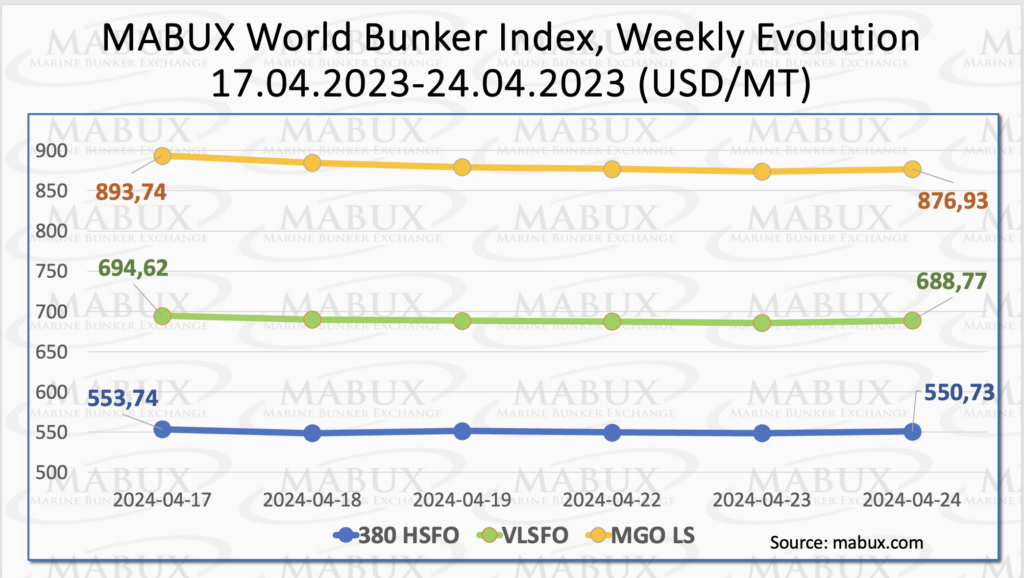

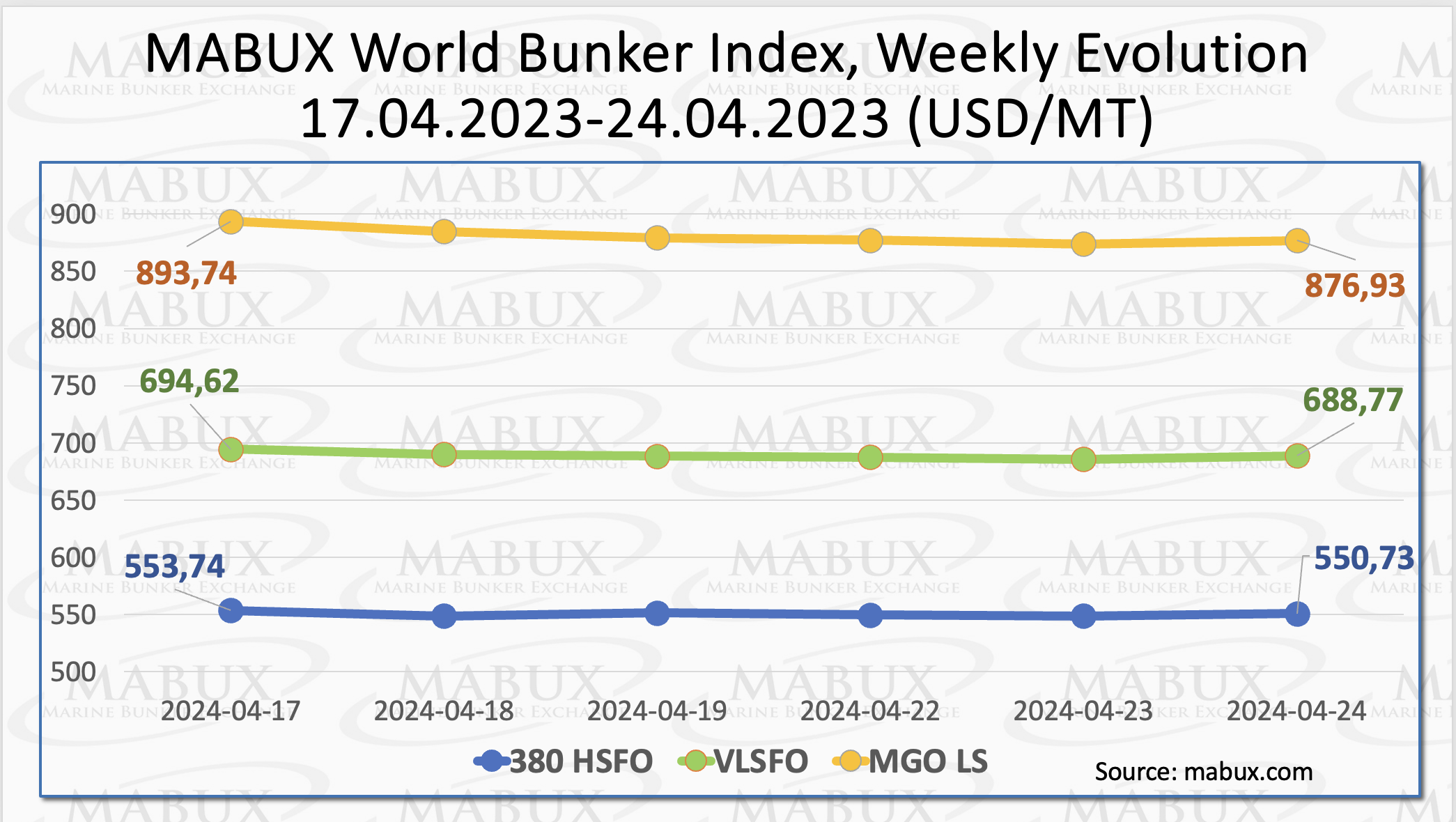

Over the Week 17, the world MABUX bunker indices experienced a modest decline. The 380 HSFO index fell by 3.01 USD: from 553.74 USD/MT last week to 550.73 USD/MT. The VLSFO index decreased by 5.85 USD (688.77 USD/MT versus 694.62 USD/MT last week), consistently staying below the 700 USD mark. The MGO index declined by 16.81 USD (from 893.74 USD/MT last week to 876.93 USD/MT). At the time of writing, the global bunker indices showed signs of modest growth.

