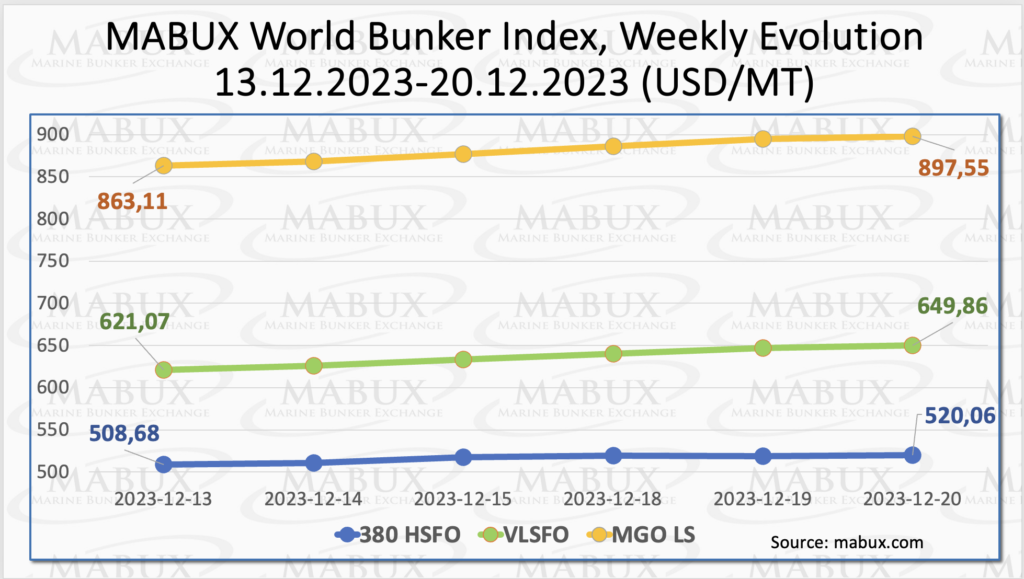

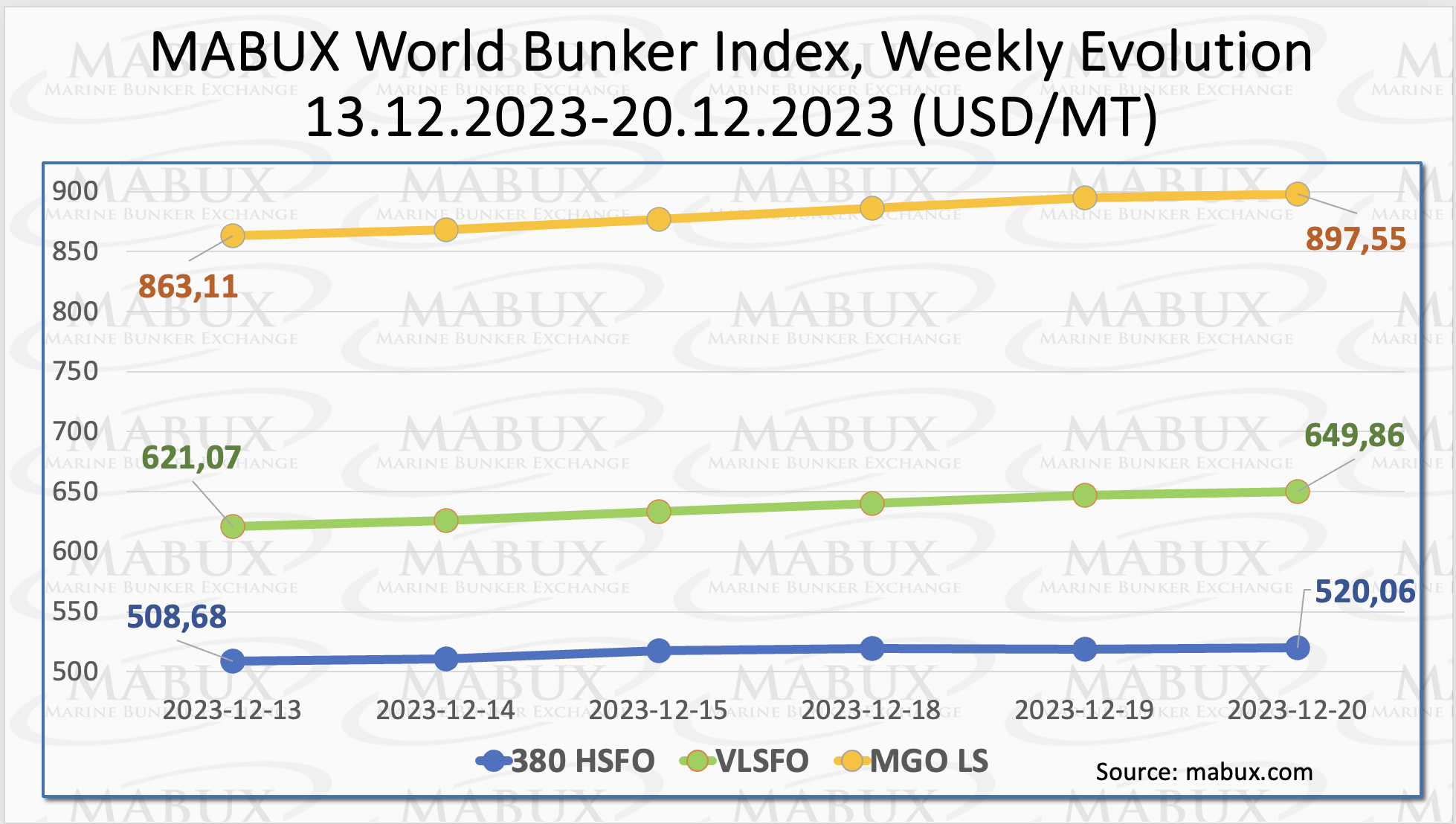

During Week 51, the MABUX global bunker indices began an upward trajectory, marking the first positive movement in the past five weeks. The 380 HSFO index rose by 11.38 USD: from 508.68 USD/MT last week to 520.06 USD/MT. The VLSFO index, in turn, added 28.79 USD (649.86 USD/MT versus 621.07 USD/MT last week). The MGO index increased by 34.44 USD (from 898.92 USD/MT last week to 862.87 USD/MT). At the time of writing, the upward trend in the market continued.

