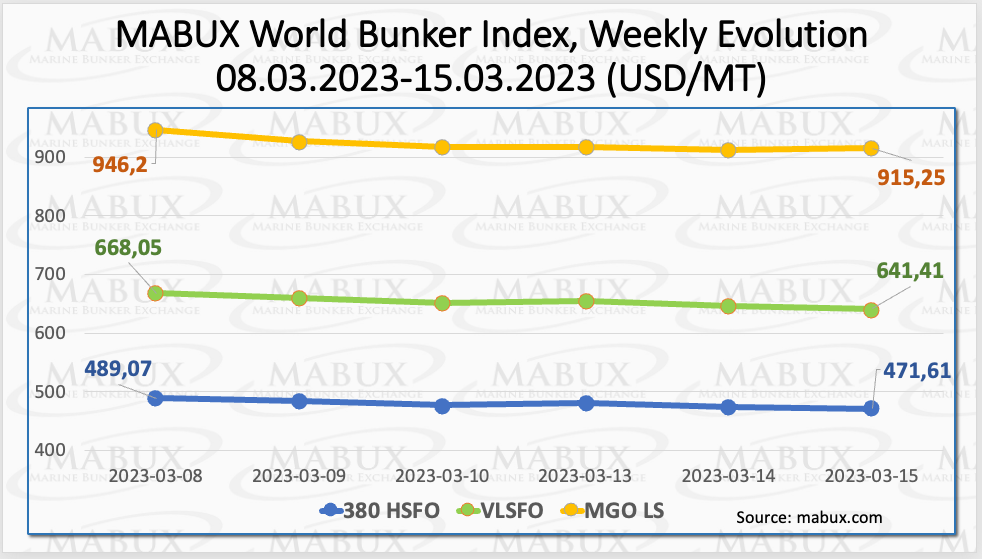

Over the Week 11, MABUX global bunker indices reverted to a firm downtrend. The 380 HSFO index fell by 17.46 USD: from 489.07 USD/MT last week to 471.61 USD/MT. The VLSFO index decreased by 26.64 USD (641.41 USD/MT versus 668.05 USD/MT last week). The MGO index also lost 30.95 USD (from 946.20 USD/MT last week to 915.25 USD/MT), coming close to 900 USD mark. At the time of writing, the market was still in a downtrend.