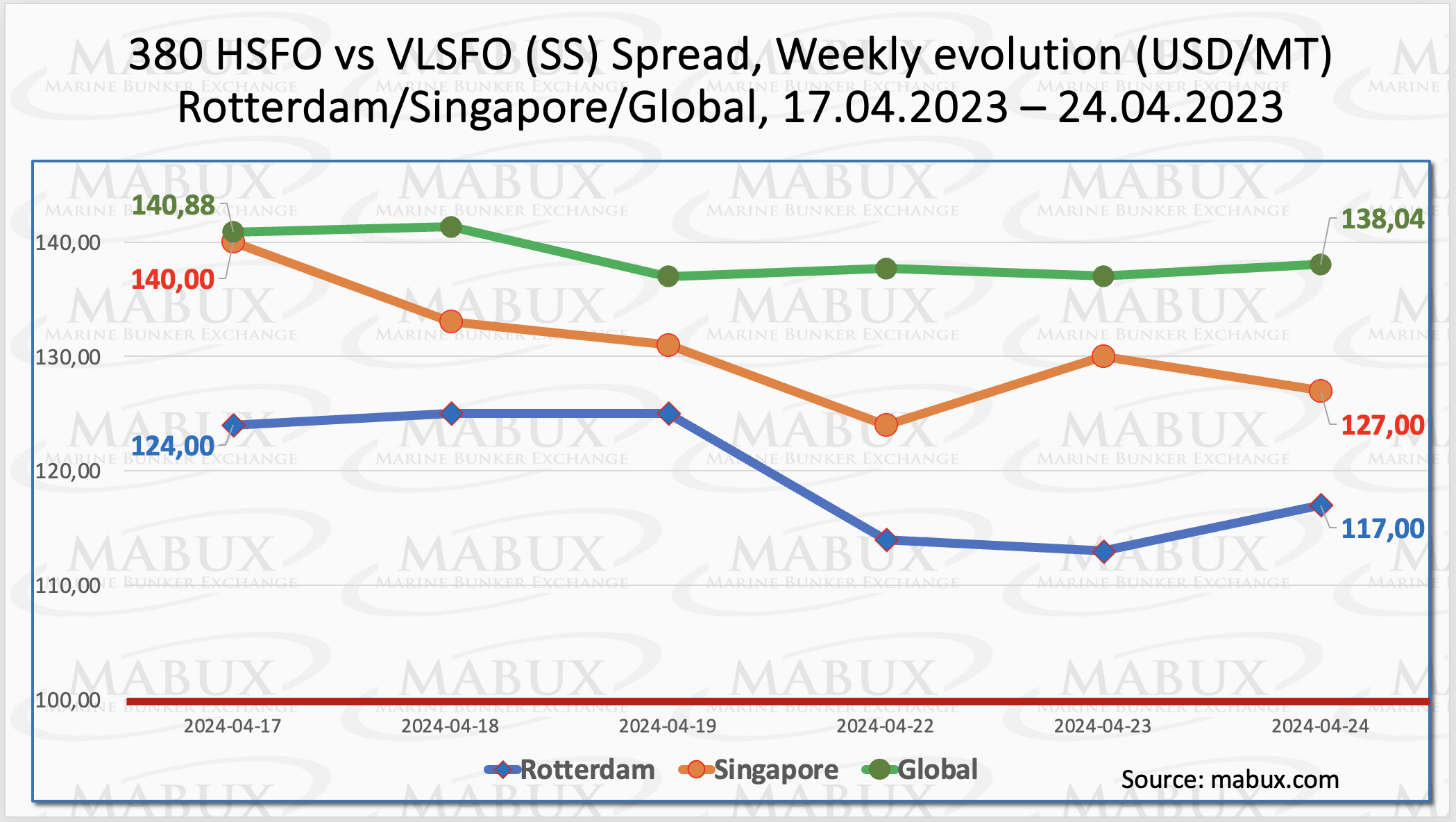

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued its gradual decrease to minus $2.84 ($138.04 versus $140.88 last week), breaking through the $140.00 mark. The weekly average also dropped by $6.55. In Rotterdam, the SS Spread narrowed by $7.00 (from $124.00 last week to 117.00), gradually approaching the $100.00 mark (SS Breakeven). The port’s weekly average also fell by $2.66. In Singapore, the 380 HSFO/VLSFO price differential narrowed by $13.00 ($127.00 versus last week’s $140.00), and the weekly average decreased by $10.34. We expect the SS Spread reduction trend to persist next week. More information is available in the “Differentials” section of mabux.com.

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued its gradual decrease to minus $2.84 ($138.04 versus $140.88 last week), breaking through the $140.00 mark. The weekly average also dropped by $6.55. In Rotterdam, the SS Spread narrowed by $7.00 (from $124.00 last week to 117.00), gradually approaching the $100.00 mark (SS Breakeven). The port’s weekly average also fell by $2.66. In Singapore, the 380 HSFO/VLSFO price differential narrowed by $13.00 ($127.00 versus last week’s $140.00), and the weekly average decreased by $10.34. We expect the SS Spread reduction trend to persist next week. More information is available in the “Differentials” section of mabux.com.