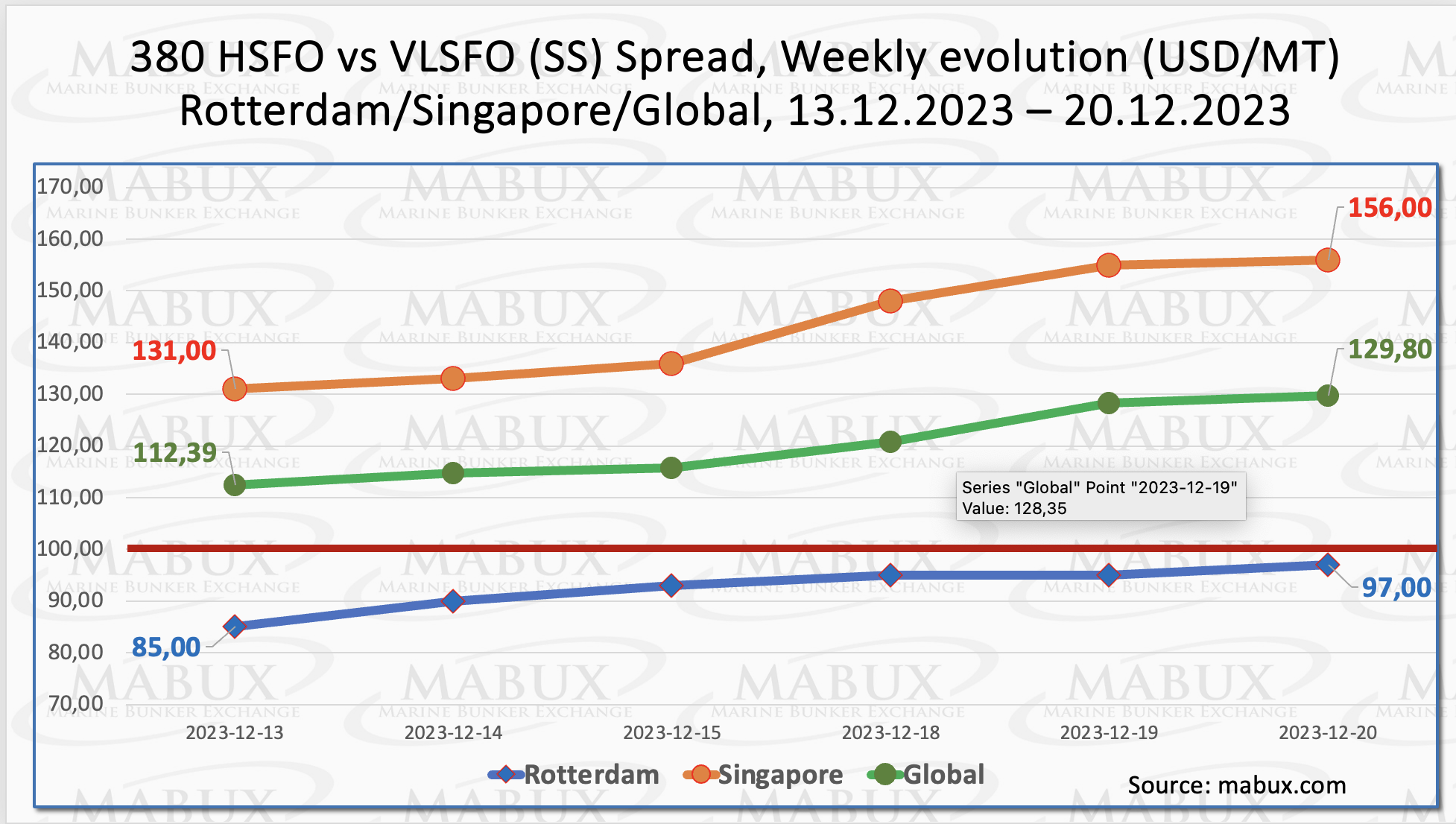

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – has entered the growth phase: plus $17.41 ($129.80 versus $112.39 last week). The weekly average also increased by $1.49. In Rotterdam, SS Spread rose by $12.00 (from $85.00 last week to $97.00), while the weekly average, on the contrary, dropped by $3.00. In Singapore, the price difference for 380 HSFO/VLSFO widened by $25 ($156.00 versus $131.00 last week), with the weekly average narrowing by $11.33. We expect the upward trend in SS Spread will continue in the upcoming week. More information is available in the “Differentials” section of mabux.com.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – has entered the growth phase: plus $17.41 ($129.80 versus $112.39 last week). The weekly average also increased by $1.49. In Rotterdam, SS Spread rose by $12.00 (from $85.00 last week to $97.00), while the weekly average, on the contrary, dropped by $3.00. In Singapore, the price difference for 380 HSFO/VLSFO widened by $25 ($156.00 versus $131.00 last week), with the weekly average narrowing by $11.33. We expect the upward trend in SS Spread will continue in the upcoming week. More information is available in the “Differentials” section of mabux.com.

High inventories, alleviated concerns of supply shortages, weakened demand, and increased confidence in Europe’s ability to navigate the winter without significant supply disruptions have collectively contributed to a decline in natural gas prices across Europe in recent weeks. The winter premiums in both the futures and options market have virtually disappeared. Meanwhile, the supply continues to expand, as global exports from January to November (492 billion cubic meters) have increased by 2.4% (11.4 billion cubic meters) compared to the same period last year. This growth is still notably lower than the increase of just over 5% (22-24 billion cubic meters) observed in both 2021 and 2022.