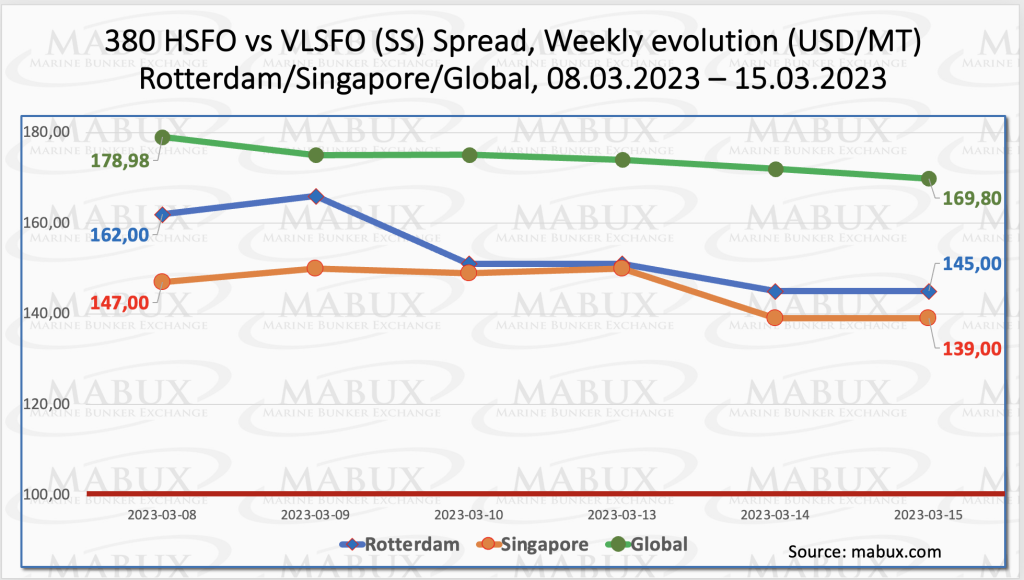

The Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – showed a firm decline in a Week 11 – minus $9.16 ($169.80 vs. $178.89 last week). At the same time, the weekly average also decreased by $8.90. In Rotterdam, the SS Spread fell by $17.00 to $145.00 (vs. $162.00 last week), while the weekly average lost $8.67. In Singapore, the 380 HSFO/VLSFO price difference also continued to decrease: minus $ 8, dropping to $ 139 (the weekly average weekly lost $ 2.50). We expect SS Spread to continue downtrend next week. More information is available in the “Differentials” section of mabux.com.

The Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – showed a firm decline in a Week 11 – minus $9.16 ($169.80 vs. $178.89 last week). At the same time, the weekly average also decreased by $8.90. In Rotterdam, the SS Spread fell by $17.00 to $145.00 (vs. $162.00 last week), while the weekly average lost $8.67. In Singapore, the 380 HSFO/VLSFO price difference also continued to decrease: minus $ 8, dropping to $ 139 (the weekly average weekly lost $ 2.50). We expect SS Spread to continue downtrend next week. More information is available in the “Differentials” section of mabux.com.

As per the International Energy Agency (IEA), natural gas demand in the European Union fell in 2022 by 55 bcm, or 13%, its steepest drop in history. The IEA said that the milder winter temperatures ‘certainly played a role’, as it noted that Heating Degree Days (a measure of how much energy is required to heat a building due to colder weather) across the European Union (EU) were 12% lower on average in 2022 than in 2021. ‘Production curtailment’ in ‘energy-intensive industries’ played a major part in the natural gas demand drop, as ‘several plants reduced production, and in some cases imported finished products from outside the EU instead of manufacturing them domestically at higher cost’. Other significant factors including ‘fuel switching’ and ‘behavioural changes’ (i.e. households turning the thermostat down and using less hot water) in response to the higher natural gas prices. In terms of fuel switching, the IEA estimated that ‘around 7 bcm of gas-to-oil switching occurred in the industrial sector’.

As per the International Energy Agency (IEA), natural gas demand in the European Union fell in 2022 by 55 bcm, or 13%, its steepest drop in history. The IEA said that the milder winter temperatures ‘certainly played a role’, as it noted that Heating Degree Days (a measure of how much energy is required to heat a building due to colder weather) across the European Union (EU) were 12% lower on average in 2022 than in 2021. ‘Production curtailment’ in ‘energy-intensive industries’ played a major part in the natural gas demand drop, as ‘several plants reduced production, and in some cases imported finished products from outside the EU instead of manufacturing them domestically at higher cost’. Other significant factors including ‘fuel switching’ and ‘behavioural changes’ (i.e. households turning the thermostat down and using less hot water) in response to the higher natural gas prices. In terms of fuel switching, the IEA estimated that ‘around 7 bcm of gas-to-oil switching occurred in the industrial sector’.

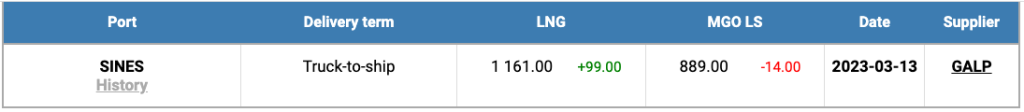

Despite the general downward trend in natural gas indices, the price of LNG as a bunker fuel at the port of Sines (Portugal) increased and reached 1161 USD/MT on March 13 (plus 99 USD compared to the previous week). The price difference between LNG and conventional fuel also widened on March 13 to 272 USD: MGO LS at the port of Sines was quoted at 989 USD/MT that day. However, we do not expect LNG prices to continue their upward trend in the near term. More information is available in the LNG Bunkering section of mabux.com.