According to Rystad, LNG bunkering reached a historic peak in 2023, with 4.7 million cubic meters delivered globally, marking a 62% increase from 2022. This growth was mainly fueled by a substantial rise in ship-to-ship (STS) deliveries, which doubled in 2022. As of the end of March 2024, LNG bunkering sales have started robustly, with 1.9 million cubic meters already sold. This figure is nearing the total sales volume for 2022, indicating the potential for a substantial annual increase. If this trend continues, total LNG bunker sales could exceed 7 million cubic meters by the end of 2024, underscoring LNG’s growing significance in maritime business and trade.

According to Rystad, LNG bunkering reached a historic peak in 2023, with 4.7 million cubic meters delivered globally, marking a 62% increase from 2022. This growth was mainly fueled by a substantial rise in ship-to-ship (STS) deliveries, which doubled in 2022. As of the end of March 2024, LNG bunkering sales have started robustly, with 1.9 million cubic meters already sold. This figure is nearing the total sales volume for 2022, indicating the potential for a substantial annual increase. If this trend continues, total LNG bunker sales could exceed 7 million cubic meters by the end of 2024, underscoring LNG’s growing significance in maritime business and trade.

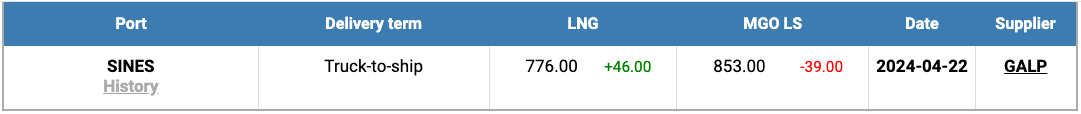

The price of LNG as bunker fuel at the port of Sines, Portugal, has climbed to 776 USD/MT as of April 22, marking an increase of 46 USD compared to the previous week. Concurrently, the price gap between LNG and traditional fuel has narrowed, now standing at 77 USD in favor of LNG. This is a significant reduction from the 165 USD difference observed just a week earlier. On the same day, MGO LS was priced at 853 USD/MT in Sines. For further details, refer to the LNG Bunkering section on mabux.com.