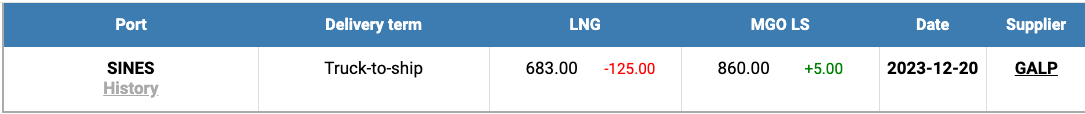

The price of LNG as bunker fuel in the port of Sines (Portugal) continued firm decline, reaching 683 USD/MT on December 20 (minus 125 USD compared to the previous week). Concurrently, the price difference between LNG and conventional fuel on December 20 favored LNG by 117 USD, compared to 22 USD a week earlier. On that day, MGO LS was quoted at 860 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of mabux.com.

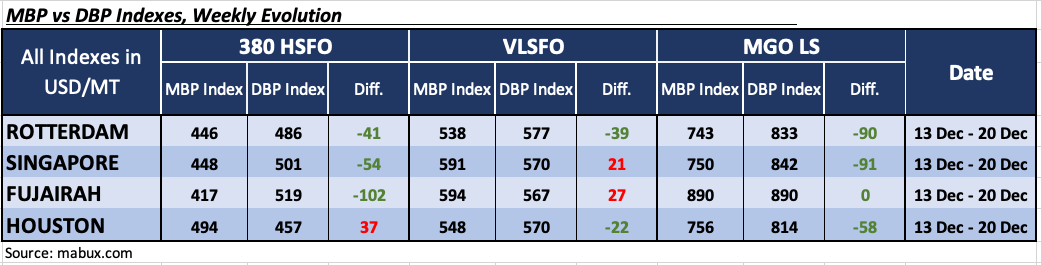

During the 51st week, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) revealed the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

During the 51st week, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) revealed the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, Houston was the only overvalued port, with the average weekly overpricing increasing by 4 points. Rotterdam and Singapore saw weekly average increases of 4 and 5 points, respectively, while Fujairah experienced a decrease of 2 points, maintaining an undervaluation premium above the $100 mark.

In the VLSFO segment, Singapore and Fujairah were deemed overcharged according to the MDI, with the average weekly ratio decreasing by 19 points in Singapore and 13 points in Fujairah. In Rotterdam and Houston, VLSFO remained undervalued. Weekly average levels of undercharging increased by 7 points in Rotterdam and 5 points in Houston.

In the MGO LS segment, all ports remained underpriced, with the average margins showing a decrease of 5 points in Rotterdam, 20 points in Singapore (here the undervaluation level fell below the $100 mark) and 17 points in Houston. In Fujairah, the MDI index achieved 100 percent correlation between market price and the digital benchmark.

There is still no consistent trend in the dynamics of the MDI index in the world’s largest hubs.

There is still no consistent trend in the dynamics of the MDI index in the world’s largest hubs.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of mabux.com.

A recent study released on December 14 by the non-governmental organization Transport & Environment (T&E) reveals that Europe presently imports 80% of the used cooking oil (UCO) utilized in the transport sector. The escalating demand for UCO has raised concerns about potential fraud, with suspicions that virgin oils, such as palm oil, might be falsely labeled as “used” to exploit the inflated value of ostensibly green fuels. T&E reports a significant surge in Europe’s consumption of used cooking oil, more than doubling between 2015 and 2022. This surge has led to a corresponding increase in imports, with 60% originating from China. Consequently, there is a pressing need for enhanced transparency regarding the origin of these fuels. T&E contends that Europe is being inundated with questionable used cooking oil, and European governments express the difficulty of preventing virgin oils like palm from being misrepresented as waste. T&E underscores the necessity for greater transparency and the imposition of import limits to prevent UCO from becoming a gateway for deforestation-driven palm oil. Emphasizing that “greener options exist outside of biofuels,” T&E urges the European Union (EU) to consider alternatives. The report concludes by stating that waste-based biofuels will remain limited, cautioning against viewing them as a comprehensive solution to the climate crisis. Instead, T&E advocates for intensified efforts to reduce energy demand in the transport sector. It recommends prioritizing direct electrification for road transport and emphasizing hydrogen-based fuels, specifically renewable fuels from non-biological origins (RFNBOs), for aviation and shipping.

We expect that the global bunker market will maintain the potential for moderate growth in the coming week.

Source: MABUX