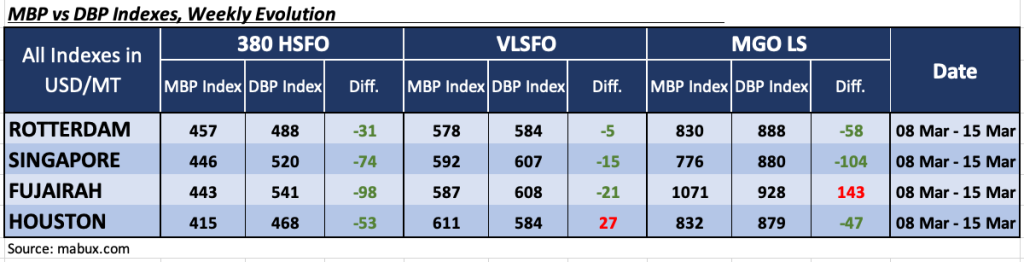

Over the Week 11, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered undervaluation of 380 HSFO fuel in all four selected ports. The weekly average showed a reduction at all ports. The most significant was MDI decline at Rotterdam: minus 76 points at once reaching minus $31 mark. In Singapore, Fujairah and Houston, MDI showed minus $74, minus $98 and minus $53, respectively.

Over the Week 11, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered undervaluation of 380 HSFO fuel in all four selected ports. The weekly average showed a reduction at all ports. The most significant was MDI decline at Rotterdam: minus 76 points at once reaching minus $31 mark. In Singapore, Fujairah and Houston, MDI showed minus $74, minus $98 and minus $53, respectively.

In the VLSFO segment, according to MDI, the three selected ports – Rotterdam, Singapore and Fujairah – remain undervalued by minus $5, minus $15 and minus $21, respectively. The underestimation weekly average moderately narrowed. Houston remained the only overvalued port in this fuel segment with a plus $27, the overpricing level slightly increased.

There are still three ports in the MGO LS segment: Rotterdam, Singapore and Houston. The weekly average underpricing premium rose moderately in Rotterdam and Singapore to $94 and $101 respectively but decreased in Houston to $54. Fujairah remained the only overvalued port – plus $155. In general, the MDI changes in this fuel segment were insignificant.

There are three underpriced ports in the MGO LS segment: Rotterdam, Singapore and Houston. Average weekly undercharge ratio slightly declined at Rotterdam and Houston to $58 and $48 respectively but rose to $104 in Singapore. Fujairah remains the only overvalued port – plus $143. In general, there is gradual narrowing of undervaluation margins registered in all fuel segments.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at mabux.com.

The 3,794,300 metric tonnes (mt) of marine fuel sales in the Port of Singapore last month was 8.3% up on the 3,504,000 mt recorded in February 2022. However, last month’s total marked a 13.3% decrease on the 4,376,900 mt registered in January, Sales of very low sulphur fuel oil 380 cSt stood at 1,938,500 mt for the month – 11.8% up on the 1,733,500 mt recorded in February 2022 but 15.7% down on January’s total. For a ninth successive month, sales of high sulphur fuel oil 380 cSt (1,105,600 mt) surpassed the 1 million tonne mark. The 297,000 mt of low sulphur marine gasoil sales represented a 5.9% year-on-year (y-o-y) increase but a 5.3% decrease on the 313,700 mt recorded in January. Over the first two months of the year a total of 8,171,200 mt of marine fuel was sold in Singapore compared to 7,533,000 during the same period in 2022.

Global bunker market retreated to downtrend following crude oil as the collapse of Silicon Valley Bank and problems with Credit Suisse sparked fears of a fresh financial crisis that could reduce future oil and fuel demand. We expect bunker indices to keep falling next week.

Source: www.mabux.com