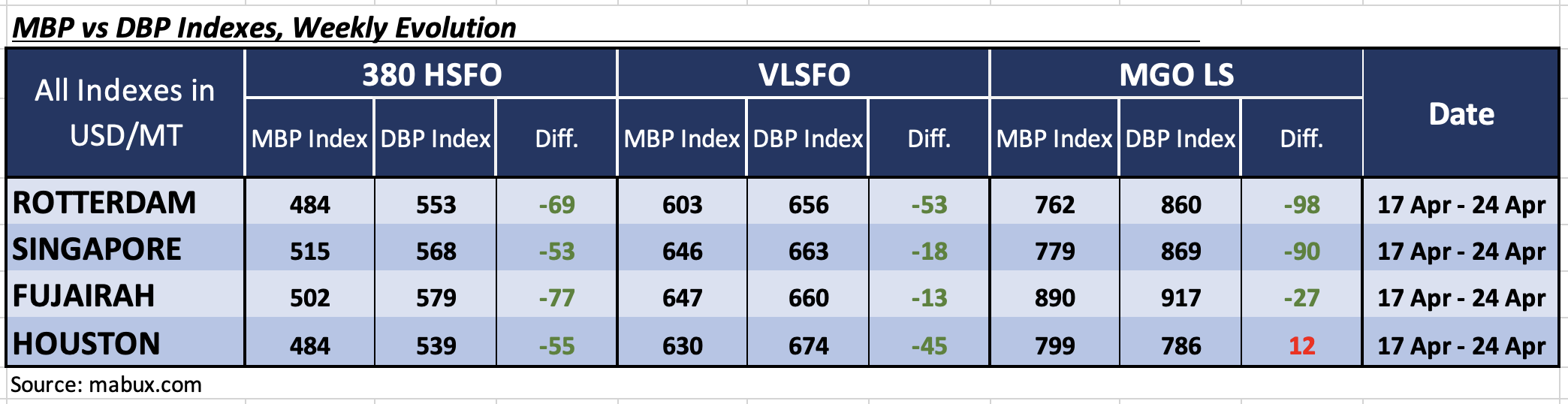

In Week 17, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In Week 17, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all selected ports remained in the undervalued zone. Weekly averages dropped by 4 points in Rotterdam, 16 points in Singapore and 13 points in Houston but increased by 8 points in Fujairah.

In the VLSFO segment, according to the MDI, all ports were undercharged, with average weekly levels declining by 4 points in Rotterdam, 10 points in Singapore, 15 points in Fujairah and 4 points in Houston. The MDI indexes in Singapore and Fujairah approached the 100% correlation mark between the market price and the MABUX digital benchmark.

In the MGO LS segment, Houston remained the only overpriced port, with the average weekly ratio increasing by 5 points. All other ports remained undervalued, with the weekly average increasing by 1 point in Rotterdam but decreasing by 5 points in Singapore and 68 points in Fujairah. MDI indices in Rotterdam and Singapore consistently remained below the $100 mark.

At week’s end, the balance of overvalued/undervalued ports across all market segments remained unchanged, with an ongoing general trend towards undervaluation of bunker fuel across the global market segments.

At week’s end, the balance of overvalued/undervalued ports across all market segments remained unchanged, with an ongoing general trend towards undervaluation of bunker fuel across the global market segments.

For more insights on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on mabux.com.

IBIA (The International Bunker Industry Association) and BIMCO have entered into a Memorandum of Understanding (MoU) to jointly address challenges and opportunities in the bunker, marine energy, and maritime sectors, aiming to advance shipping’s decarbonisation goals. The collaboration aims to harness their combined expertise and resources to devise innovative solutions promoting the shift towards cleaner fuels and fostering sustainable shipping practices. The key focus areas of this partnership MoU include:

– Research and Development: Jointly undertake research initiatives, studies, and projects pertinent to the bunker and marine energy industry as well as the broader maritime sector.

– Information Sharing: Exchange pertinent information, publications, and data to benefit the members of both organizations.

– Training and Education: Identify and pursue opportunities for collaborative training programs, seminars, and educational initiatives to elevate the competencies of professionals in the maritime, bunker, and marine energy sectors.

– Influence: Collaborate on advocacy and initiatives to collectively address and overcome industry-specific challenges and issues.

We expect that next week, the global bunker market will lack clear movers to establish a sustainable trend, with bunker indices likely to continue shifting sideways.

Source: MABUX